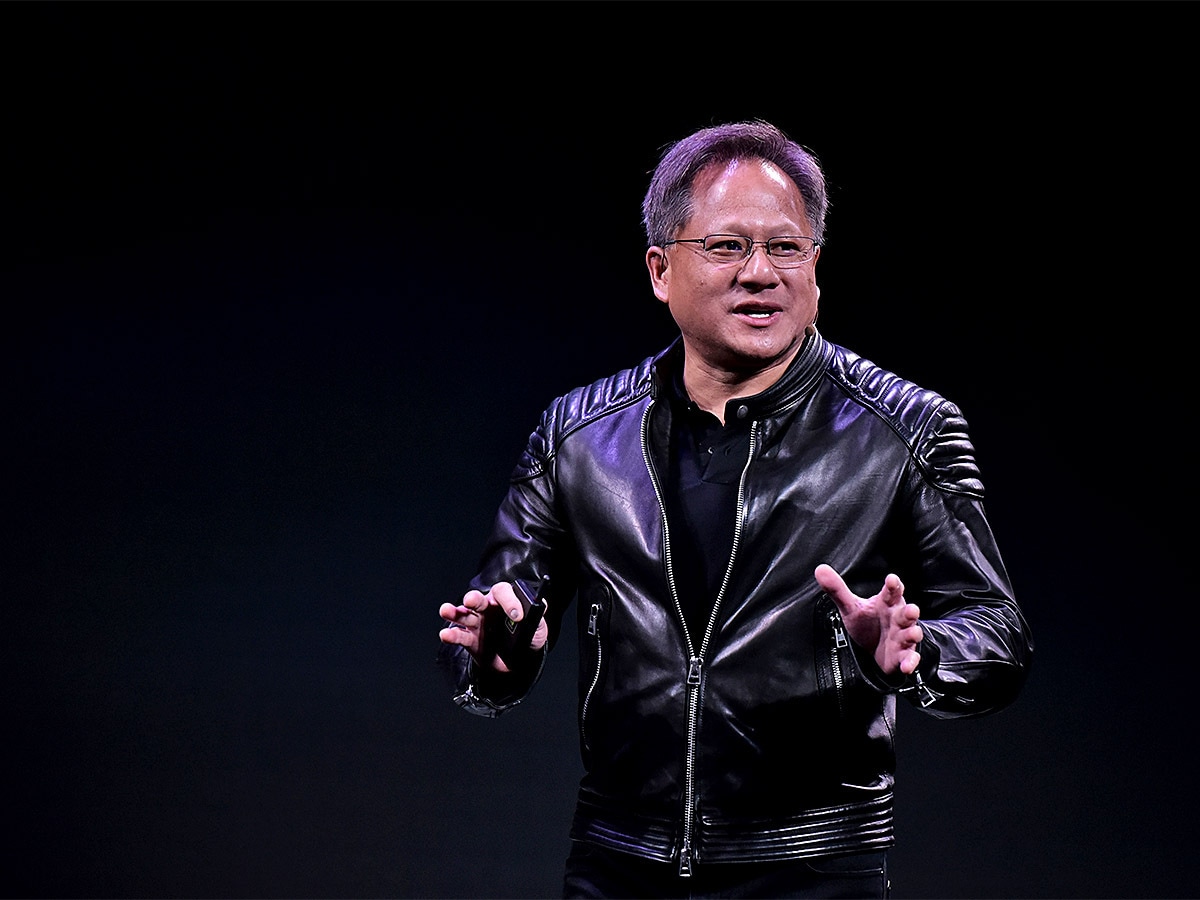

In a speech earlier this month, Nvidia CEO Jensen Huang described ChatGPT as “the iPhone moment of artificial intelligence”. Frenzy around the chatbot helped push the Nvidia share price higher ahead of its Q4 earnings report.

– Nvidia’s data centre revenue driven by demand for AI chips.

– ChatGPT usage could generate $3-11bn in sales for the company, according to CitiGroup.

– The VanEck Video Gaming and eSports ETF holds the chipmaker as its top holding and is up 11% year-to-date.

A big question ahead of Nvidia’s [NVDA] fourth quarter (Q4) 2023 earnings on Wednesday was whether the chipmaker had been impacted by a slowdown in enterprise computer and data centre spending.

The company narrowly beat both top and bottom-line estimates for the November to January period. Revenue came in at $6.1bn versus $6bn as expected by analysts polled by Refinitiv, while EPS were $0.88 adjusted versus expectations of $0.81.

Revenue was down 21% from Q4 2022, and non-GAAP EPS were down 33% year-over-year. Net income plunged 53%. Full-year revenue was flat at $26.97bn, while non-GAAP EPS were down by 25% and net income by 26%.

Sales are forecast to be in the region of $6.5bn in Q1 2024, a sharp drop from the $8.29bn reported for Q1 2023.

The Nvidia share price jumped as much as 9.15% after the bell, having already soared 42% year-to-date before the earnings report, to $207.54.

Data centre segment delivers

Shares have been heading higher as investors are buoyed by signs that Nvidia is holding up well during the current economic downturn.

Graphics processing unit (GPU) sales were down 46% year-over-year to $1.8bn, although up 16% sequentially. This was to be expected, given the weakening consumer demand for gaming chips. Nvidia’s professional visualisation segment, which is much smaller, fell 65% year-over-year to $226m due to clients cutting back on costs.

The standout performance, however, was in the company’s data centre business, its biggest segment. Revenue, which includes chips for artificial intelligence (AI) applications, was up 11% year-over-year to $3.6bn and up 41% for the full fiscal year to $15bn.

Nvidia founder and CEO Jensen Huang said in a statement released with the earnings that “AI is at an inflection point, setting up for broad adoption reaching into every industry”.

The hope is that rising demand for machine learning software will translate into more businesses buying Nvidia’s AI chips.

Back in December, the chipmaker announced that it had partnered with Deutsche Bank [DBK.DE] to accelerate the use of AI in financial services. In January, Nvidia and Dell [DELL] together announced their largest-yet joint AI endeavour when they launched a new line of Dell PowerEdge servers to enable enterprise adoption of AI.

Chipmakers boosted by ChatGPT hype

Huang expects Nvida’s “new Ada architecture GPUs with AI neural rendering” could boost the gaming segment’s recovery. But it is ChatGPT’s potential to elevate the demand for AI chips that has got many investors excited.

“Nvidia has started to capture investor imagination on the first potentially big AI inference application in the chatbot world,” Rosenblatt Securities analyst Hans Mosesmann wrote in a note to clients ahead of Wednesday’s earnings, seen by Investor’s Business Daily.

“We believe ChatGPT is just one of a multitude of AI-centric growth vectors going forward,” added Mosesmann, who reiterated his ‘buy’ rating on the stock. His price target of $320 is the highest on Wall Street and implies an upside of 54.2% from the most recent closing price.

Citigroup analyst Atif Malik estimates that ChatGPT usage could generate $3-11bn in sales for Nvidia over a 12-month period.

Advanced Micro Devices [AMD], Samsung Electronics [005930.KS] and SK Hynix [000660.KS] are among other chipmakers that stand to gain from AI-powered chatbots and data centres running AI workloads.

Funds in focus: VanEck Video Gaming and eSports ETF

Given the rising demand for generative AI and Nvidia’s potential to be a disruptor, it’s no surprise that the chipmaker is a popular holding for thematic funds outside of the semiconductor space.

Nvidia is the top holding in the VanEck Video Gaming and eSports ETF [ESPO], with a weighting of 9.46% as of Wednesday. The fund is up 10.5% year-to-date and down 17.6% over the past year.

The stock is also the top holding in the Pacer Data and Digital Revolution ETF [TRFK], with a weighting of 9.85% as of Thursday. The fund is up 10.3% year-to-date and up 2.3% over the past 12 months.

It’s also the top holding in the Roundhill Metaverse ETF [METV] as of Wednesday and the second-biggest in the Global X Metaverse ETF [VR] as of Tuesday. They have allocated the stock 8.67% and 7.01% of their portfolios, respectively; the funds are up 17.8% and 13.4% year-to-date.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy