Against the backdrop of a global pandemic that impacted most facets of society in an unprecedented fashion, two investment areas shone through in 2020: thematic investing and sustainable investing.

In this article, Warner Wen, research director, Canada, and Andrew Little, research analyst at Global X, explore the investment potential in cleantech, clean water and renewable energy production.

Thematic investing refers to the process of identifying disruptive macro-level trends and the underlying investments that stand to benefit from the materialisation of those trends.

Sustainable investing is an investment approach that considers environmental, social, and governance (ESG) factors, alongside financial ones, in the pursuit of competitive returns and positive impact for people and planet.

At the end of 2020, aggregate U.S.-listed Thematic ETF AUM stood at $104.1bn, representing a growth of 274% and close to quadruple the number from a year prior ($27.8bn at the end of 2019). At the same time, on a global scale ESG-oriented ETFs reached a tipping point in 2020 with AUM growing 223% over the year to a record $189bn. (1)

While at first glance these two areas may seem independent from each other, thematic investing and sustainable investing are not only far from mutually exclusive, but potentially synergistic and complementary to each other in certain circumstances.

Both investment philosophies inherently focus on a long-time horizon. Looking at investor demographics, both thematic investing and sustainable investing notably appeal to younger investors: 83% of millennials said they were “extremely interested” or “very interested” in thematic investing according to a Global X-commissioned 2017 survey, while 86% of millennials expressed interest in sustainable investing, according to a Morgan Stanley [MS] survey in the same year. (2)

As millennials enter their peak earning years and inherit trillions of dollars, we believe investment assets in both thematic and sustainable areas, especially those that sit at the intersection of thematic and sustainable investing (or “sustainably-themed investing”), will continue to rise meaningfully.

In the following sections, we will discuss why it may make sense to consider sustainably-themed investments, and then highlight Cleantech, renewables, and clean water as sustainable themes in focus.

Sustainably-themed investing: Aligning impact with growth

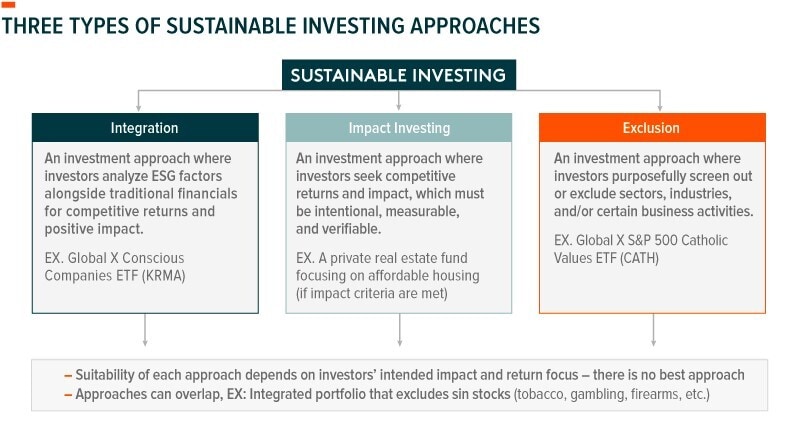

Broadly speaking, there are three categories of sustainable investing approaches: integration, impact investing, and exclusionary.

Typically, ESG-oriented ETFs track indices that employ integration and/or ESG-related exclusions in the security selection process. ESG data is a critical input to this process, informing company-level composite ESG scores (for an integration approach) and business involvement metrics (for an exclusionary approach).

If exclusions are part of an index methodology, index providers use business involvement metrics, usually expressed as revenue percentages, to narrow investment universes down to only companies with an acceptable level of involvement in certain activities, like manufacturing or distributing weapons or alcohol, for example. In ESG integration approaches, company-level ESG scores or ratings are used alongside traditional considerations to identify and weight index constituents.

For public market investors, an ESG integration approach could be the best way to affect changes while providing broad market exposure. As we previously discussed in How Sustainable Investing Can Create Long-Term Value, as capital increasingly flows to responsible companies, other investors could view the resulting momentum as a positive sign and invest accordingly themselves.

Ideally, companies recognise the source of positive investor sentiment and maintain their standards, while less responsible companies are motivated to improve theirs. Data has shown that companies with high ESG scores, on average, experienced lower costs of capital compared to companies with poor ESG scores. (3)

A limitation of ESG integration and exclusionary approaches is the difficulty for investors to articulate or gauge the direct sustainable outcome of their invested dollars. This is largely due to two reasons.

First, the complex and dynamic nature of ESG data makes it hard to know if one is investing in best-in-class companies in terms of sustainability. There are many ESG data providers and sometimes scoring methodologies and resulting outputs contrast. Second, the characteristics of public equity markets afford investors little opportunity to directly trace, monitor, and measure the impact of their investments. This stands in contrast to the private markets, where investors have more visibility into where their funds are being directed.

Compared with ESG integration, impact investing draws a clearer line between one’s investment dollars and achieving a specific outcome. Industry definitions of impact investing limit much of a public equity investor’s opportunity set, given the requirements on measurability of impact and “additionality”, the latter of which means “only allocating to businesses that they would not otherwise choose to invest in if they were not seeking to achieve a positive social impact.” (4)

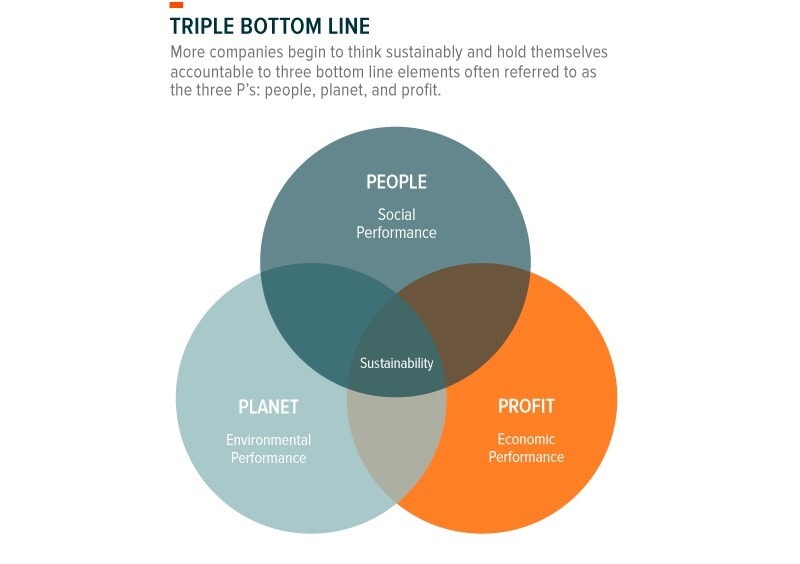

In our opinion, one way to potentially facilitate positive environmental and social changes without sacrificing financial returns is to approach sustainable investing through a thematic lens. Following a sustainably-oriented theme means targeting innovative and disruptive industries that could lead to tangible improvements in certain environmental and/or social matters. As relevant industries grow and representative businesses scale, they may not only affect more positive changes for people and planet, but also reward their investors with financial profits (see the Triple Bottom Line framework as shown in chart below).

It is not by chance that we are witnessing numerous disruptive themes emerge at the intersection of thematic and sustainability. When examining the key stakeholders in the adoption of thematic investing — consumers, businesses, governments — all three are prioritising goals that could propel sustainable themes forward. These goals include ambitious climate neutrality targets, better health outcomes, improving quality of life around the world, and increased productivity in the labour force, just to name a few.

In the next sections, we will discuss how cleantech and renewable energy, and Clean Water initiatives contribute to sustainability goals, while providing investors with potential for economic profit.

Cleantech and renewable energy

Clean technology, or cleantech, describes myriad disruptive technologies that mitigate or inhibit negative environmental impacts. The business activities under this theme could involve renewable energy production, energy storage, smart grid implementation, residential/commercial energy efficiency, and/or the production and provision of pollution-reducing products and solutions.

Since the inking of the Paris Agreement in 2016 to fight climate change on a global scale, many signatories have upped the ante, vowing to take more aggressive measures in the pursuit of carbon neutrality.

The European Green Deal, for example, is a set of policy initiatives by the European Commission with the overarching goal of making Europe the first climate-neutral continent by 2050. In North America, the government of Canada submitted draft legislation in November 2020 to Parliament, titled The Canadian Net-Zero Emissions Accountability Act, adding Canada to the list of over 120 countries pledging to reach net-zero emissions by 2050. (5)

The further development and adoption of cleantech will be essential to achieving carbon-neutrality goals and limiting emissions to acceptable levels. It will also require significant investment. A scenario presented by the International Renewable Energy Agency (IRENA) estimates that $110trn of cumulative global investments between 2016 and 2050 would keep the world on the right track, with about 80% of that going to clean technologies.

In the Canadian government’s Pan-Canadian Framework on Clean Growth and Climate Change (the “PCF”), which is the government’s master plan for climate action, clean technology is listed as an important pillar. After establishing the PCF, the government announced in 2017 a budget of $21.9bn over 11 years for green infrastructure that will include “targeted investments to support greenhouse gas reductions and enable greater climate change adaptation and increased resilience.” (6)

Turning our attention to the US, the new climate-conscious administration under US president Joe Biden and a supportive Democrat-controlled Congress will likely accelerate climate action, directing capital to cleantech. Biden’s climate action pledge includes an ambitious $2trn plan that would accelerate a clean-energy transition, cut carbon emissions from the electricity sector by 2035, and achieve net-zero emissions by 2050. (7)

Closely related to cleantech, renewable energy production is also a theme of critical importance for environmentally-conscious investors. Despite being inherently related, these two themes are complementary to each other in that they primarily cover different parts along the climate / “green” value chain.

Cleantech encompasses up-chain activities such as manufacturing of photovoltaic (PV) components, inverters, wind turbines/blades, grid components, and stationary storage/batteries.

Further down the green value chain, renewable energy producers primarily engage in energy generation from renewable sources such as wind, solar, hydroelectric, geothermal, and biofuels. It is worth keeping in mind that beyond renewable energy, part of the cleantech theme is related to pollution reducing practices like carbon capture, use, and storage (CCUS) and carbon dioxide removal (CDR) which could be useful for achieving carbon neutrality.

Clean water

Water fuels life on earth and is a fundamental input for economic productivity. While it is seemingly abundant, competing uses and structural challenges presented by population growth, pollution, and climate change are stretching water resources precariously thin.

Clean water — the water we drink, prepare our food with, and use for sanitation — faces the most immediate pressure with the direst societal and economic impacts. Over 2.3 billion people live in water-stressed countries and in 2019, unsafe drinking water resulted in more deaths than diabetes, malaria, or HIV/AIDs. (8, 9, 10)

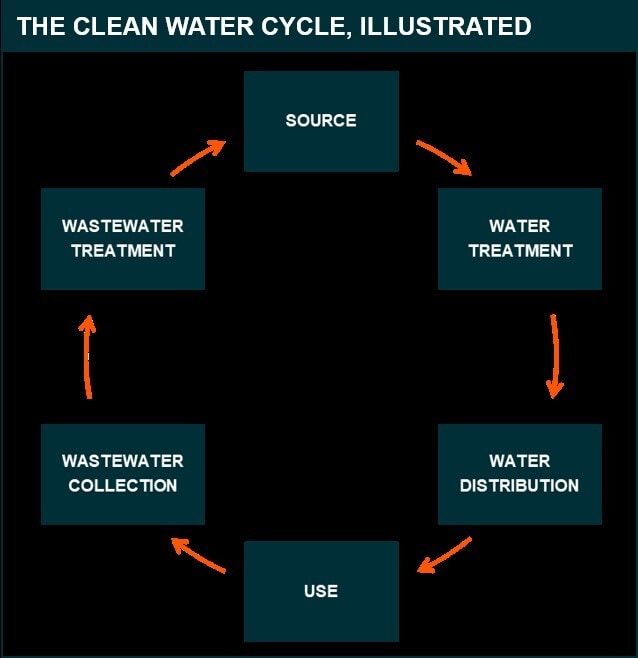

Fortunately, a shift to a more sustainable model is possible, led by government policy, technological innovation, and growing consumer and public health advocacy. Keys to this transition include:

- sustainable and next-generation water sourcing;

- innovation in water treatment and distribution; and

- wastewater management and water reuse.

Technological innovation can play an important role in all aspects of the clean water cycle. For sourcing, solutions like connected sensors and artificial intelligence can monitor aquifers and surface sources in real time. Supervisory, control, and data acquisition (SCADA) systems, for example, measure water levels, monitor wells for infiltrations, and automate pumping. (11)

Technological advancements in water treatment tend to focus on improved methods for removing contaminates — either doing so more efficiently or relying less on chemicals additives. Such technologies include membrane filtration, ultraviolet irradiation, and nanoparticle purification. (12)

The latest in water distribution technologies allow for real time monitoring of quality and usage rates, AI-based forecasting of future demand trends, and dynamic adjustments to water networks to meet these needs.

When it comes to usage, further adoption of cutting-edge technologies in agriculture like precision irrigation, indoor farming, and crop modification can reduce water usage, while maintaining similar levels of food production. Finally, we can improve wastewater management by retrofitting facilities for greater electric efficiency (which can reduce operating costs and capture geothermal energy), replacing chlorine treatments with ultraviolet disinfection techniques, and integrating greater automation and software in daily operations.

Conclusion

Thematic investing and sustainable investing approaches are each important in their own right and top-of-mind for today’s increasingly ESG-minded investment community.

In our view, sustainably-themed investing is a way for investors to recognise the benefits of both approaches, leveraging key concepts drawn from each. Importantly, looking at companies through a thematic lens could allow investors to grow their investments, while delivering tangible positive change on the environment and/or society. In particular, we believe well-defined themes such as cleantech, renewable energy production and clean water can all serve investors well in their quest to achieve multiple objectives (financial and otherwise) simultaneously.

This article was published by Global X. The original article, including footnotes where readers can find original source material, can be found here.

Investing involves risk, including the possible loss of principal. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations. CleanTech and Clean Water Companies typically face intense competition, short product lifecycles and potentially rapid product obsolescence. These companies may be significantly affected by fluctuations in energy prices and in the supply and demand of renewable energy, tax incentives, subsidies and other governmental regulations and policies. Clean Water Companies are subject to significant regulation regarding the usage, treatment, and distribution of water. Clean Water Companies may also be adversely affected by the impact of global climate change on the available supply of clean water reserves. Investing using ESG guidelines may underperform other similar investments that do not consider conscious company/ESG guidelines when making investment decisions. Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.

Carefully consider the funds’ investment objectives, risks, and charges and expenses. This and other information can be found in the funds’ full or summary prospectuses, which may be obtained at globalxetfs.com. Please read the prospectus carefully before investing.

Global X Management Company LLC serves as an advisor to Global X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy