Legendary contrarian investor Jim Rogers, co-founder of the Quantum fund, takes a qualitative and quantitative approach to investing. He drills down into research in order to discover overlooked opportunities that minimise his downside risk, and maximise the opportunity to sell high.

Jim Rogers co-founded the Quantum Fund with George Soros, which returned an astonishing 4,200% during its first decade. His contrarian, value-driven approach is shared by investors such as Michael Burry, Warren Buffett and John Templeton.

As a youth, says Jim Rogers, he wasn’t fully aware of the stock market, beyond knowing that something bad happened on Wall Street in 1929.

“I didn't know there was a difference between stocks and bonds back in those days,” he says.

However, he quickly caught the bug once he started learning how investing works.

“What you have to do is figure out what’s going on in the world, what’s going to happen in the world, and then adjust, adapt and work accordingly... And you might be successful. I loved it.”

He was also heavily influenced early in his career by a trip to China, during which he saw incredible things happening. This meant that, at a time when most investors were focused on Japan, which later stagnated economically, Rogers got ahead of the game in China. This has led to him taking a keen interest in investing in Asia ever since, especially given the cheap valuations that result from the continent being overlooked by investors.

“What you have to do is figure out what’s going on in the world.”

Due Diligence

Rogers describes his investing strategy as “basically to buy low and sell high”. This deceptively simple formula hints at the real challenge: how to identify which assets were priced low, and which priced high.

The key, he believes, is rigorous research. In an interview with the Financial Times in 2009, Rogers stressed the importance of doing “enough homework” to make sure his thesis was correct.

“Every time I make a mistake, it is usually because I did not do enough homework,” he said.

Buying cheaply is important, because it minimises the potential downside to these occasional mistakes, as well as maximising the upside when he is correct.

Rogers previously told OPTO Sessions that he believes it is crucial for investors, including himself, to only invest in assets they know well themselves.

“Only invest in what you know, because first of all, everybody makes mistakes. And second, when things start going wrong, you won’t know what to do if you don’t know why you bought it in the first place.”

Silver and Gold

One of the most distinctive aspects of Rogers’ approach is how qualitative his reasoning often tends to be. While many contrarian and value investors obsess over valuations, ratios and other metrics, Rogers keeps a close ear on the temperament of market participants.

“When everybody is throwing it out the window, that is usually a good time to buy anything,” he told Forbes in 2017. “Investing is both qualitative and quantitative. I wish it was simple, but investing is a combination of everything.”

Rogers’ approach makes room for finding value wherever it can be found. For this reason, he doesn’t limit himself to (or avoid) specific markets or asset types. In the right circumstances, he will invest in a wide range of securities.

“When everybody is throwing it out the window, that is usually a good time to buy anything.”

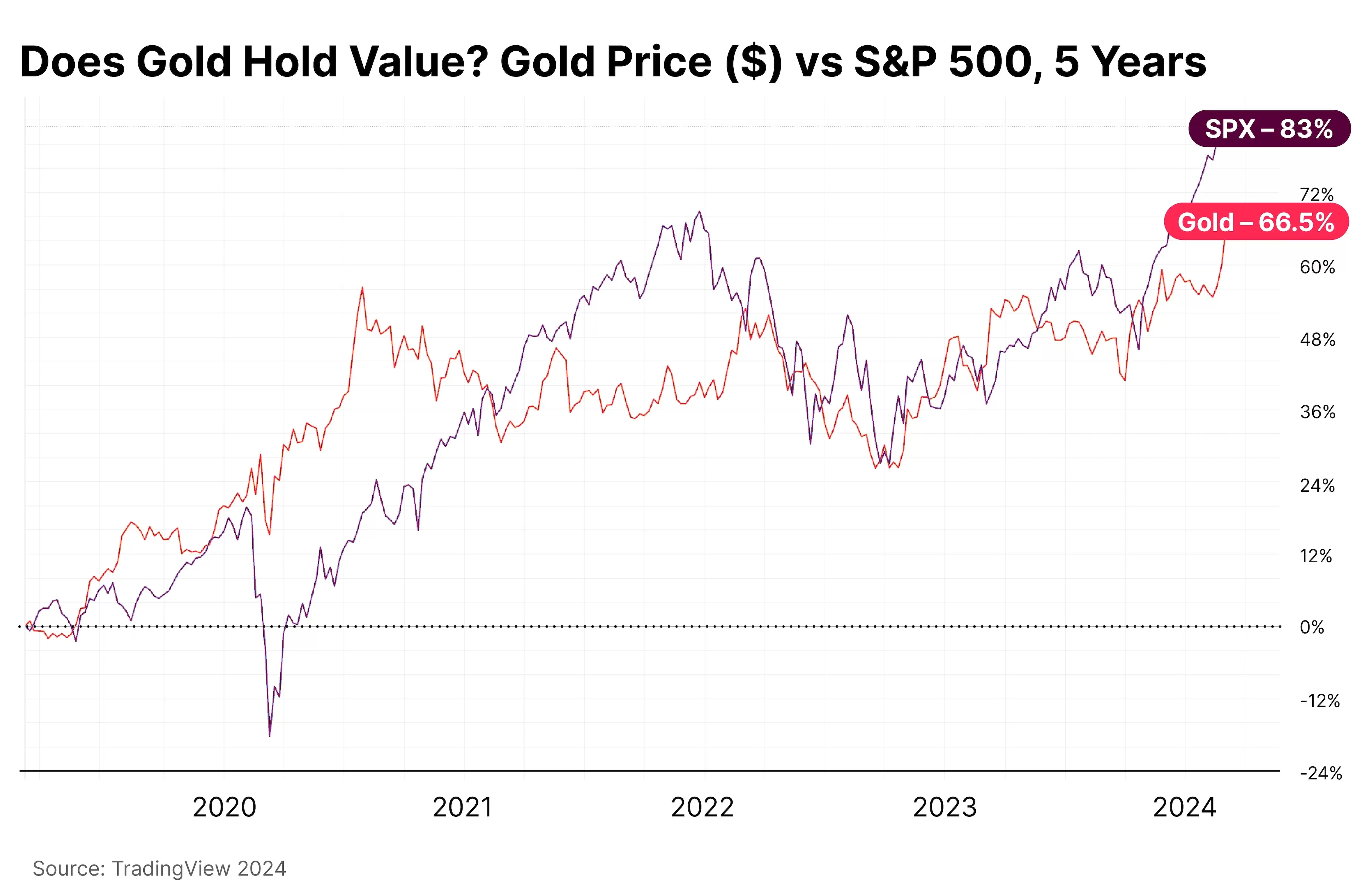

This means that he has invested in commodities at various points in his career. He views silver and gold, in particular, as commodities that investors can turn to in order to ride out economic storms.

However, he remains cognizant of the cyclical nature of markets, especially commodities. “Gold and silver go down too. They have many times, in various markets.”

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy