Future cash flows are no longer as valuable as they were during the pandemic, so quality companies with steady earnings and current cash flow have come into sharper focus.

The iShares S&P 500 Growth ETF [IVW] logged a 29.5% negative return last year after gaining 31.8% and 33.2% in 2021 and 2020 respectively. For comparison, the iShares S&P 500 Value ETF [IVE] posted a negative return of 5.4% in 2022 after gaining 24.6% and 1.2% in the two previous calendar years.

However, the fact that value stocks have been outperforming their growth counterparts doesn’t mean there shouldn’t be room for growth stocks — companies that can generate earnings growth in the future — in portfolios.

Identifying structural themes and trends

“The selloff we saw in 2022 has perhaps offered investors an attractive entry point for many themes,” Tom Bailey, head of ETF research at HANetf, tells Opto.

“Since the start of 2023, we have seen a market shift towards expectations of a slowdown in rate rises. As a result, some of the worst-affected thematic ETFs have seen tremendous recovery, with double-digit returns, particularly among those providing exposure to digital asset-related themes.”

The ETC Group Digital Assets and Blockchain Equity UCITS ETF [KOIP.L], launched via HANetf, posted a negative return of 76.34% in 2022, but returned 30.26% in January, for example*.

Meanwhile, the HANetf Digital Infrastructure and Connectivity UCITS ETF [DIGI.L] fell 31.4% in 2022 but gained 11.41% in January this year. The fund holds companies that will enable and influence the ways we live, work, and play in the future, including those involved in expanding data applications and bandwidth.

Businesses involved in structural and secular trends whose outlooks aren’t tied to boom-and-bust cycles, like digital infrastructure, could be long-term market beneficiaries even if their share prices have struggled in recent months. However, not every company in a structural theme, which is a market that is undergoing a dramatic shift, is going to be a winner.

“It’s a good idea to sift through the companies that sold off last year, the pre-profit companies, and figure out which ones will never be profitable and which ones are making the changes to eventually become profitable,” said Gabriela Santos on Opto Sessions in January.

“It’s important to separate what happened during the pandemic versus what’s an actual structural change that’s going to continue,” Santos added.

This can require a lot of active management, noted Santos, which is where actively managed ETFs tend to be a better option for investors who don’t have the time to manage their portfolios but want to gain broad exposure to a theme. An ETF’s manager will shift allocations based on the current market conditions and financials, managing risk on behalf of investors.

One way investors can identify which companies could be on the path to profitability is to look for those that are successfully raising prices by passing on costs, as well as expanding margins, without inhibiting demand. Pricing power will be “a key element going forward”, Peter Lowman, chief investment officer at Investment Quorum, a London-based boutique wealth management firm, told Opto. “Now that free money has come to an end, fundamentals will very much be the order of the day.”

The investment case for clean energy in 2023

Red-hot rates have led to concerns that the carbon and green transition could slow. Renewable energy projects are capital intensive and tend to involve a lot of upfront costs, on the basis that they’ll deliver a return on investment years from now. The worry is that some projects may be pushed back to when interest rates on new debt are lower.

“From a sector perspective”, Lowman says he likes commodities, industrials, financials and energy as ways to play “stubborn inflation”. One structural theme within these sectors that stands to gain, despite near-term headwinds, is renewable energy.

Yet the sun is generating more electricity than ever before. According to renewables think tank Ember, wind and solar power sources together accounted for 22% of the electricity generated across Europe last year, versus 20% from natural gas.

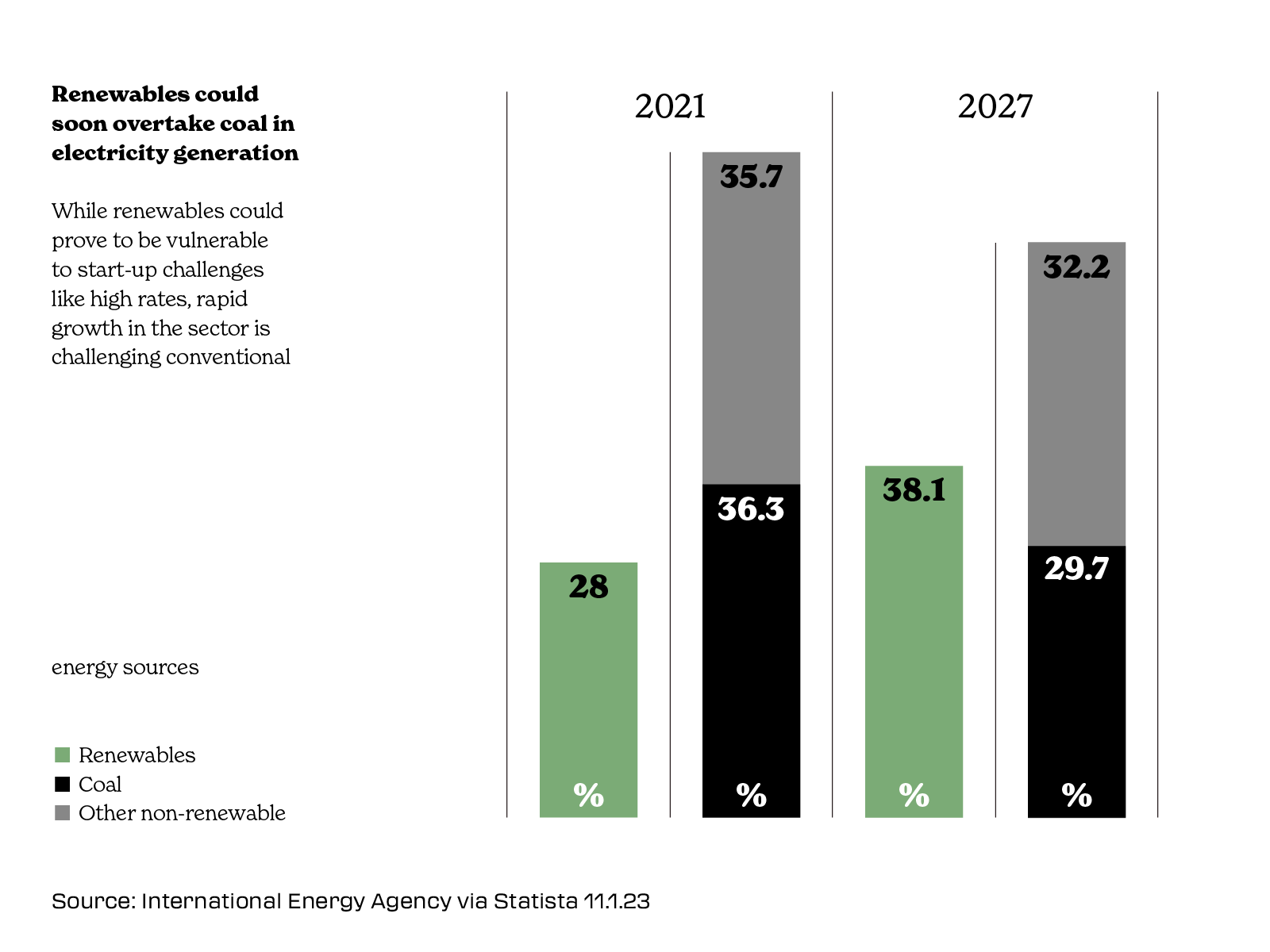

Coal power is in structural decline, however. The war in Ukraine has underlined the need for energy independence. And — although oil and gas majors cashed in on Russia’s invasion of Ukraine and its impact on gas supplies, reporting record annual profits for 2022 — investments in utilities and renewable energy are expected to grow in the coming years to accelerate the shift away from Russian supplies, which is increasing the growth potential of the sector.

Positive sentiment helped clean energy funds to hold better than the main US indices in 2022, although they still saw annual losses, says Bailey. The HANetf S&P Global Clean Energy Select HANzeroTM UCITS ETF [ZERO.L] logged a negative return of 9.9% last year versus a 19.4% slump for the S&P 500 and one of 33.1% for the Nasdaq Composite.

“Despite the headwind of rising interest rates, [renewable energy funds] were given a boost by policy catalysts,” says Bailey. The US Inflation Reduction Act (IRA) has committed $369bn in subsidies to boost clean energy and to incentivise domestic manufacturing of solar power technology. The REPowerEU policy is the European bloc’s plan to end its dependence on Russia’s fossil fuels by 2027.

“These initiatives are spurring the world on towards achieving decarbonisation. The IRA, in particular, has been a game changer for the clean energy space,” says Bailey. “This is a massive structural shift in the global economy.”

There could be stormy weeks and months ahead for stock markets if global economies do slip into a recession, and it might take time for investors to adjust to the old normal, but structural themes are showing signs of strength in the era of no free money.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy