In this article, Pedro Palandrani and Andrew Little, research analysts at Global X, break down the biggest company news across disruptive trends such as cloud computing and electric vehicles.

‘Buy now pay later’ expands with Stripe

Two large names at the intersection of fintech and ecommerce, Afterpay [APT.AX] and Stripe, are teaming up to launch a potentially powerful partnership. Teaming together will allow merchants to offer their customers Afterpay’s ‘buy now pay later’ option through Stripe’s digital payments platform.

This collaboration could be beneficial to all parties by expanding the reach of the ‘buy now pay later’ option across thousands of merchants and millions of customers. Afterpay will offer Stripe users the option to pay for an online order in four instalments without the liability of loans, interest, or upfront fees, according to Finextra.

Merchants will be able to accept Afterpay transactions without consumers having to meet any prerequisites. The partnership extends further by allowing any ecommerce platforms integrating Squarespace [SQ] to offer a ‘buy now pay later’ option as well, Retail Dive reported.

Beyond the clouds

The Mars Rover team at NASA has enlisted the help of Amazon Web Services [AMZN] (AWS) in processing data retrieved from their Perseverance Rover’s trip to Mars.

Having AWS as an asset in the NASA Jet Propulsion Lab allows them to store, process, and distribute large quantities of data and the thousands of images taken from Perseverance’s stay on Mars.

One of the main highlights of having AWS as a cloud computing server is alleviating the time constraint NASA faces when sending instructions to the rover and giving it visibility when driving.

AWS additionally provides a 3D view of Mars from the perspective of the Perseverance Rover. With the integration of cloud computing technology, increased efficiency has permitted Perseverance to travel longer distances and gather more data than previously possible, according to ZDNet.

"With the integration of cloud computing technology, increased efficiency has permitted Perseverance to travel longer distances and gather more data"

At-home workouts elevated

The stay-at-home economy has been beneficial for companies such as Lululemon [LULU] that provide the resources for consumers to stay fit at a time when many cannot or will not step foot in gyms.

Since the holiday season, Lululemon began advertising their recently acquired Mirror, which is an at-home exercise equipment tool incorporating a mirror and TV screen. Mirror costs $1,500 up front, with additional monthly fees for classes.

Traditionally, Lululemon has been an athleticwear brand, but its move into equipment places it alongside Peloton [PTON] as an at-home-fitness solution. Although the purchase of Mirror cost the company $500m, Lululemon reports that the expected $150m in revenue has already been exceeded, Yahoo Finance reported.

While the coronavirus pandemic may be coming to a close with greater vaccine distribution, recent inroads by at-home fitness equipment could prove to be an irreversible trend.

New approaches to monetisation for socials

Twitter [TWTR] and Snapchat [SNAP] revealed many upcoming features to be rolled out within their respective platforms following Investor Day. ‘Super follows’ announced by Twitter will offer users the alternative to charge followers for access to additional content.

The content may include bonus tweets, exclusive groups, newsletters, or badges for support. It is being advertised as a package deal for followers to receive monthly perks.

This announcement comes following the success of Patreon, Facebook [FB], YouTube [GOOGL], and other direct payment platforms, according to TheVerge. Snapchat’s announcements circulated around prospective major ad revenue gains which can already be seen through Stories, Snap Maps, and Spotlight.

Snap Maps is starting to add small businesses in a bid to increase ad revenue. Snapchat’s monetisation potential was stressed when mentioning that despite having less than 2% of the US digital ad market, the app is reaching almost half of US smartphone users.

2%

Snapchat's share of US digital ad market while reaching almost half of US smartphone users

Green Act boosts EV car tax credit

Top selling electric vehicle (EV) manufacturers such as Tesla [TSLA] and General Motors [GM], previously faced competitive headwinds by exceeding the sales limits that qualify for federal tax credits.

Introduced in the GREEN Act of 2021, the new bill proposes to provide US consumers $7,000 in tax credits for buying a car from manufacturers that already exceeded the 200,000 unit limit, according to Tesmanian.

Tesla buyers stopped receiving tax credits after 2019 as the auto manufacturer entered a two-year “phase-out” period due to high sales volumes. The GREEN Act would renew EV tax credits in a bid to reward early adoption of EVs. The credit limit for manufacturers would be raised to 600,000 vehicles, and likely spur faster adoption of EVs in the US.

2020 ecommerce wrap-up

US retail ecommerce sales totalled $206.7bn in the fourth quarter of 2020, up 23.56% year-over-year. Total ecommerce sales for 2020 were estimated at $791.7bn, up 32.4% year-over-year.

Comparatively, total retail sales (ecommerce and brick-and-mortar) in 2020 were up 3.4% from the previous year, according to US Census Bureau news. The fastest-growing categories for ecommerce expenditure included: groceries, items for leisure activities such as sporting goods and musical instruments, and home improvement tools, CNBC reported.

The rapid growth of ecommerce is representative of consumers’ embrace of digital technologies amid the pandemic. While it is likely the huge growth in ecommerce seen in 2020 will not remain at such elevated levels as COVID-19 regulations ease, some changes in behaviour may be lasting, including curbside pickup and online grocery delivery.

Groceries were formerly a niche industry for the online market, making up just 2% of total food and beverage sales in 2019. But with the pandemic, online grocery adoption is expected to reach 55% of US consumers by the end of 2024.

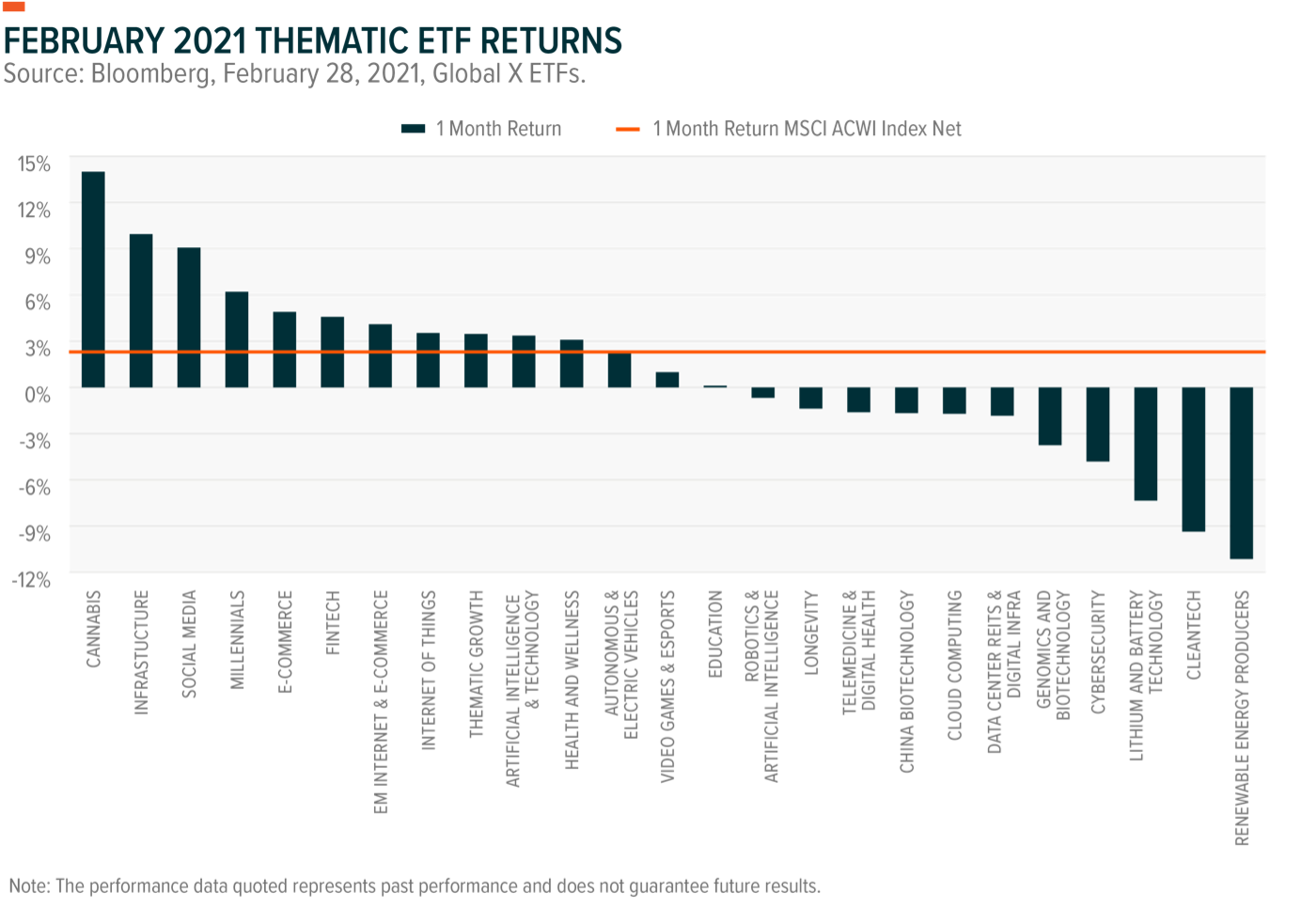

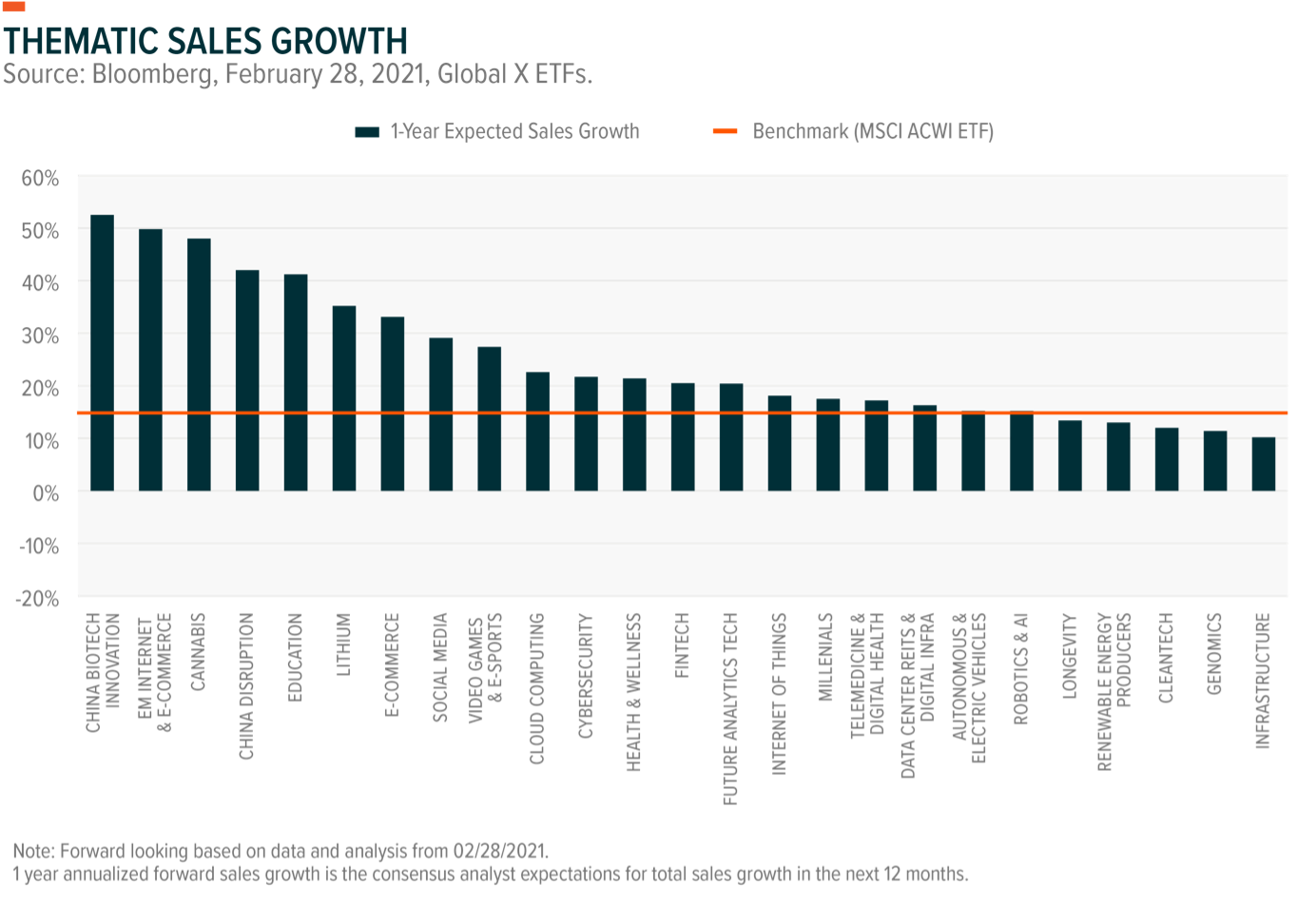

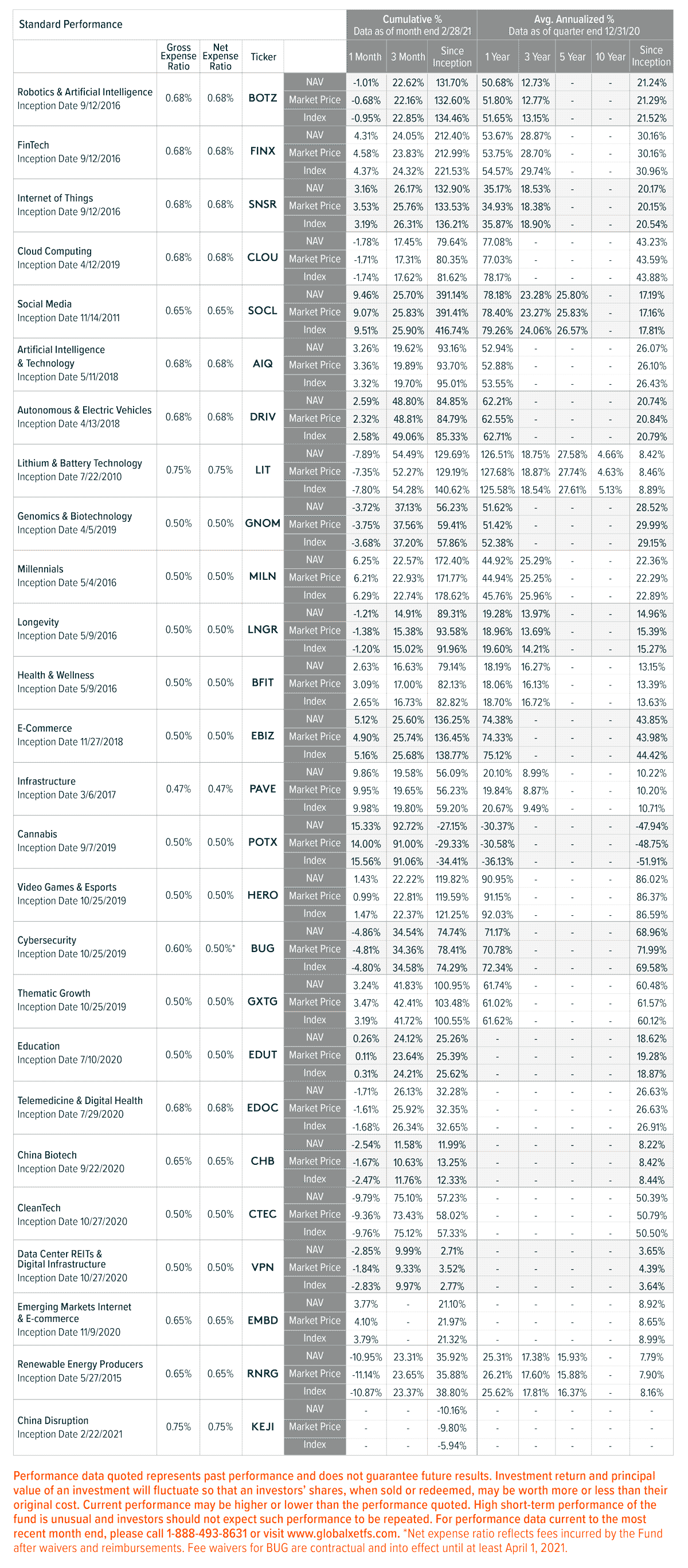

The numbers

The following charts examine returns and sales growth expectations by theme, based on their corresponding ETFs:

This article was originally published on Global X ETFs, a New York-based provider of exchange-traded funds that offers insights on the disruptive themes changing the world.

SEI Investments Distribution Co. (1 Freedom Valley Drive, Oaks, PA, 19456) is the distributor for the Funds.

Investing involves risk, including the possible loss of principal. There is no guarantee the strategies discussed will be successful. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Narrowly focused investments may be subject to higher volatility. The funds are nondiversified.

Information Technology companies can be affected by rapid product obsolescence, and intense industry competition. Risks include disruption in service caused by hardware or software failure; interruptions or delays in service by third-parties; security breaches involving certain private, sensitive, proprietary and confidential information managed and transmitted; and privacy concerns and laws, evolving Internet regulation and other foreign or domestic regulations that may limit or otherwise affect the operations. Healthcare, Genomics, Biotechnology and Medical

Device companies can be affected by government regulations, expiring patents, rapid product obsolescence, and intense industry competition.

CleanTech Companies typically face intense competition, short product lifecycles and potentially rapid product obsolescence. These companies may be significantly affected by fluctuations in energy prices and in the supply and demand of renewable energy, tax incentives, subsidies and other governmental regulations and policies. The risks related to investing social media companies include disruption in service caused by hardware or software failure, interruptions or delays in service by third-parties, security breaches involving certain private, sensitive, proprietary

and confidential information managed and transmitted by social media companies, and privacy concerns and laws, evolving Internet regulation and other foreign or domestic regulations that may limit or otherwise affect the operations of such companies. There are additional risks associated with investing in lithium and the lithium mining industry.

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in the Funds’ summary or full prospectus, which may be obtained by calling 1.888.493.8631, or by visiting globalxetfs.com. Please read the prospectus carefully before investing.

Global X Management Company LLC serves as an advisor to Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC or Mirae Asset Global Investments.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Beginning October 15, 2020, market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share. Prior to October 15, 2020, market price returns were based on the midpoint between the Bid and Ask price. NAVs are calculated using prices as of 4:00 PM Eastern Time. The returns shown do not represent the returns you would receive if you traded shares at other times.

Indices are unmanaged and do not include the effect of fees, expenses or sales charges. One cannot invest directly in an index. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy