In this article, Pedro Palandrani, research analyst at Global X, analyses the growth of the nascent telemedicine and digital health theme and explores its future potential.

Your living room is the new waiting room with remote access to healthcare recently making remarkable headway due to necessary adaptations amid the COVID-19 pandemic.

Telemedicine and digital health services, like video conferencing with doctors and internet of things (IoT) connected medical devices, became essential during the pandemic to avoid risky trips to hospitals and medical offices, resulting in accelerated adoption. In January 2020, only 0.24% of total medical claims in the US were telemedicine-related.1 One year later, they totalled 7%.2

Now, many providers envision an omni-channel future, where they offer a combination of in-person and virtual care options to patients, depending on needs and preferences. Helped by private and government payers restructuring coverage and reimbursement policies, we expect patients and providers to continue to embrace this new era of remote medicine.

Next-generation healthcare gains traction

Healthcare systems pivoted quickly to limit COVID-19’s spread last year. In many cases, telemedicine became standard patient care. Since March 2020, the Mayo Clinic has conducted more telehealth visits per day than all such visits combined in 2019.3

Total annual virtual visits for Teladoc [TDOC], a leading telemedicine provider, increased 156% year-over-year to 10.6 million in 2020.4 And NextGen Healthcare’s [NXGN] software enabled providers to deliver over 700,000 virtual visits in 2020, a nearly 200 times increase from 2019.5

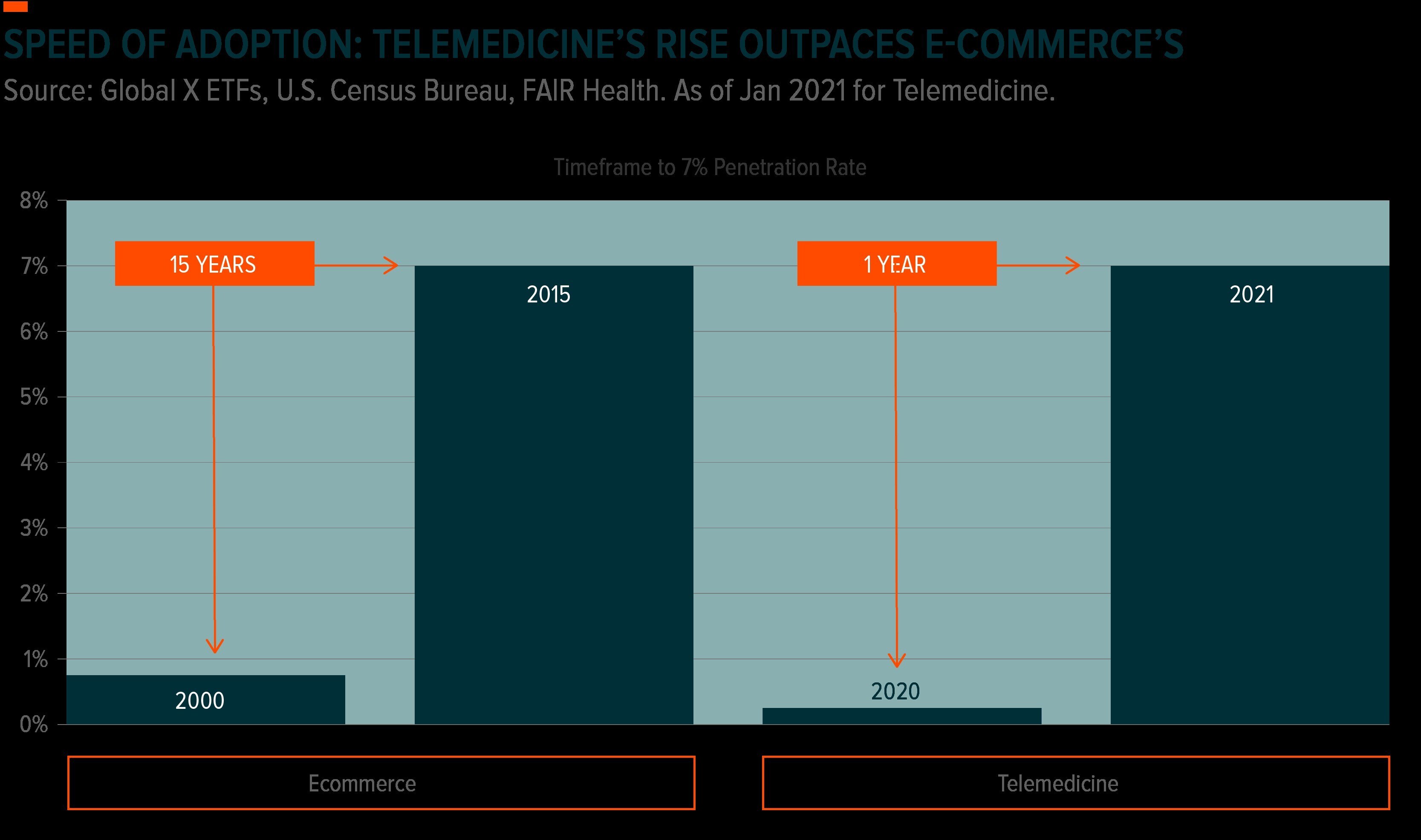

To put telemedicine’s ascent another way, it took 15 years for ecommerce penetration to rise from less than 1% to over 7%.6 The pandemic helped telemedicine do it in one.

While the pandemic helped accelerate telemedicine and digital health solutions, there are several reasons why continued growth is likely in a post-pandemic world, including the potential cost savings and conveniences.

Studies suggest virtual health can reduce visit times by about 20%, allowing providers to see more patients.7 And new rules stipulate that more telephone-only communications can be covered at rates similar to traditional face-to-face visits.

On the data side, implementing digital systems can help health providers instantly identify information critical to effective patient care, including patient histories through electronic health records (EHR), the number of physicians on duty, or the number of beds and medical equipment available.8

Just optimising EHRs can potentially save $3,000 per physician per month and reduce time spent retrieving data and completing documentation by 39%.9

For patients, telemedicine solves geographical challenges, too. They can get access to providers they need outside of their immediate area in just a few clicks. On average, telemedicine can save patients 37 minutes of transportation time and 64 minutes of waiting time at the physician’s office.10 So a 20-minute consultation can take exactly that — 20 minutes, not two hours.

New policies can help overcome adoption challenges

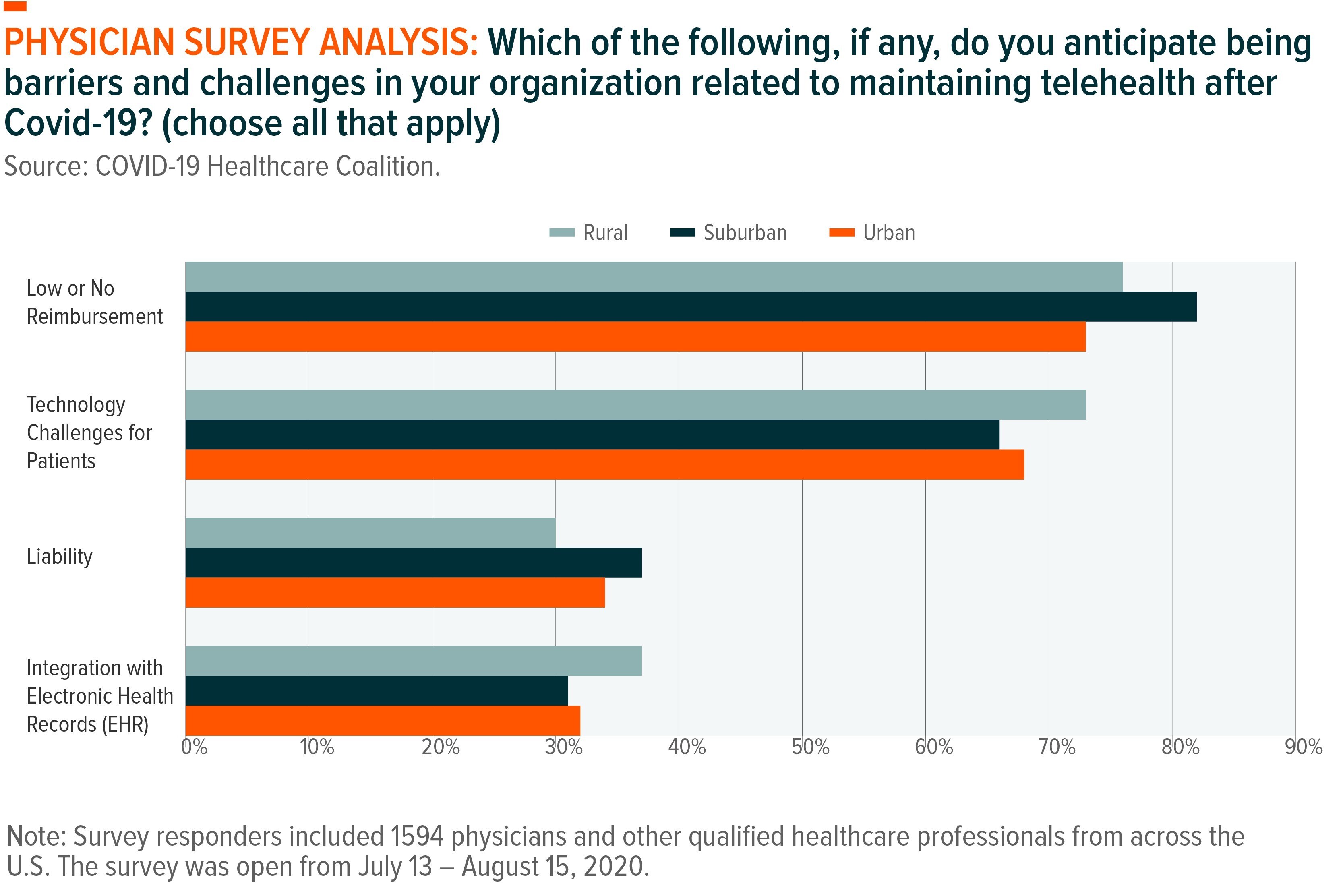

Surveys of physicians show low or no reimbursement as a major concern standing in the way of further telemedicine adoption. However, governments and private payers are taking steps to expand coverage and reimbursement for virtual health solutions.

In 2020, the Center for Medicare & Medicaid Services (CMS), added multiple telemedicine services to its covered services.11 These services include telemedicine-enabled therapeutic interventions that focus on cognitive function (e.g. attention, memory, reasoning, executive function, problem solving, and/or pragmatic functioning) and evaluation of auditory function for surgically implanted devices, among many others.

The added coverage helped telemedicine services for Medicare beneficiaries increase from 15,000 per week to 875,000, on average, between mid-March and mid-October 2020.12

Private payers, the primary source of health coverage for 68% of Americans in 2019, also expanded telemedicine access in response to the pandemic.13 For example, Cigna [CI] announced that for the first time their coverage includes routine virtual primary care visits, telephone-only evaluation and management visits, new patient exams, and behavioural assessments.14

Complicating the private payer side is that telemedicine regulation occurs at the state level, meaning coverage and reimbursement policies vary significantly. All states have mandates for private payer telemedicine visits, but as of January 2021 only seven states mandate that private payers must reimburse telemedicine services at the same rate as in-person visits.15

Of the remaining states, temporary telemedicine coverage during the pandemic has been extended into 2021 in some cases, but future, permanent extensions remain uncertain.

Telemedicine aligned with value-based healthcare model

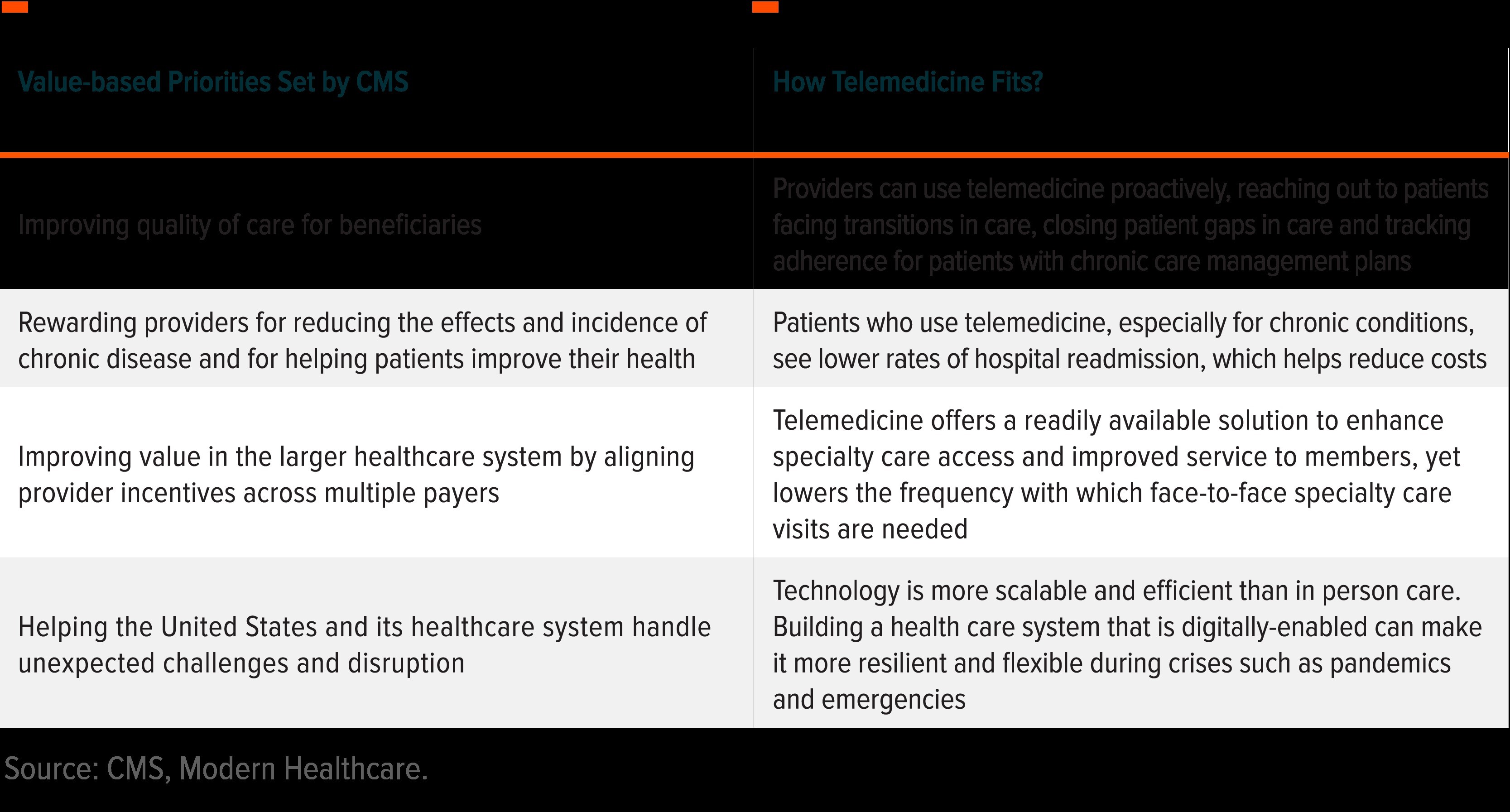

A potential solution is to transition healthcare reimbursement from the traditional fee-for-service system to a fee-for-value approach. CMS has issued guidance to advance the adoption of such a system, where providers are reimbursed based on their ability to improve the quality of their care in a cost-effective manner, rather than just volume.16

An added benefit of such a system is that it could help transform healthcare from a largely treatment-based system to a more preventative endeavour, helped by greater adoption of health-tracking technologies and digital therapeutics. Medicare rules often set the bar for private payers and state regulations, so it’s possible that a value-based care system can become more widespread in the US if CMS’s guidance is adopted.

Conclusion

Population-wide immunity to COVID-19 may be on the horizon, but other health challenges will inevitably arise in the future, whether it’s lingering effects from COVID-19, the emergence of a different infectious disease, or adapting a health care system to care for a rapidly aging population.

One of COVID-19’s many lessons is that society’s resilience to health crises requires supreme coordination and flexibility, which telemedicine and digital health services can help facilitate.

Prior to 2020, only about 24% of American healthcare organisations had virtual options.17 But with patients and providers experiencing the benefits over the past year, we expect that number to continue to increase over the next decade.

While a more value-based reimbursement system could be a major key to unlocking widespread adoption, reduced costs, more widespread reimbursement policies, and several conveniences offered by telemedicine should all help propel adoption as well.

This article was published by Global X. The original article, including footnotes where readers can find original source material, can be found here.

SEI Investments Distribution Co. (1 Freedom Valley Drive, Oaks, PA, 19456) is the distributor for the Global X Funds.

Check the background of SIDCO and Global X’s Registered Representatives on FINRA’s BrokerCheck

Investing involves risk, including the possible loss of principal. The Health Care and Information Technology sectors can be affected by government regulations, rapid product obsolescence, intense industry competition and loss or impairment of patents or intellectual property rights. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Carefully consider the fund’s investment objectives, risks, and charges and expenses. This and other information can be found in the fund’s full or summary prospectuses, which may be obtained at globalxetfs.com. Please read the prospectus carefully before investing.

Global X Management Company LLC serves as an advisor to Global X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC. Global X Funds are not sponsored, endorsed, issued, sold or promoted by Solactive nor does Solactive make any representations regarding the advisability of investing in the Global X Funds. Neither SIDCO nor Global X is affiliated with Solactive.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy