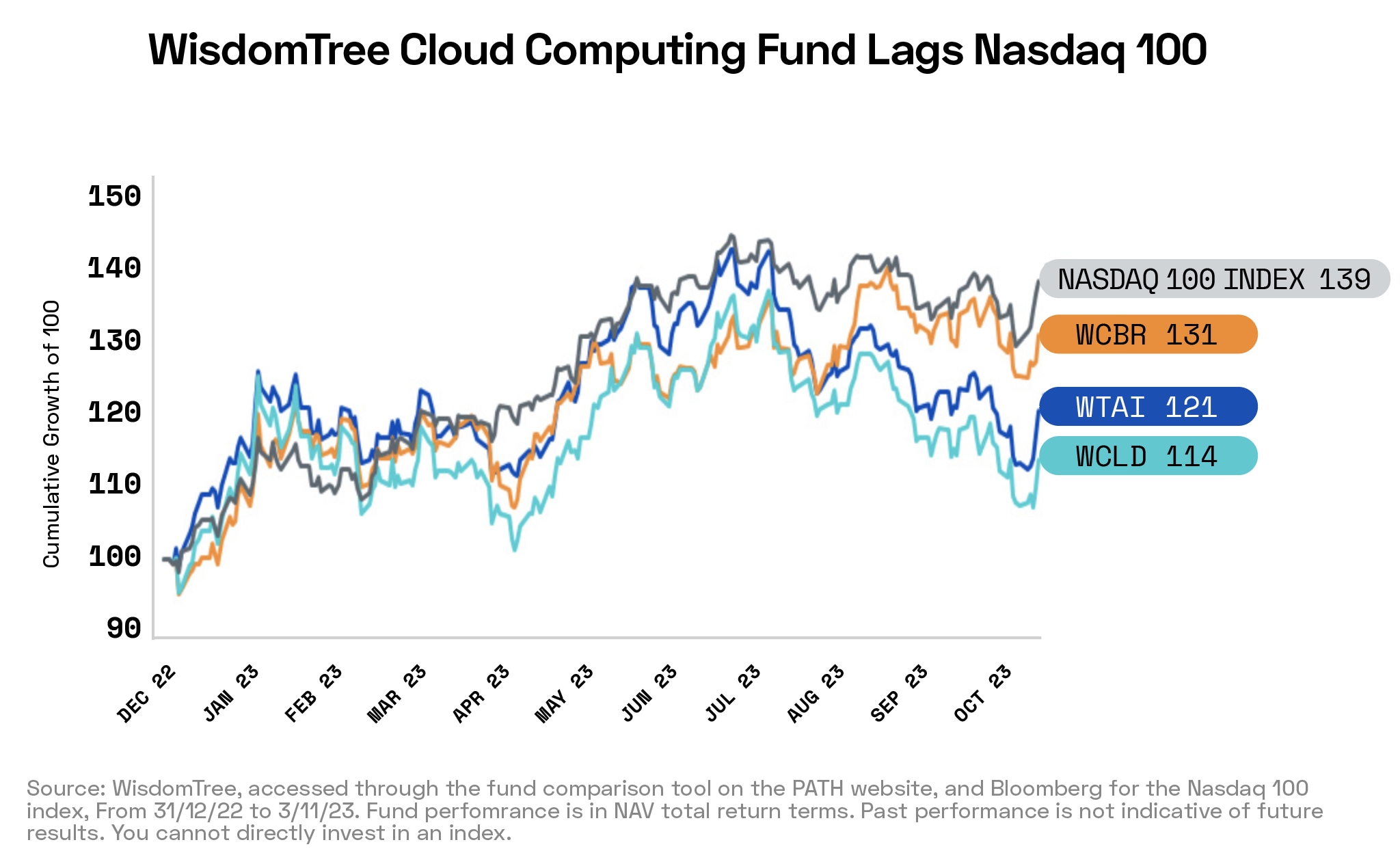

WisdomTree’s Cloud Computing Fund appears not to have capitalised on the AI rally this year, despite cloud models being fundamental to AI programs. However, two-thirds of the global cloud infrastructure market is accounted for by three Magnificent Seven companies: Google, Microsoft and Amazon. These companies are already shaping themselves for the next generation of cloud and AI computing.

- Despite cloud underpinning the AI rally, some cloud funds have lagged behind the sector.

However, market leaders like Amazon have gained 74% year-to-date.

Cloud providers are partnering with AI firms, and preparing for quantum computing.

“Cloud software companies have not participated in 2023’s AI rally,” wrote Christopher Gannatti, Global Head of Research at WisdomTree, in a 15 November report entitled ‘How Will You Use AI: Cloud Software’.

Despite the fact that most AI applications run on cloud platforms, WisdomTree’s Cloud Computing Fund [WCLD] — which tracks an index of emerging public companies focused on delivering cloud-based software to customers — has lagged behind the Nasdaq 100 over the past year.

This could suggest a future bounce in the fund, assuming that the underlying thesis — that cloud is fundamental to AI applications — is correct, and that the market is yet to price this in. However, there are other possible reasons for cloud stocks’ underperformance.

One is that emerging cloud stocks are expensive by traditional valuation metrics (such as dividends and earnings), and are likely to remain so, because of their large expected growth trajectories. Another is that cloud stocks appear to be highly rate-sensitive. On one level, this reflects the fact that cloud stocks tend to be growth stocks; high interest rates are a headwind because they discount the future returns of these stocks.

However, cloud companies seem to be especially sensitive: the WCLD fund’s price-to-sales ratio recently fell below that of the Russell 1000 Growth Index.

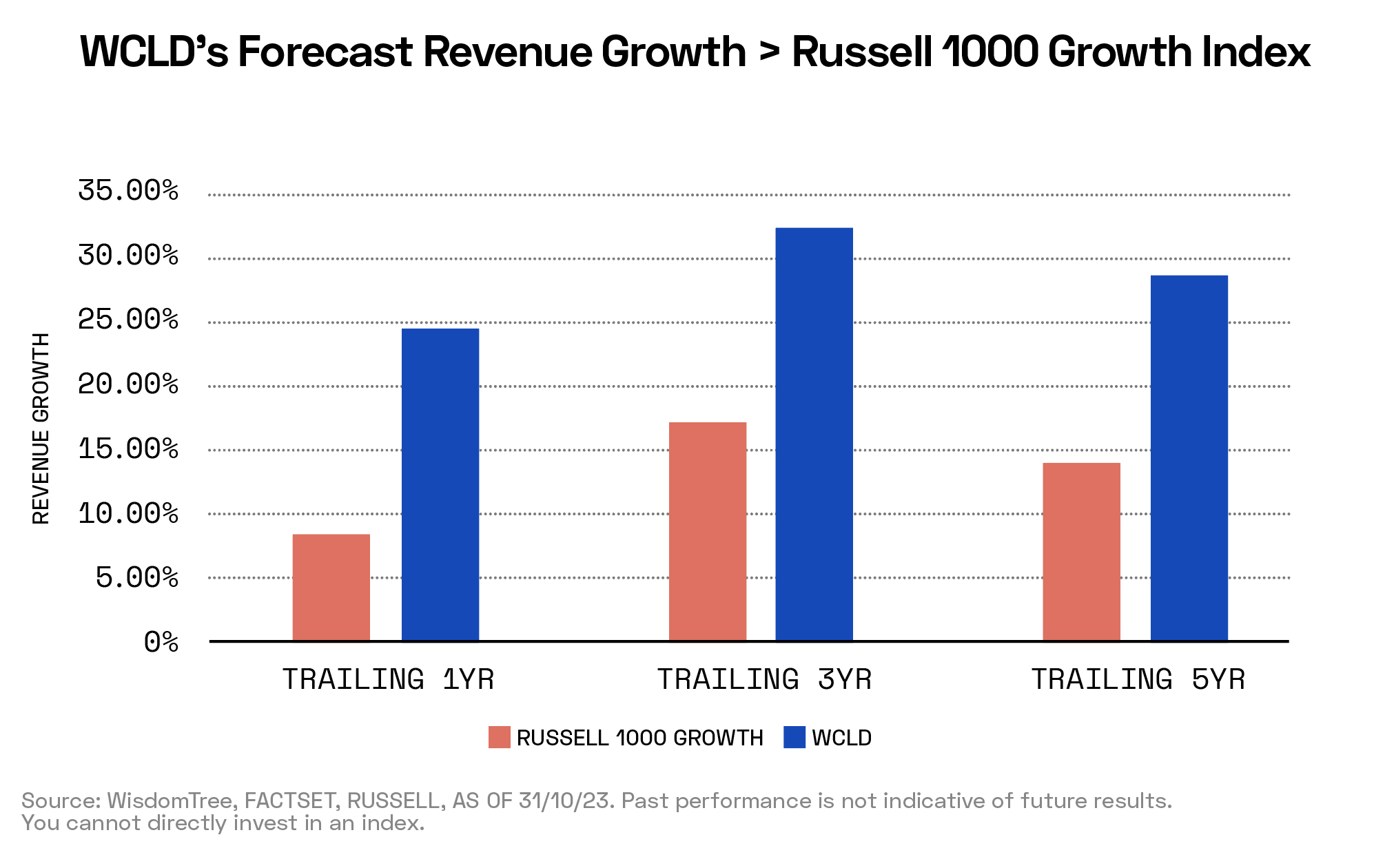

Gannatti’s hypothesis, however, relies on the notion that cloud-based computing underpins AI applications. While this may be true, there is a disconnect between the cloud-hosted products from which WCLD’s holdings derive the bulk of their revenue, and the cloud providers that actually host other applications, such as AI. Those companies have already seen large gains, and more could be on the way.

Gartner Forecasts GenAI Gains

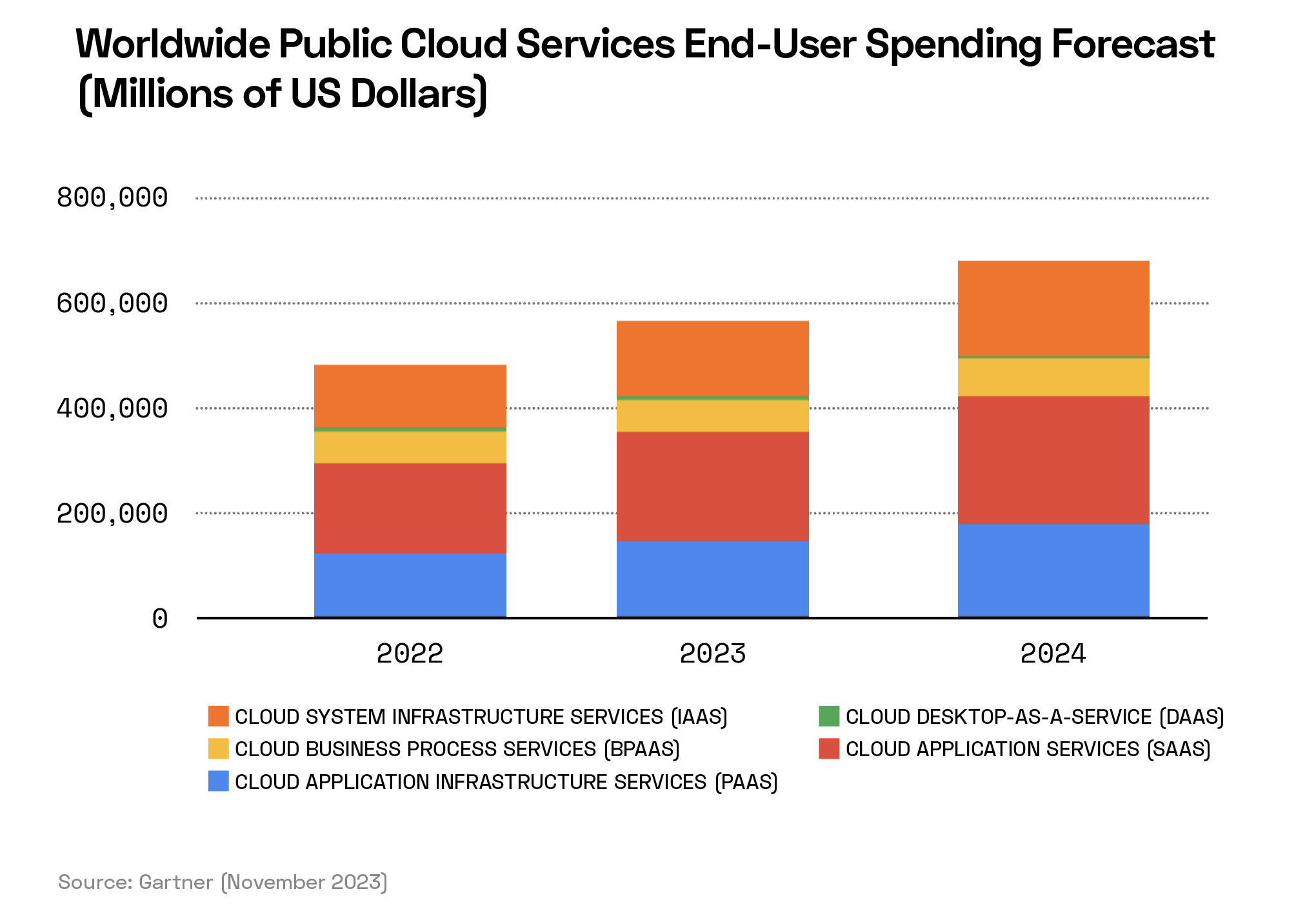

Research consultancy Gartner is of the opinion that generative AI is among the technologies that could push public cloud spend to $678.8bn in 2024. This marks a 20.4% year-over-year increase from the $563.6bn forecast for 2023.

The highest-growth segment of the cloud market is forecast to be infrastructure-as-a-service (IaaS), which is expected to grow 26.6%, followed by application platform-as-a-service (PaaS) which is expected to grow by 21.5%.

Synergy Research Group puts global cloud infrastructure spending at $68bn in Q3, up approximately 18% year-over-year. The market research firm contends that the increased demand for cloud infrastructure services brought about by AI is helping to overcome other headwinds the sector is facing, such as challenging economic and political situations.

According to Synergy, Microsoft [MSFT] increased its share of the global cloud-infrastructure market by nearly two percentage points to 11% in the third quarter (Q3), while “market leader Amazon [AMZN] stayed within its long-standing market share band of 32–34%, though towards the bottom end of that range”.

Between them, Amazon, Microsoft and Google [GOOGL] accounted for 66% of the global market in Q3. The tier-two providers that had the highest year-on-year growth rates were Oracle [ORCL], Snowflake [SNOW], MongoDB [MDB], VMware [VMW], Huawei and China Telecom [0728:HK].

Cloud Collaboration

Generative AI poses significant challenges for cloud providers. The largest among them — Microsoft, Alphabet’s Google, and Amazon — are ramping up their capital spend to ensure that they can offer sufficient capacity, the Financial Times reported in early November. Between them, the companies’ capital spend totalled $32bn in the three months to September, nearly 50% more than the same period in 2020 and 10% more than in the quarter to June.

This extra capacity is enabling the major cloud providers to form groundbreaking partnerships that centre on the potential of generative AI.

In October, Google Cloud announced a partnership with Moody’s [MCO] to develop AI systems for financial experts. While the partnership does not explicitly cite the use of cloud-based systems, its three key goals are likely to benefit from Google’s role in the segment: to create specialised large language models for financial analysis, to provide access to Moody’s data via Google’s data warehouse BigQuery, and to enable search of Moody’s financial data using Google’s Vertex AI.

Elsewhere, data security and management provider Cohesity announced a partnership with AWS for its Turing generative AI features on 13 November. This will aim to improve data management, security and analysis; enrich data interaction and learning; and enable dynamic training of Turing via retrieval augmented generation.

Quantum is Coming

While AI is adding to the demands on cloud providers, quantum computing — which requires large amounts of cloud power — has the potential to multiply those pressures in the not-so-distant future. This, in turn, may generate a growth area.

Poised to take advantage of AI- and quantum-related demand, a consortium of French academic and industrial researchers dubbed the CLUSSTER project is developing a cloud service tailored towards AI, high-performance computing (HPC) and quantum computing.

The system will be available for HPC and AI from 2024, and will later be expanded to incorporate quantum computing.

Microsoft has already made its own move into the space, with the launch of its Integrated Hybrid feature for Azure Quantum. “Hybrid quantum applications with a mix of classical and quantum code together will empower today’s quantum innovators to create a new class of algorithms,” said Microsoft’s press release.

How to Invest in Cloud and AI

The three predominant cloud service providers — Amazon, Microsoft and Google — are all among the so-called “Magnificent Seven” stocks that have seen outsized gains in the past year thanks to the AI boom.

These three companies can be directly linked to the AI programs underlying this trend; Anthropic hosts mainly on Amazon’s AWS, OpenAI hosts its applications such as ChatGPT on Microsoft’s Azure, while Midjourney is hosted on Google cloud.

The stocks have gained 74%, 58.8% and 54.4% respectively in the year to 21 November. In the same period, WCLD gained 22.4%. WCLD’s top three holdings as of

21 November are Crowdstrike [CRWD], ZScaler [ZS] and Shopify [SHOP]. Their share prices gained 98.48%, 71.01%, and 100.89% in the same time period.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy