In this article, Andrew Little, a research analyst at Global X, breaks down how the US infrastructure plan will stimulate certain themes and highlights the main beneficiaries.

The long-awaited $2trn US infrastructure plan has arrived. On 31 March 2021, the Biden Administration announced the American Jobs Plan and the complementary Made in America Tax Plan. They outlined which areas could receive investment, the amount of investment required, and different ways it could get funded.

At a high level, it includes investment in:

Physical infrastructure:

- Transportation Infrastructure ($621bn)

- Buildings, schools, and hospitals ($250bn+)

- Infrastructure resilience ($50bn)

Energy, water, and digital infrastructure:

- Cleantech, clean energy, and related in infrastructure ($300bn+)

- Water utilities ($111bn)

- Digital infrastructure ($100bn)

Much of the plan is in line with the expectations set in advance of the 2020 presidential election, though there are some differences (see: How a Biden presidency and COVID-19 could impact infrastructure development).

In addition to the above, it includes investment in care for older and disabled individuals ($400bn), manufacturing and small businesses ($300bn), innovation and research ($180bn), and workforce development ($100bn).

In the next section, we will take a look at each infrastructure-related investment area. Following that, we will explore how the plan could get funded and what legislation could actually pass through congress.

Investing in physical infrastructure

Transportation: The American Jobs Plan addresses transportation infrastructure through investment in roads and bridges; public transit; electric vehicles (EV); passenger and freight rail services; and ports, waterways, and airports.

In particular, the plan would:

- Build and repair 20,000 miles of highway, roads, and streets, as well as fix 10,000 bridges in disrepair ($115bn)

- Establish and grow the US EV market by incentivising EV purchases, building a network of charging stations, reshoring supply chains for EVs and batteries, replacing or electrifying transit vehicles, school buses and the federal fleet ($174bn)

- Address repair backlogs for buses, rail cars, stations, and thousands of miles of tracks and other related infrastructure, as well as expand public transit’s reach to meet demand ($85bn)

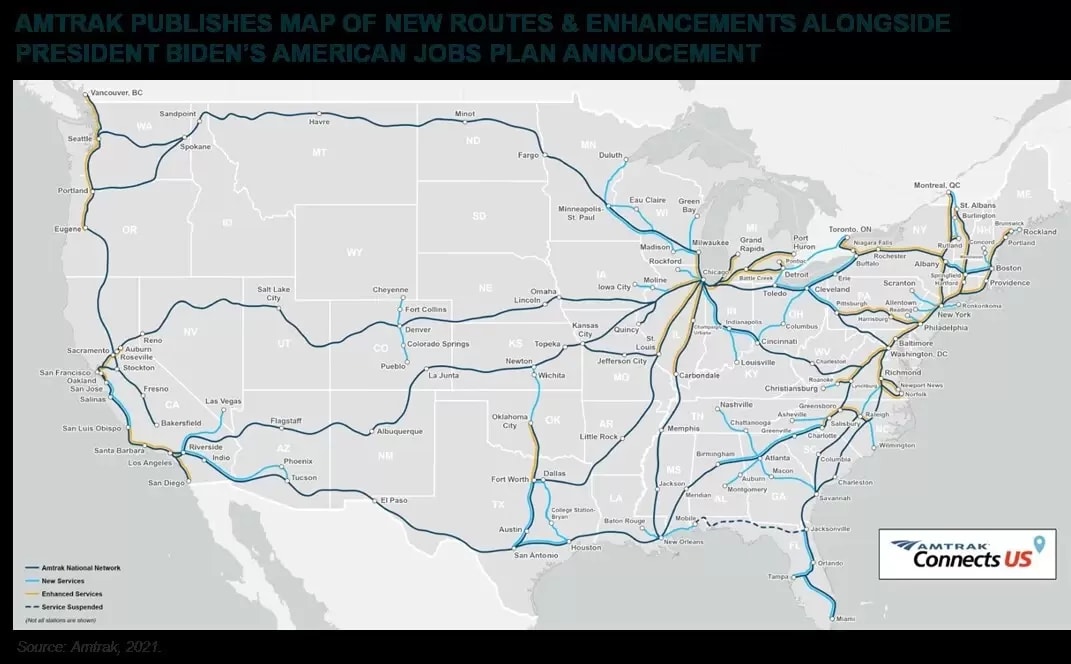

- Bolster passenger and freight rail services by addressing Amtrak project backlogs, connecting new destinations, and enhancing services in high traffic areas ($80bn)

- Upgrade commerce-facilitating infrastructure by improving ports and waterways, and modernising airports ($42bn)

- Expand general transportation infrastructure in areas without affordable transportation options and where past investment created economic boundaries ($20bn)

Buildings, schools and hospitals: Other efforts to revitalise physical infrastructure encompass investment in commercial buildings, homes, schools, and hospitals.

In particular, the plan would:

- Build, retrofit, and/or rehabilitate over two million energy efficient and electrified housing units, low and middle-income homes, and commercial buildings ($213bn)

- Improve education infrastructure by modernising public schools, community colleges, and childcare centres with climate friendly and innovative facilities ($130bn+)

- Upgrade Veterans Affairs hospitals and federal buildings by building state of the art, climate-friendly facilities (~$30bn)

Infrastructure resilience: Biden’s plan highlights the importance of ensuring that existing and new infrastructure is resilient to climate risk, natural deterioration, and obsolescence.

Investment areas in this vein include protection from wildfires, coastal resilience, and research and development in durable advanced materials. While the entire plan inherently seeks to build resilient and climate-aware infrastructure, it also carves out $50bn for these efforts.

Our take

Inadequate transportation infrastructure results in significant economic losses that can be avoided with investment. Every year, traffic congestion costs our economy over $160bn, motorists spend over $1,000 on lost fuel, and traffic accidents result in over 35,000 deaths (four times that of Europe per capita).

By investing in physical infrastructure like roads, bridges, ports, and airports, the US can limit economic loss by mitigating inefficiencies. Further, enhancements to public transit like offering new options, upgrading existing ones, and increasing their range can improve overall productivity by facilitating commerce and improving economic participation.

Similar benefits could come from investing in commercial buildings, homes, and hospitals. Widespread affordable housing could expand employment opportunities, while keeping consumption dollars (disposable income) in the hands of workers. The modernised nature of the structures the plan seeks to build could provide further economic benefit by improving the health of those who occupy them.

While building this infrastructure will create jobs, investment in schools can go a step further. Improving educational outcomes can ensure that more individuals are equipped with the skills needed for next-generation employment. And by offering childcare and public schooling, the US can improve labour force participation rates for caregivers, bringing back those who may have been excluded or forced to leave in the past.

Key beneficiaries

New and retrofitted physical infrastructure will be comprised of materials like asphalt, construction aggregates, concrete, steel, and copper. Construction products and equipment will be essential in building physical infrastructure, while construction and engineering service companies will likely be those putting said materials and equipment to use.

Industrial transportation companies are also a key player, bringing all the above to the areas where infrastructure is needed most. And finally, across all these segments, the plan favours companies based in America, that generate revenues in America, and already pay taxes in America.

Energy, water and digital infrastructure

Cleantech and clean energy: Investment in clean energy and cleantech is inextricable from the development of next-generation infrastructure. This is especially true given Biden’s intention to catch up with the rest of the world by achieving 100% carbon free electricity by 2035 and putting the country on a path to reach net-zero emissions by 2050.

Many of these investments are included in physical infrastructure investments. Expanding electrification and energy efficiency in buildings, homes, schools, and hospitals and growing the market for EVs means investment in the cleantech value-chain.

Other areas, however, can be considered separately, including the intention to:

- Modernise the power sector by embracing smart grid technologies, building out at least 20 gigawatts of high-voltage capacity power lines, and creating incentives for clean energy generation and storage. This includes exclusively purchasing clean energy for federal buildings and creating energy sector jobs focused on plugging orphan oil and gas wells ($100bn)

- Make the US a leader in climate science and innovation by investing in research and development for clean energy, utility scale storage, hydrogen, carbon capture use and storage, among other technologies ($35bn)

- Catalyse cleantech manufacturing by procuring EVs, charging ports, and electric heat pumps with federal funds ($46bn)

Water utilities: The plan includes a significant overhaul of the US water utility infrastructure to improve the safety of drinking water.

Investment in water utilities seeks to:

- Replace 100% of all lead pipes and service lines that deliver drinking water ($45bn)

- Revamp and upgrade treatment plants and systems for drinking water, wastewater and stormwater ($56bn)

Digital infrastructure: The plan also seeks to expand internet infrastructure, covering 100% of the country with high-speed and future-proof broadband ($100bn)

Our take

US investment in cleantech and clean energy could provide immense economic benefit. Cleantech includes the infrastructure and technology that enables clean power implementation and adoption.

Without modern grids, utility-scale storage, and the technology that goes into clean energy sources, the ability to scale next generation power would be extremely limited. Power infrastructure in the US already desperately needs to be revitalised — the economy loses up to annually $70bn from power outages.

Investment in cleantech would support the shift to clean energy, while dampening economic losses from current inadequacies. Such a transition could also create job opportunities in installation, maintenance, and manufacturing, as well as long-term opportunities in clean energy research and development. The plan has tens of billions of dollars dedicated to creating job opportunities for those working in the energy sector and for underserved individuals.

Looking more broadly, a shift to clean energy and clean technologies would reduce levels of the atmospheric carbon-dioxide that causes 75% of global warming. Impacts of this warming include increased billion-dollar natural disaster frequency, submerged coastlines, and lethal heat waves — all things which could result in direct or indirect negative economic impacts. If warming continues on its current path, some scenarios estimate annual GDP per capita losses reaching as much as 14% in the next 80 years.

Investing in digital infrastructure will bring high-speed internet to the 30 million Americans who live in areas with no broadband infrastructure. The internet is essential to modern life and next-gen work and education. Such an investment would level the playing field for those living in underserved areas.

In the long-term, this should increase the US’s overall intellectual capital and give more people a chance to work in next-gen jobs. The plan also seeks to reduce internet costs by removing legislative barriers to competition. This should put more consumption dollars in American’s pockets.

The US is falling behind China and others when it comes to investing in these areas. Aggressively funding digital infrastructure and clean technologies could help the US become a leader in next-gen industry and innovation. Wright’s Law describes the idea that the cost of each unit manufactured decreases as a function of cumulative units produced.

So, for technologies like EVs, where the US lags the rest of the world in adoption, investment in related domestic manufacturing could dramatically increase sales by making them more affordable.

Key beneficiaries

Companies involved in the clean energy and cleantech value-chains would be well positioned to benefit from the plan. These include renewable energy producers and component manufacturers, as well as those with business activities related to electric grids, energy storage, electrification, and energy efficiency. Other efforts to reduce emissions should benefit companies involved in carbon capture, use, and storage, and renewable hydrogen.

Additionally, companies that manufacture or produce telecommunications equipment and semiconductors related to connectivity and electrical transmission could benefit from digital infrastructure spending. Construction and engineering companies could also benefit from this aspect of the plan.

Additional Investments

Innovation and research: The Jobs Plan underscores the importance of the US re-establishing itself as a hub of innovation. It seeks to use public funds to make the US a leader in artificial intelligence, biotech, advanced computing, clean energy and more ($180bn).

Manufacturing: Biden is seeking to bring the US back to the forefront of manufacturing and secure supply chains through investment in monitoring domestic industrial capacity and semiconductor manufacturing ($100bn). Other related efforts include those mentioned for clean energy, health care and pharmaceuticals, and assorted research and development ($300bn total).

Workforce Development: The plan includes initiatives to provide dislocated workers and underserved communities with next-gen training that would equip them with the skills needed to work in clean energy, manufacturing, and caregiving ($100bn).

Long-Term Care: Biden calls for Congress to invest in expanding access to long-term care for older and disabled individuals ($400bn).

Our take

These investments would help the US maintain its economic competitiveness through the rest of the century. Bolstered manufacturing and re-shored supply chains would increase domestic output and productivity, while research and development funding would help the country keep pace with global technological advancement. These areas would also provide jobs in the short-term, while creating new opportunities in high-skill industries.

Getting it built

The American Jobs Plan seeks to invest over $2trn in the next decade, with 1% of GDP per year invested in infrastructure over the next eight years. The Made in America Tax Plan is the complementary funding component of this effort.

The Tax Plan seeks to:

- Set the corporate tax rate at 28%;

- Increase the minimum tax on US companies to 21% to avoid multinational US companies receiving an exemption on foreign asset returns;

- Limit the ability of corporations to use foreign tax havens;

- Eliminate the ability to deduct offshore expenses;

- Establish a 15% minimum tax on corporations’ book income.

The American Jobs Plan also seeks to activate the private sector and garner private investment for funding and participation in construction and development. It also includes innovative approaches to reducing costs and removing constraints, including changes to zoning laws, thoughtful removal of red tape, and by favouring companies based in the US and generate revenues in the country.

While the cost is steep, the economic benefits explained in the previous sections could outweigh the tax increases stipulated by the Made in America Tax Plan. Overall, S&P estimates that such a plan could create 2.3 million jobs by 2024 and inject $5.7trn into the economy, raising per-capita income by $2,400 (note this is analysis was done prior to the announcement, but is rooted in the same idea).

US GDP has levelled out at around 2% for the past 20 years, well below the 4% long-term average. Looking to history as an example, the US Interstate Highway System cost $500bn to build. In the years since, the system has returned more than $6 in economic productivity for every $1 it cost. While the American Jobs Plan is expensive, it could prove worthwhile in the short- and long-term.

Getting it passed

Speaker Nancy Pelosi set the ambitious goal of passing the bill through the house by 4 July. Unlike the American Rescue Plan (aka the COVID-19 Stimulus Package), which was an outgrowth of last year’s policy discussions, the infrastructure bill needs to be drafted into law. Passing the bill in July means the Senate isn’t likely to take it up until later in the summer, factoring in recess. This means possible Senate passage likely falls after Labor Day.

We think it is reasonable to expect that more gets added to the core infrastructure component of the plan, rather than it being trimmed down. The more legislative priorities it addresses, the harder it will be for moderate or progressive Democrats to vote no. The bill could be passed through reconciliation or majority, and while moderate Democrats have indicated that they would rather avoid reconciliation, senate majority leader Chuck Schumer has indicated there is room for a second reconciliation bill in 2021.

This article was originally written and published by Global X. The original article, which includes footnotes where readers can find the original source material, can be found here.

SEI Investments Distribution Co. (1 Freedom Valley Drive, Oaks, PA, 19456) is the distributor for the Global X Funds.

Check the background of SIDCO and Global X’s Registered Representatives on FINRA’s BrokerCheck Investing involves risk, including the possible loss of principal. Data Center REITs and Digital Infrastructure Companies are subject to risks associated with the real estate market, changes in demand for wireless infrastructure and connectivity, rapid product obsolescence, government regulations, and external risks including natural disasters and cyberattacks.

CleanTech Companies typically face intense competition, short product lifecycles and potentially rapid product obsolescence. These companies may be significantly affected by fluctuations in energy prices and in the supply and demand of renewable energy, tax incentives, subsidies and other governmental regulations and policies. Investments in infrastructure-related companies have greater exposure to the potential adverse economic, regulatory, political and other changes affecting such entities.

Investment in infrastructure-related companies are subject to various risks including governmental regulations, high interest costs associated with capital construction programs, costs associated with compliance and changes in environmental regulation, economic slowdown and excess capacity, competition from other providers of services and other factors. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from the differences in generally accepted accounting principles or from social, economic or political instability in other nations.

The investable universe of companies in which DRIV may invest may be limited. The companies in which the Fund invests may be subject to rapid changes in technology, intense competition, rapid obsolescence of products and services, loss of intellectual property protections, evolving industry standards and frequent new product productions, and changes in business cycles and government regulation. There are additional risks associated with investing in mining industries.

The investable universe of companies in which SNSR may invest may be limited. The Fund invests in securities of companies engaged in Information Technology which can be affected by rapid product obsolescence, and intense industry competition. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations.

Investing involves risk, including the possible loss of principal. Investments in smaller companies typically exhibit higher volatility. The value of securities issued by companies in the energy sector may decline for many reasons, including, without limitation, changes in energy prices; international politics; energy conservation; the success of exploration projects; natural disasters or other catastrophes; changes in exchange rates, interest rates, or economic conditions; changes in demand for energy products and services; and tax and other government regulatory policies.

Investments in yieldcos involve risks that differ from investments in traditional operating companies, including risks related to the relationship between the yieldco and the company responsible for the formation of the yieldco. Yieldco securities can be affected by expectations of interest rates, investor sentiment towards yieldcos or the energy sector.

Yieldcos may distribute all or substantially all of the cash available for distribution, which may limit new acquisitions and future growth. Yieldcos may finance its growth strategy with debt, which may increase the yieldco’s leverage and the risks associated with the yieldco. The ability of a yieldco to maintain or grow its dividend distributions may depend on the entity’s ability to minimize its tax liabilities through the use of accelerated depreciation schedules, tax loss carryforwards, and tax incentives.

International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume.

This information contains a manager’s opinion, is not intended to be individual or personalized investment or tax advice, and should not be used for trading purposes.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Carefully consider the funds’ investment objectives, risks, and charges and expenses. This and other information can be found in the funds’ full or summary prospectuses, which may be obtained at globalxetfs.com. Please read the prospectus carefully before investing.

Global X Management Company LLC serves as an advisor to Global X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy