In this article, Frank Holmes, CEO of U.S. Global Investors and executive chairman of HIVE Blockchain Technologies, considers how the $1.9trn US stimulus package could bolster growth in the aviation sector. He also looks at how the chip shortage in semiconductor companies could lead to higher inflation and provides an update on digital currencies.

A little over a hundred years ago, the United States emerged from the double whammy of a world war and a deadly influenza pandemic. Eager to get back to “normal” life, Americans went on a decade-long spending splurge, buying cars and radios and stocks, most for the first time ever.

Although we all know how it ended, the roaring twenties was largely a product of pent-up demand.

This summer, I believe we could see the start of a similar demand-driven economic boom as millions of Americans, newly vaccinated and $1,400 richer, make up for lost time by booking flights and vacations, going on cruises, taking the family to Disney World [DIS] and more.

As I shared with you earlier this month in a previous article, close to $18trn sits in Americans’ savings accounts right now — a record amount. Much of this cash is just waiting to be unleashed into the US economy.

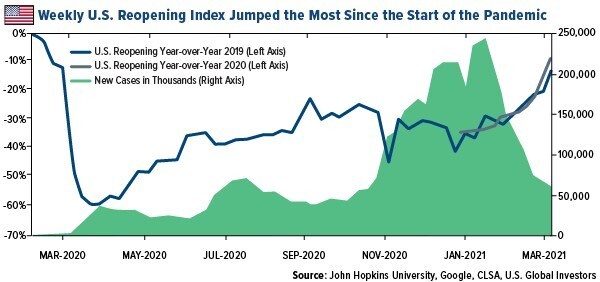

Things are already heading in the right direction. According to CLSA’s proprietary reopening index, the US saw the biggest weekly gain since the start of the coronavirus pandemic, up 8%, as the number of new daily infections dropped further. Here in Texas, all COVID-19 restrictions were lifted 100% last Wednesday, just in time for spring break.

Airlines betting on a strong rebound in summer bookings

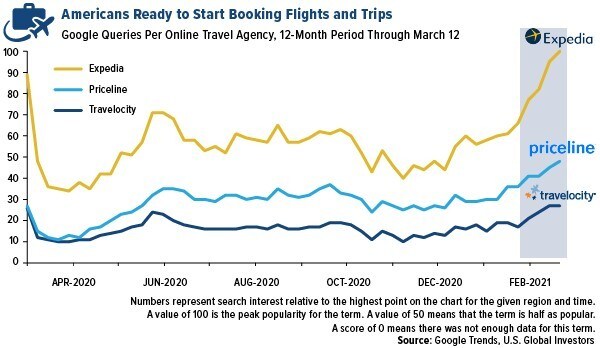

Last week marked the one-year anniversary of the start of the pandemic, and if Google Trends data is any indication, Americans are ready to travel again.

The number of Google queries for online travel agencies Expedia [EXPE], Priceline and Travelocity hit pandemic highs last week as airlines announced new deals and routes.

Low-cost carriers Allegiant Air [ALGT] and Southwest Airlines [LUV] recently expanded their networks to include 36 new non-stop routes in the former’s case, 17 in the latter’s. According to Bloomberg, this is the second-largest network expansion in Allegiant’s history and the largest for Southwest since 2013.

Across the Atlantic, Lufthansa [LHA.DE] is also adding to its slate of summer destinations in anticipation of a strong rebound in bookings. Europe’s largest carrier will add around 20 new routes from Frankfurt and 13 from Munich to vacation spots such as the Caribbean, Canary Islands and Greece.

Meanwhile, credit card data from the end of February shows an uptick in airline bookings among older Americans — those most likely to have been fully vaccinated. At a Raymond James conference, the CEOs of Delta Air Lines [DAL] and Spirit Airlines [SAVE] told investors that bookings took a positive turn in mid-February.

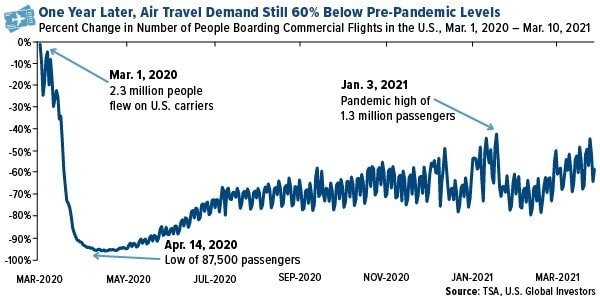

Passenger volume in the US is still down about 60% compared to pre-pandemic levels, but I expect this to improve the closer we get to vacation season and as more people get their shots.

Cowen aviation analyst Helane Becker, who helped us launch our airlines ETFs in 2015, told Yahoo Finance that she believed the number of daily passengers would cross above 1 million by 20 March. As of 14 March, the number exceeded 1 million people for the fourth day straight.

American Airlines [AAL] is so optimistic of a recovery in summer leisure travel that it just increased the size of its debt financing, from $7.5bn to $10bn. The debt, according to MarketWatch, is underpinned by the carrier’s $20bn AAdvantage loyalty programme.

In another sign that airlines are sensing a shift in Americans’ appetite for air travel, budget carrier Frontier filed to IPO last Monday, saying that it was “well-positioned to take advantage of the anticipated demand recovery as vaccine distribution continues”.

Rival carrier Sun Country also provided new details for its own upcoming IPO on Monday, telling investors it seeks to raise some $200m to help pay off pandemic crisis loans from the federal government.

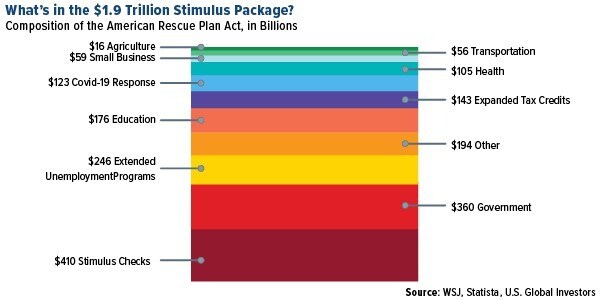

$15bn stimuli for airlines and airline contractors, $8bn for airports

The US aviation industry is set to receive another round of fresh stimulus now that president Joe Biden has signed the $1.9trn rescue package. American and United Airlines [UAL] immediately dropped plans to lay off or furlough a combined 27,000 workers.

Included in the bill is approximately $15bn for airlines and airline contractors, $8bn for airports and concessionaires.

As expected, U.S. airline and airport trade groups were quick to praise the rescue package. Airlines for America (A4A) wrote that it’s “vital to have our employees on the job and ready to assist as our nation prepares to move forward from this crisis”.

Meanwhile, the American Association of Airport Executives (AAAE) said that the amount earmarked for airports “underscores the enormous financial impact that the pandemic is having on airports and the entire aviation ecosystem”.

How the semiconductor chip shortage will contribute to inflation

One of the anticipated consequences of economic reopening is higher inflation. Add trillions of dollars in new debt and money-printing, and inflation could end up being hotter than any of us expected.

Last week, the Bureau of Labor Statistics (BLS) reported that the consumer price index (CPI) rose slightly to 1.7% year-over-year in February, up from 1.4% in January.

Of the items tracked by the BLS, used car and truck prices advanced the most at 9.3%. This was the sixth straight month that used vehicle prices jumped more than 9% compared to last year.

The reason for this is simple economics: Too few vehicles available for sale during the pandemic and too many buyers. The price hike is likely to continue with the global shortage in semiconductor chips, which are used extensively in automotive manufacturing. The “smarter” our cars and trucks get, the more chips are needed.

In a research report, CLSA wrote that the chip shortage “should ultimately hasten electrification of the global automotive industry”. With chip supply in question, automakers are shifting priority to the products highest in demand right now, i.e., electric vehicles (EVs). A number of companies, including Ford [F], General Motors [GM] and Toyota [TM], have extended plant shutdowns due to limited chip availability.

"[The chip shortage] should ultimately hasten electrification of the global automotive industry" - CLSA

As a result, prices for traditional internal combustion engine (ICE) vehicles will certainly face upward pressure as fewer of them roll off factory floors. The moral to the story? If you’re in the market for a new car or truck, you might want to make a purchase sooner rather than later.

Ethereum mining revenue broke above $1bn for the first time

The chip shortage has hit other industries, of course, including crypto mining. Demand from miners is so high right now that chipmaker Nvidia [NVDA] announced it would be releasing a new series of semiconductors designed specifically for mining Ethereum.

In other Ethereum-related news, Coin Metrics data shows that monthly revenue generated by Ethereum miners hit a record $1.37bn in February, an incredible 1,300% increase from the same month in 2020 and a 65% increase from the previous month.

$1.37 billion

Ethereum miners' revenue in February

Miner revenue includes inflation rewards (block subsidy) and transaction fees. Miners are paid rewards in the blockchain’s native currency for producing valid blocks and processing transactions.

This is very good news for HIVE Blockchain Technologies, the only publicly traded crypto miner that mines both Bitcoin and Ethereum using 100% green energy.

This article was originally published on Frank Talk, a blog by Frank Holmes, CEO of U.S. Global Investors and executive chairman of HIVE Blockchain Technologies.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy