Elon Musk’s Side Hustles

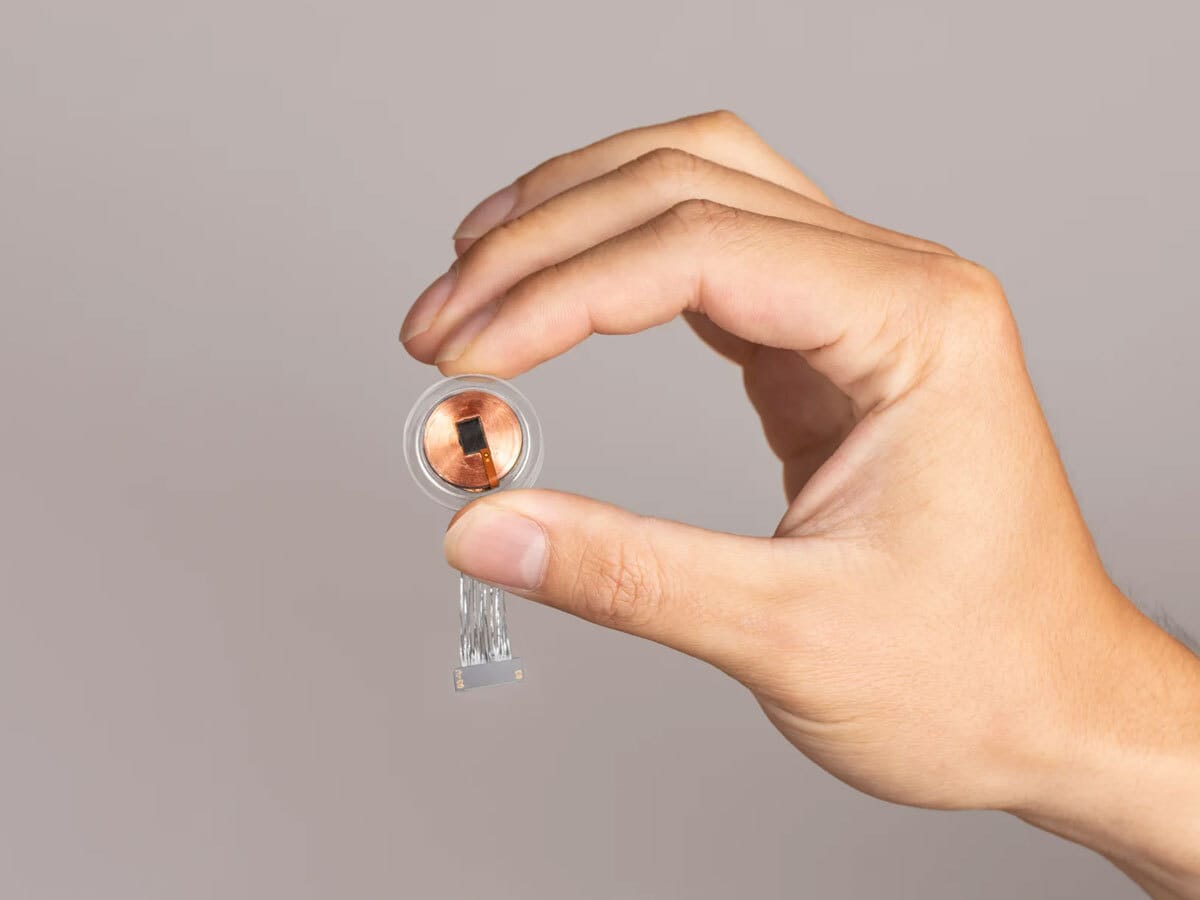

Neuralink, the Tesla [TSLA] CEO’s brain-implant company, has received approval from regulators in Canada to start clinical trials on its flagship device that enables patients to control external devices with their minds. The trials will be held at Toronto Western Hospital, according to Bloomberg, and the firm is seeking participants with quadriplegia due to Lou Gehrig’s disease, or spinal cord injury. Elsewhere, Musk’s artificial intelligence (AI) start-up xAI has reached a valuation of $50bn after its latest funding round, which raised $5bn, the Wall Street Journal reported.

NVDA Earnings: Sky-high but Not Stratospheric

Nvidia [NVDA] reported a 94% year-on-year revenue increase to $35.1bn in its latest quarter, driven by robust AI-related infrastructure demand. While growth slowed relative to the prior quarter, revenue exceeded Wall Street’s $33.25bn estimate. Guidance for the current quarter stands at $37.5bn, aligning with expectations. Shares dipped 1.1% in pre-market trading on Thursday, as analysts scrutinized the performance of Nvidia’s new Blackwell chips; technical issues with chip implementation are being closely monitored.

DOJ Comes for Google

“Restoring competition to the markets for general search and search text advertising as they exist today will require reactivating the competitive process that Google has long stifled,” wrote US Department of Justice lawyers in a landmark court filing intended to curb Alphabet’s [GOOGL] Google’s monopoly in online search, the BBC reported. Measures include forcing the company to sell its Chrome browser and ending contracts with firms like Apple [AAPL] and Samsung [SSNLF] that set Google Search as the default option on devices.

SOUN Stock: Can SoundHound Corner the AI Voice Market?

A leader in the burgeoning AI voice generator market, SoundHound AI [SOUN] aims to offer its customers natural conversational experiences. Despite considerable stock momentum and an upbeat Q3 earnings report, shares in SoundHound AI tumbled last week. While some analysts believe SOUN stock has run up too far, too fast, the company is confident that it will be at the forefront of the human conversation revolution. OPTO examines the company’s key partnerships, and unpacks why it considers customer service to be its “greatest growth engine”.

EU Car Sales Flat; Cutbacks Announced

Car sales in Europe remained stagnant in October, with new registrations rising only 0.1% year-over-year to 1.04 million units, according to the European Automobile Manufacturers’ Association. Declines in markets like France, Italy and the UK offset gains in Germany. Automakers are grappling with weak demand amid the electric vehicle transition and economic pressures. Ford [F] announced plans to cut 4,000 jobs in Europe, about 15% of its workforce, while Volkswagen [VWAGY] is exploring cost-saving measures, including potential factory closures in Germany.

SNOW Storm

Snowflake [SNOW] surged 20% in pre-market trading after issuing a strong sales forecast of $906m–911m in product revenue for the next quarter, surpassing analysts’ $890.7m estimates. Its adjusted operating margin outlook of 4% also beat expectations. CEO Sridhar Ramaswamy credited new AI-driven products for customer growth. Snowflake also announced plans to acquire Datavolo, enhancing its capabilities to process unstructured data for generative AI.

MicroStrategy Soars, Pours Capital into Crypto

The MicroStrategy [MSTR] share price has surged 15% to a record high, reflecting nearly 900% growth over the past year. The software firm, which has pivoted to aggressive bitcoin investments, has raised over $7bn since the US election. This includes a $2.6bn convertible bond offering, up from the initially planned $1.75bn, and $4.6bn from a recent stock sale, both funneled into bitcoin purchases as the cryptocurrency hits new highs. CEO Phong Le recently joined OPTO Sessions to discuss the company’s approach to bitcoin and business intelligence.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy