Between them, Amazon [AMZN], Microsoft [MSFT] and Alphabet [GOOGL] have laid off 50,000 workers since the beginning of 2023 (through 28 April).

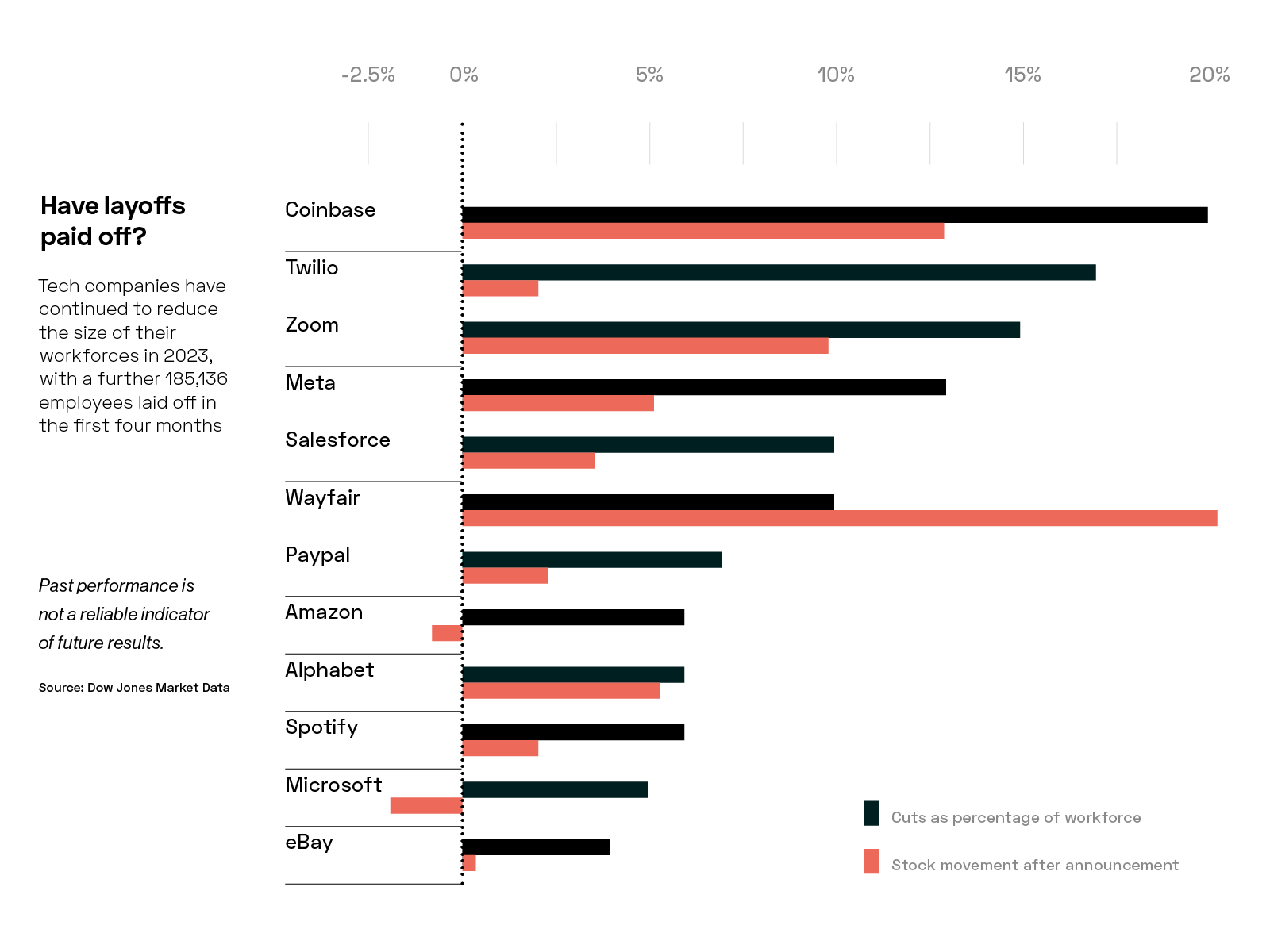

The job cuts follow years of rapid growth (read more in the End of The Free Money Era report on p. 20), which reversed in 2022 as tech companies looked to rein in costs, with careers firm Challenger, Gray & Christmas noting a 649% annual increase in job cuts after 97,000 positions were terminated across the sector. Tech firms are keen to demonstrate to investors that they have a handle on spending and can deliver more sustainable growth in a higher interest rate environment.

The plan seems to have worked. Up to 28 April 2023, Amazon, Microsoft and Meta [META], which cut 11,000 workers in November last year and a further 10,000 in March, have added more than $1trn to their market capitalisations since the start of 2023.

“January was by far the worst month for tech layoffs on record since the dot-com [bubble],” Amit Taylor, founder of tech careers platform TrueUp, says. “No one was expecting January to be as big as it was.”

Taylor says this was in part due to firms wanting announcements to coincide with earnings calls, giving them an opportunity to break the bad news but also explain the impact the layoffs could have on the bottom line. Analysis by Barron’s found that more than 27 US companies with market capitalisations above $10bn noted the positive effect of layoffs in January earnings calls.

At its 31 January call, Snap [SNAP] chief financial officer Derek Andersen said its 20% headcount reduction was part of a $450m cost savings package. In its 9 February earnings call, PayPal [PYPL], meanwhile, announced that a 7% reduction in employee numbers would result in an additional $600m cost savings in 2023. In the day following their earnings calls, Snap and PayPal’s share prices rose 4.2% and 3%, respectively.

Despite the wave of cost-cutting, analysts have continued to slash profit expectations for 2023. According to data from Bloomberg, the S&P 500 Information Technology Index is forecast to contract 0.4% — earlier estimates had called for 4% annual growth.

“The industry shifted from growth at any costs to an emphasis on profitability,” Taylor says, adding that during such a paradigm shift, the way you manage your business is going to change dramatically.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy