In this article, Frank Holmes, CEO of U.S. Global Investors, explains why he’s bullish on Nano One Materials.

One of our favourite stocks at the moment is Nano One Materials [NNO], a small-cap tech firm that specialises in developing high-performance cathode materials used in next-generation lithium-ion batteries for the still-emerging electric vehicle (EV) market.

Right now, most standard EV batteries contain polycrystalline cathode particles, which can fracture and break apart from the stress of repeated charging, reducing range and longevity. Nano One’s patented technology uses individually coated nanocrystal cathodes that resist fracturing, thereby boosting batteries’ durability and performance.

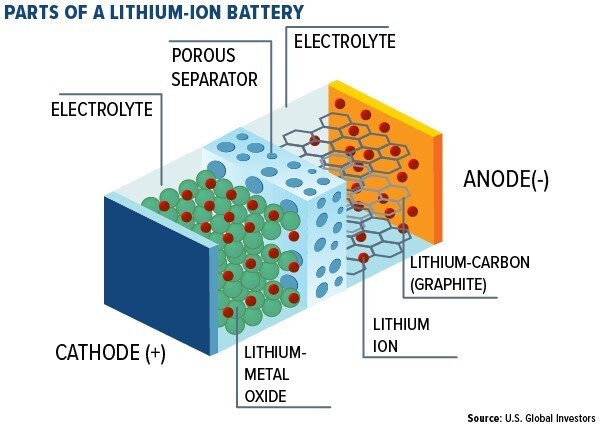

A cathode, by the way, is the positive electrode, often made from lithium cobalt oxide (LiCoO2), that “accepts” electrons during cell discharge. This is opposed to the anode, which is the negative electrode, made from graphite, that “donates” electrons.

We like Nano’s leadership team, which has over 150 combined years of experience in advanced technology, battery metals (particularly lithium) and equity market finance. The British Columbia-based company employs six PhDs and currently has 16 patents, with 30 more pending, helping to protect its various breakthroughs.

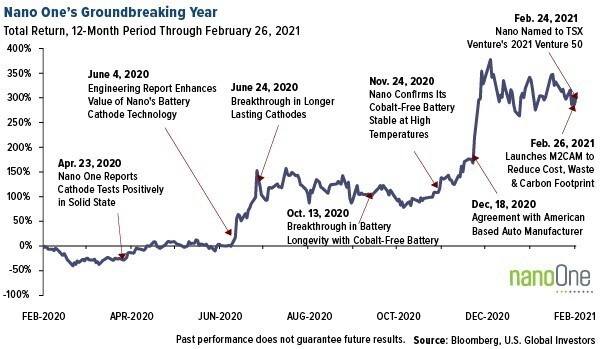

Indeed, there’s no lack of breakthroughs (see Nano One’s performance chart below). The company has unveiled a number of advancements over the past 12 months alone, including longer-lasting cathodes and high-voltage batteries that do not require cobalt.

Most recently, Nano One announced its M2CAM (metal-to-cathode active material) initiative, enabling cathode materials to be made directly from metal using nickel, manganese and cobalt metal powders, thereby reducing cost, waste and carbon footprint.

To be clear, Nano One is a speculative play and highly volatile, with a 52-week range between CA$0.75 and CA$6.20. Trading on Canada’s Toronto Stock Exchange [TSX] Venture Exchange, it currently has no revenue.

Instead, it receives its funding mostly from government assistance programmes and its strategic partners, including Volkswagen’s [VOW.DE] research group, China’s Pulead Technology, France’s Saint-Gobain [SGO.PA] and an undisclosed North American auto manufacturer.

In late February, the company announced that it had been named to the Toronto Stock Exchange Venture’s 2021 Venture 50, an annual ranking of the top-performing Canadian companies based on 2020 share price appreciation, trading volume and market cap growth.

Shares of Nano One soared 425% in 2020, while its daily trading volume exploded 10,801%, from as little as 2,400 shares at the end of 2019 to more than 260,000 shares by 31 December 2020.

Rotation into battery metals

Our conviction in Nano One and its future is such that it was the top holding in our World Precious Minerals Fund [UNWXP] as of 31 December 2020. Battery technology is big business, requiring incredible amounts of metals and minerals, and we plan to increasingly position the fund to play the trend.

To give you an idea of the significant growth in battery metal demand, global battery capacity in all newly sold EVs combined jumped 93% in the second half of 2020 compared to the same period a year earlier, according to Adamas Intelligence. Battery-grade nickel usage rose 69% over the same period, battery-grade cobalt 85%, and lithium carbonate equivalent 96%.

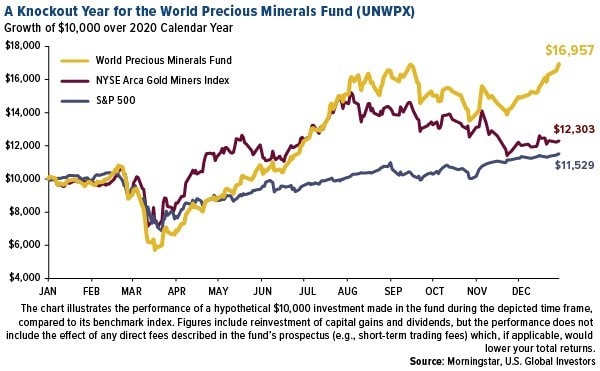

We believe the rotation into battery metals and technology was wisely made. The World Precious Minerals Fund returned 70.6% in 2020, putting it in the very top percentile rank of funds in the Equity Precious Metals category for the year ended 31 December 2020, out of 68 funds, according to Morningstar data, based on total returns.

Had you invested $10,000 in the World Precious Minerals Fund at the beginning of 2020, you would have ended the year up nearly $7,000, according to Morningstar data.

Although you can’t invest in an index, had you made a similar hypothetical investment in the benchmark NYSE Arca Gold Miners Index [GDMNTR], you would have seen a return of around $2,300. For the S&P 500, the return would have been approximately $1,500.

This article was originally published on Frank Talk, a blog by Frank Holmes, CEO of US Global Investors.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy