On 8 April, HIVE Blockchain Technologies’ [HIVE.V] share price climbed 2.6% after it announced that its cryptocurrency assets had jumped 300% in value during the first quarter of 2021.

Before the blockchain company published its fiscal year-end coin holdings on 7 April, the stock had soared 105.4% to CA$4.91 during the first three months of the year.

Shares in the Vancouver-based cryptocurrency miner had been relatively flat throughout January. However, the stock was boosted by a six-day winning streak the next month that saw it hit an intraday high of CA$7.25 on 19 February before closing at CA$6.80.

The stock was up 110% for the year to 13 April, outperforming both the S&P 500 and the Harvest Portfolios Blockchain Technologies ETF [HBLK.TO].

HIVE Blockchain had a 2% weighting in the Blockchain Technologies fund as of 31 March. It was also held by the Horizons Big Data & Hardware Index ETF [HBGD.TO], with a 3.96% weighting as of 12 April. The ETF was up 65.45% for the year to 13 April’s close.

Bitcoin and Ethereum rally key to asset boost

On 7 April, HIVE Blockchain revealed that its coin inventory value had soared by 300% from $15m on 31 December 2020 to $60m on 31 March.

The value of the company’s digital currency holdings climbed 85.7% quarter-over-quarter from $3.5m to $6.5m in the first quarter of 2020 and a further 64.6% to $10.7m in the second quarter.

By the end of the fourth quarter, the company had more than 320 Bitcoins and 20,030 Ethereum coins held in its cold (offline) wallets. The recent rally in cryptocurrencies was a major driver in increasing the dollar value of HIVE Blockchain’s coin portfolio.

The price of Bitcoin against the US dollar rallied 825.8% in the last 12 months, from $6,859 to $63,503.46 on 13 April. Meanwhile, the price of Ethereum against the dollar jumped by an astronomical 1,263.7% in the past year to $2,157.66 from just $158.22.

1263.7%

Ethereum's 12-month jump against the dollar

Frank Holmes, chief executive of HIVE Blockchain, said that the growth in Ethereum and decentralised finance was a significant part of boosting its coin asset value. It’s also why investors were attracted to the stock. “HIVE has become a proxy for Bitcoin and Ethereum,” he told Opto.

If Bitcoin and Ethereum prices continue to trade at such high multiples, Holmes believes the company could double in valuation from here. He is also looking at a potential Nasdaq listing by the end of the year, following the success of companies like Riot Blockchain [RIOT] and Marathon Digital Holdings [MARA].

Given that HIVE Blockchain was one of the most liquid stocks in Canada last year — with 1.7 billion shares traded — Holmes believes that it could fetch a higher valuation compared to its peers based on its improving revenue and cash flow.

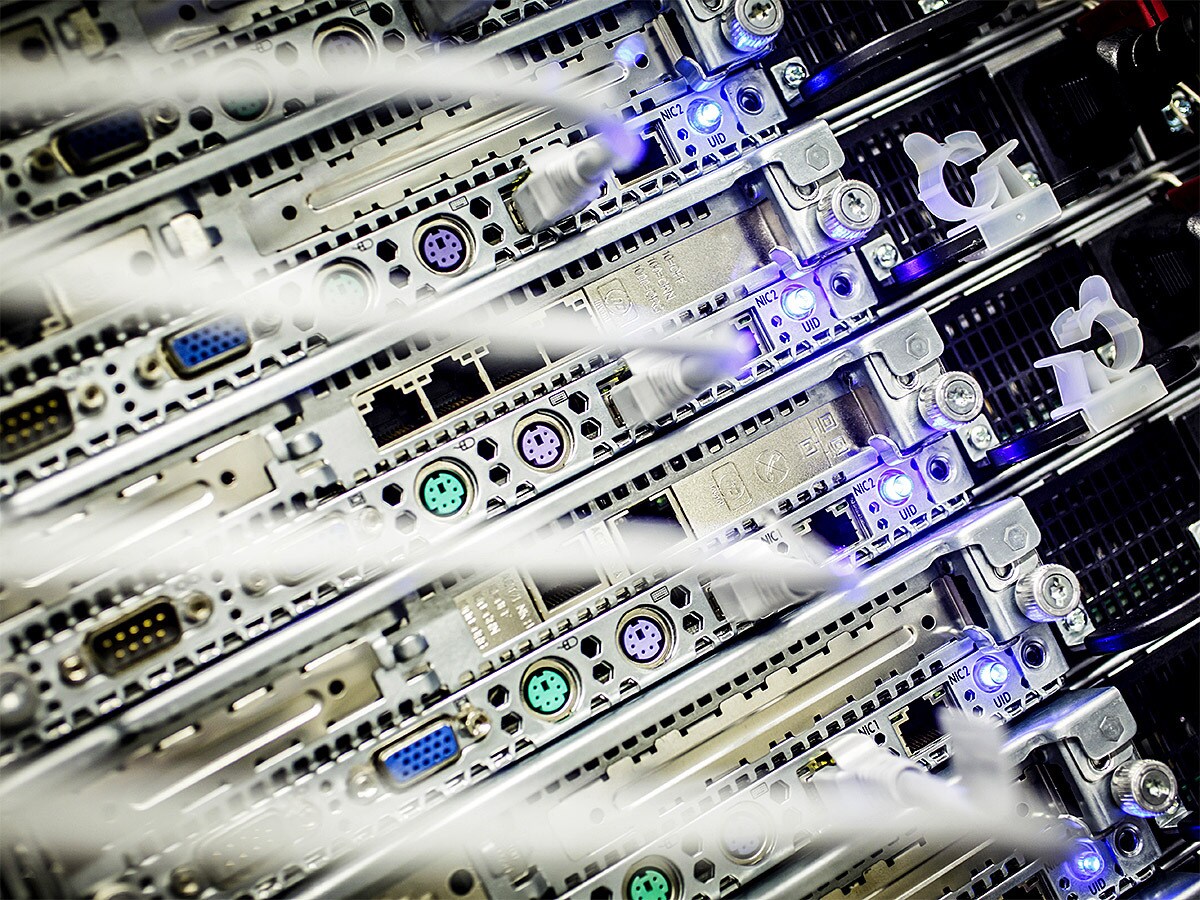

Next-generation mining equipment

The positive results meant Hive Blockchain had $36m in cash by the end of 31 March, a 3,500% increase from the $1m it had in the previous quarter, which it will continue to use to invest in mining hardware.

HIVE Blockchain said it would look to continue investing in ASIC and GPU next-generation mining equipment, which is set to boost its gross mining margins. The company forecast revenue to triple over the next year based on current Bitcoin and Ethereum prices.

“Our strategy is to continue holding coins, as we feel that it will benefit our shareholders,” Holmes said in a statement.

"“Our strategy is to continue holding coins” - Frank Holmes, HIVE Blockchain chief executive

Brian Paradza, a chartered financial analyst, believed the company could easily follow through with its strategy based on its improved cash position, he wrote in The Motley Fool.

However, Paradza also believed that it could have reported much more coin inventory if it had held onto some previously mined Ethereum coins that it sold during the quarter.

“If the company produced anywhere near the 21,500 Ether and 165 Bitcoin coins produced during a previous quarter, then the total coin portfolio should have grown to something between 33,200 and 34,700 Ethereum coins, and nearly 347 Bitcoins,” he said, adding that sales could explain the difference during the period.

A digital gold rush

HIVE Blockchain’s strategy pivot to focus on building its coin inventory was received positively by the market.

While he expects that the Vancouver-based company’s shares will be subject to some price swings in the short term, Bruce Campbell, president and portfolio manager at StoneCastle Investment Management, predicts that increased digital currency adoption and higher Bitcoin prices will drive its shares higher in the long term.

Bitcoin bullishness is also seen at JPMorgan: “Considering how big the financial investment into gold is, any such crowding out of gold as an ‘alternative’ currency implies big upside for Bitcoin over the long term,” Nikolaos Panigirtzoglou, MD at JPMorgan, wrote in a note to clients seen by Forbes.

JPMorgan is targeting a Bitcoin price of $130,000 in the long-term if it continues to converge with gold. If this were to occur, then it could stand to benefit cryptocurrency miners like Hive Blockchain considerably.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy