The past week, Elon Musk’s company, Tesla, made it into the S&P 500.

That kickstarted the stock, which had been floundering at around $400 per share, to over $500 per share.

I have had a saying for years concerning Elon Musk. “Love him or hate him, but never bet against him. “

That is, I figure, like betting against the hand of the king (although at this point, he could be the king).

With the stock maintaining a bullish phase on the weekly charts going back to October 2019, the recent dip closer to 390 was a great buy opportunity.

Once analysts came out with an upgrade to $540, Tesla made a high last week of $508.62 before selling off a bit on Friday.

Tesla has been a darling of the Robinhood investors. Surely, with last week’s surge in volume, that darling has returned.

Rumor has it that Warren Buffett also bought the stock recently.

Any new buyer of TSLA at these levels, $475 should hold as a smart risk point.

Should the stock close over $500 per share, shares could easily head to $540 as per the analyst’s upgrade level. We see $600 as a possibility as well.

The final frontier

Tesla stockholders also closely watch SpaceX.

Before SpaceX made a deal with NASA, the company was teetering on bankruptcy. Once NASA supplied SpaceX with $1.6 Billion, it was well, lift-off.

Currently, the Dragon housing four astronauts is docked at the International Space Station. Another successful notch in King Musk’s belt.

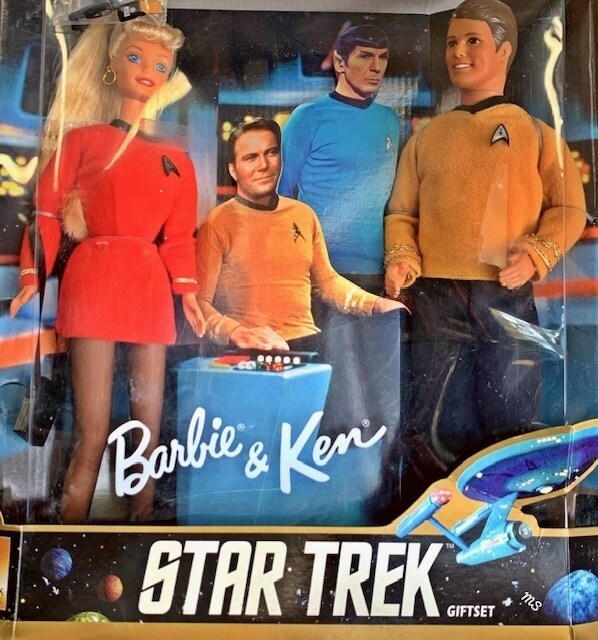

And speaking of space, I can barely imagine anyone alive today who has not seen either the old or newer versions of Star Trek, or one of the movies made between 1963 to the present.

So, it is any great surprise that the notion of “Space, the Final Frontier” resonates with Elon Musk?

In fact, the fever has spilled over to Jeff Bezos and Richard Branson. Bezos has Blue Origin, a privately owned aerospace manufacturer. Blue's vision is a future where millions of people are living and working in space.

Richard Branson and Virgin Galactic state their mission as “together we open space to change the world for good.”

As a publicly traded company, SPCE the stock, has formed a base since its IPO in September 2017. After two and half years of essentially flatline price action, the stock began to explode at the end of 2019.

With plans to launch from guess where-Truth or Consequences, New Mexico come January and March 2021, the stock has gained the attention of many young traders (and some older ones too).

Branson, along with Musk and Bezos are now considered Space Baron billionaires. Hence, they have taken the Star Trek slogan, “Go where no man has gone before," and turned it into reality.

Furthermore, perhaps even closer to Star Trek’s mission to keep the galaxy safe from Klingons, is the new Space Command.

In December 2019, President Trump signed a Defense spending bill authorizing the creation of a "Space Force," as the sixth branch of the United States armed forces.

The new organization, or the 21st-century version of the Star Trek’s Starship Enterprise, would develop teams to defend satellites from attack, along with other space-related missions.

Musk and his fellow barons have exceeded the label of innovator or visionary. The Space Barons are a movement-with all the emotions that movements bring with them.

Skepticism, criticism, adoration, and yes, envy, all emotionally embody the race to space.

For us forward-thinking investors, there is not too much to choose from to buy.

And that is partially why Tesla’s market cap is now roughly in-line with the combined market caps of nearly the entire legacy auto industry. Investors bank on Tesla and Musk.

Only two other space-related companies, Virgin Galactic (SPCE), and Iridium Communications (IRDM) are in bullish phases.

The other two most recognizable companies, Lockheed Martin, and Aerojet Rocketdyne (AJRD) are in bear phases.

Nonetheless, keep your eyes open for new space travel companies to go public.

And when they do, think of the words of Samuel Beckett “You're on Earth. There's no cure for that.”

Alas, we are still on earth. Yet hopefully, we can look for emerging investment possibilities that enable us to “Live long and prosper.”

Bio

Michele 'Mish' Schneider currently serves as Director of Trading Research and Education at MarketGauge.com. She writes and produces daily market analysis in "Mish's Daily", and serves as a developer and trading mentor in several of our trading services, drawing on her 30+ Years of Trading and Teaching Experience.

Mish is a former floor trader on several New York Commodity Exchanges, including Coffee, Sugar and Cocoa NYMEX and FINEX in NYC. While on the trading floor Mish also served as a market analyst for two of the largest commodity trading firms at the time - Continental Grain, and Conti-Commodities.

Mish also wrote the best-selling finance book, Plant Your Money Tree; A Guide To Growing Your Wealth.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy