These two companies cater to people setting up websites or creating online stores and have seen rapid growth due to the pandemic. Although the two differ slightly in their offerings, both are beneficiaries of growing entrepreneurship levels and a shift to digital. These companies also avoid the conflict of interest that tech giant Amazon has come under scrutiny for, but what company could be a better investment now?

This article was originally published on MyWallSt — Investing Is for Everyone. We Show You How to Succeed.

Shopify: Bull vs Bear Arguments

Shopify (NYSE: SHOP) is the most well-known of these two companies and has established itself as a real competitor to Amazon. It allows merchants to set up online stores and powers more than 1 million businesses. Shopify is benefitting from tailwinds due to the pandemic, which is expected to endure. It estimates that the total-addressable-market is $78 billion, which gives it room to grow.

Shopify has one of the world’s best CEOs at the helm in Tobias Lütke, who owns roughly 6.7% of Shopify’s stock, an encouraging sign for investors. Since its days as a snowboard store, Lütke has instilled a positive company culture and his 93% approval rating on Glassdoor is testament to this.

Shopify reported outstanding results in Q3 of 2020 with revenue growth of 96% to $767.4 million and saw a record number of paid subscribers. Gross merchandise volume (GMV) grew by 109% year-over-year (YoY). Shopify is also profitable and reported a net income of $191.1 million in Q3 versus a loss of $72.8 million a year prior. Despite regularly smashing quarterly earnings expectations Lütke has said in his 2015 letter that, “Shopify has been about empowering merchants since it was founded, and we have always prioritized long-term value over short-term revenue opportunities.”. This should resonate with long-term investors.

However, Shopify’s stock’s most significant risk is its valuation, and it is currently trading at a price to sales ratio of almost x60. Investors have factored in high growth rates for the foreseeable future, and there is also a risk that as the pandemic subsides growth may slow.

Wix: Bull vs Bear Arguments

Wix (NASDAQ: WIX) is an Israeli-based company founded in 2006 and went public on the Nasdaq in 2013. It currently enables 180 million users across 190 countries to create a website and manage their business with various tools. Wix is a free platform but monetizes its users through premium upgrades.

Co-founder Avishai Abrahami is the current CEO and has been leading the company since 2010, overseeing impressive growth in that time. Abrahami and his co-founders set up the company due to the frustration of website creation.

Wix reported impressive Q3 results and the strength in Q2 has continued with management stating that the “trend of growth will stay even when the pandemic has slowed down”. Wix reported 302,000 net premium subscription additions in the third quarter of 2020, a 164% increase YoY to 5.3 million. It was also the highest conversion of registered users to premium subscriptions in two years and higher collections per subscription.

It has consistently grown revenue and Q3 was no exception, with revenue increasing by 29% YoY to $254.2 million and forecast to accelerate in Q4. Annual recurring revenue also came in 24% higher than a year previously. Wix also has high gross margins at 69% in Q3, albeit down slightly from the previous quarter.

However, it is still unprofitable, reporting GAAP net loss in Q3 of $56.8 million, which widened significantly YoY up from $17.4 million. This is primarily due to costs associated with sales and marketing and the costs associated with new debt issuance. The company continues to reinvest in its business rather than focusing on the bottom line, but investors should be mindful of this cash burn. The company is also relatively small with a market cap of under 14 billion and is likely to be volatile.

Which stock is a better buy right now?

Both these founder-led companies benefit from global trends and don’t appear to be slowing down anytime soon. Either could make a great addition to a portfolio to gain exposure to e-commerce, but Shopify has a track record of high growth and a visionary CEO. However, Wix may have more growth left in the tank because it is roughly ten times smaller than Shopify.

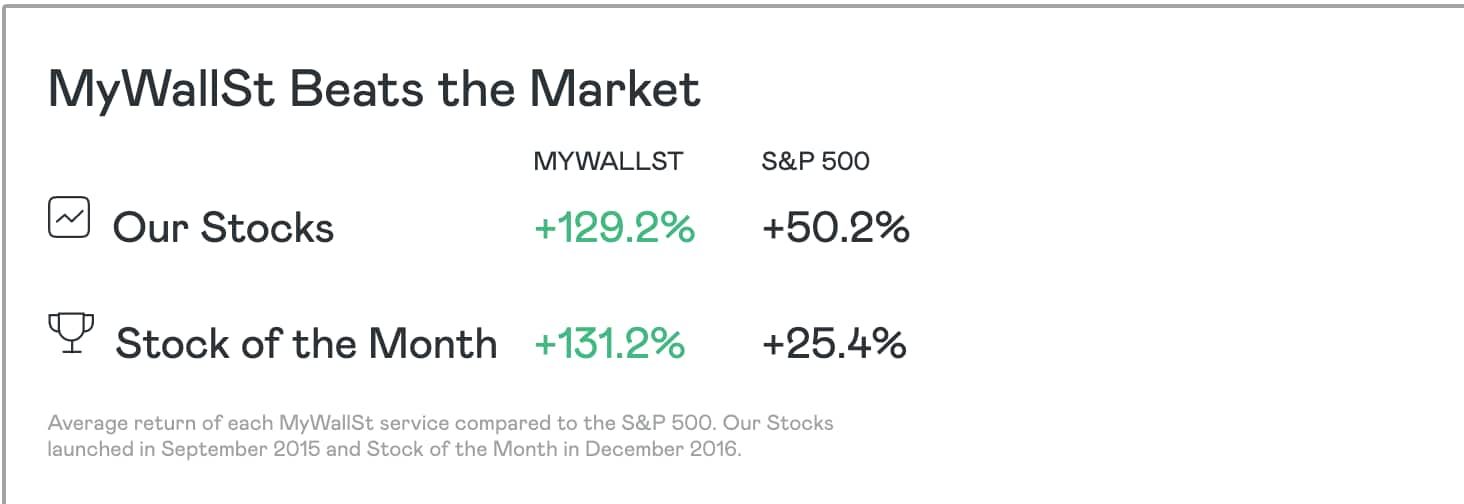

MyWallSt makes it easy for you to pick winning stocks. Start your free trial with us today— it's the best investment you'll ever make.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy