OPTO Research defines Innovation Stocks in the context of thematic investing in this two-part series. Technology and future-proof megatrends are central to innovation. How can innovation uniquely position a company and its investors for competitive edge and long-term exponential growth, particularly amid periods of economic uncertainty?

Innovation Outperforms

Research consistently shows that stocks of innovative companies tend to outperform their less innovative counterparts. GlobalData's Innovation Indices, for instance, have revealed an annualised alpha of 3-8%, aligning with BCG’s finding that innovative firms have a 2.2x higher future earning potential. This is even more pronounced in sectors like Artificial Intelligence (AI), where the GlobalData AI Innovation Index surpasses the S&P 500 with an 8.5% annualised alpha.

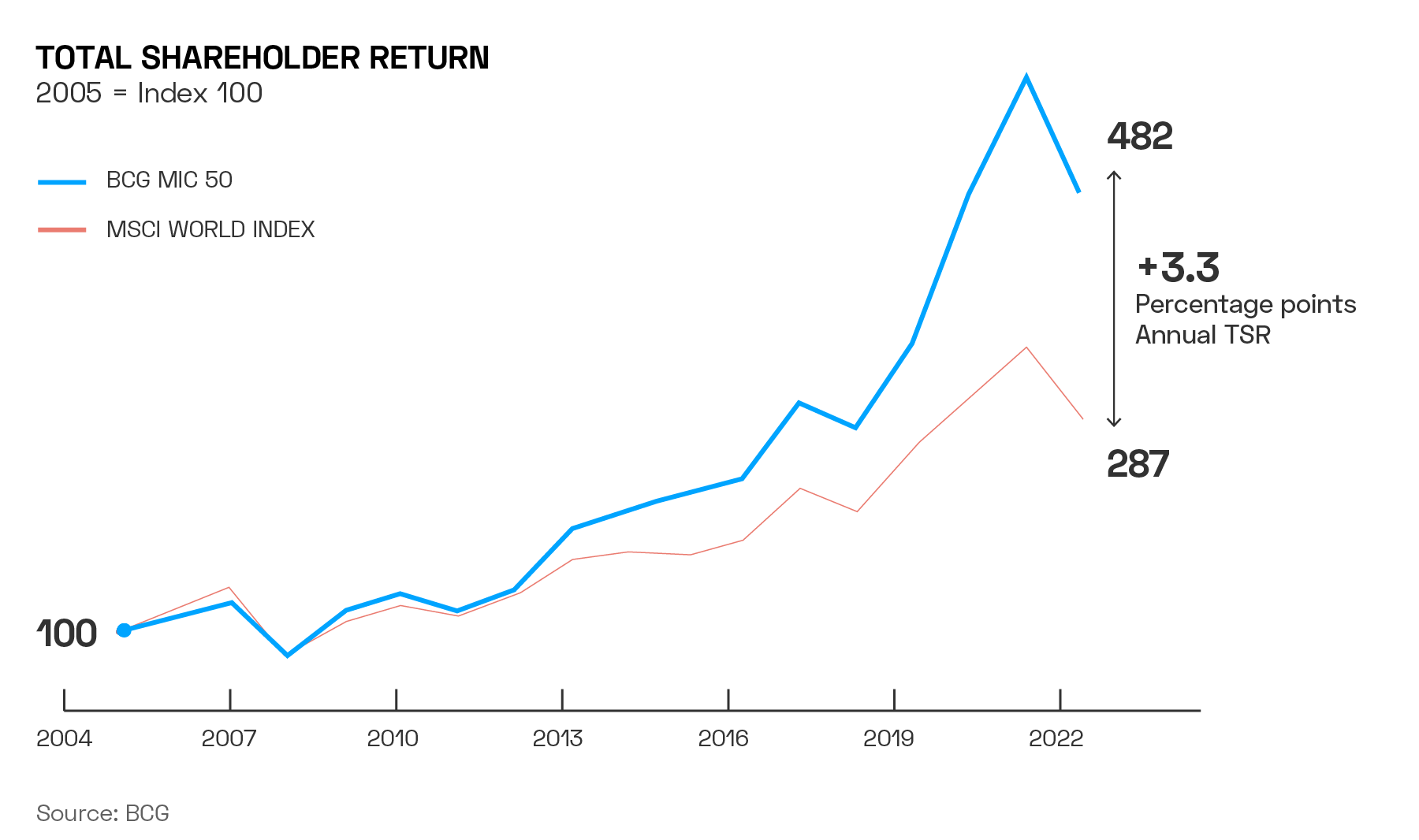

Long-term data supports this trend, with indices like GlobalData showing superior performance in innovative companies across 1, 3, or 5-year periods. McKinsey's studies echo this, indicating that most innovative companies achieved shareholder returns well above industry medians between 2012 and 2022. Similarly, BCG's 2023 report highlights that the top 50 innovative companies outperformed the MSCI World Index in shareholder return by an average of 3.3 percentage points yearly.

Innovation is so strongly correlated with outperformance, that some asset managers have funds dedicated to companies adopting it. Specialised investment funds like ARK Invest’s ARK Innovation ETF [ARKK], focusing on disruptive innovators in fields like AI and blockchain, have also historically outperformed standard benchmarks like the S&P 500.

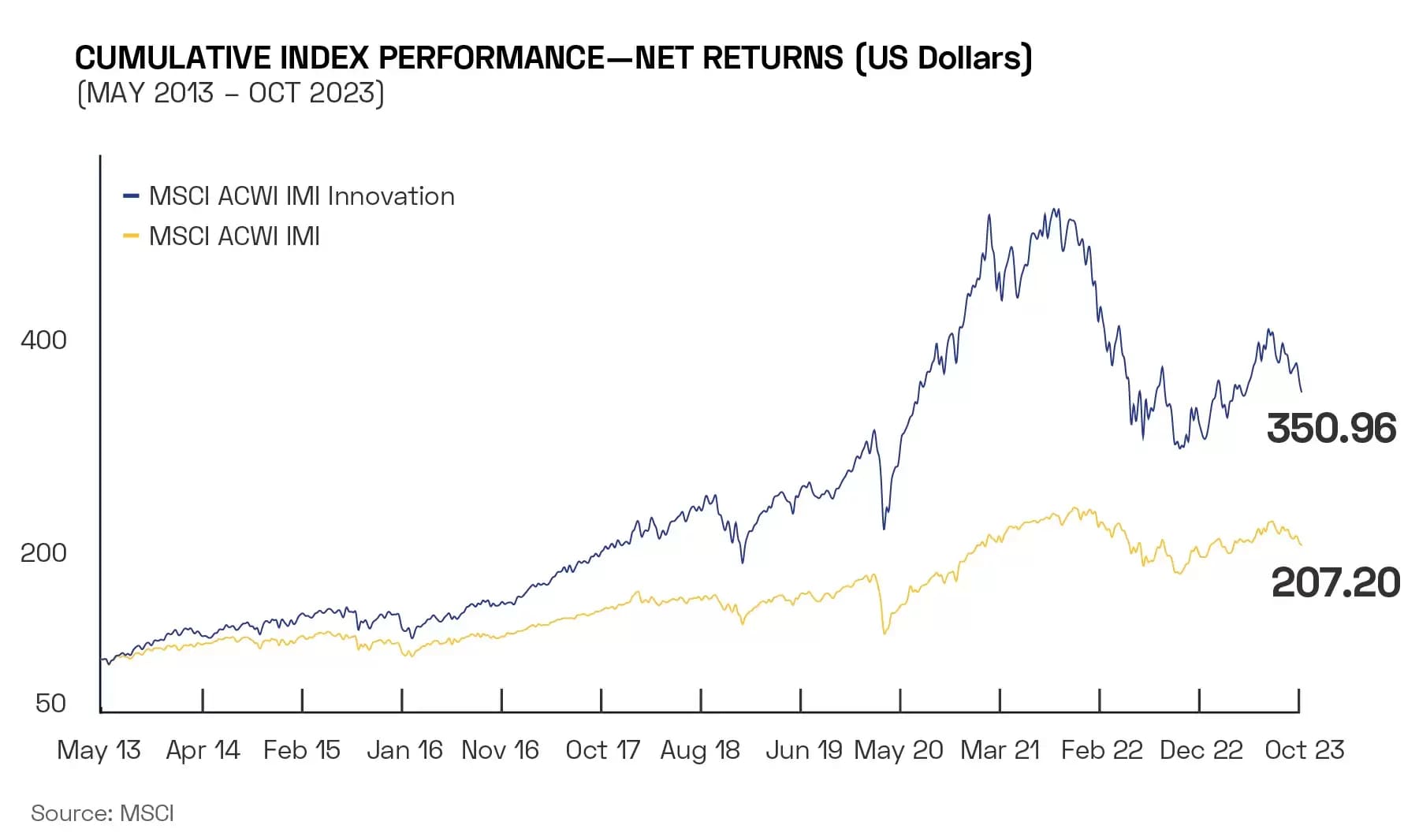

The MSCI ACWI IMI Innovation Index below, developed with ARK Invest, combines four thematic innovation indices: autonomous technology and industrial innovation, genomic innovation, fintech innovation and next-generation internet innovation.

ARK believes a strategic allocation to innovation is likely to evolve into a sub-asset class like emerging markets.

These findings collectively underscore the importance of innovation as a key driver of sustainable growth and market leadership, offering substantial long-term financial returns compared to non-innovative firms.

Defining Innovation

Innovation, in the context of thematic investing, is the identification and exploitation of novel and transformative technologies, trends, products, processes, or methodologies that significantly reshape industries and market dynamics. Drawing from Schumpeter's notion of creative destruction, it represents companies that not only introduce groundbreaking technologies or services but also have the potential to disrupt and redefine existing market structures. In line with BCG and McKinsey's insights, these companies are often at the forefront of addressing emerging global challenges and creating new economic opportunities. They exhibit a blend of technological advancement, strategic foresight, and market leadership, making them prime candidates for investors seeking exposure to sectors poised for substantial growth and transformation.

Over the past decade, disruption-led innovation trends have accelerated. This is evident from the increase in patent applications and companies focusing on innovation in their corporate strategies. This trend has led to a business landscape where 84% of S&P 500 market capitalisation comprises intangible assets, with intellectual property (IP) accounting for a significant portion.

Technology is currently at the forefront of most, if not all, innovation.

A digital backbone is crucial for scaling AI and other advanced technologies. BCG research underscores the importance of a strong digital foundation, particularly in sectors like medtech, chemicals, and pharma, which are heavily reliant on research and development (R&D).

Growing Significance of Innovation within Businesses

According to BCG’s research, an emerging group of forward-thinking companies is placing innovation at the heart of their growth strategies. These companies are not only increasing their investment in incremental innovations but are also dedicating one-third of all their spending to breakthrough innovations. They employ a variety of strategic tools to enhance their innovation capabilities, including aggressive M&A strategies to acquire cutting-edge technologies and innovative talents. They actively engage in and foster ecosystems, collaborating with external entities, including competitors, to drive innovation. These companies emphasise digital innovation, agile methodologies, and enhanced customer insights. They leverage AI for innovation, continuously assess the performance of their innovation units, and strategically reallocate resources to areas yielding success. Moreover, they recognise the importance of effective portfolio governance and data transparency in achieving impactful innovation.

ARK's analysis supports this trend, arguing that companies neglecting to invest in innovation platforms risk falling behind, including established industry leaders. They suggest that companies with a focus on long-term strategic innovation are more likely to achieve stock market outperformance compared to those focused on short-term profitability.

The MIT Centre for Information Systems Research notes that today’s top-performing companies excel in speed to market and innovation, using new technologies to drive revenue.

What is an Innovation Stock?

Innovation Stocks, as defined by OPTO, are those publicly listed companies that display the qualities mentioned above, and tend to outperform their non-innovative peers in the long run.

BCG’s 2023 global survey reveals that companies are increasingly using strategic tools to enhance their innovation capabilities, including M&A, portfolio planning, and AI. When evaluating a company, these activities often signal a forward-looking growth strategy and can be strong indicators of an innovation stock.

Since innovation is challenging to purely measure quantitatively, especially when attempting to value intangible assets, having qualitative metrics in the mix helps to provide a more holistic picture.

Below are some typical fundamental characteristics of innovation stocks.

High R&D spending ratio: Innovative companies tend to dedicate a high proportion of their spending towards R&D, product development and innovation solutions.

Aggressive investment: Optimising the innovation pipeline and funnel to maximise the impact of investments, they allocate a high proportion of spending on innovation projects.

Investments in technology and AI: Technology and innovation are heavily intertwined. More businesses are investing in AI than any other technology, and it is increasingly being seen as a commitment to innovation.

Robust free cash flow: This is a general indicator of a company with strong financials. The more free cash flow a company has, the more capacity it has to spend on growth opportunities.

Intellectual property (IP) & patents: Innovation stocks often exhibit a high rate of patent applications and hold a substantial portion of their market value in intangible assets like IP. According to GlobalData, the number of patent applications has increased 1.5 times in the last ten years, with a 10% compound annual growth rate. In any given month, over half of S&P 500 corporations have at least one patent approved against their name.

Strategic M&A activity: Companies often fast-track their innovation by acquiring and merging with companies possessing innovative technologies or processes, focusing on M&A that brings in new technologies and talent. They also acquire IP, targeting complementary ideas or capabilities and monetising off-strategy IP assets, capitalising on market trends like smart climate initiatives.

Ecosystem expansion: Participating in industry ecosystems for access to external capabilities and talent.

Dynamic business models:

- Long-term commitment to innovation: Balancing long-term innovation goals with near-term opportunities to improve market positions, even in downturns.

- Business model transformation: Altering the business model in strategic, game-changing ways through technology or technology combinations to secure a sustainable advantage.

- Innovative market disruption: Using innovation to challenge competitors’ profit strongholds, and entering new markets with new models.

It is important to note, however, that corporate investments in innovation do not always directly translate into actual impact, making the evaluation of innovation stocks a nuanced process.

Disruptive and Sustaining Innovation

Innovation-ready companies prioritise breakthrough or disruptive ideas, whereas less experienced innovators focus more of their resources on "near-in" or sustaining innovation, BCG’s report finds.

Sustaining innovation refers to smaller, incremental, near-term, cost-saving innovations, such as “renovations” to existing designs and processes. Disruptive innovation, on the other hand, refers to longer-term breakthrough bets.

A sizable portion of the businesses polled in their 2023 survey are putting more of an emphasis on developing new digital products, related new business models, cost reduction, and innovative working practices. Businesses prepared for innovation are allocating more of their resources to disruptive or breakthrough ideas that open up new markets or sources of income rather than to small-scale advancements that maintain existing positions or advantages.

To diversify risk and lend resilience during both periods of uncertainty and prosperity, McKinsey highlights the importance of a balanced portfolio, comprising companies focusing on both sustaining and disruptive innovation. Companies that make minor product adjustments respond to current market demands, while those investing in significant process enhancements aim for future growth. A strategy of diversifying investment across companies with various approaches to innovation offers a balanced exposure to potential near-term gains and long-term growth opportunities.

Innovation Thrives in Economic Downturns

Innovation breakthroughs tend to accelerate during economic downturns, making them a particularly attractive bet in current climates.

In a context of economic and geopolitical instability, innovation equities are uniquely positioned for outperformance, according to a 2022 Goldman Sachs report. This resilience is underpinned by several factors:

Tailwind from long-term growth drivers: Benefiting from key secular growth drivers like technological innovation and environmental sustainability.

Inflation offset: Innovation helps businesses increase revenues and reduce expenses, with innovative companies typically having pricing power.

Encouragement of business investment: Inflation drives businesses to invest in innovative solutions for cost reduction and efficiency.

Response to geopolitical uncertainty: Innovation equities are favoured in scenarios of geopolitical tension, driving trends like energy and technology independence.

Adaptation and growth: As the world changes, innovation enables companies to adapt and thrive, with a continued appetite for innovation despite rising prices.

OPTO's Approach: A Thematic Lens on Innovation

OPTO’s philosophy holds that applying a thematic lens on markets is a scalable way of identifying the world's most innovative companies. Themes have the power to transcend regional, regulatory, and market biases, and can be geared to long-term growth trends. OPTO’s themes are fundamentally rooted in innovation and future-oriented trends. In the fintech theme, for instance, the ‘neobanking’ segment’s global revenue growth potential is expected to jump 94.88% between 2023 and 2027, according to Statista data.

This future-proof approach aligns well with the shifting dynamics of modern markets and can function as a roadmap for navigating the uncertainty they bring.

Goldman Sachs also highlights the strengths of thematic portfolios from a macro perspective. These portfolios often maintain robust fundamentals and show resilience, even during market downturns. They are strategically positioned to excel in environments of high inflation or geopolitical volatility, thanks to their focus on innovative solutions with inherent pricing power. In times of inflation, businesses increasingly invest in innovation for cost efficiency, directly benefiting thematic portfolios. Similarly, rising geopolitical tensions that push towards energy and technology independence play to the strengths of thematic portfolios invested in these areas. Thematic portfolios, especially those focused on innovation, are adept at adapting and growing amid global changes, maintaining a steady demand for innovation.

OPTO integrates these insights into its unique methodology, and has developed its own Innovation Index. By applying a thematic lens to the markets, OPTO identifies and analyses companies that are not just at the cutting edge of innovation but also aligned with global megatrends and technological advancements. This approach ensures a forward-looking, growth-oriented investment strategy, harnessing the full potential of innovation in the current economic landscape.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy