- Date

- Edition INTERNATIONALUKAU

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money

69% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Opportunities

+ You'll also receive our newsletter and other Opto emails in accordance with our privacy policy.

Ecommerce and the DTC Boom: What you’ll learn

Retail revolution

Find out how the coronavirus is accelerating an ecommerce overhaul

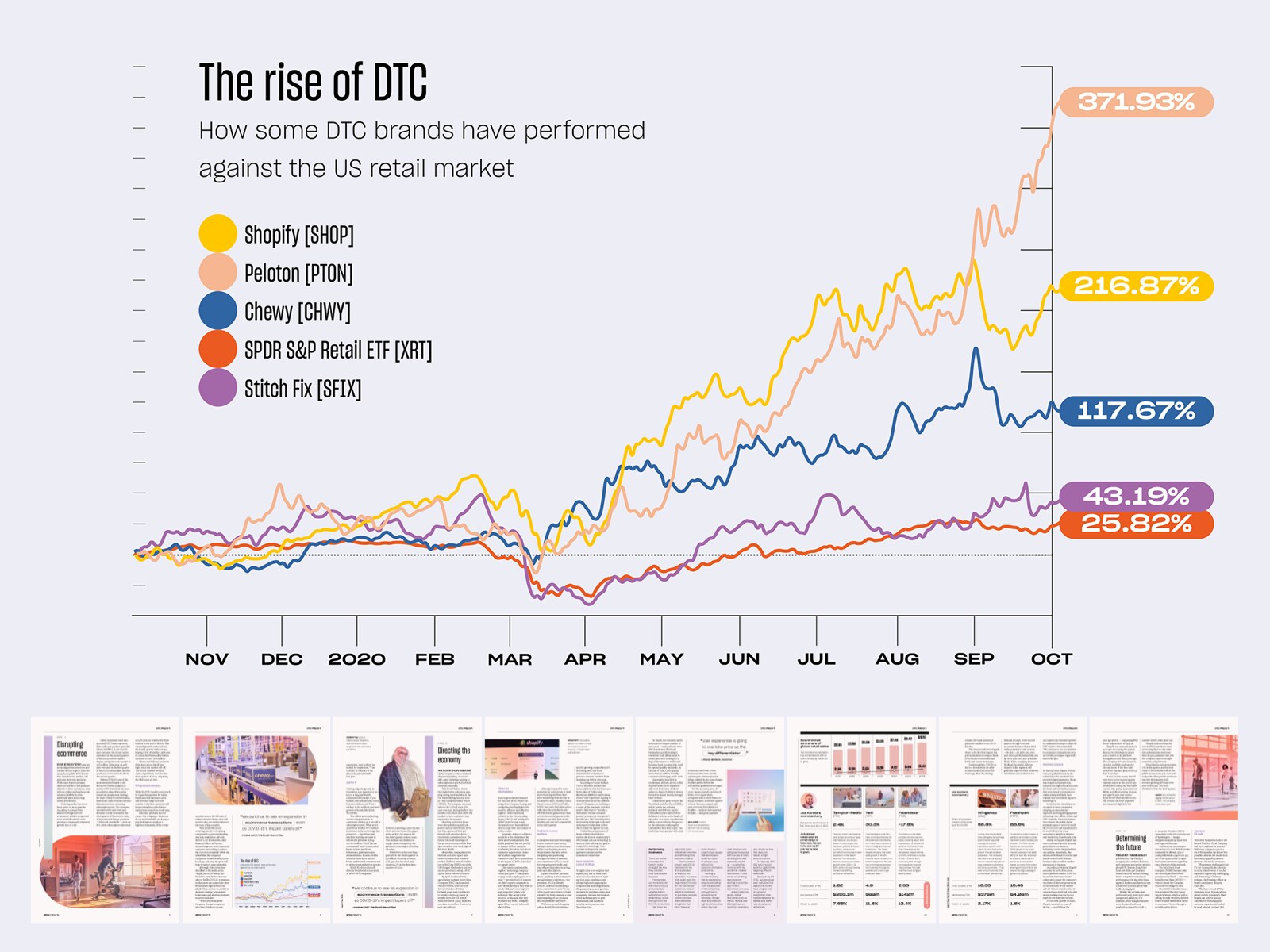

The rise of DTC

Direct-to-consumer retail stocks are surging – find out why

Ecommerce unicorns

The secrets behind DTC’s biggest success stories

Expert insights

Hear from retail brand leaders and ecommerce investment experts

Stocks to watch

The retail & ecommerce stocks exposed to this high-growth trend

Direct-to-stock

Can DTC be applied to the stock market? Find out how

2021 outlook

Ecommerce exploded during global lockdowns, but is it here to stay?

Retail’s changing face

Discover how retail is going digital, and why

DTC tech

Meet the big tech stocks driving the ecommerce revolution

Stock watch-list

Success stories + the DTC newcomers set to break out

ebook preview

Disrupting Ecommerce: The changing face of retail, and how to trade DTC

We explore the future of retail, from ecommerce’s troubled past to DTC’s current boom and future prospects.

$6.2trn

DTC’s forecast worth by the end of 2027

256%

Naked Wine’s new customer increase in 2020

$17.75bn

DTC’s forecast annual sales by the end of 2020

$1.37bn

DTC razor brand Harry’s acquisition price

Sneak preview…

For every DTC unicorn attracting private investors and raising venture capital, there are many more public DTC brands that manufacture, market, sell and ship their own products. While their primary objective will be to sell products directly to their customers, some will use online retail marketplaces like Amazon [AMZN] to drive additional sales and to widen distribution.

Indeed, accessing ecommerce has never been easier or more popular. According to Grand View Research, the global B2C ecommerce market is expected to be worth $6.2tn by 2027, growing at an annual compound growth rate of 7.9%.

Global lockdowns have exacerbated the speed and rate of DTC brand exposure. Take online pet product specialist Chewy [CHWY]. It added 1.6 million new active customers in the first quarter of fiscal 2020, which ended 3 May, taking the total number to 15 million. Initial orders were up 11%, and new customers were adding more to their cart than pre-pandemic consumers. Overall, sales were up 46% year-over-year.

As we come out the other side of the pandemic, DTC businesses may look like attractive opportunities for FMCG players [like Unilever] that are wanting to diversify their route to market and reduce their reliance on brick-and-mortar retailers.

Andrew Taylor, Aldwych Partners co-founder

We are OPTO

Trading intelligence for the serious trader

OPTO started with a simple idea: that markets cannot truly be understood through numbers alone. Every company, investor and executive plays a role in shaping the market from one day to the next. By telling their stories and understanding what drives them, OPTO’s analysis provides a more holistic picture of what truly moves markets – and what those cold, hard numbers really mean.

Website

100,000+ monthly visits

Quarterly magazine

Global circulation of 25,000

Free industry reports

30,000+ downloads

Exclusive events

London-based with industry experts

Leveraged ETFs are complex financial instruments that carry significant risks. Certain leveraged ETF's are only considered appropriate for experienced traders