In part two of this three-part series, Morgan Creek Capital Management’s China-based investment team continues to explore the evolution of corporate venture capital in China. In today’s article, the firm focuses on how Tencent expanded its business through strategic investments, creating one of the world’s top venture funds.

In our previous article, we discussed the evolution of North American corporate venture capital (CVC) and the opportunities and challenges it has faced navigating changing investment environments. In the upcoming article, we will focus on the two most active CVC investors in China: Tencent [0700.HK] Ventures and Alibaba [BABA] Ventures.

We will explore each of these two CVC technology powerhouses separately, analysing their diverse investment goals and strategies, as well as their relationships with their parent companies.

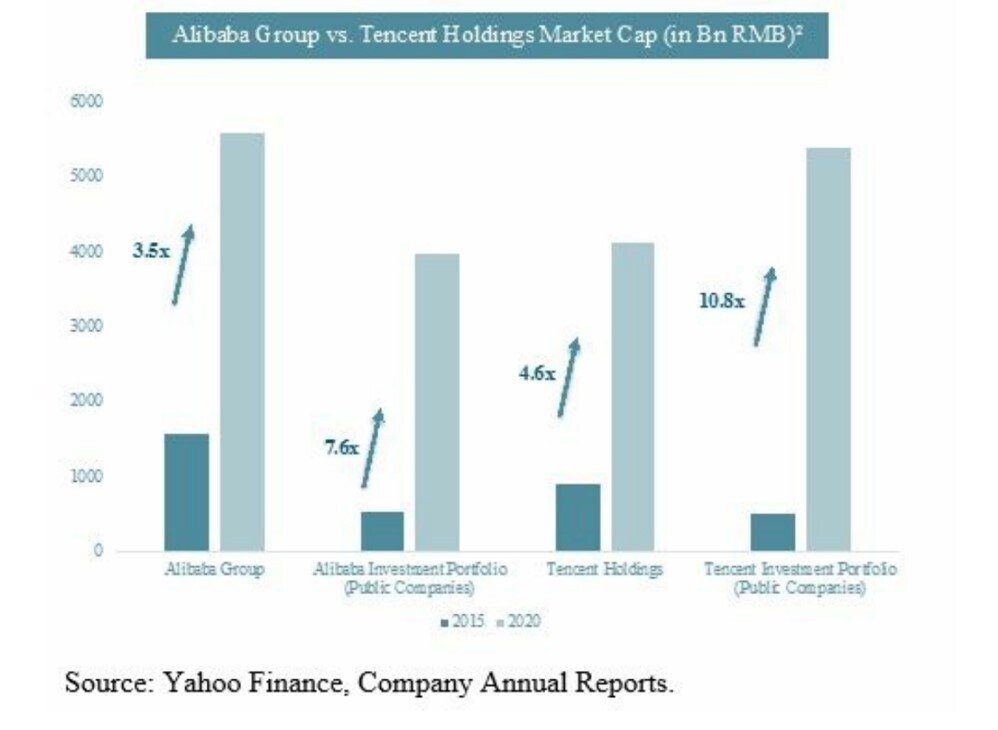

Over the past decade, Alibaba’s and Tencent’s investments have resulted in an ecosystem worth almost RMB10trn in combined market value — Alibaba’s public investment market portfolio is worth RMB4trn and Tencent’s is worth RMB5.4trn.

This week, we will focus on Tencent.

Tencent set up its investment and mergers & acquisitions (M&A) department in 2008, and in 2011 established its industry CVC fund with RMB5bn in assets under management.

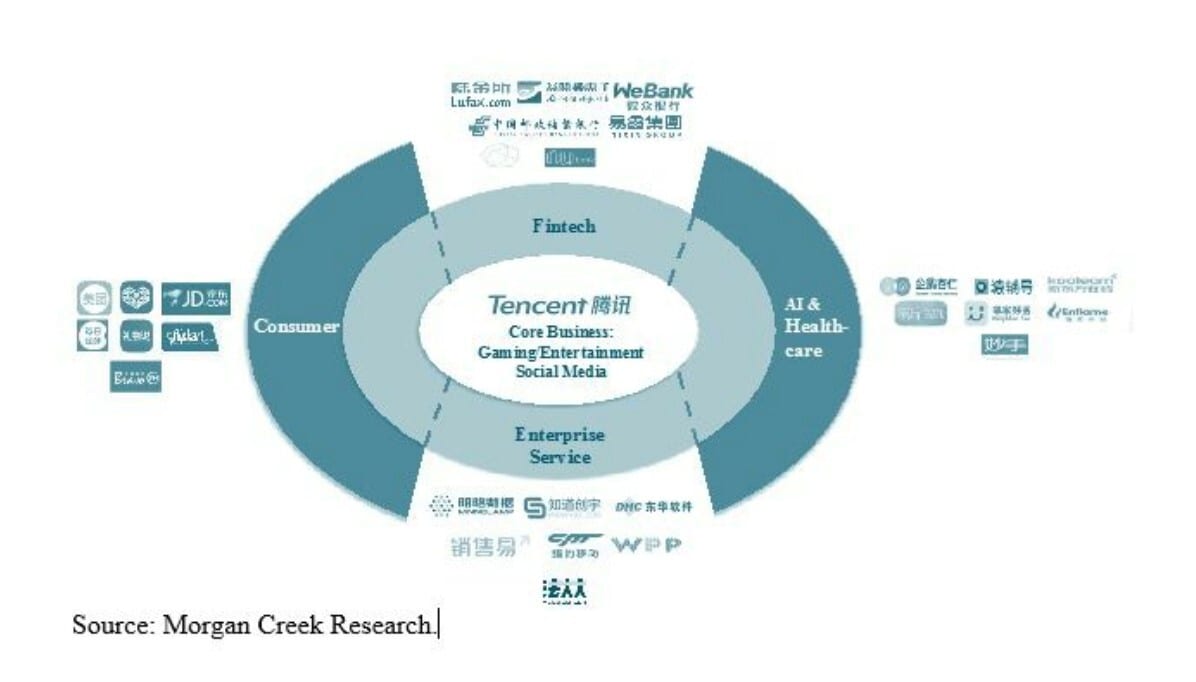

Tencent CVC’s investment strategy is to strengthen its primary business and to discover potential market disruptors through its investments. Tencent aims to hold controlling stakes in its core gaming and entertainment/communications industries.

And minority stakes in non-core sectors, including fintech, enterprise services, ecommerce, artificial intelligence (AI), healthcare and education.

Tencent controls significant consumer traffic through its WeChat ecosystem, which has 1.2 billion monthly active users (MAU) as of the third quarter of 2020.

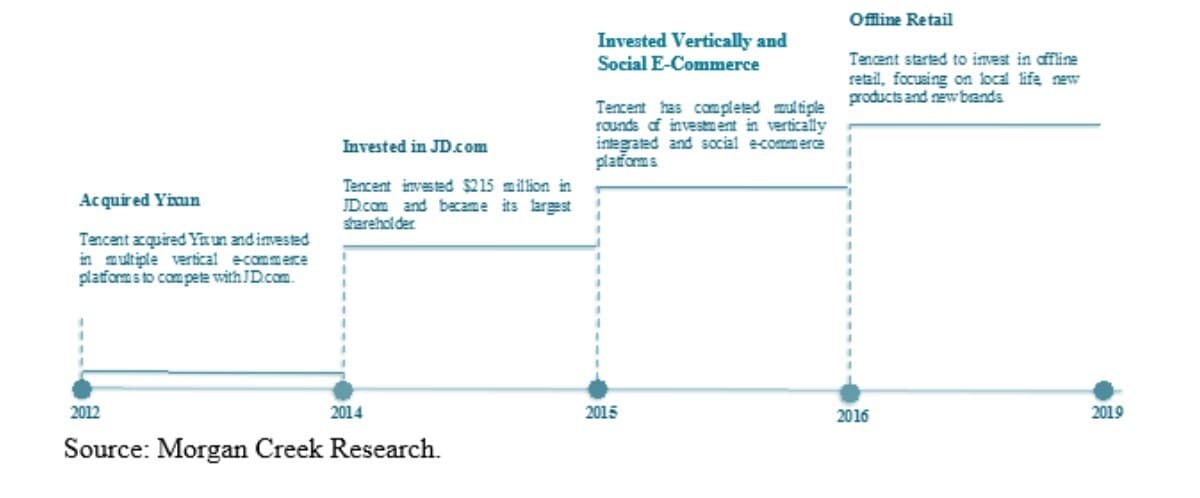

It is working actively to monetise that consumer base, with 43 of the 90 portfolio companies Tencent has invested in over the past decade being in the ecommerce space.

Tencent has also focused on social ecommerce and mini ecommerce programmes to leverage its WeChat ecosystem, creating an internal app marketplace.

To strengthen its offline retail presence, Tencent invested RMB4.2bn into Yonghui Superstores [601933.SS], the fifth-biggest supermarket in China.

This investment has allowed Tencent to direct online traffic to Yonghui’s online to offline (O2O) retail stores Chaoji Wuzhong (Super Species) to compete with Alibaba’s Hema Xiansheng.

In 2018, Tencent adjusted its organisational structure once again when it added a Platform and Content Business Group (PCG) and a Cloud and Smart Industry Business Group (CSIG) after the company made investments in business to business (B2B) companies.

Tencent believes that the technologies and business models it has developed and utilised in its consumer businesses may have wider applications in B2B sectors including transportation, AI, logistics, and robotics.

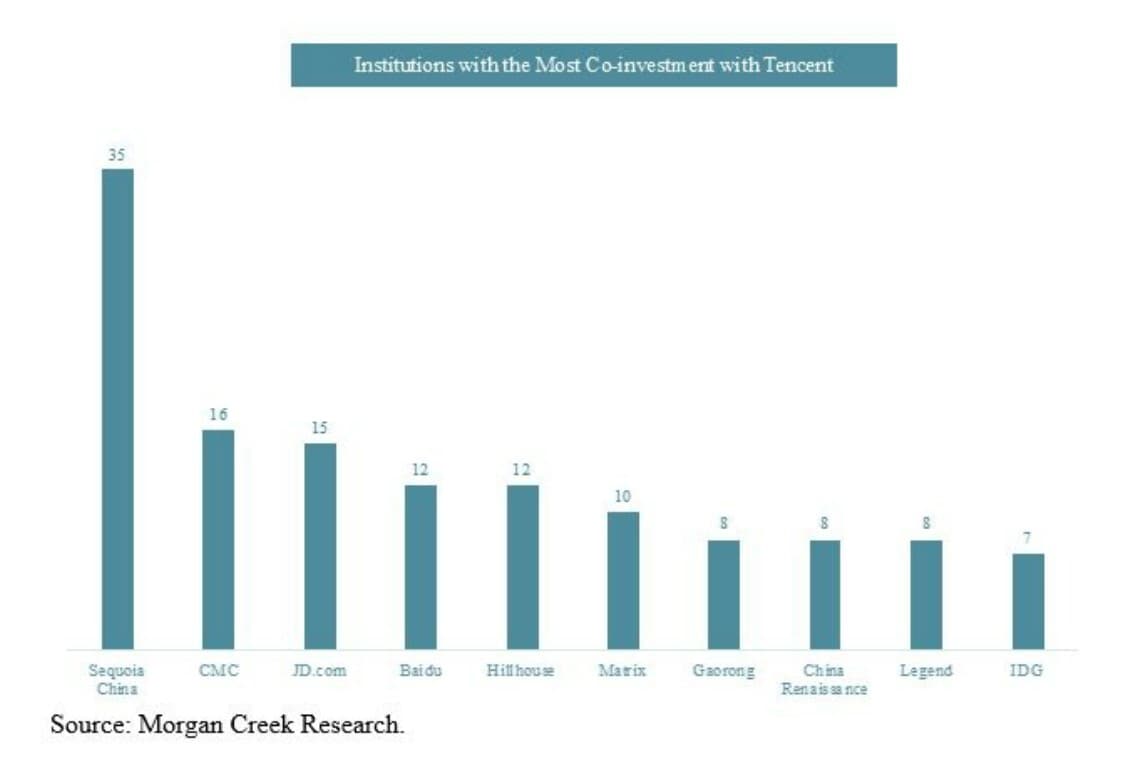

Compared with other CVCs, Tencent tends to invest in the relatively early-stage companies and has close relationships with VC and PE funds including Sequoia China, CMC Capital and Hillhouse Capital. Tencent also partners closely with JD.com [JD] and Baidu’s [BIDU] CVC programmes.

This article was reproduced with permission from Morgan Creek Capital Management. It was originally published on the firm’s website on 19 March. To learn more from the Morgan Creek investment team, Chinese fund managers and entrepreneurs on investing in private equity markets in technology and healthcare in China, register for the New China Symposium webinar, which is on from the 4 to 6 May 2021.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy