Whilst the name might inspire some biblical connotations, ARK Investment Management LLC has managed to raise heads in the midst of a pandemic of all things, as its ‘Innovation ETF (NASDAQ: ARKK)’ exploded in popularity last year. This ETF contains some very exciting companies and it has experienced high growth over the past year — throughout 2020 the Innovation ETF’s share price grew 281%.

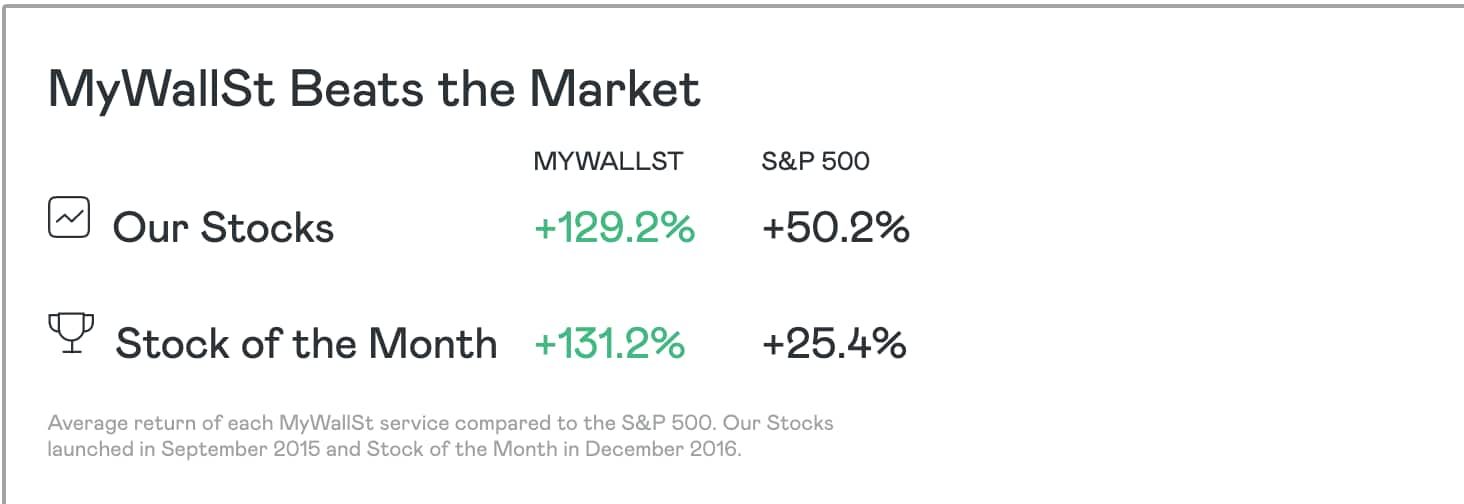

This article was originally published on MyWallSt — Investing Is for Everyone. We Show You How to Succeed.

Whilst ETF’s notoriously are slower in growth than individual stocks, there are some very strong reasons why you should not ignore this collaboration of stocks in particular.

Spend, spend, spend

The ARK Innovation fund is the largest of the ARK ETFs with a total of $17.6 billion in net assets. One great thing about this fund is that investors can get daily updates on its spending habits. In the second week of January for example it bought shares in Tencent on no less than four occasions throughout the week, totaling 1.3 million shares.

In the last week of January, it made 83 transactions with the smallest being 1,115 shares of Fate Therapeutics and the largest being 545,875 shares in Taiwan Semiconductor Manufacturing Co LTD. This fund is continually spending large amounts of cash and it is buying up the most innovative and exciting companies it can find.

Being a transparent and actively managed fund, investors can get daily information as to what is happening with their money and which companies ARK’s chief investment officer, Cathie Wood, deems worthy of investment.

Risky vs Smart

Innovation is always risky, particularly when it comes to financing. So why is this ETF doing so well?

Currently, its strategy is focused on 5 different areas for innovation:

- DNA technologies (genomics).

- Energy storage.

- Autonomous technology.

- Next-generation Internet services.

- Fintech.

For each of these ‘themes’, the ETF has a team that researches the best and brightest in this area. These ‘themes’ span across many different industries which makes each area and the ETF, in general, less susceptible to volatility.

Additionally, the fund looks into technologies that have already emerged and whose overall costs of production are decreasing as demand increases and materials used become cheaper. These declining costs are often a major part of the researcher’s investment theses. As new technologies become cheaper, then the company producing them will increase its profit margins.

The other side of this model is that often the companies that are chosen are not yet profitable and thus present much more risk for at least the short-term. Additionally, the downside of investing in any ETF, not just this one, is that growth is slower overall than choosing a selection of individual companies.

Revolutionary Leadership

There has been a movement over the last few years to change the overall market focus from traditional industries such as car manufacturers and financial services to innovative industries including information technology and new energy tech. The S&P 500 has reshuffled its index to further represent this change in the type of industries that now make up modern-day America’s market.

The ARK Innovation fund is run by Catherine Wood, who is the CEO and CIO of the wider ARK Holdings. Cathie Wood is a visionary investor who has become one of the most influential investors out there. Highly driven and focused on the world around us and how we will continue to innovate in new and exciting industries, this ETF represents her vision. With Tesla, Roku, CRISPR Technologies,and Square forming the top 4 holdings in this ETF, no-one could say that this is a boring collection of companies.

In addition, the team that Cathie Wood has put together for research all come from the industries that they are assigned to. This helps keep the knowledge flow going in the right direction as her researchers can fully understand the science behind each business model.

The ARK Innovation ETF could be a great option for any investor who wants to add something a bit more exciting to their portfolio. With its continuous movement, its well thought out, driven approach to innovation, as well as impressive leadership this ETF is an opportunity to invest in the future.

MyWallSt makes it easy for you to pick winning stocks. Start your free trial with us today— it's the best investment you'll ever make.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy