Phong Le, President and CEO of MicroStrategy, explains how the business has adopted artificial intelligence technology both internally and externally in order to improve efficiency and boost its offering.

Internal Efficiencies

MicroStrategy [MSTR] is a serial innovator. Perhaps best-known for its ground-breaking bitcoin strategy, the firm has keenly embraced the emergence of more sophisticated generative artificial intelligence (AI) technology.

Internally, Le explains, this has created efficiencies in the development of products. For example, GitHub’s Copilot functionality has sped up the development progress and allowed technologists to focus more on aspects like design and functionality.

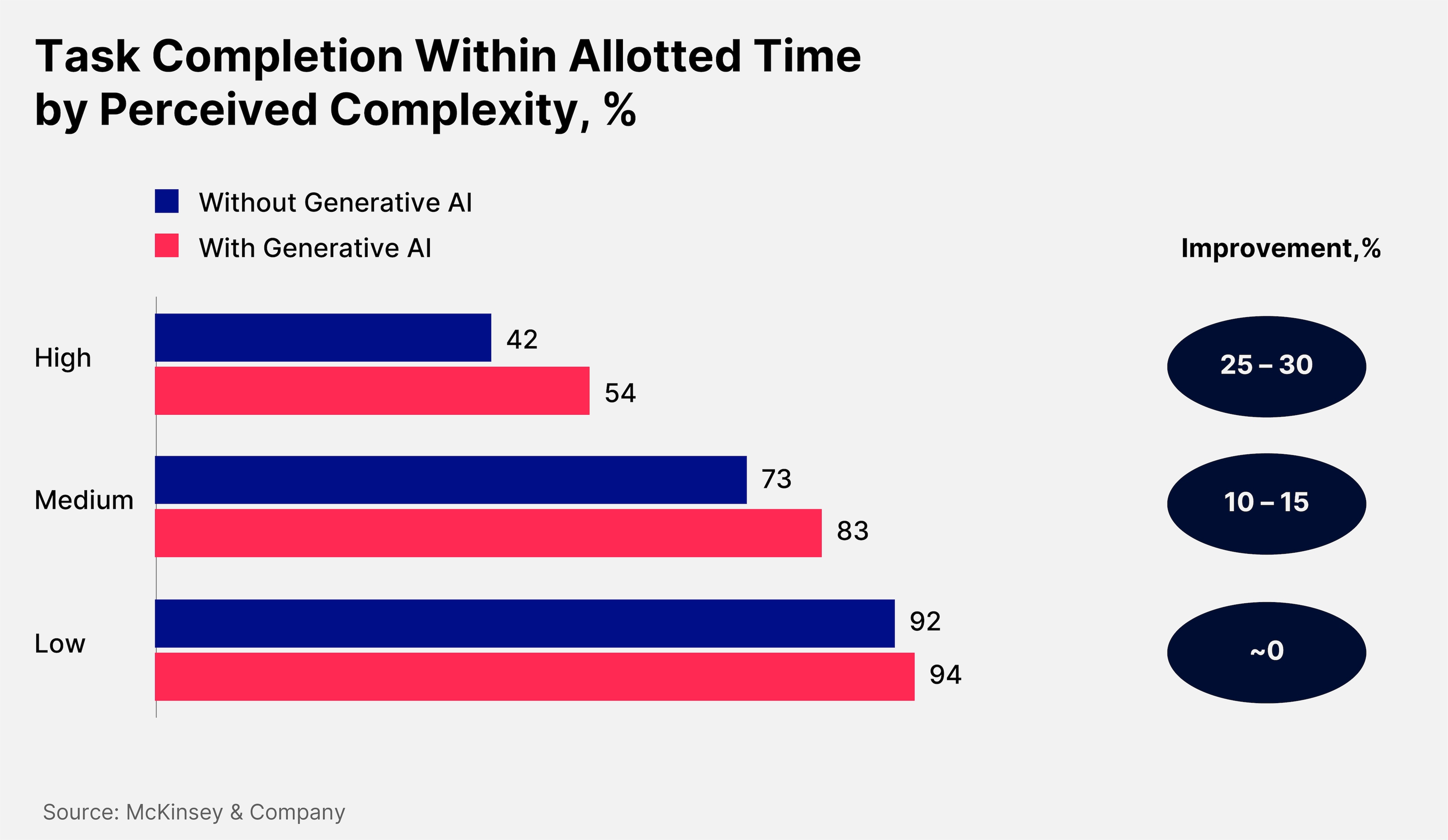

Le estimates that generative AI has driven a 15–20% increase in coding efficiency. This tallies with research from McKinsey, which found that software developers were 25–30% more likely to complete complex tasks within a given timeframe if assisted by AI.

The efficiencies MicroStrategy has realized with AI are greater in other functions, such as design, copywriting and customer support. “The other thing that we’ve done that has been very effective is we’ve created a bot for support cases.” He estimates that this bot, Auto Expert, has reduced the case load for the support team by 20–30%.

Asking the Right Questions

Externally, much of MicroStrategy’s functionality is now AI-accelerated. For instance, customers can interact with the platform using natural language.

Historically, a pharmaceutical salesperson would have had to manually reconfigure a report, or request an update from an analyst, if it didn’t return the desired information — this could scupper a deal if a potential customer requested the information mid-pitch.

“Now, you can just ask questions of the data and it gives you the answer.”

Generative AI has the potential to hallucinate. In unstructured use cases such as video or text generation this isn’t usually a problem.

“But what we’ve done,” explains Le, “is combine generative AI with the ability to ask the data questions, and now we’re talking about numerical, structured data. It’s not okay if the answer is just sort of okay. You want the answer right, and the same every single time.”

The trick to overcoming this, Le explains, is to understand what generative AI is good at: interpreting the question, interacting in natural language and producing its answer in a clear format.

“We use the generative AI to interpret what the person means when they ask a question. The AI doesn’t just tell us what they meant, it tells us what query we should run, the SQL. Then we take that query and we run it against our data. When you take that query and run it against the data, it’s going to give you the same answer every single time, so there is no hallucination.”

This consistent answer is then packaged into a readable format for the end user.

“We’re not asking the generative AI to answer the question. We’re asking it to interpret the question, and then we answer the question.”

Future Innovation

Much of the conversation around generative AI currently centers on prompt engineering. “You have to know the question you want the answer to before you get the answer,” as Le puts it.

MicroStrategy, however, is aiming to go further. “If you’re a frontline employee at Starbucks [SBUX], do you really want to be able to perfectly phrase the question before you get the answer? Or do you want to be told the answer to the question you didn’t even know to ask? That’s what we’re working on next.”

Looking even further ahead, Le envisages a world where an AI with perfect knowledge of the context in which a worker is operating could not only answer the question they didn’t know to ask, but also execute the action that answer might prompt — at least, for low-risk, transactional tasks.

“Then you’ve just automated away the mundane task of that employee, so he or she can spend more time with the customer.”

MicroStrategy has often been the first company to do something — from mobile and cloud analytics, to incorporating generative AI into the product and adding bitcoin to the company balance sheet.

“We’re a tech company. We’re inventors, we’re innovators,” he says.

“We’re all about product-led growth. We’re going to invent the next thing.” While keeping tight-lipped about the details, Le hints that the next iteration of its business intelligence software evolution is in the works for next May.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy