Over the course of its history, certain visionaries have developed entirely new ways to play the stock market, garnering outsized returns and inspiring generations of both institutional and retail investors. Understanding the methods of such visionaries can help investors optimise their own approaches.

Michael Burry is a contrarian value investor famous for predicting, and profiting from, the 2008 sub-prime mortgage crisis.

Despite having taken bearish positions on various technology stocks throughout his career, Burry currently appears to be adopting a bullish stance towards artificial intelligence (AI).

The Dot-Com Doctor

Burry holds a bachelor’s degree in economics from the University of California, Los Angeles, as well as a doctorate of medicine from Vanderbilt University School of Medicine.

He reached the third year of a neurology residency at Stanford University before leaving to concentrate full time on investing. Despite this, he keeps his medical qualifications and education current.

Burry’s true passion has always been the stock market. While he was still a child, his father warned him against ever investing in it. Naturally, Burry devoured books on the topic.

Especially during the mania of the 1990s dot-com bubble, the principles of value investing — particularly those espoused by Benjamin Graham and his student, Warren Buffett — resonated with him as an approach to investing. Burry began communicating online about his trades during the late ‘90s while still in medical school, and his results soon attracted the attention of professional investors.

Using his own funds along with help from his family — including a payout following his father’s fatal cancer misdiagnosis — Burry opened Scion Capital in 2000, shortly after the peak of the dot-com bubble.

Scion immediately began shorting tech stocks, which were trading at valuations he correctly identified as unsustainable. In 2001, his first full year in business, the S&P 500 fell 11.9%, but Scion made gains of 55%. The following year, the S&P 500 fell 22.1% and Scion gained 16%.

On the Contrary

Burry is a value investor. Value investors, by definition, tend to be contrarians — the underlying philosophy of value investing, after all, involves identifying stocks or sectors that the market is currently overlooking or over-rewarding.

But he is especially contrarian. Indeed, Forbes contributor Anna-Louise Jackson called him “a face for contrarian investing”. Burry’s investment strategy explicitly seeks to counter the herd mentality that markets often reflect, and identify assets that are either over- or under-priced.

He even went so far as to coin a term for his philosophy: ‘ick investing’.

In a letter to shareholders, Burry explained that “ick investing means taking a special analytical interest in stocks that inspire a first reaction of ‘ick’”.

Burry’s strategy has typically taken the form of bets against the technology sector. Burry has shorted Tesla [TSLA] and the ARK Innovation ETF [ARKK] in recent years, although technology currently has the largest sectoral weighting in his $98.9m portfolio, at 25.4% as of 13 March. Consumer discretionary and healthcare come next, with respective weightings of 24.1% and 18.7%.

Macro Ops analysed Burry’s online investment writings, and discerned five recurring qualities in stocks that his investment strategy favours:

- Small or micro-cap stocks that lack liquidity, since these trade at a discount to their cash flows, relative to larger, more liquid stocks.

- Downside protection (such as cheap valuations relative to free cash flow), since this protects against losses.

- Companies with low share counts, which reflects management protection of shareholder value.

- Stocks that have cheap valuations in absolute terms, rather than in comparison to industry or country peers.

- A variety of markets; given the above four points, Burry searches everywhere to find value, rather than restricting himself to particular markets.

The Big Short

The success for which Burry is now best known was to identify the looming financial crisis of 2008 before it happened. Burry realised that the mortgage market might be unsound when he noticed that basement-bottom lending standards had become commonplace.

“What you want to watch are the lenders, not the borrowers. The borrowers will always be willing to take a great deal for themselves. It’s up to the lenders to show restraint,

and when they lose it, watch out.” — Michael Burry in The Big Short, Michael Lewis (2010).

Burry persuaded Deutsche Bank and Goldman Sachs to sell him credit-default swaps on subprime-mortgage bonds. In 2007, Burry made $100m personally and a further $700m for his clients. The episode tested the strength of his convictions, though, with Burry having to quell an investor revolt along the way.

Burry’s exploits leading up to the 2008 financial crisis have been immortalised in the film The Big Short (based on Michael Lewis’ book of the same title). Onlookers often refer to Burry as ‘the Big Short investor’, and continue to observe his short trades as an expression of his contrarian view of the markets.

It’s worth noting that his short trades haven’t always been successful. Burry incorrectly predicted a recession in 2023, posting the word “sell” on X in January, before admitting in March that he was “wrong” to do so.

Burry held a bearish position with regard to artificial intelligence (AI) during 2023, expressed via put options on the iShares Semiconductor ETF [SOXX], Bloomberg reported. Burry’s latest 13F filing reveals that he closed this position during Q4, with the ETF having gained 22% during the quarter.

Burry Bets on AI

Since then, Burry appears to have turned bullish on technology and AI stocks.

Oracle [ORCL] — whose Q3 (of FY 2024) earnings release on 11 March beat analyst expectations and underlined the company’s role in the AI boom — is Burry’s third-largest holding, comprising 5.8% of his portfolio, according to Stockcircle.

Burry’s fourth-largest holding, Alibaba [BABA], similarly reflects his bullish stance on AI, given the Chinese e-commerce giant’s efforts to compete with Amazon [AMZN] and Microsoft [MSFT] in the space.

JD.com [JD] is another of his top ten holdings, and Burry added to his positions in both Alibaba and JD.com during Q4 2023, at a time when many investors have been withdrawing funds from Chinese stocks due to fears over the company’s slowing growth and possible property crisis.

Bets like these reflect Burry’s value-driven, contrarian approach to investing.

Burry closed Scion Capital in 2008 so that he could focus on his own investments. Then in 2013, he incorporated his private investment firm as Scion Asset Management.

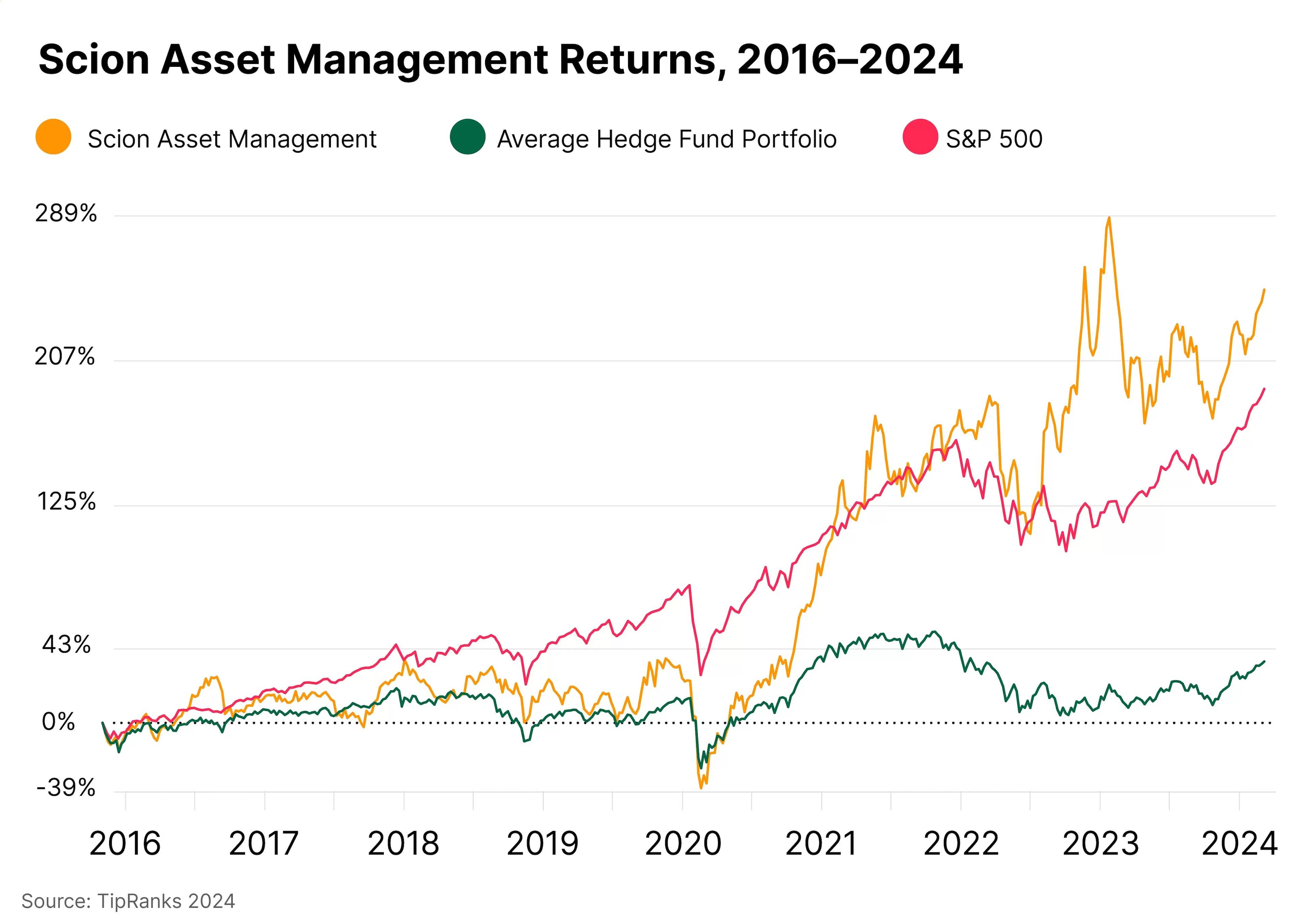

According to TipRanks, Scion Asset Management has returned 247.2% since its inception, with an average annualised return of 30.2% over the past three years.

Scion’s three top holdings as of its Q4 filing are healthcare facilities operator HCA Healthcare [HCA], Citigroup [C] and Oracle.

HCA has gained 32.2% over the past 12 months and 19.5% year-to-date as of 13 March. Citigroup has gained 34.3% over the past 12 months and 12.8% year-to-date, while Oracle has gained 52.5% in the past 12 months and 21.4% year-to-date.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy