An earnings and revenue beat for Q3 2023 nudged Medtronic’s share price upwards on 21 February, with the medical device manufacturer reporting high single-digit growth in two key divisions. Despite its diabetes division underperforming competitors, analysts were broadly positive about the results.

- Medtronic shares nudged upwards following an earnings and revenue beat.

- Diabetes category growth lags rival Dexcom’s.

- Medtronic accounts for nearly 9% of iShares US Medical Devices ETF.

Medtronic’s [MDT] share price was unmoved in after-hours of trading on 21 February after the company posted earnings for the third quarter (Q3) 2023, revealing an earnings and revenue beat.

The share price has gained 10% in 2023 so far, though it is down 15% over the past year.

Medtronic, an American medical device producer, posted constant currency growth across all divisions within its business. However, diabetes product sales fell 2.4% year-over-year, and showed a steeper 15.6% drop-off in the US.

But analysts were relatively unconcerned by Medtronic’s underperformance in the diabetes division, highlighting instead the progress made in its neuroscience and cardiovascular segments, and the firm footing the results show it is on.

Stifel analyst Rick Wise said that “positive [Q3] momentum across all major business-lines is an encouraging [Q4] setup”, positioning Medtronic for strong growth and recovery in fiscal year 2024.

Multicategory growth

Medtronic’s revenue came in at $7.7bn, an increase of 4.1% year-over-year, excluding the $379m negative impact of exchange rate movements, as well as a $26m contribution from the company’s acquisition of Intersect ENT.

Analysts polled by Refinitiv had yielded a consensus revenue estimate of $7.5bn, giving Medtronic a 2.7% revenue beat for the quarter. Non-GAAP diluted EPS of $1.30 beat analyst expectations of $1.27 by 2.4%, but marked a 4% year-over-year decline.

Medtronic’s revenue increased across all device categories globally. Sales of cardiovascular products rose 6.5% on a constant currency basis, to $2.8bn. Even Diabetes product sales rose 3.3% on a constant currency basis, to $570m. But the largest increase from the year-ago quarter was in Medtronic’s neuroscience division, which grew 4.9% year-over-year, or 8.5% on a constant currency basis, to $2.2bn.

In the US, however, diabetes sales fell 15.7% year-over-year, and medical surgical revenue fell 2.5%. An overall increase in US sales of 3.1% was driven by a 7.9% increase in neuroscience sales, followed by cardiovascular sales at 6% growth.

Geographically, Medtronic saw the largest year-over-year growth in emerging markets, where its revenue increased 13.1% on a constant currency basis.

Medtronic issued Q4 revenue growth guidance of 4.5% to 5%, which would put Q4 revenue ahead of current analyst expectations even at the low end. However, Medtronic warned that exchange rates, if maintained at the present level, could have a negative impact of $165m to $215m. Full-year non-GAAP EPS guidance was revised from between $5.25 and $5.30 to between $5.28 and $5.30.

Medtronic lags diabetes competitors

Medtronic’s diabetes product growth is arguably underwhelming considering the boom that other diabetes equipment manufacturers are experiencing. Dexcom [DXCM], a maker of continuous glucose monitors, reported an increase of 20% in organic sales on 10 February.

In October, market research firm Spherical Insights calculated the size of the global diabetes devices market to have been $26.7bn in 2021, with scope to grow at a CAGR of 8.5% to $55.6bn by 2030. Medtronic and Dexcom were listed among the companies driving this growth.

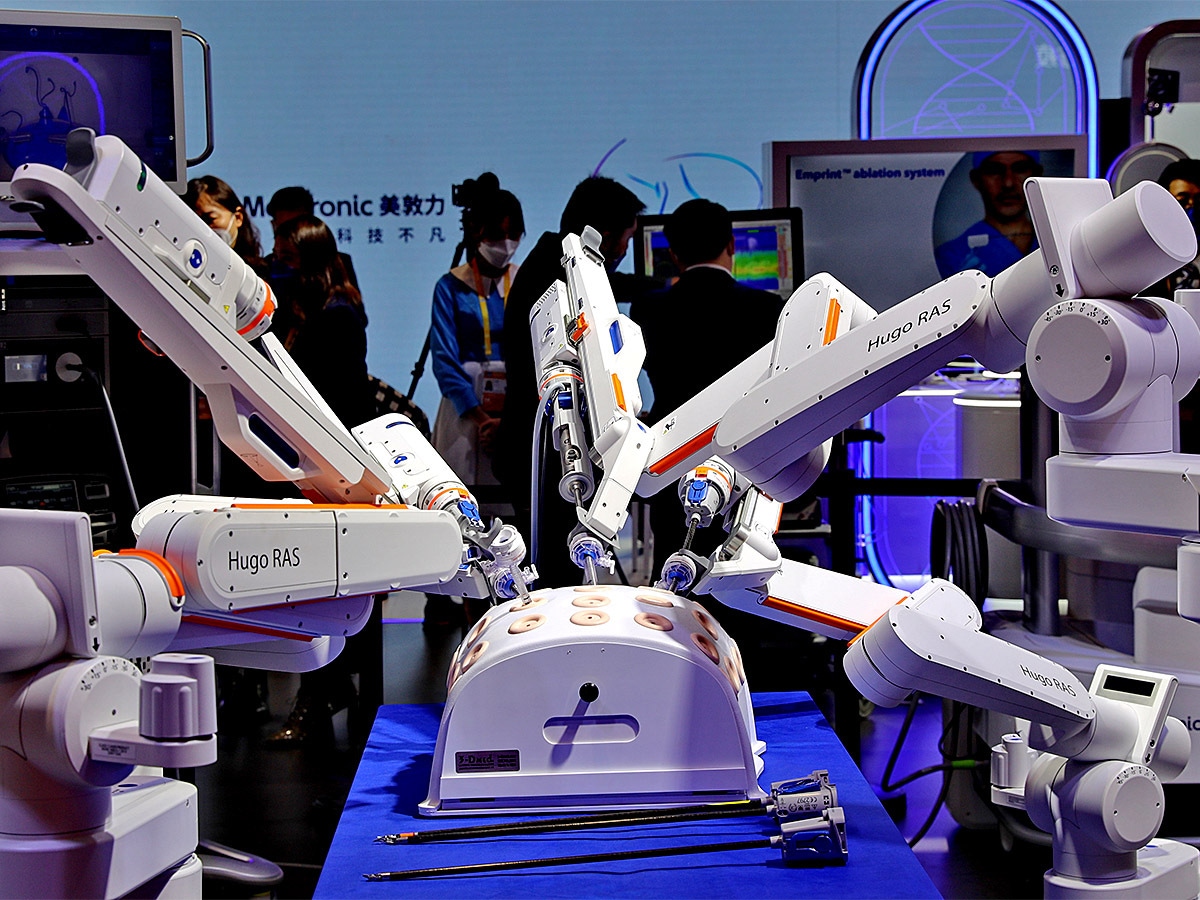

Geoff Martha, chairman and CEO of Medtronic, hailed the “strong, high single-digit organic growth” that the company’s cardiovascular and neuroscience divisions achieved during the quarter. Understandably perhaps, he made no reference to diabetes, but in any case analysts were not unduly concerned by Medtronic’s underperformance in this division, which exceeded expectations of $530m.

Funds in focus: iShares US Medical Devices ETF

According to etf.com, the ETF offering the greatest exposure to Medtronic is the iShares US Medical Devices ETF [IHI], in which Medtronic is the third-largest holding, with an 8.90% weighting as of 17 February. Dexcom is the ninth-largest holding and has a 4.15% weighting in the fund.

For exposure to both stocks, investors can also select the Simplify Health Care ETF [PINK]. Medtronic is PINK’s second-largest holding with a 5.41% weighting as of 17 February. Dexcom is the sixth-largest holding with a 4.44% weighting.

IHI is flat year-to-date, gaining just $0.01 over its share price at the final close of 2022. On the other hand, PINK has fallen 5.6% in the year so far. However, over the past 12 months, IHI fell 7.4%, while PINK gained 2.8%.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy