In a new wave of activity in the space industry, a pattern of consolidation and skyrocketing share prices on SPAC mergers is surfacing and possibly repeating old cycles. Intuitive Machines surged up to 1,260% within a week of its SPAC-merger IPO, and Terran Orbital gained 101% on a potential SpaceX collaboration. Virgin Galactic shares also soared ahead of its commercial space tourism flight launch in Q2. Will the bubble burst, or are the gains here to stay?

- Intuitive Machines surged as much as 1,260% within a week of its SPAC-merger IPO on 13 February.

- Terran Orbital shares surged as much as 101% on 22 February on a new deal with Rivian, and sector advisers expect it to be acquired by Lockheed and Martin.

- 10.8% of the 232 stocks that went public through SPAC mergers since 2021 are likely to go bankrupt within the next 12 months, according to Audit Analytics.

Intuitive Machines [LUNR] made a stock market debut on the Nasdaq on 13 February, trading under a new ticker symbol (previously IPAX) after a SPAC (Special Purpose Acquisition Company) merger with Inflection Point Acquisition. Founded in 2013, Intuitive Machines is the most NASA-awarded commercial lunar program, with three NASA missions.

Its shares have shot to the moon since, gaining up to 259% on 14 February and skyrocketing as much as 1,260% within a week of its IPO.

The stock surge built on speculation over collaborations with Elon Musk’s SpaceX due to a tweet by Intuitive Machines, saying, “We knew @ElonMusk was taking #Dogecoin to the Moon, but had no idea it would be on our flight.”

A SPAC(e) bubble?

However, Intuitive Machines’ extreme share price volatility is accompanied by bold future revenue targets.

Guidance issued in September 2022 said the company anticipates tripling its revenue in 2023 to $300m and then more than doubling the target for 2024 to $759m. These targets represent enormous growth rates for business divisions that have yet to generate revenue.

This resembles the blank-check acquisition frenzy from 2021, which saw SPAC-acquired companies surging along with grand financial guidance.

According to data analytics firm Audit Analytics, 10.8% of the 232 stocks that went public through SPAC mergers rather than via a traditional IPO over the past two years are on the verge of going bankrupt within the next 12 months.

Terran Orbital and SpaceX

In another instance of SPAC-IPO companies surging alarmingly, Terran Orbital [LLAP] shares surged as much as 101% on 22 February after its subsidiary Tyvak Nano-Satellite Systems won a $2.4bn contract from Rivada Space Networks to build 288 low-earth orbit satellites. “I believe this is the largest small [satellite] deal in the history of small sats,” Terran co-founder, chairman and CEO Marc Bell told CNBC.

However, the stock had its IPO through a SPAC merger with Tailwind Two Acquisition [TWNT] last year (March 2022) and has slid in value since its debut.

Terran Orbital, one of the last independent satellite producers, could be the industry’s next acquisition target. There is speculation that aerospace defence company Lockheed Martin [LMT], which already has a stake in the company, could be a potential acquirer, sector advisers told Dealreporter. Lockheed invested $100m in the satellite maker in October 2022.

Other space stocks activity

Another recent move in the space sector’s consolidation is Maxar Technologies’ [MAXR] $6.4bn acquisition by private equity firm Advent International, announced in December 2022.

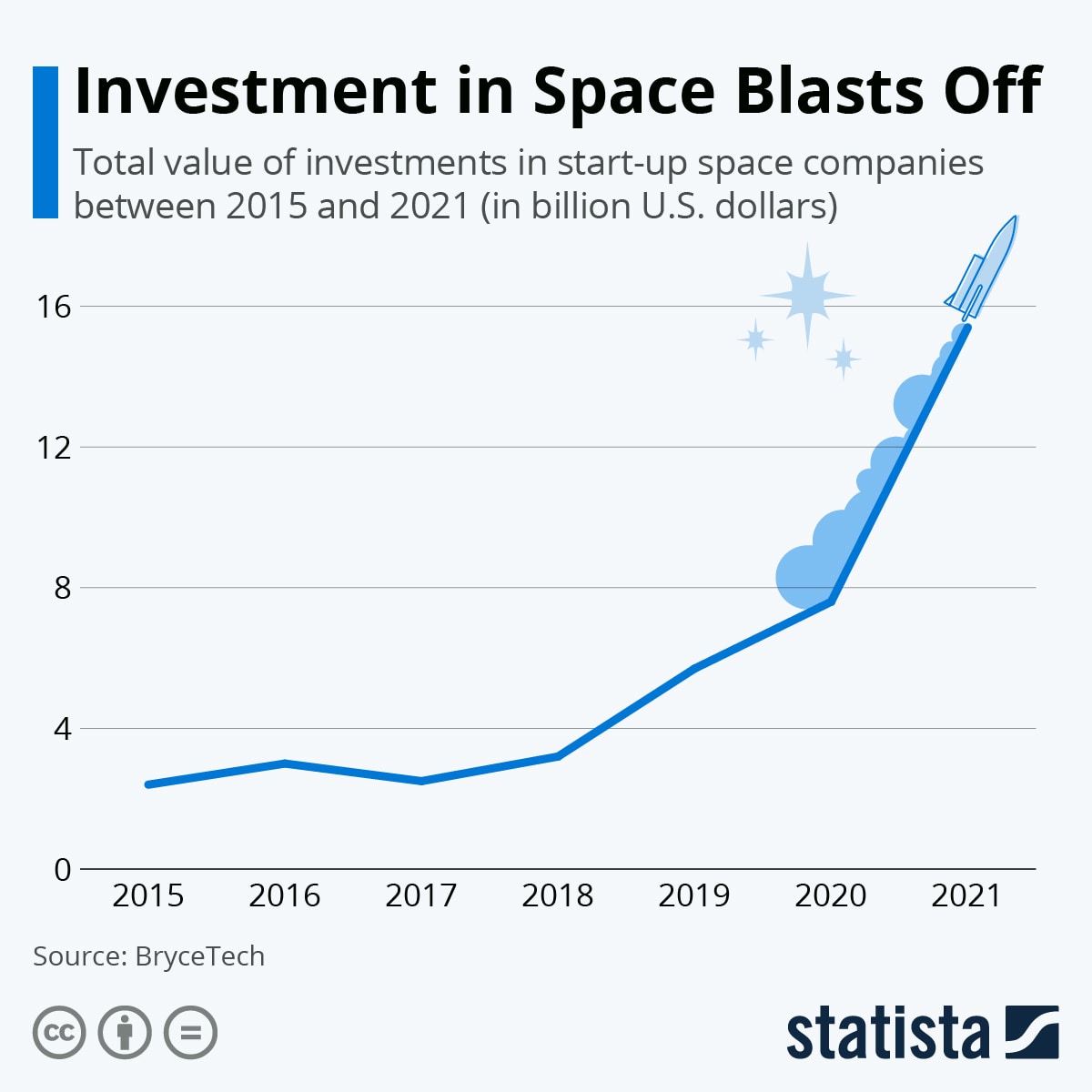

The Statistainfographic below shows how the volume of investment in space start-ups has surged between 2015 and 2021.

Meanwhile, Virgin’s space ventures have been moving in opposite directions, Optoreported previously. Virgin Galactic’s [SPCE] share price is gaining on successful test flights as it draws closer to launching its commercial space tourism flights in Q2 2023, while Virgin Orbit [VORB] is struggling to keep up with cash flow problems.

Funds in focus: SPDR S&P Kensho Final Frontiers ETF

Several ETFs provide exposure to the space industry.

The SPDR S&P Kensho Final Frontiers ETF [ROKT] is up 15.14% in the last six months and up 6.77% year-to-date as of 2 March. The fund’s top holding is Maxar, with a 6.29% weighting, and includes a 3.59% holding of Virgin Galactic, as of 1 March.

The Procure Space ETF [UFO] has Iridium Communications [IRDM] as its top holding, followed by Maxar. The fund was down 2.94% in the last six months and up 2.10% year-to-date as of 2 March.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy