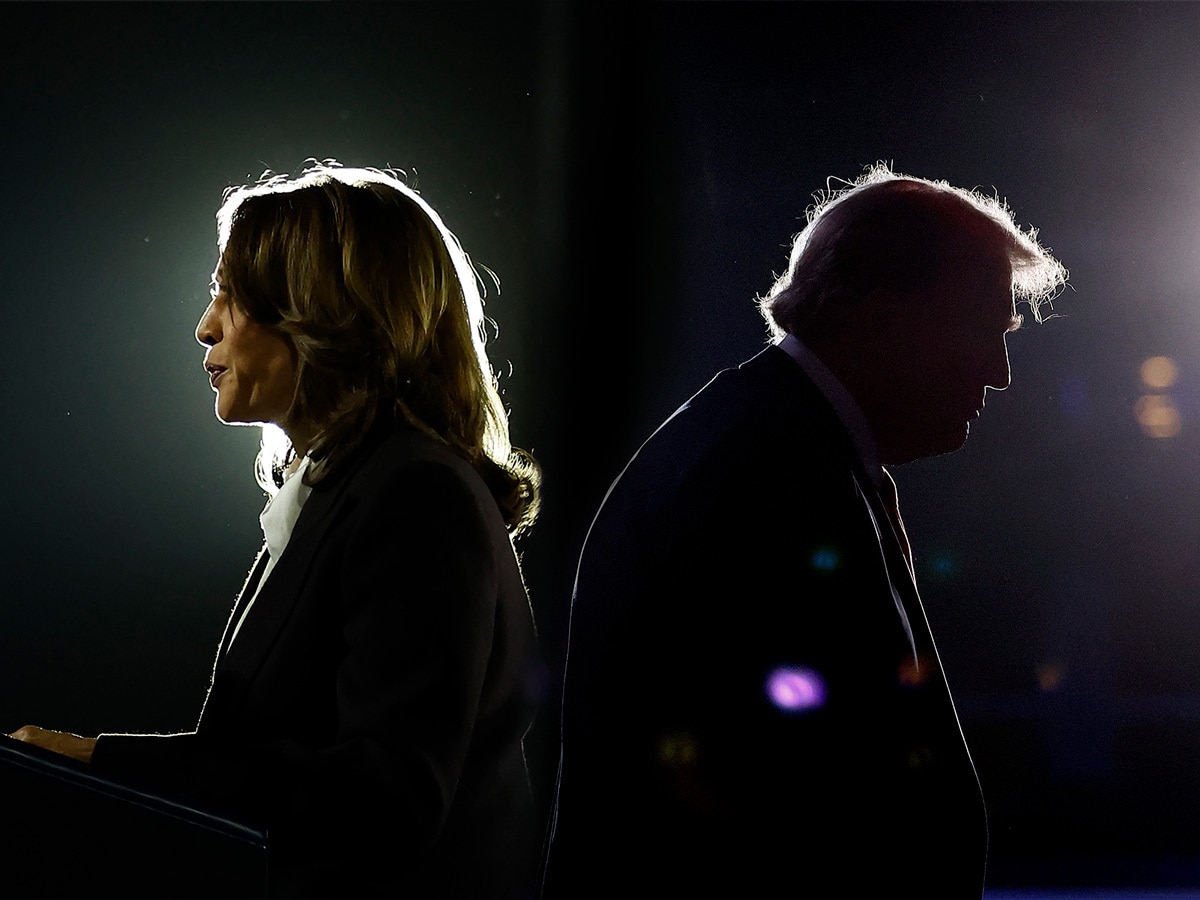

Dollar Surges with Trump on Course to Victory

The greenback hit a two-year high and bond yields jumped as Donald Trump closed in on an unequivocal victory in the 2024 election. Traders have revisited “Trump trades” on expectations that Trump’s proposed tariff hikes and tax cuts would fuel inflation, potentially slowing the pace of interest rate cuts. Wall Street appears optimistic, with S&P 500 futures rising 2% and Nasdaq 100 futures up 1.7% ahead of Wednesday’s open, suggesting confidence in a possible economic boost from such policy shifts, according to the Financial Times.

The Most Expensive Software Stock on the Market

Palantir Technologies [PLTR] shares surged 15% after-hours on Monday following record quarterly income and an upward revenue forecast, driven by robust demand for its artificial intelligence (AI) software. With shares up 140% in 2024, Palantir has gained $60bn in market value. Trading at over 100 times future earnings, it is the most expensive software stock on the market. For Q3, revenue reached $725.5m, surpassing estimates of $703.7m, while net income hit $144m.

Hon Hai Concerns

Apple [AAPL] supplier Hon Hai Precision Industry Co [HNHPF] reported October sales of NT$804.9bn, Bloomberg reported, marking its slowest growth since February and raising concerns about demand for AI infrastructure and iPhones. With just 8.6% growth in October, Hon Hai’s performance is still short of analysts’ target of 15% for the current quarter, reinforcing Apple’s weak holiday forecast. Hon Hai also assembles servers for Nvidia [NVDA].

What is Buffett Up to?

Berkshire Hathaway’s [BRK-B] increased cash reserves, now at an all-time high of $325bn, alongside significant cuts to stakes in Apple and Bank of America [BAC], have raised questions about Warren Buffett’s market outlook. His recent moves suggest a cautious approach, possibly reflecting concerns over a potential downturn. Alternatively, he may be adhering to his classic investment philosophy of “being fearful when others are greedy”, according to Seeking Alpha. Earlier this year, OPTO tried to figure out the ingredients of Buffett’s secret investing sauce.

Mid-Cap Tech Picks from Wells Fargo

Wells Fargo sees strong potential for mid-cap growth stocks [MDYG] to outperform, Seeking Alpha reported, boasting better earnings stability, risk metrics, liquidity and balance sheets than small caps. Total returns since June for MDYG are 12.7%, surpassing the S&P 500 at 8.8%. Within the broader tech space, Wells Fargo highlighted names including Guidewire Software [GWRE], HubSpot [HUBS], Monolithic Power Systems [MPWR], Pure Storage [PSTG], CrowdStrike [CRWD], Spotify [SPOT] and Block [SQ].

Amazon Nuclear Setback; Bees Thwart Meta

On Monday, the Federal Energy Regulatory Commission rejected an amended interconnection service agreement for Amazon [AMZN]. The tech giant aimed to directly connect a Pennsylvania data center to Talen Energy’s [TLN] Susquehanna nuclear plant, bypassing the traditional grid. Elsewhere, Meta’s plans for an AI data center powered by nuclear energy in the US faced were halted by the discovery of a rare bee species on the proposed site.

SQ Stock: Why Did Cathie Wood Sell Block?

Best known for its digital wallet Cash App, Block is a fintech company with exposure to the cryptocurrency and buy now, pay later subthemes, and has gained investor interest for its strong fundamentals. With the Block share price trading at a six-month high in October, Cathie Wood offloaded shares from two ARK ETFs last week. Nevertheless, Cash App could be a key driver of growth for SQ stock in the long term. OPTO explores the fintech firm’s recent financial performance and what investors can expect from its Q3 earnings on November 7.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy