In this article, the team at Global X explores the semiconductor shortage and contextualises this in terms of some significant long-term trends.

Among many things, the pandemic exposed the underlying vulnerabilities of global supply chains. This is certainly the case for the semiconductor industry, where barriers to entry are notoriously high, technological competition is cut-throat, lead times are long, and the balance of power overwhelmingly tilts towards a few gargantuan companies.

At the same time, several industries depend on semiconductors for their latest products, including automobiles, personal electronics, and home appliances. With production backlogs forming due to the disruptive nature of COVID-19, those depending on an uninterrupted supply chain of semiconductors are feeling the pain.

Auto manufacturers, for example, could experience a $61bn loss in revenue due to supply constraints in 2021. (1) The problem has escalated to the point where governments are getting involved, not only to help alleviate near-term bottlenecks, but also to develop policies that protect the stability of semiconductor supply chains over the long-run in an effort to avoid future disruptions.

$61billion

Losses faced by auto manufacturers due to chip shortage

Although the semiconductor shortage creates headwinds for various industries in the short-term, it is important not to lose sight of the long-term trends in motion. In many ways, chips are the new bricks, with a wide range of industries and products depending on semiconductors to provide innovative new features and take advantage of the latest technologies.

In this piece, we’ll discuss both the reasons for the underlying shortages and how securing semiconductor supply chains in the future will be critical to geopolitics and technological advancements.

Key Takeaways

- America leads the world in chip design, while South Korea and Taiwan lead in manufacturing. This uneven geographical distribution of certain aspects of the semiconductor supply chain has been exposed as a critical weakness amid a world with increasing geopolitical risks.

- Semiconductor production is difficult to adjust over short time frames for several reasons, including the high R&D requirements for chip design, the immense capital and time needed to build efficient semiconductor factories and high barriers to entry for potential competition.

- Governments are taking notice of the economic and geopolitical risks the chip shortage presents, and are taking measures to alleviate it in both the near-term and long-term.

- Meanwhile, disruptive technologies in fast-growing industries like 5G, artificial intelligence (AI), cloud computing, and electric & autonomous vehicles are driving up long-term demand for semiconductors.

- Policymakers around the world are exploring options to reshore semiconductor manufacturing and reduce dependency on other countries, especially geopolitical rivals.

The supply side

The semiconductor supply chain is notoriously rigid and difficult to enter. This is mainly because of three reasons:

- High R&D requirements for chip design.

- An uneven geographical distribution of power in chip manufacturing.

- The difficulty of building new factories or adjusting orders.

- Chip design.

America is the global leader in the field of chip design, with American companies accounting for 47% of global semiconductor sales in 2019. America’s ability to draw in talented engineers from abroad and its R&D spending as a percent of sales in the semiconductor industry, which leads the world at 16.4%, are both crucial drivers of innovation that allow it to maintain a competitive edge. (2)

America’s R&D spending in the chip industry is helping it maintain a competitive edge in the field of chip design. This decisive advantage in chip design is why American companies take in most semiconductor sales revenue, despite only accounting for a small portion of global semiconductor manufacturing.

Chip manufacturing

Although most cutting-edge semiconductor technology comes from America, the lion’s share of manufacturing goes to East Asia, particularly Taiwan and South Korea. Fabless companies, like Qualcomm [QCOM] and Nvidia [NVDA], only engage in chip design and sales, but outsource the actual production of chips to other companies.

Foundries are companies that specialise in manufacturing chips. Pure-play foundries like TSMC [2330] only manufacture chips and do not design any of their own. Others like Samsung [005930] both design and manufacture chips.

The fabless business model is why almost half of global sales are attributed to US companies, despite only 12% of global manufacturing capacity being located in the US, compared to 43% in Taiwan and South Korea. (3) Out of all the Taiwanese and South Korea semiconductor companies, TSMC and Samsung overwhelmingly dominate the field because they have the fabs capable of making the most advanced chips in the world.

"TSMC and Samsung overwhelmingly dominate the field because they have the fabs capable of making the most advanced chips in the world”

Rigidity of the supply chain

As the current shortage has demonstrated, it is difficult for semiconductor fabs to adjust their output in response to external shocks. Building a new fab to meet growing demand is simply not a feasible solution for short-term disruptions because of the immense capital and time required to do so.

Building a fab and bringing it up to full capacity can take anywhere from 24 to 42 months, at a price tag of anywhere from $1.7bn to $5.4bn, depending on the quality of the chips manufactured. (4)

Those costs are only increasing as semiconductors continue to become smaller and more complex. That is not to mention the fact that fabs require lead time for orders and cannot easily open capacity at moment’s notice. Lead times were already long enough to begin with, but the pandemic only extended them.

Between January and April 2021, lead times reportedly increased an average of 75%, with some customers seeing increases of 52 weeks. (5) Businesses that require semiconductors in their products must balance their orders with just the right amount of production to avoid having too many or too few semiconductors on hand.

How things fell apart on the supply side

A perfect storm of geopolitical tensions, inflexible supply chains, high barriers to entry, concentration of power in a select handful of companies, and the once-in-a-century shock of COVID-19 led to a supply-side logjam that is now impacting several aspects of the economy.

Before COVID-19, geopolitical tensions were already setting the stage for the ongoing shortage. The US-China trade war saw sanctions levelled against key Chinese tech firms like Huawei [002502] and ZTE [000063], which were cut off from buying chips made with US technology. In response to these sanctions, 2019 saw Chinese tech companies like Huawei and Hikvision [002415] scrambling to stockpile chips.

When COVID-19 struck, factories around the world were left with no choice but to shut down because of stay-at-home orders. Despite the lockdowns, semiconductor companies were given a little more leeway; at the height of the lockdown in Wuhan, YTMC and XMC [XMC] could continue operations. (6) Faced with unusual changes in demand, semiconductor companies could not adjust their production fast enough.

"Faced with unusual changes in demand, semiconductor companies could not adjust their production fast enough”

To make matters worse, a combination of natural disasters and fab incidents exacerbated the shortage. In February, an unprecedented blizzard led to power outages across Texas that brought production at fabs owned by Samsung, Infineon [IFX] and NXP Semiconductors [NXPI] to a grinding halt. In March, a fire resulted in production stopping for nearly a month at a Renesas [6723] factory in Ibaraki Prefecture, Japan. Furthermore, an ongoing drought in Taiwan threatens to impact operations of major fabs run by TSMC, UMC [UMC] and more, though at the time of writing the impact is minimal.

The demand side

On the demand side, the uncertainty of COVID-19 caught companies and consumers off guard. With unprecedented lockdowns and travel restrictions in place, it was not entirely clear how demand for various products would be impacted. Automotive companies, many of which prefer not to stockpile inventory, anticipated a decline in automobile demand and adjusted their plans accordingly. Meanwhile, with people confined to their homes, demand for household electronics remained resilient. While automotive companies cut back on chip orders, consumer electronics companies continued to order chips.

Fast forward to September 2020. At this point car sales rose close to their pre-pandemic levels and carmakers needed to ramp up production. The trouble is that semiconductors are necessary for the functioning of modern vehicles and therefore a shortage of them can easily threaten production.

"Semiconductors are necessary for the functioning of modern vehicles and therefore a shortage of them can easily threaten production”

Modern vehicles can utilise hundreds of semiconductors — a number that is increasing as cars become ever more advanced. (7) The average semiconductor price per car increased from 27% in 2010 to 40% in 2020, and the rise of electric and autonomous vehicles will likely further increase that number. (8) When carmakers got back in line for semiconductor orders, chipmakers already had a significant backlog of orders from other companies.

Worldwide PC shipments and vehicle sales both took a hit in 2020 and followed a similar trajectory afterwards. This was not the scenario many automakers prepared for.

Governments get involved

The semiconductor shortage has escalated to the point where governments of major economies feel the need to take action and even reassess the current mode of operation in the industry.

In the United States, the president Joe Biden’s administration:

- signed an executive order calling for a 100-day review of supply chains;

- held a semiconductor summit at the White House in April;

- is pushing the Chips for America legislation, which earmarks $50bn for semiconductor R&D;

- agreed with Japan to cooperate on semiconductor development and supply chains.

In Japan, the Shinzo Abe and Yoshihide Suga administrations:

- dispatched a delegation in June to negotiate with and invite TSMC to build a fab in Japan;

- asked Taiwanese manufacturers in March to cooperate in alternative production of chips;

- and encouraged equipment makers to support Renesas in the wake of the Renesas factory fire.

Meanwhile, South Korea responded by:

- exempting businesspeople procuring auto chips from the two-week quarantine;

- offering increased vaccinations for key people in auto chip supply chain;

- holding a Blue House summit with companies in the automotive and semiconductor industries;

- and dispatching government officials to Taiwan to negotiate for more secure chip supply.

Disruptive technologies support long-term semiconductor growth

Many of the disruptive technologies currently moving up the S-Curve in adoption rely on semiconductors. Whether it’s electric and autonomous vehicles, AI, industrial robots, or internet of things (IoT) devices, few disruptive technologies don’t rely on semiconductors in one way or another.

In fact, in its Q1 2021 earnings conference, TSMC said its decision to ramp up capital expenditure to $30bn in FY2021 was because of “multi-year structural megatrends of 5G-related and HPC (high-powered computing) applications.” (9)

The takeaway is that despite short-term obstacles in the semiconductor industry, it is important not to lose sight of the long-term trends that are already in motion and likely to structurally increase semiconductor demand over the next decade, or longer.

The auto industry

Production cuts in the auto industry have grabbed headlines. It is estimated that carmakers could lose $61bn as a result of the chip shortage in 2021. (10) In the first half of 2021, Japanese carmakers may potentially need to reduce production by 500,000 units. (11)

Modern vehicles are increasingly reliant on semiconductors for advanced brakes, infotainment and steering systems, so missing chips can easily stall production. Some carmakers have resorted to manufacturing cars without chips and storing them in inventory as they await these critical ingredients.

Despite temporary production cuts for carmakers, the EV industry continues to march forward. In March, Xiaomi [1810] announced its bold ambitions to start making electric vehicles (EVs). Chinese-EV maker NIO [NIO] is currently preparing for expansion into the European market in the second half of 2021. (12) Increased adoption of EVs is a good sign for semiconductor companies over the long run due to their heavy usage of semiconductors in battery, drive, and infotainment systems.

Robotics and automation

Capital expenditure from semiconductor manufacturers is on the rise. Given how automated semiconductor fabs are, it is possible much of that will go into industrial robots for fabs.

”Capital expenditure from semiconductor manufacturers is on the rise”

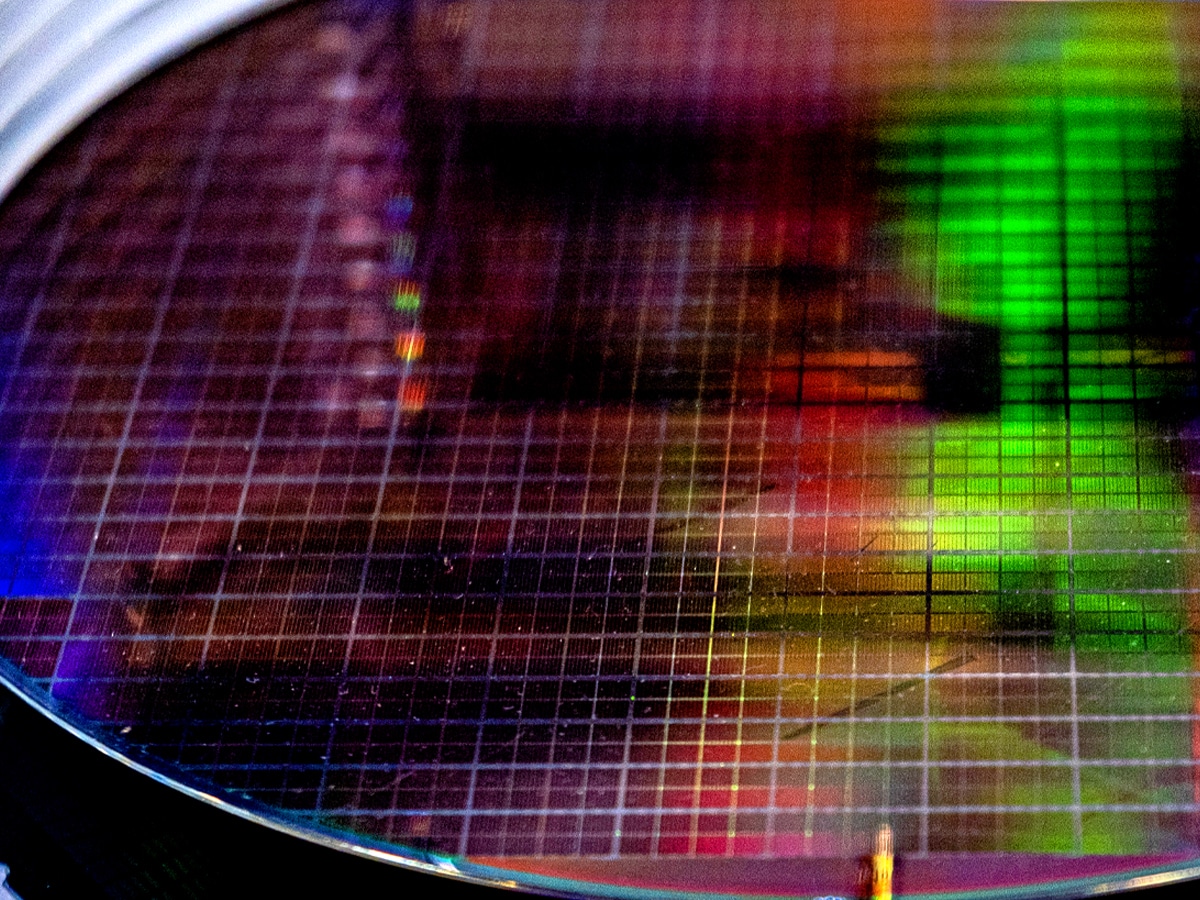

Semiconductor companies like TSMC and Samsung have put some effort into increased automation in recent years. In 2020, TSMC developed the world’s first automated wafer transportation system, which can safely carry wafers from warehouse docks to fabs and reduce manual handling weight by 95%.

This automated system was rolled out in Q1 2020, and TSMC plans to roll out the system to all of its 12-inch Gigafabs in Taiwan before the end of 2021. (13) As of February 2020, Samsung started implementing Robotic Process Automation at its Pyeongtaek 2 semiconductor fab. Six tasks were automated in February and that number was expected to rise to 12 by the first half of 2020. (14) These innovations could possibly be carried over to the Pyeongtaek 3 foundry, which is currently under construction.

AI

Extracting insights from massive datasets with AI and machine learning (ML) requires more processing power than simple operations. This processing power depends heavily on advances in semiconductor technology. Because of this, new semiconductors that specially cater to the needs of AI and ML have gained traction over the past few years.

Field Programmable Gate Arrays and Application Specific Integrated Circuits are two examples of semiconductors that suit the needs of AI. (15) The size of the AI chip market is forecast to increase eight-fold from an estimated $10.14bn in 2020 to $83.25bn by 2027. (16)

$83.25 billion

AI chip market prediction by 2027

5G and IoT

Plans to roll out 5G technology are already noticeably impacting demand for semiconductors. The higher data rates and lower latencies made possible by 5G are expected to be drivers of demand for advanced semiconductors, and the concurrent growth of the IoT will likely reinforce that. (17)

The shortage of semiconductors could create headwinds for 5G in the short run, but the actions of chipmakers suggest they believe these headwinds will not last for too long, as evidenced by TSMC’s decision to ramp up capital expenditures to $100bn over the next three years. In a 2021 KPMG survey, 53% of semiconductor companies believe 5G will become a significant driver of revenue growth in one to two years, and 19% believe it could happen in less than a year. (18)

Other electronic devices

Automakers have borne the brunt thus far, but the effects of the shortage have also spilled over to other industries, albeit to a lesser degree. The shortage may reduce smartphone production by 5% in Q2 2021. (19) The shortage contributed to both Apple [AAPL] and Samsung delaying the launch of new phones.

5%

Potential reduction in smartphone product in Q2 2021 due to chip shortage

Meanwhile, manufacturers of other products like TVs, video game consoles and even appliances are beginning to feel anxious about possible risks. The wide-reaching impact of the shortage across subindustries is a testament to how ubiquitous semiconductors are.

Major tech companies with in-house chip design units are working hard to design chips that are specially tailored to their needs. Many of these needs come from the themes discussed above. Apple developed the M1 system of chips for tablets and MacBooks, Amazon [AMZN] developed the Graviton chip for servers, Google [GOOGL] developed the Tensor Processing Unit for neural network ML and Alibaba [9988] developed the XuanTie 910 for IoT technology. (20)

International effects

The interconnectedness of the semiconductor supply chain has invited scrutiny. Governments are mulling the pros and cons of reshoring semiconductor supply chains to prevent future disruptions. Reshoring the semiconductor industry is difficult and not all efforts to do so will succeed. In fact, 53% of semiconductor companies in a 2021 survey identified territorialism as the biggest industry issue. (21)

The geographical centres of power in the semiconductor industry shifted over the past 30 years. Japan once dominated as its companies took in 49% of integrated circuit sales in 1990. In 2017, that number dwindled down to 7%, with most of it going to Japan’s rapidly growing neighbours. (22) In 2020, Japanese officials invited TSMC to build a facility in Japan, which ultimately resulted in TSMC deciding to raise $9bn for a Japanese subsidiary in 2021. It is not clear how determined the Japanese government is to pursue reshoring.

Between 1990 and 2017, Japanese companies lost their relative share of semiconductor sales to competitors in rising Asian economies.

In China, there is an increasing sense of urgency over the independence of the domestic semiconductor industry. Policymakers have been trying to boost the semiconductor industry for a while now.

"Policymakers have been trying to boost the semiconductor industry for a while now.”

In 2015, the State Council put forth a goal of 70% self-sufficiency in semiconductors by 2025. Although China is still far off track from meeting that goal, it has not become complacent. If anything, pressure from US sanctions on companies like Huawei and SMIC [0981] has spurred policymakers to step up their efforts.

Commentators in China often debate how to avoid being “choked in the neck” in key areas like semiconductors. The 14th five-year plan, released in March 2021, strongly emphasises technological innovation, and also includes third-generation semiconductors on a list of technologies the government aims to support with scientific research programs.

Biden signed an executive order to launch a 100-day review of supply chains that includes an assessment of how America gets its semiconductors. On 12 April, the White House held a special CEO summit with companies that make semiconductors or are affected by the shortage. In a readout of the meeting, the White House stated that participants emphasised the importance of boosting semiconductor manufacturing in America.

Intel [INTC] has already made the decision to spend $20bn on new chip plants in Arizona and $3.5bn to upgrade an existing plant in New Mexico. Other companies could decide to follow suit.

$23.5 billion

Intel’s planned spend on chip plans

Meanwhile, European Union (EU) officials are already brewing up plans to restore some of the faded glory of the continent’s semiconductor manufacturing industry. Thierry Breton, the European Commissioner, sees the chip shortage as a sign that it is time to restructure supply chains. To achieve that goal, the EU Commission put forth a plan that aims to bring EU chip production up to 20% of world supply by 2030. (23)

A reshoring of the semiconductor industry could bring about a decline in the “fabless” model as companies vertically integrate from chip design to manufacturing. Intel’s recent decision to build new fabs on American soil shows that it is committed to growing its foundry business.

Pat Gelsinger, CEO of Intel, confirmed this when he stated that it is time to reverse the trend of decline in US chip manufacturing. If other firms like Nvidia or even major tech firms like Apple decide to follow suit and pursue vertical integration, it will take a lot of capital and talent to overcome Samsung and TSMC’s dominant position in manufacturing. Not all efforts to reshore the semiconductor industry will succeed, but the attempt alone will probably be enough to add pressure to the fabless, global model.

"Not all efforts to reshore the semiconductor industry will succeed, but the attempt alone will probably be enough to add pressure to the fabless, global model”

The real winners from the semiconductor shortage and subsequent supply chain shakeup will be those that pursue innovation.

There is plenty of room for that as Moore’s Law, which predicts that the number of transistors that can fit on a chip will double every two years, has generally stayed true. Companies that reach for “More Than Moore” innovation, namely finding new methods of chip optimisation that are more efficient than traditional architecture, will have a better chance at disrupting the status quo of the semiconductor industry.

Conclusion

The semiconductor shortage will have a palpable impact across multiple industries in 2021. Current trends in demand for semiconductors are indicative of the rapid pace of digitalisation and the rise of disruptive technologies.

As semiconductors become increasingly important to a digitalised economy, governments and businesses are reassessing their dependence on supply chains that run through foreign countries. Companies are questioning the fabless model and their lack of vertical integration, while policymakers are looking for ways to incentivise breakthroughs in semiconductor research, innovation, and production.

With the growing importance of innovation for economic growth, we expect to see greater investment in chip design and manufacturing alongside attempts to reshore strategic components of the chip industry to domestic markets.

This article was published by Global X. The original article, including footnotes where readers can find original source material, can be found here.

SEI Investments Distribution Co. (1 Freedom Valley Drive, Oaks, PA, 19456) is the distributor for the Global X Funds.

Check the background of SIDCO and Global X’s Registered Representatives on FINRA’s BrokerCheck

Investing involves risk, including the possible loss of principal. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Securities focusing on a single country and narrowly focused investments may be subject to higher volatility. The companies in which the Funds invest may be subject to rapid changes in technology, intense competition, rapid obsolescence of products and services, loss of intellectual property protections, evolving industry standards and frequent new product productions, and changes in business cycles and government regulation. The investable universe for thematic ETFs may be limited. The funds are non-diversified. There is no guarantee the trends discussed will continue.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Carefully consider the funds’ investment objectives, risks, and charges and expenses. This and other information can be found in the funds’ full or summary prospectuses, which may be obtained at globalxetfs.com. Please read the prospectus carefully before investing.

Global X Management Company LLC serves as an advisor to Global X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC. Global X Funds are not sponsored, endorsed, issued, sold or promoted by MSCI nor does MSCI make any representations regarding the advisability of investing in the Global X Funds. Neither SIDCO nor Global X is affiliated with MSCI.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy