In this article, Pedro Palandrani and Andrew Little, research analysts at Global X, explore some of the most exciting themes in their latest Next Big Theme report.

Lithium and battery tech

Factories charge up battery cell production

In a bid to satisfy the growing demand for battery cells used in electric vehicles, Ford [F] announced it will open a $185m R&D battery lab. (1) The lab indicates that Ford will likely vertically integrate, moving towards in-house production of batteries in the future. Executives at Ford noted that the global pandemic and the ensuing semiconductor shortage highlight the value of localised supply chains. Ford’s new facility will likely be around 200,000 square feet and will open at the end of 2022 (2).

In the US, there are currently three operational gigafactories — large scale factories producing batteries for electric vehicles — including Tesla [TSLA] and Panasonic’s [6752] Gigafactory 1, LG Chem’s [051910] Michigan plant supplying GM [GM], and AESC Envision’s factory in Tennessee. In 2020, battery cell production in the US was just below 40 GWh, while battery demand exceeded 42 GWh. (3)

For context, achieving US president Joe Biden’s goal of a 100% electric fleet of US government vehicles will require 69 GWh of battery cells. (4) With rising demand for electric vehicles, as well as growing concerns around the reliability of global supply chains, the build out of additional gigafactories domestically and further vertical integration among US auto manufacturers is likely.

Cloud Computing

Cloud platforms bundled up

Flexera’s 2021 survey of 637 enterprises reported 36% of enterprises spending more than $12m per year on public clouds and 55% of enterprise workloads expected to be in a public cloud within twelve months. (5)

Continuing on the public cloud front, 79% of enterprises implement Amazon [AMZN] Web Services (AWS), up 3% year over year (YoY), 76% of enterprises reported using Azure, up 7% YoY, and 49% mentioned Google [GOOGL] Cloud, up 15% YoY. (6)

Google secured one of its largest-ever cloud-computing contracts, Univision Communications Inc, in a deal displaying Google’s commitment to growing its cloud offering. Google beat out rival services for the collaboration by packing its offering with benefits across its YouTube video platform, advertising and search services.

Bundles are becoming a common strategy for many cloud computing companies, including Microsoft’s [MSFT] pairing of Office 365 with large enterprise cloud deals and Amazon’s pairing of Amazon’s Fire TV alongside its cloud contract with WarnerMedia. Under Google’s new deal, Univision will consolidate multiple distribution platforms onto Google Cloud, and utilise Google’s artificial-intelligence tools to develop personalised content recommendations for its customers. (7)

Video Games and esports

Gaming spend exceeds expectations

More than a year after initial stay-at-home orders were enacted to limit the spread of COVID-19, video game engagement is not showing signs of deceleration. Total consumer spending on video gaming in the US totalled $14.92bn in the first quarter of 2021, an increase of 30% compared to Q1 2020. (8)

Hardware expenditures, such as the PlayStation 5 and Xbox Series consoles, increased 81% in Q1, followed by a 42% rise in accessories spending and 25% rise in content spending. (9)

Within software, the most popular games included ‘Among Us’, ‘Animal Crossing: New Horizons’, ‘Call of Duty: Black Ops Cold War’, ‘Candy Crush Saga’, ‘Fortnite’, ‘Grand Theft Auto V’, ‘Mario Kart 8’, ‘Minecraft’, ‘Super Mario 3D All-Stars’, and ‘Super Mario 3D World’. In addition, Activision Blizzard’s [ATVI] monthly active users (MAUs) reached 435 million during the first quarter, up from 397 million in Q4 2020.

Social media

Supporting creators in emerging mediums

For several years, major social media platforms strategically shifted towards monetising their existing users bases rather than focusing on user growth. A new piece of this strategy includes investing in additional mediums and supporting content creators to drive greater engagement.

Facebook [FB], for example, is rolling out multiple new audio products. The new products will include soundbites, podcasts, text-to-speech, music from Facebook’s sound collection, and most notably, Live Audio Rooms. (10) The social media app, Clubhouse [CMGR], offers similar features, but Facebook’s will be included in its Messenger app, tapping into its large embedded user base.

In anticipation of this rollout, Facebook also launched an Audio Creator Fund to support emerging creators in the audio medium. In conjunction with the Audio Creator Fund, Facebook is introducing Stars, Facebook’s tipping system. Viewers can buy stars and send them to creators. For each star received, Facebook will pay the creator $0.01. (11)

Cannabis

More US states legalise cannabis

18 states now allow for adult recreational use of cannabis, with New York, Virginia, and New Mexico recently joining the growing list. On 31 March 2021, New York legalised cannabis usage for individuals aged 21 and older, the possession of up to 3 ounces or 24 grams of concentrated cannabis, and the liberty to smoke anywhere cigarette smoking is permitted. (12)

New Mexico signed legislation legalising recreational cannabis use within months and kicking off sales next year. Home cannabis growers will be allowed to grow up to six plants per person, or 12 per household, and cannabis businesses will be able to set up retail space. (13)

Following close behind, on 21 April 2021, Virginia signed a bill that legalises adult possession of small amounts of recreational marijuana. Each household will be able to cultivate up to four marijuana plants, but the plants must not be accessible to children. It will also be legal to gift up to an ounce of marijuana to another adult. Smoking will still only be permitted in private areas. (14) Rhode Island, Pennsylvania, Maryland, Delaware, and Connecticut have also added cannabis to their legislative agendas this year.

Telemedicine and digital health

Telehealth backed by government funding

The Federal Communications Commission (FCC) approved the distribution of nearly $250m towards telehealth services. (15) This funding is added onto the $200m program dedicated to COVID-19 relief, which was a part of the CARES act last year.

The new funding is designated to facilitate telecommunications services, information services, and connected devices for healthcare workers and patients. Applications for the FCC’s COVID-19 Telehealth Program will be evaluated based on socioeconomic status and location. Biden has also recently announced an expectation to include $400bn for expanding Medicaid beneficiaries’ access to home- and community-based care for seniors and the disabled as part of a larger infrastructure package. (16)

The numbers

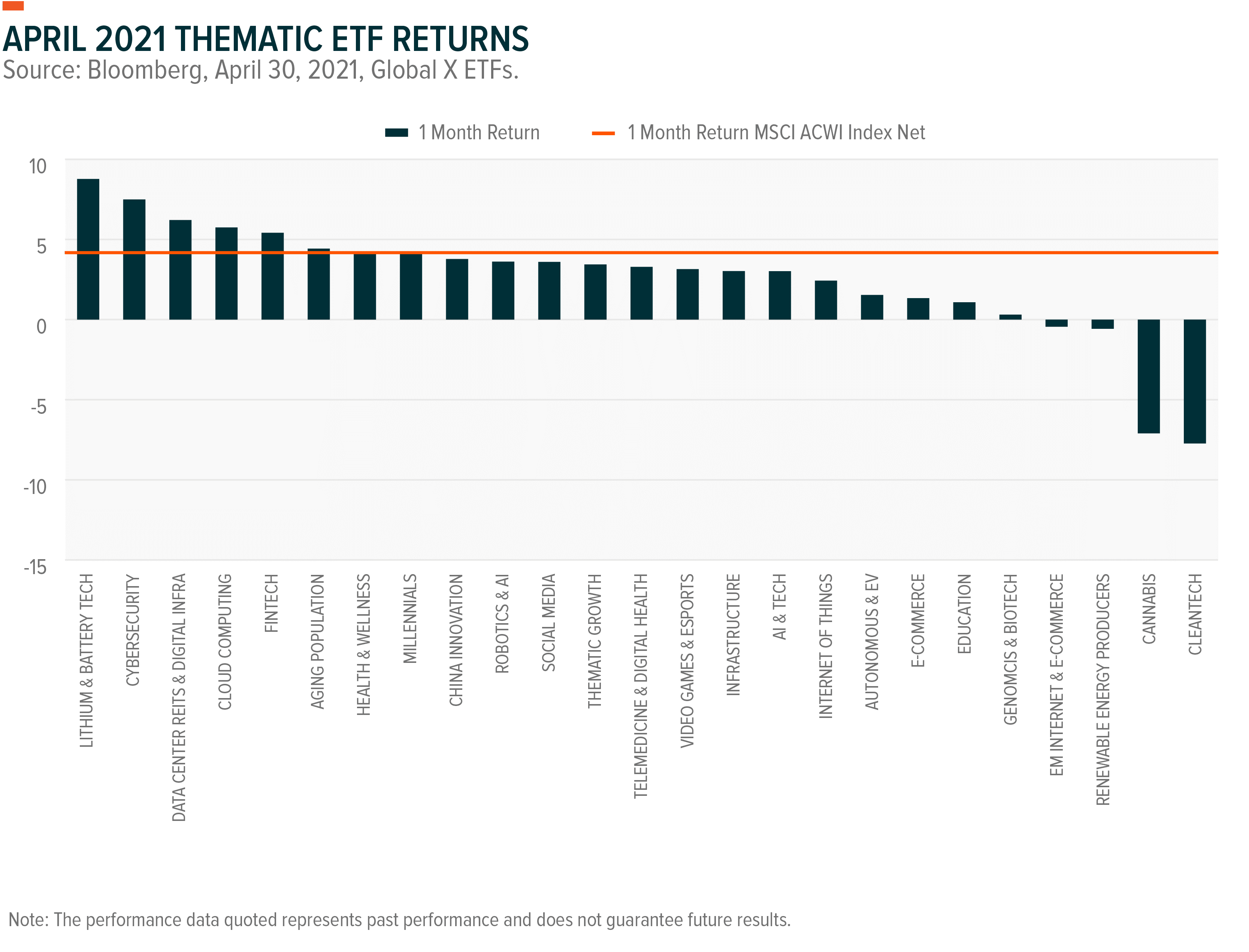

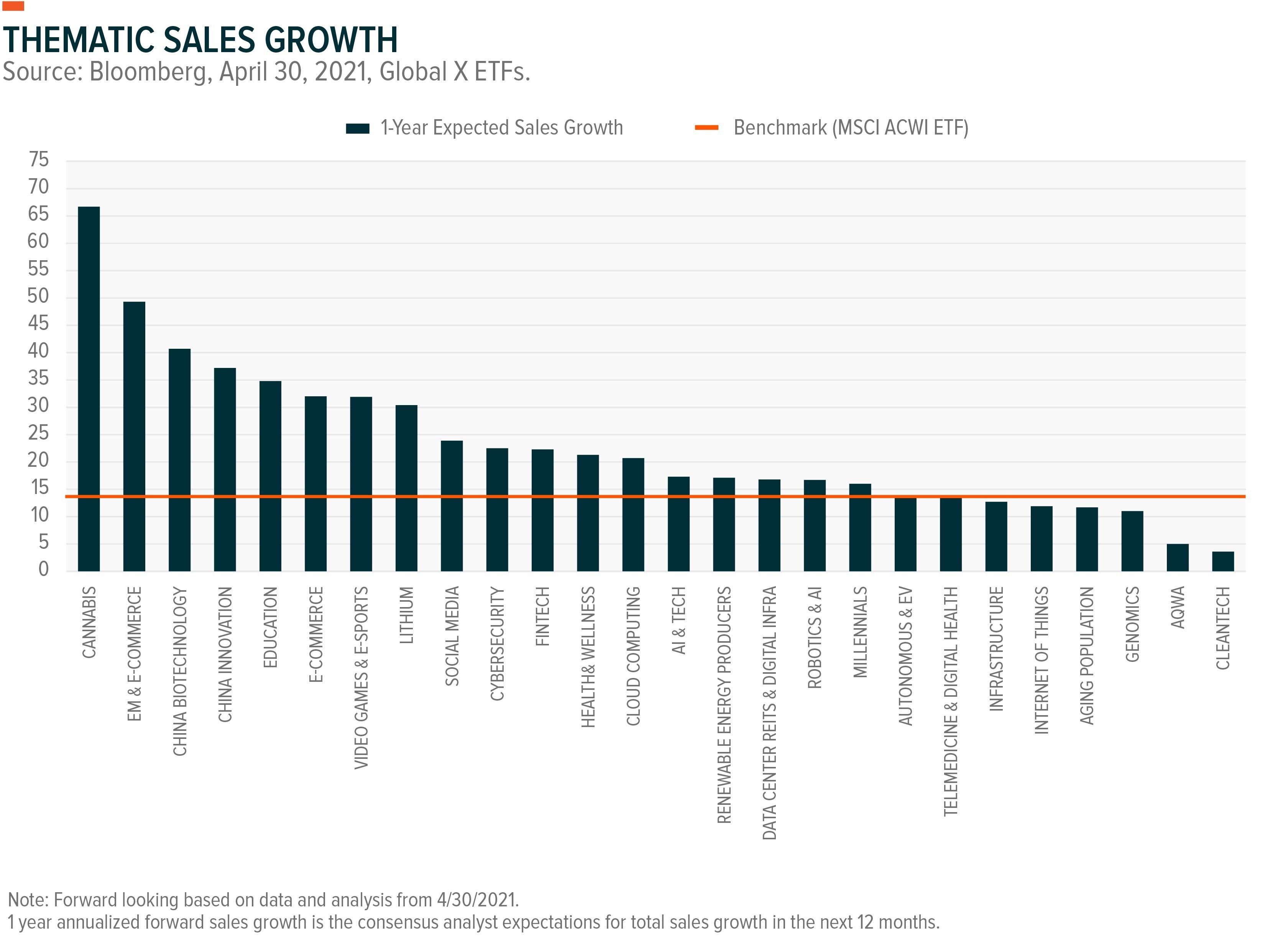

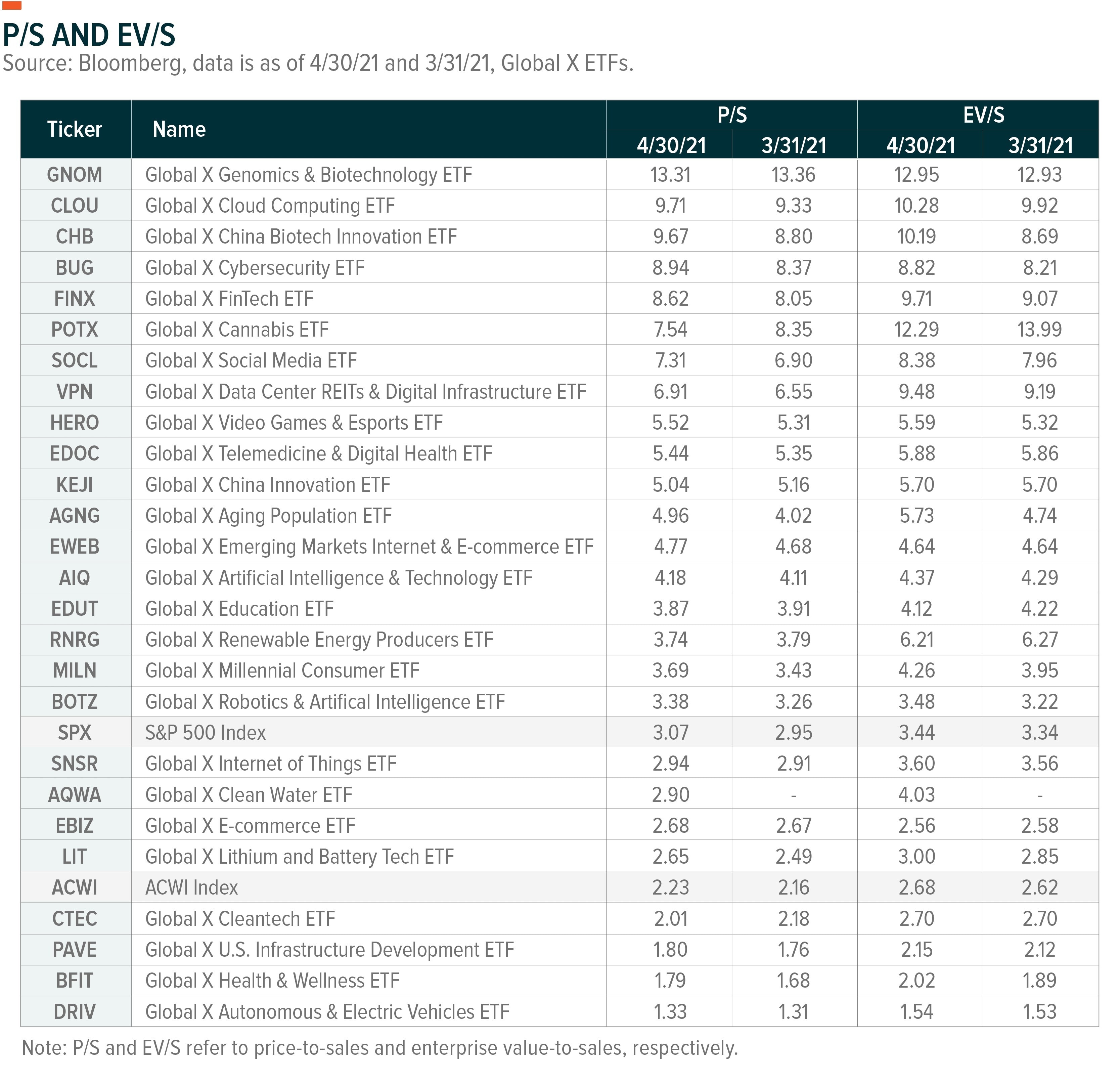

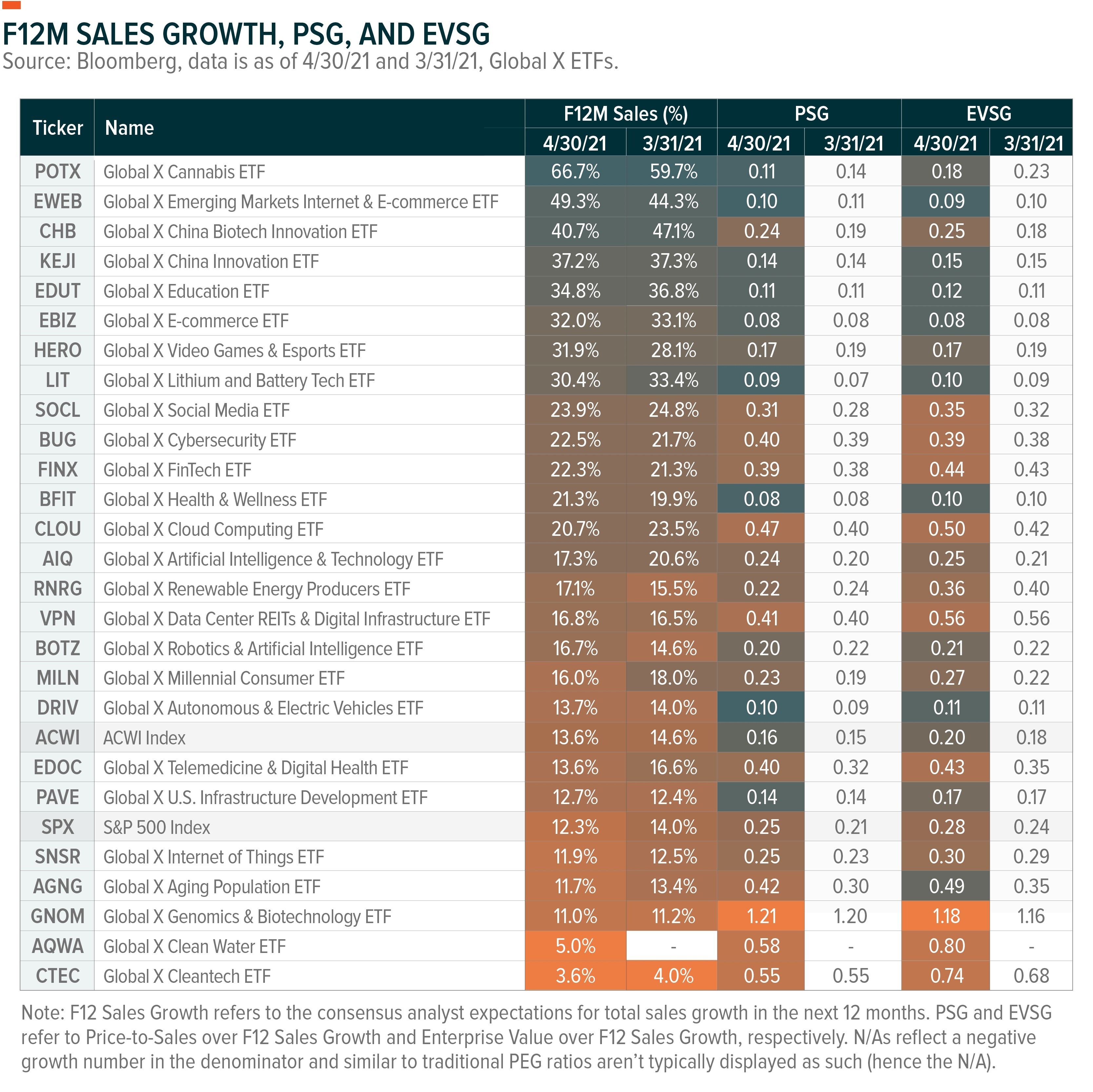

The following charts examine returns and sales growth expectations by theme, based on their corresponding ETFs:

This article was published by Global X. The original article, including footnotes where readers can find original source material, can be found here.

SEI Investments Distribution Co. (1 Freedom Valley Drive, Oaks, PA, 19456) is the distributor for the Global X Funds.

Check the background of SIDCO and Global X’s Registered Representatives on FINRA’s BrokerCheck

Investing involves risk, including the possible loss of principal. There is no guarantee the strategies discussed will be successful. International investments may involve risk of capital loss from unfavourable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Narrowly focused investments may be subject to higher volatility. The funds are non-diversified.

Information Technology companies can be affected by rapid product obsolescence, and intense industry competition. Risks include disruption in service caused by hardware or software failure; interruptions or delays in service by third-parties; security breaches involving certain private, sensitive, proprietary and confidential information managed and transmitted; and privacy concerns and laws, evolving Internet regulation and other foreign or domestic regulations that may limit or otherwise affect the operations. Healthcare, Genomics, Biotechnology and Medical Device companies can be affected by government regulations, expiring patents, rapid product obsolescence, and intense industry competition. Cleantech Companies typically face intense competition, short product lifecycles and potentially rapid product obsolescence. The risks related to investing social media companies include disruption in service caused by hardware or software failure, interruptions or delays in service by third-parties, security breaches involving certain private, sensitive, proprietary and confidential information managed and transmitted by social media companies, and privacy concerns and laws, evolving Internet regulation and other foreign or domestic regulations that may limit or otherwise affect the operations of such companies. These companies may be significantly affected by fluctuations in energy prices and in the supply and demand of renewable energy, tax incentives, subsidies and other governmental regulations and policies. There are additional risks associated with investing in lithium and the lithium mining industry.

Investments in the cannabis industry may be susceptible to loss due to adverse occurrences affecting this industry. The cannabis industry is a very young, fast evolving industry with increased exposure to the risks associated with changes in applicable laws (including increased regulation, other rule changes, and related federal and state enforcement activities), as well as market developments, which may cause businesses to contract or close suddenly and negatively impact the value of securities held by the Fund. Cannabis Companies are subject to various laws and regulations that may differ at the state/local, federal and international level. These laws and regulations may significantly affect a Cannabis Company’s ability to secure financing and traditional banking services, impact the market for cannabis business sales and services, and set limitations on cannabis use, production, transportation, export and storage. The possession, use and importation of marijuana remains illegal under U.S. federal law. Federal law criminalizing the use of marijuana remains enforceable notwithstanding state laws that legalize its use for medicinal and recreational purposes. This conflict creates volatility and risk for all Cannabis Companies, and any stepped-up enforcement of marijuana laws by the federal government could adversely affect the value of investments.

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in the Funds’ summary or full prospectus, which may be obtained by calling 1.888.493.8631, or by visiting globalxetfs.com. Please read the prospectus carefully before investing.

Global X Management Company LLC serves as an advisor to Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC or Mirae Asset Global Investments.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Beginning October 15, 2020, market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share. Prior to October 15, 2020, market price returns were based on the midpoint between the Bid and Ask price. NAVs are calculated using prices as of 4:00 PM Eastern Time. The returns shown do not represent the returns you would receive if you traded shares at other times.

Indices are unmanaged and do not include the effect of fees, expenses or sales charges. One cannot invest directly in an index. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy