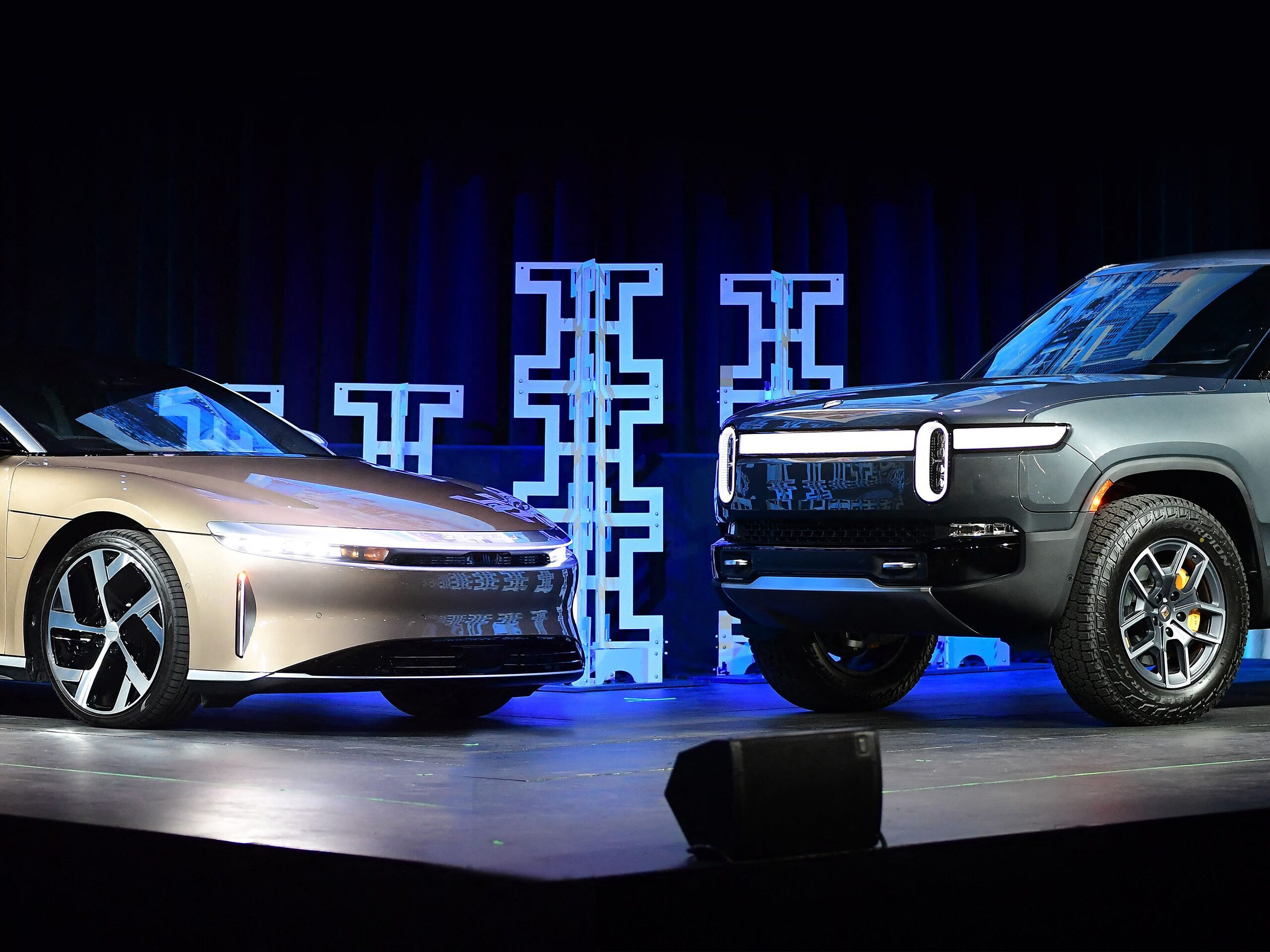

EV makers have suffered due to supply chain shocks and production shortfalls. Rivian shares have fallen more than Lucid, leaving a higher upside for the Amazon-backed company, even as analysts remain optimistic about the prospects of both companies.

The share prices of Rivian [RIVN] and Lucid Motors [LCID] have shown diverging trends over the past month.

The Rivian stock price is down 18.8% since the start of last month, closing at $50.24 on 31 March. In comparison, the Lucid share price is up by 1.6% over the same period.

This may be because of a standout difference in the companies’ production styles. Rivian entirely outsources the production of its electric motors. Lucid on the other hand, much in line with other EV companies like Tesla [TSLA], builds them in house or ‘insources’ them.

Sectoral weakness for EVs

Despite the general euphoria surrounding electric vehicles under the global green movement, shares of EV makers have been under pressure since the start of 2022. Investors are in the process of churning their portfolios from growth-oriented companies to value stocks. In addition to that, pressure from supply chain disruptions and limited production of semiconductors has further hurt the auto market.

The Global X Autonomous and Electric Vehicles ETF [DRIV], which tracks key players in the EV space, as well as technology providers with exposure to the electric vehicle industry, has fallen 9.7% in the first quarter of 2022.

However, Rivian has had it worse. It was publicly listed in November 2021 and rose approximately 70% immediately. Then, it started falling and is now at half the level at which it started the year.

Lucid stock is also down 30% since the start of 2022, although since 1 March it has reversed some of its earlier losses.

Fresh pair of hands at Rivian

In its fourth-quarter update on 12 March, Rivian warned that it may have to halve its production outlook for 2022 to 25,000 units because of supply chain concerns. Then,

it grabbed headlines when it raised and reversed a price hike on its flagship electric pickup truck to offset inflationary pressure.

It didn’t help that its blue-chip buyer Amazon [AMZN], which holds 20% in the company, placed an order from rival Stellantis, owner of the Chrysler brand.

To course correct, Rivian is relying on freshly hired chief operating officer Frank Klein, who joins the company in the role on 1 June, according to a company press release. Klein will be responsible for building “robust and stable operations processes as well as scaling vehicle production”, the company said.

Lucid’s regulatory probe challenge

Lucid, at its end, is also facing production challenges and revised this year’s output estimates to 12,000–14,000 vehicles from 20,000 earlier.

The luxury EV manufacturer said the lower targets were a result of shortages of parts such as window glass and interior carpeting. Lucid, like Rivian, may be forced to increase prices as raw material costs inch up, particularly as Russia’s war in Ukraine has exacerbated supply issues. Lucid’s CEO Peter Rawlinson told Reuters that there is an “inevitability” that the company will need to “look at the price points of models that are coming out in the future”.

The Lucid stock also faces a regulatory overhang. It came under the lens of the US Securities and Exchange Commission (SEC) with regards to disclosures and projections it made when it was publicly listed in July last year. Lucid has still not made any statement on the matter.

Rawlinson said he was “optimistic” that these issues would be resolved, helped at least in part by Lucid’s plans to develop a vehicle assembly facility in the US and a second factory in Saudi Arabia.

Rivian or Lucid: Which stock is better?

Analysts are optimistic about both stocks, although the projected returns on Rivian at this time appear to be higher.

According to 15 analysts polled by MarketScreener, Rivian has a consensus ‘buy’ rating and an average price target of $86.87, representing a 72.9% upside on its 31 March closing price. Adam Jonas of Morgan Stanley calls it “the one that can challenge Tesla,” in a widely reported investor note.

Lucid has a consensus ‘outperform’ rating and a $34.75 price target, representing a 36.8% upside on its share price at the close on 31 March.

Citi analyst Itay Michaeli reduced his price target on Lucid stock from $57 to $45 last month, because of the lower-than-expected production forecasts for its Air model, reported The Fly. However, Michaeli maintained a ‘buy’ rating as Lucid’s Q4 losses were lower than expected.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy