The holidays are almost here and whilst we are splurging on toys, gifts, and copious amounts of food, it is always good to add a little extra to your nest egg, no matter the time of year. So here are two companies that could be a good investment this holiday season.

This article was originally published on MyWallSt — Investing Is for Everyone. We Show You How to Succeed.

The bull and bear case for Walmart

Walmart (NYSE: WMT) is the planet’s largest company by revenue as well as being the largest private-sector employer in the world. To further illustrate this fact, the company is on track to generate $550 billion in 2020 and as a result, shares have grown more than 20% this year.

Walmart rolled out Walmart+ as its latest foray into the e-commerce industry. The hope is to claw into the competition where Amazon reigns supreme, by leveraging it’s brick-and-mortar stores alongside the newly vamped up digital service. Indeed, its Walmart+ service will help retain new customers gained during the pandemic, particularly as it only costs $12.95 per month and same-day delivery is available at 2’700 of its stores. In addition, Walmart and Shopify have teamed up to help 3rd party sellers escape the pervasive grasp of Amazon, redirecting them to Walmart’s own marketplace.

On the other hand, achieving high growth will be difficult for a company like Walmart, mainly due to the sheer size of the business; sales growth for its fiscal 2020 grew only 2% year-over-year (YoY). This is likely to get harder as more and more people opt for online shopping whilst Walmart still gets the vast majority of its revenue from brick-and-mortar stores. Furthermore, competition with Amazon in this arena will be tough and could impact future growth.

Walmart is a business that is currently transitioning from fully brick & mortar into curating an equally large online presence. Considering its household name status and its sheer ability to bring in truckloads of revenue, Walmart will continue to grace us with its discounts for many years to come.

The bull and bear case for Etsy

If you thought Etsy (NASDAQ: ETSY) was popular before the pandemic, then you ain’t seen nothing yet. Yes, Etsy was a well-known brand, with plenty of potential in the e-commerce space, but, it really boomed this year. Etsy became the go-to business to find home-made and locally sourced masks. In fact, Etsy sold about $133 million worth of artisan masks, with around 12 million of them in April alone.

Etsy has stolen the show this year as it caters to the current market trends of home-grown, local, artisan, and vegan. Beyond the mask boom, sales grew 93% by its Q2 earnings driven by sales in homewares and home furnishings; craft supplies; and beauty and personal care. For the third-quarter, total revenue was up by 128.1% to $451.5 million. Etsy is growing at an explosive rate with many small businesses utilizing its services as an alternative to Amazon.

However, this growth might not be sustainable once pandemic-related restrictions ease. With regards to shopping local, many will prefer to slip back into the local brick-and-mortar stores that fill up our towns and suburbs.

As for the sellers, there has been backlash this year against Etsy’s mandatory changes to the service, such as automatically advertising products without the prior consent of the seller. For small businesses, this represents a move away from helping small companies to instead creating a slurry of unforeseen costs that could seriously affect the margins of their businesses.

However, for investors, Etsy is currently a buy right now as an asset-light business with high gross margins that came in at just under $1 billion for the twelve months ending September, an increase of 90% YoY.

So, which should I watch?

Both of these stocks present a good option. Walmart is the giant of these two choices, although it might struggle to grow further due to both competition and the sheer size of the company, it has really been making tracks by building up a digital alternative to its brick-and-mortar stores. Walmart is a company that will not stop, it is a good trusty stock to have in your portfolio.

Etsy on the other hand is perfect for the investor who wants high, fast growth and who isn’t averse to a little risk. This company could go far, but it needs to be able to sustain its continued growth along the way.

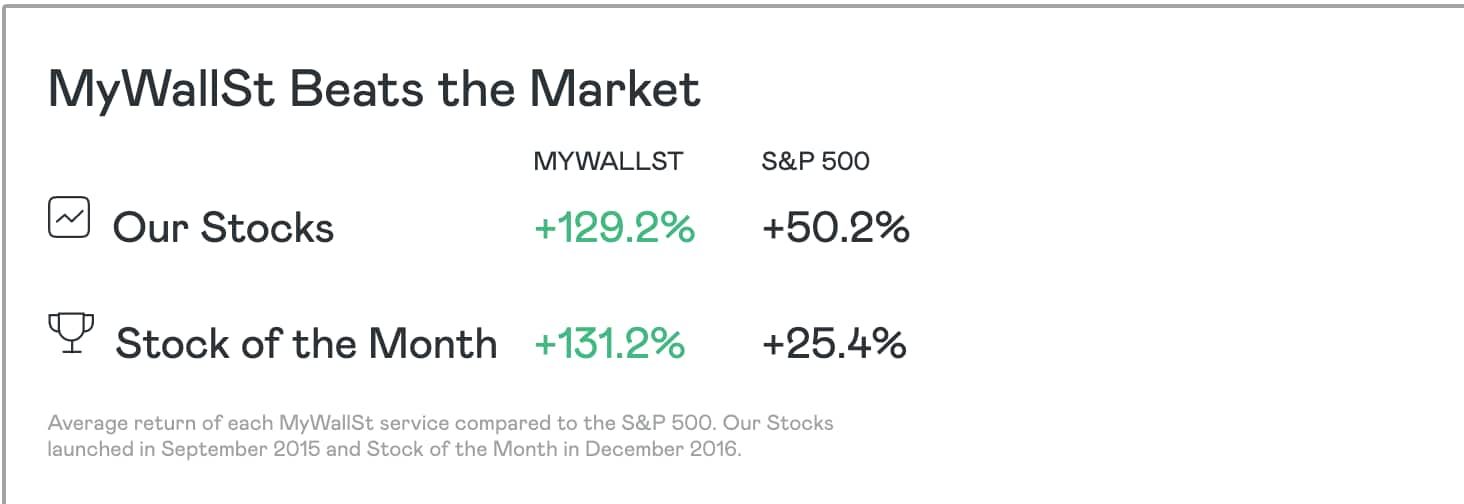

MyWallSt makes it easy for you to pick winning stocks. Start your free trial with us today— it's the best investment you'll ever make.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy