Jens Nordvig, Co-Founder and CEO of MarketReader, joins OPTO Sessions to discuss why India is emerging as the chief beneficiary of China’s recent decline. Among the tailwinds benefitting the country are a perception of political stability and a healthy labour market.

Despite the headwinds that are facing the country’s economy, Nordvig admits that China is still very competitive in export markets. The automobile sector is a prime example here: within the last two years, China has overtaken Germany and Japan to become the world’s largest exporter of cars.

This, however, is just a “trade issue” according to Nordvig. It hasn’t translated into increased demand for the country’s currency: “If you look at the broader financial markets, there’s no evidence that the Chinese currency has become a substitute for the dollar,” he says. Moreover, among the central banks he advises, a previous trend towards holding some Chinese currency as reserve has ended.

This underscores the breadth of the movement away from China among global market participants.

“China is losing market share in terms of financial assets,” says Nordvig. “The key destination for emerging market flows is now India.”

This is a “big shift” that would have been impossible to predict ten years ago, says Nordvig. In terms of capital flows, “China is the biggest loser on that front, and India is the biggest winner.”

Why India?

This isn’t just a story about Chinese weakness. It is at least as much about Indian strength.

“There are some powerful anecdotes. Apple [AAPL] wants to make its smartphones in India,” for example; Bloomberg reported on Wednesday that India was actively seeking to lure more investment of this type by cutting the import tariffs on smartphone components.

India may also appeal to foreign investors for political reasons. “If you think about western companies that want to diversify their supply chains, they're probably more comfortable with what is happening in India, where we have a democratically elected government,” says Nordvig.

India also boasts an attractive labour market, with the world’s largest population and a well-regarded tech education system.

Finally, data transparency is another metric on which India outperforms China. “In India, there’s less concern about the data being manipulated,” says Nordvig. Furthermore, he believes that India’s history of interconnectedness with western nations gives western investors greater confidence in Indian accounting systems.

Funds, Flows and the Fed

India’s increasing appeal could have a radical impact on various asset classes within the country.

HSBC Asset Management recently revealed that it expects there to be $100bn of flows into the country’s bond market over the coming years, driven in part by the country’s inclusion in major indices, as well as increased attention from institutional investors. “Chinese bonds have fallen out of favour,” says Nordvig.

Goldman Sachs estimated in early January that the Indian rupee could appreciate to 81 against the dollar by the end of 2024, given the expected size of foreign inflows this year. Should the Federal Reserve cut interest rates this year, flows could increase further.

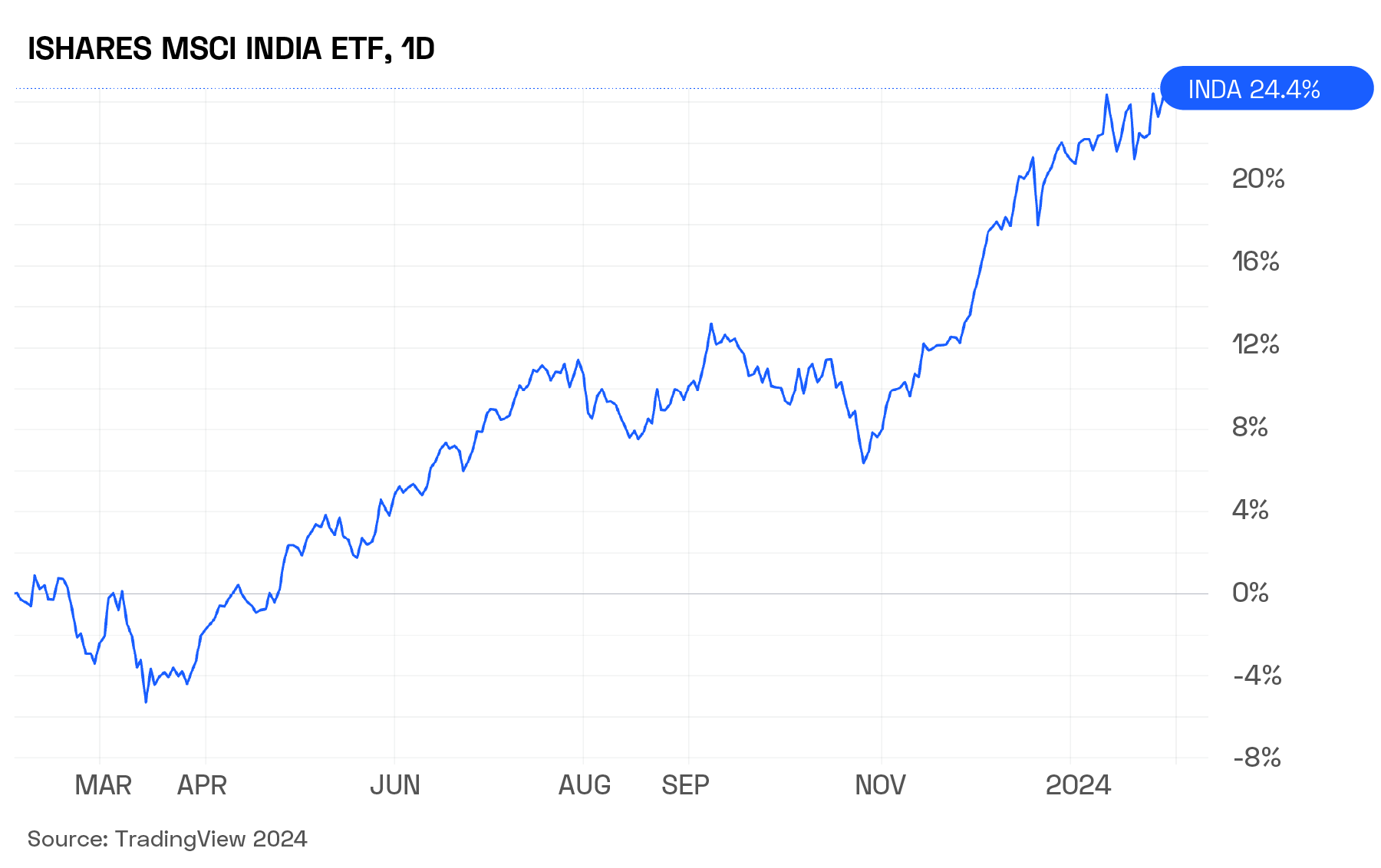

However, equities still appear to be leading the charge. ETFs tracking Indian stocks saw record inflows of $8.6bn during 2023, up 16.2% from the previous record of $7.4bn during 2021. The iShares MSCI India ETF [INDA], for example, gained 24.4% in the 12 months to 1 February.

Tom Bailey, Head of ETF Research at HANetf, told Reuters that the strength of the inflows indicate that investors see little risk in the country despite its upcoming elections. This is in contrast to Taiwan, whose elections last year saw investors withdraw $91.6m from ETFs linked to the country.

Other Emerging Markets

Given the range of asset classes affected, however, India is not the sole beneficiary of China’s demise.

“It depends on the asset in question,” says Nordvig. “There’s a lot of focus on Mexico, because it’s close to the US market. If you want to avoid a supply chain where everything is centred around China, you could have one that’s focused on Texas and Mexico. There’s an incredible amount of trade there; those supply chains are very interlinked.”

For this reason, Mexico attracts a large amount of foreign direct investment, but this is shared to a certain extent with Asian countries including Vietnam. India, however, remains the preference for investors looking to buy overseas equities.

LINKS TO THE INTERVIEW:

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy