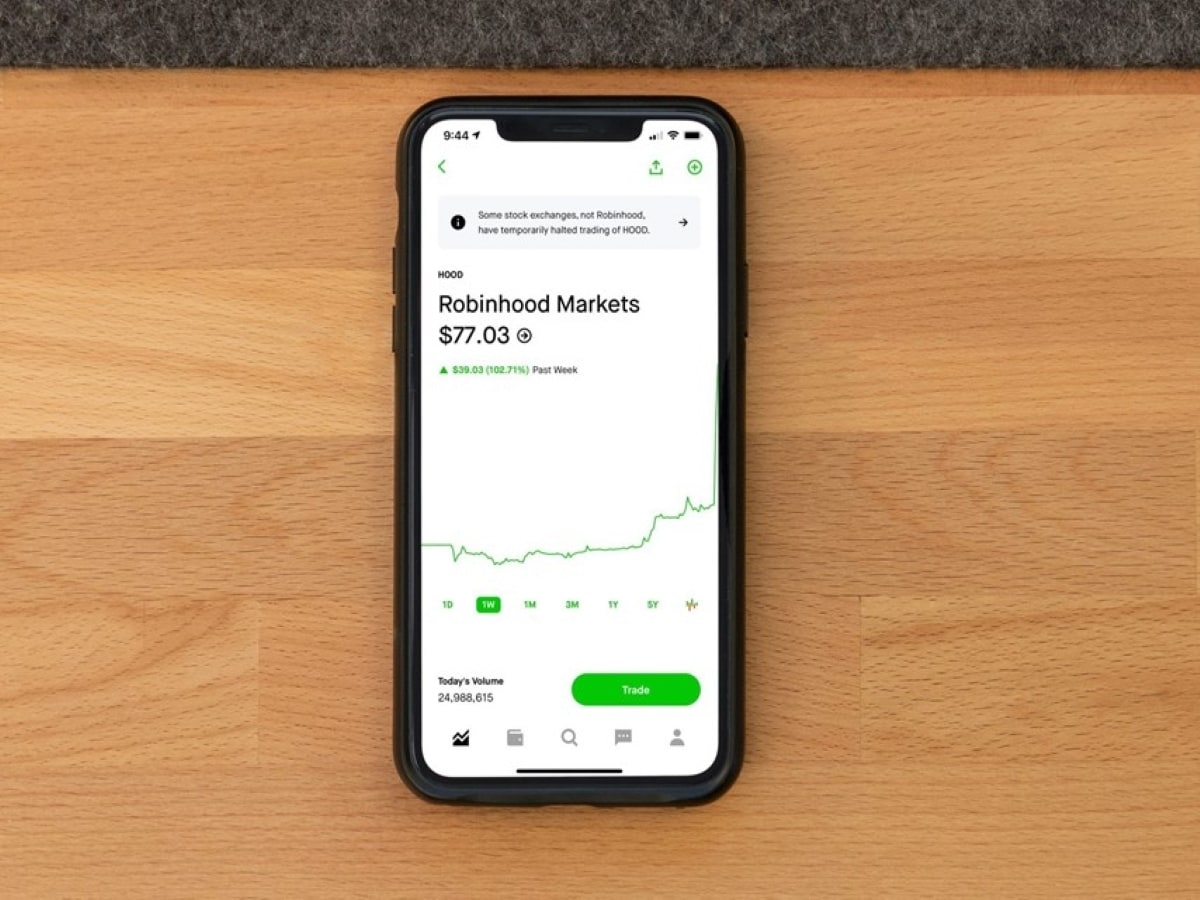

Trading platform provider Robinhood [HOOD] saw a huge spike in its stock price yesterday following the announcement of extended trading hours on its platform.

Users will now be able to avail of four extra hours per day — two in the morning and two in the evening. The news saw shares in the firm pop by over 24%.

This article was originally written by MyWallSt. Read more insights from the MyWallSt team here.

Why is Robinhood stock up?

A slowdown in trading volume has been one of the many reasons behind Robinhood’s struggles so far this year. With the stock down over 13% year-to-date, even after this significant jump it’s clear changes had to be made to entice more users to engage with the platform.

In a blog post released by the company announcing the news, the company stated its position:

“Our customers often tell us they’re working or preoccupied during regular market hours, limiting their ability to invest on their own schedule or evaluate and react to important market news. In fact, we’ve seen a community of Robinhood early birds and night owls who log in exclusively outside of regular market hours.”

If this truly is the case, an additional four hours of trading time outside typical hours could be a huge boon to the company. Retail investors will now be able to trade from 7am to 8pm Eastern Time (12pm to 1am in the UK). This puts Robinhood’s hours more in line with legacy brokers such as Charles Schwab or Fidelity.

Robinhood has also confirmed that its end goal is to eventually work towards offering 24/7 investing. This intermediate step could be extremely important in ascertaining whether or not there will be a true value in allocating time and effort to a 24-hour platform.

What does this mean for Robinhood investors?

For current shareholders, this move should be viewed positively. Robinhood’s stock is flagging, but this shows clear signs that the firm is willing to innovate in an attempt to turn its fortunes around. There’s still a considerable amount of work to be done, with the company down more than 55% from all-time highs it hit shortly after its July 2021 IPO.

While it’s unlikely that this move alone will continue to eat up some of those losses, it could provide the spark from which Robinhood will continue to grow out of. Moving its offerings further in line with other legacy competitors could help it attract new customers that previously shied away from the relatively limited offering put forward by Robinhood. Once customers are in, the app’s ease of use and user friendliness could drive high retention rates.

Robinhood remains a stock to keep an eye on as it attempts to pivot away from the frenzy of 2021. The firm is not without its faults, but its mission to “democratise finance for all” is certainly admirable, and it has proven already that there is certainly a place in the market for apps of its kind.

MyWallSt gives you access to over 100 stock picks, as well as providing free analysis, multiple podcasts, customised market updates straight to your phone, and much more. Sign up for free today

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy