Arelis Agosto, Senior Healthcare Analyst at Global X ETFs, discusses the potential that Nvidia has to improve data processing and clinical drug trial outcomes for the healthcare sector during this week’s episode of Opto Sessions.

Nvidia [NVDA] is a “confusing company to be speaking about when we’re talking about genomic sequencing and the market opportunity for that”, says Arelis Agosto, Senior Healthcare Analyst at Global X ETFs, on this week’s episode of Opto Sessions. Nevertheless, she feels the company is reflective of the part that non-traditional healthcare firms are playing in the evolution of the sector.

Healthcare is the largest data-generating industry in the world, according to a 2018 white paper published in the Internal Medicine Journal. But at present the sector lacks the technological infrastructure to process the reams of data that it produces. This leads to huge inefficiencies which manifest as elevated costs and long waits for new treatments to come to market.

Agosto explains to Opto Sessions why the data processing and artificial intelligence (AI) capabilities of Nvidia could thus be a powerful force within the healthcare industry.

Unlocking the Potential of Genomic Data

One area in which Nvidia has a long-standing foothold in healthcare is in the analysis of radiography, which Agosto calls “the most mature segment of the healthcare industry when it comes to AI”. The company’s AI technology has been used “to map out or pinpoint abnormalities in scans that might otherwise go undetected, which is really impressive”, according to Agosto.

Now, however, Nvidia is making further inroads into the space. Agosto discusses the need of the healthcare industry for digitisation, as well as the far-reaching potential of genomic technology. Nvidia has the capabilities to offer solutions on both fronts, she says.

“We can offer genomic profiling to the entire world, but we can't really garner the full potential of the technology if we don't have a way to actually analyse and collect all this data. Currently, unfortunately, it’s either not prevalent enough, or we don’t have the computing power to actually process all the benefits of genomic sequencing.”

Nvidia’s technology is the key to unlocking this value. “This is where Nvidia really sees potential,” she says.

“We can offer genomic profiling to the entire world, but we can't really garner the full potential of the technology if we don't have a way to actually analyse and collect all this data.”

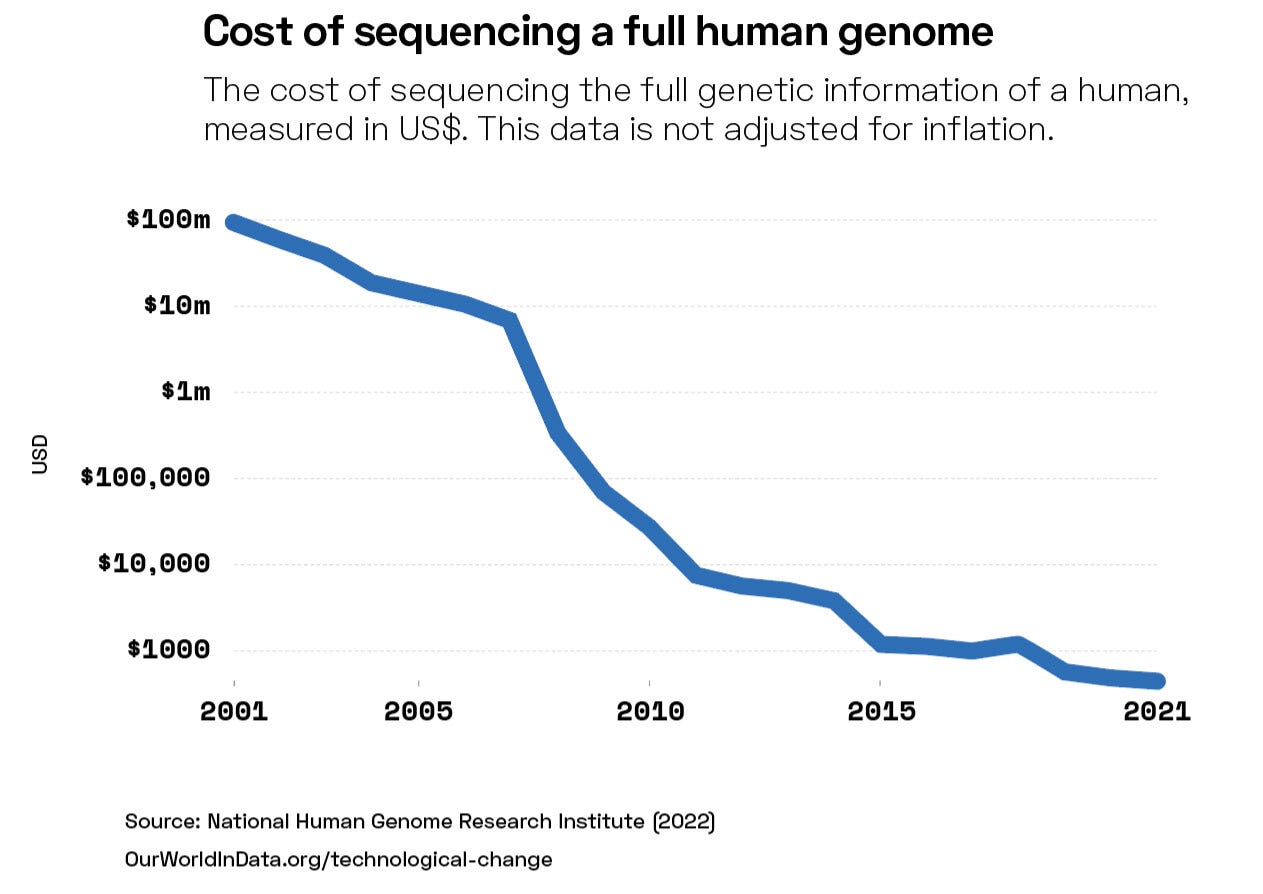

“To put this into context, less than 0.1% of the human population so far has had their genome sequenced. We’re already saying that the computing power for the industry isn’t enough to actually analyse that genomic data... When we increase significantly and make this available to patients across the board, that infrastructure from companies like Nvidia needs to be there for us to make all of this adoption worth it.”

Drug Discovery

Genomic analysis could unlock an abundance of data with many potential uses. Agosto thinks the data’s deployment in drug discovery will be especially influential.

There is an advantage in “simply having information from electronic medical records, genomic profiling, clinical trial data and prescription data, to feed into models to predict better efficacy for drugs, a better safety profile for drugs, and drugs that can serve multiple purposes, from the onset,” she says.

The implications for the pharmaceutical industry in particular are profound. As of February 2022, it takes 10–15 years to bring a new drug to market, at a cost of over $1bn, according to Duxin Sun, Professor of Pharmaceutical Sciences at the University of Michigan, writing in The Conversation.

Pharmaceutical companies face a failure rate of 90% during clinical trials. These are major costs for the industry, but AI could halve the time it takes to bring new drugs to market, Insilico Medicine Founder Alex Zhavoronkov told the Financial Times last June. This could dramatically save on costs as well as time.

“It opens up the industry,” says Agosto.

By 2025, Agosto expects 30% of treatments entering human testing in clinical trials to have been investigated using AI first. “There will be a lot of back-end work. Whether it is in terms of their genomic role and being able to comprehend and analyse all the genomic data coming about, or more broadly, being able to analyse electronic medical records, prescription data, etcetera — we will have more comprehensive analysis at the onset of drug discovery.”

Agosto therefore has “no doubt” that the healthcare sector represents a significant revenue-generating opportunity for Nvidia. “I still think that the opportunity is underestimated, given the digitisation that needs to happen in the healthcare industry as a whole and the potential that they have.”

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy