Trump officially becomes the 47th President of the US on January 20, 2025, and one thing is certain: markets will continue reacting.

Macroeconomics expert Julian Brigden, Co-Founder and President of Macro Intelligence 2 Partners (M12), identifies what he believes will be the three key phases of Trump 2.0: assumption, confirmation and reality.

Phase One: Assumption

Brigden says in the run-up to the election there was remarkably little detail from either presidential candidate. “And for markets, minutiae are very, very important…”

Post-victory, “what the market did, which was the logical thing to do, was run on the assumption that Trump 2.0 would look very similar to his first term in office” — in other words, “a very pro-growth kind of environment.”

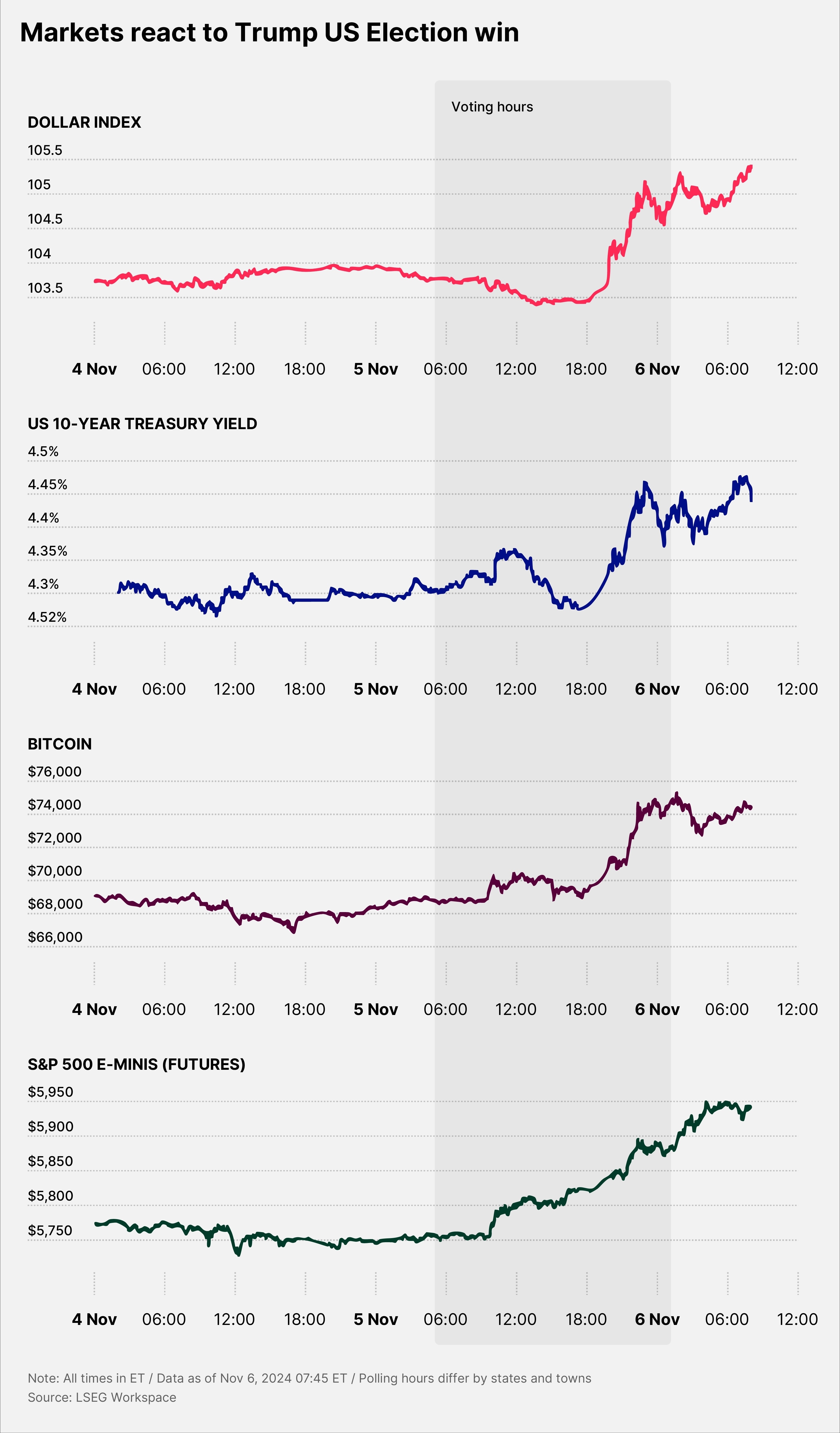

Several broad themes have played out, says Brigden. “Bullish for equities, broadly, slightly inflationary, bearish for fixed income, bad for the deficit and bullish for the dollar.”

One change this time, however, concerns crypto, with Trump’s position apparently having evolved. “He was not a fan of crypto in his first term. He seems to be converted. Whether that actually pans out, we will see.”

Brigden adds: “Some of the claims being stated by people, about the US moving a chunk of its reserves into crypto, I think would be lunacy.”

Phase Two: Confirmation

On the heels of assumption is phase two, confirmation.

“We did that knee-jerk reaction; we ran with those trades. Now, those trades look a little played out,” asserts Brigden. “We need confirmation our assumption was correct, that we made the right guess.”

This current phase, he says, is pinned to the kind of soft data that is available faster than hard data — things like confidence metrics, the Purchasing Managers’ Index or CEO surveys. “These are the surveys where they ask industry or companies, how are you feeling about the world? What are you doing with your inventories? What are you doing with your production?”

The answers reflect the upsurge in “animal spirits” kick-started by Trump’s victory — a term originally coined by John Maynard Keynes to describe how non-rational emotions affect economics. “They’re saying their orders are going to pick up, their employment’s going to pick up … That’s your confirmation. That you’re right to be betting on that growing stronger economic argument.”

However, Brigden reckons people are laboring under misapprehensions around confirmation. “Trump’s intention has been, since his first term, to bring manufacturing and production back to the US, ensure the jobs of working Americans, but also create strategic control over industries and ensure the sanctity of defense.”

Trump 1.0 offered tax cuts to those returning money to the US, but this did not have the desired effect. This time around his approach will be to impose heavy tariffs on imports from countries including China and Mexico.

But MI2 believes tariffs are not a negotiating stance. “People say it’ll be good for growth, but there’s a cost.”

The inevitable impact will be higher prices for consumers or shrinking margins for corporations. “This is what people don’t realize. This is not such a pro-corporate agenda; this is a pro-American worker agenda. I think that’s very different.”

Phase Three: Reality

That brings us to the third phase of Trump 2.0: reality. What might happen in the markets when reality bites in late January?

Brigden predicts a shift from tech-oriented stocks, which spiked amid “Trump euphoria”, to areas like industrials. Down the line, he’s worried about a risky bond market if tariffs contribute to inflation. “I’m watching this bond market really closely... I for one don’t believe the inflation problem is really solved.”

What about the US Federal Reserve’s monetary policy, something investors everywhere are watching closely? “At bare minimum, [the Fed is] done with rate cuts. It might come to a point that the bond market starts to yield, rise enough, that the Fed is forced to hike again, conceptually.”

Conceptually, but not really? “I think they’d be really reticent to do that. They talk the talk rather than walk the walk. But we’re getting to the point where maybe we’ve got two more cuts: a December cut, maybe one in spring. Then they should not be cutting, not with growth where it is.”

Ultimately, Brigden says reality depends on what unfolds once Trump reenters the Oval Office. “How many [cuts] you actually get will depend on the policies of the new administration, how the market reacts.”

Three things, however, are unlikely to be true at once, says Brigden. “The idea we’re going to get stimulus policies, the unleashing of animal spirits and rate cuts, too? No, no…”

The proof, as always, will be in the pudding.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy