Every day, we handpick the 5 Top Stories stock market investors need to know. In 5 minutes, you’ll learn the stocks, CEOs, and money managers moving markets.

Weight loss drugs could be good for the heart

Wegovy, a weight-loss drug developed by Novo Nordisk [NOVO-B.CO], can improve cardiovascular health according to late-stage trial data. Novo Nordisk’s CEO Lars Fruergaard Jorgensen has admitted to Bloomberg that the company is struggling to meet demand for Wegovy and another similar product, Ozempic. The weight loss medication hype has lifted Chinese pharma stocks including Suzhou Highfine Biotech [301393.SZ] and Cheng Du Sheng Nuo Biotec [688117.SS].

Rivian raises production target

Rivian [RIVN] raised its production target for 2023 in Tuesday’s second-quarter (Q2) earnings announcement, while reassuring investors that it has sufficient cash to last until 2025. Revenue of $1.1bn beat the $1bn estimate of Refinitiv analysts, while gross margin improved quarter-over-quarter to negative 37% from negative 81%. Rivian’s senior vice president of software development Wassym Bensaid made a surprise appearance on the earnings call to promise improvements to the company’s software capabilities, which he described as “a structural differentiator”.

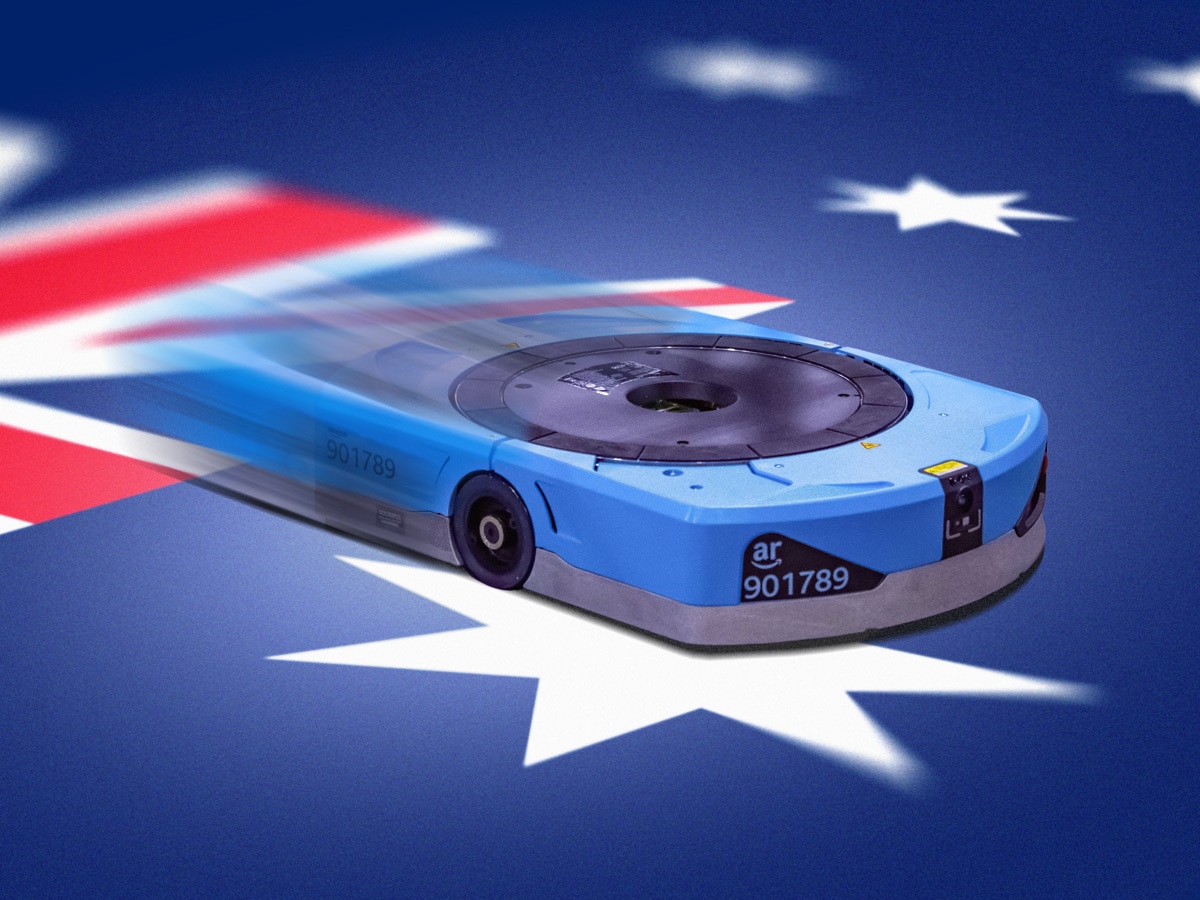

Robot fleet to run Amazon’s Australian warehouse

Australia’s largest warehouse will be partly run by a fleet of robots supplied by Amazon [AMZN], reports Bloomberg. The fulfilment centre to the north of Melbourne will create 2,000 jobs, cover 209,000 square meters and is due to be completed in 2025. Amazon has entered talks to become one of the anchor investors in Arm’s IPO, according to a person familiar with the situation cited by Bloomberg.

Struggling smartphone market hits Sony’s profits

Sony’s [6758.T] Q1 operating profit fell 31% with its financial services and movies units blamed for the slide. A downturn in China’s smartphone market also hurt Sony’s takings on smartphone image sensors, according to Bloomberg. However, the company increased its net income forecast to ¥860bn, with sales of the PlayStation 5 console expected to increase with the disappearance of supply chain constraints.

Nvidia announces new superchip

Having hit a market cap of $1trn earlier this year, Nvidia [NVDA] seeks to solidify its leading position in artificial intelligence with a new ‘superchip’ known as the GH200, which will be launched in Q2 2024. CEO Jensen Huang unveiled the chip as part of a new product lineup at the annual Siggraph computer graphics conference and exhibition on Tuesday. Nikon [7731.T] saw its biggest single-day fall on record on Wednesday following a Q1 earnings report revealing that net income fell 78%...

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy