In part two of this two-part series, Ari Polychronopoulos, product manager and head of ESG at Research Affiliates, and John West, a partner in the executive office at the firm, break down why they believe ESG is a powerful investing theme.

Key points:

- Increasingly, investors are asking if environmental, social and governance (ESG) is a factor. We conclude that ESG is not a factor.

- We do believe, however, that ESG could be a powerful theme as new owners of capital — in particular, women and millennials — prioritise ESG in their portfolios over the next two decades. Progress in aligning definitions of “good” and “bad” ESG companies will also enhance the ability of the ESG theme to deliver positive investor outcomes.

- We conclude that ESG does not need to be a factor for investors to achieve their ESG and performance goals.

ESG is not a factor, but could be a powerful theme

Even though we are unable to apply the factor framework to ESG, these strategies, however heterogeneous, may still produce superior returns. Non-robust, and even robustly negative, strategies will invariably cycle through periods — think three-to-five year stretches — of outperformance. And over the very long term, possibly decades, stocks that rank well on ESG criteria may also outperform.

We witness two principle arguments in favour of superior risk-adjusted returns for companies that rate well on ESG metrics. First, as some claim, there may be latent risks in companies that rate poorly on ESG metrics, according to the CFA Institute. In other words, ESG risk needs to be incorporated into security selection.

"ESG risk needs to be incorporated into security selection"

Let’s consider carbon. Historical fundamental analysis developed during a predominantly stable climate backdrop may miss the investment risk associated with carbon and thereby deliver poor results if the risk materialises. Coal has been a declining source of energy production in the United States for years, accounting for 52% of the nation’s total electricity generation in 1990, but just 23% at the end of 2019.

The percentage will continue to decline as energy providers move toward cleaner and more-energy-efficient alternatives to combat climate change, leaving coal companies with assets of decreasing value. Investment managers who do not consider and integrate the ESG risk of, in this case, climate change may be blindsided.

“The theme is the massive coming adoption of ESG investing on the part of new owners of capital”

Not recognising a specific type of risk implies a mispricing effect. This mispricing seems to be highly idiosyncratic in nature and probably best exploited via the forward-looking framework of active management.

Such “ESG alpha” has the potential to be sizeable, especially if very few managers are incorporating ESG criteria into their investment processes — but that’s not the case. According to Cerulli, 83% of investment managers are embedding ESG criteria into their fundamental processes.

In July 2020, over 2,200 investment managers have signed on to the United Nations (UN) Principles for Responsible Investing, which encourages signatories to “incorporate ESG issues into investment analysis and decision-making processes”. Indeed, investment manager signatories managed approximately $80trn as of 31 March 2020.

Such widespread use of ESG criteria in the investment management process means that identifying ESG skill will likely be as difficult as identifying other types of investor skill. Neither does it speak to the ability of investors to harvest the alpha, if found. Will investors have the patience to wait out manager ESG risk assessments, especially given the very long horizon for some of these risks?

A large shift in investor preference toward ESG is occurring as two distinct groups — women and millennials — take greater control of household assets. Accordingly, Bank of America [BAC] recently noted a “tsunami of assets is poised to invest in ‘good’ stocks” and concluded that “three critical investor cohorts care deeply about ESG: women, millennials, and high net worth individuals. Based on demographics, we conservatively estimate over $20tn of asset growth in ESG funds over the next two decades — equivalent to the S&P 500 today.”

"three critical investor cohorts care deeply about ESG: women, millennials, and high net worth individuals" - Bank of America

Similarly, an Accenture study concluded that $30trn in assets will change hands, a staggering amount which, at its peak between 2031 and 2045, will witness 10% of total US wealth transferred every five years.

Not only are investor preferences shifting in favour of ESG strategies, regulatory efforts in Europe aim to bring greater standardisation and transparency to ESG products, which is likely to increase demand. As of 2019, UK government pension funds are required to integrate ESG considerations into their investment management approach, according to the PRI academic blog.

Starting in March 2021, the European Union will require investment managers to provide ESG disclosures related to their investment products. The effort “aims to enhance transparency regarding integration of environmental, social, and governance matters into investment decisions and recommendations,” according to the Harvard Law School Forum on Corporate Governance.

In 2018, the European Commission set up a Technical Expert Group tasked with several ESG initiatives including creating index methodology requirements for low carbon benchmarks, increasing transparency in the green bond market, and creating an EU taxonomy to help companies transition to a low carbon economy.

Outside of Europe there has been less movement on the regulatory front, but good progress made on standard setting. In the United States, public pension funds have taken the lead on ESG integration and in 2018 held 54% of all ESG-related investments in the United States (Bradford, 2019).

The UN has created the Sustainable Development Goals, a blueprint for improving the planet, both environmentally and socially, by 2030. The 17 goals — including reducing poverty, improving education, creating affordable and clean energy, and creating sustainable cities and communities — have been adopted by all UN member states.

“ESG does not need to be a factor for investors to achieve their ESG and performance goals”

The numbers are large, and the implication that the new owners of wealth will favour “good” ESG stocks will in turn likely lead to a very different supply-demand dynamic than in the past. More demand for good ESG companies may result in an upward, one-time positive shock to relative valuations of these companies and the funds that invest in them.

We previously discussed that factors and smart beta strategies can experience such a revaluation alpha in the paper titled “How can ‘Smart Beta’ go horribly wrong?”. This is classic thematic investing, following in the footsteps of cloud, artificial intelligence, and robotics themes, but it’s not factor investing.

"This is classic thematic investing, following in the footsteps of cloud, artificial intelligence, and robotics themes, but it’s not factor investing"

The theme in this case is the massive coming adoption of ESG investing on the part of new owners of capital. Getting ahead of that demand could be substantially profitable on two conditions. First, the perceived demand is not already reflected in stock prices. Second, the market’s perception of good ESG companies is fairly consistent so that these inflows more or less benefit the same companies.

As we have explained, we currently see incredibly inconsistent definitions of good and bad ESG companies. Yes, a rising tide lifts all boats, but they all have to be in the water and in the same harbour! It may very well be that the best options for thematic investing in ESG are for narrower — and therefore homogenous — groups of securities. Low carbon, sustainable forestry, or gender equality may be easier to exploit in a thematic manner than the entire ESG company universe.

Incorporate ESG into a variety of equity index strategies

At Research Affiliates, we believe ESG is an important investing consideration despite dismissing it as a factor or lacking confidence in its ability to currently deliver as a theme. One of our core investment beliefs is that investor preferences are broader than risk and return.

As value investors, we believe that prices vary around fair value and that investing in unpopular companies and not following the herd is a strategy that will be rewarded as prices’ mean reverts over a market cycle.

Of course, investor preferences extend beyond value investing, and as we have shown, many investors have a preference for ESG strategies for many reasons, such as the desire to bring about societal change, mindfulness of the environment, promotion of good corporate governance, or all of the above.

Investors can satisfy their ESG preferences while still maintaining the characteristics of their preferred investment strategy. We illustrate this by comparing the characteristics of three strategies: RAFI Fundamental Developed Index, RAFI ESG Developed Index, and RAFI Diversity & Governance Developed Index.

All three strategies utilise the Fundamental Index approach, which selects and weights companies by fundamental measures of company size rather than market capitalisation. The RAFI Fundamental Developed Index does not incorporate any ESG considerations.

The RAFI ESG Developed Index is a broad-based ESG index that tilts toward companies with strong overall ESG scores. The RAFI Diversity & Governance Developed Index reflects a preference for companies that score well across several metrics of gender diversity and strong corporate governance.

All three strategies share similar characteristics. The Fundamental Index methodology is a contrarian approach that uses fundamental weights to act as rebalancing anchors against market price movements.

Fundamental Index strategies typically trade at a discount to cap-weight. All three strategies maintain similar valuation discounts and dividend yields, with the only noticeable differences being index concentration. Given that the ESG and Diversity & Governance indices exclude many securities that perform poorly across multiple ESG considerations, they have a much higher active share. In addition, all three strategies maintain similar factor exposures, mainly positive loadings on value and negative loadings on momentum.

The Diversity & Governance index, which incorporates a tilt toward lower-volatility companies, also has a high exposure to the low beta factor. The bottom line is that investors who would like to incorporate ESG into their investment decisions can do so and retain their desired investment characteristics.

Accordingly, they likely maintain a similar expected return outcome (although with some short-term deviations in performance) whether their preferred approach is traditional passive, smart beta, or active. ESG does not need to be a factor for investors to achieve their ESG and performance goals.

Conclusion

Let’s hope the events of 2020 — Australian wildfires, a global pandemic, a searing recession, and social protests denouncing racial inequality — lead to positive societal changes and perhaps more refinement of and greater consistency in ESG ratings.

Indeed, once the dust settles, we expect these forces to accelerate an already simmering ESG investment movement — but action will require clarity around exactly what ESG is and what it is not. Currently, various stakeholders are sending a whole host of mixed messages.

Investors, particularly fiduciaries, need education and alignment. If ESG remains a heterogeneous basket of claims, we will likely never see it fulfil its vast promise.

"Investors, particularly fiduciaries, need education and alignment."

We have debunked one of these messages: ESG is not an equity return factor in the traditional, academic sense. We have shown that, unlike vetted factors such as value, low beta, quality, or momentum, ESG strategies lack sufficient historical data, impeding our ability to make a similar conclusion of robustness.

Nevertheless, ESG can be a very powerful theme in the portfolio management process in the years ahead. Furthermore, we believe a variety of equity styles can very effectively capture ESG criteria. We believe our conclusions will add clarity around the question “Is ESG a factor?” and, therefore, quicken the pace of ESG integration in equity portfolios.

Appendix

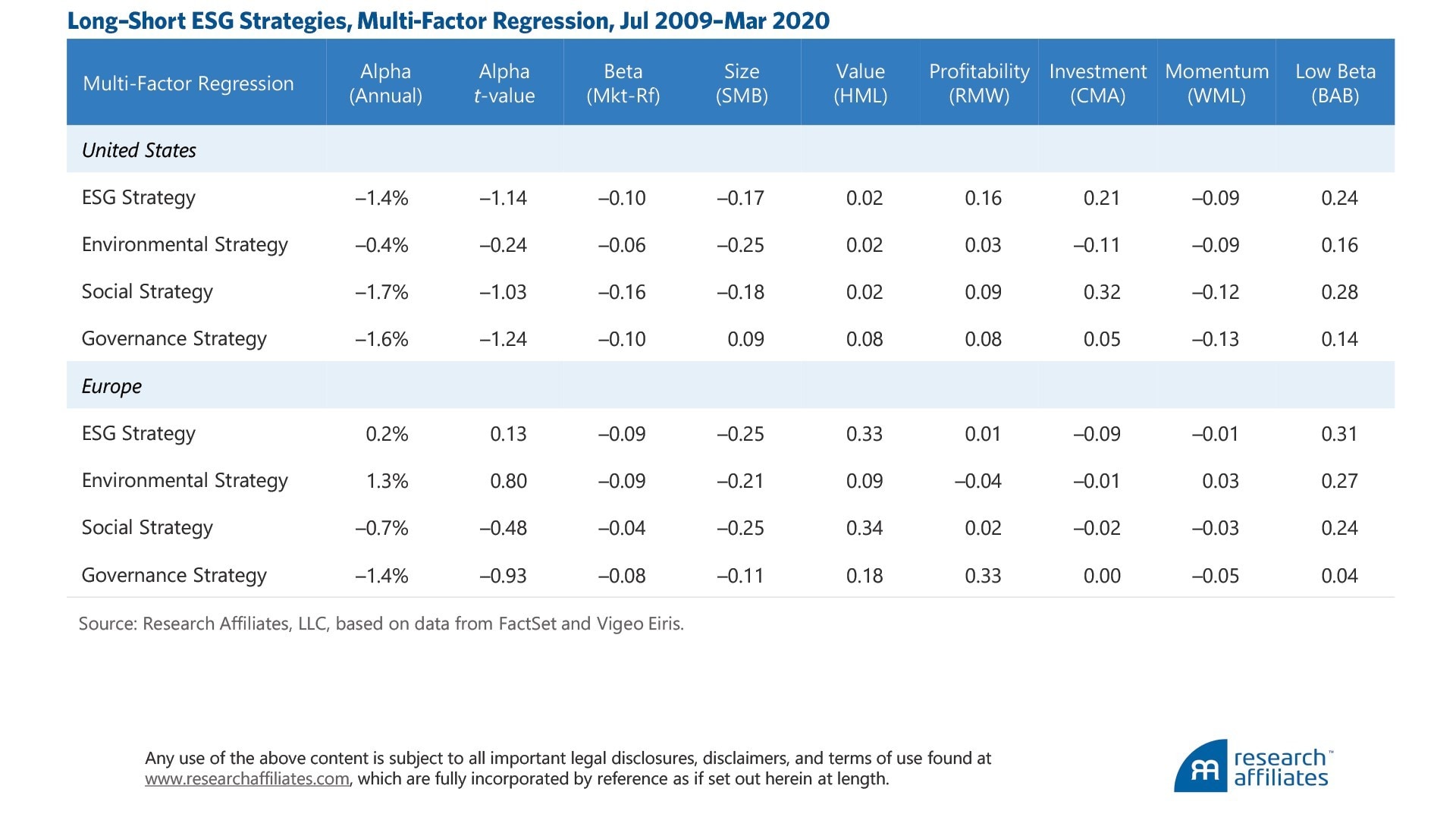

We examine the results of a multi-factor regression compared to long-short ESG portfolios in the United States and Europe. This approach results in low or negative alpha from the majority of the strategies.

The environmental strategy in Europe is the only strategy with annual alpha greater than 1.0%, however, the results are not statistically significant at the 95% t-stat level (1.96).

Most of the strategies exhibit positive loadings on the low beta, profitability, and investment factors, meaning that ESG portfolios tend to exhibit low-volatility and high-quality characteristics, bringing merit to the argument of ESG as a risk mitigation strategy.

This article was originally published in July 2020 and can be found on the Research Affiliates website.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy