Julius de Kempenaer is the creator of relative rotation graphs (RRGs), as well as being the co-founder and director of RRG Research. In his latest article for Stockcharts.com, Julius uses RRGs —which enable investors to distil the relative strength of securities into a single picture and facilitate comparison that might otherwise take weeks — to assess the merits of value over growth.

As de Kempenaer notes, recent weeks have seen the gap between value and growth widen, with the former accelerating away from the latter. This is not a new pattern, however, and the movements noted by the RRGs have been observed by de Kempenaer for a while.

Below is an excerpt from de Kempenaer’s recent article on the subject.

Value starts to accelerate away from growth

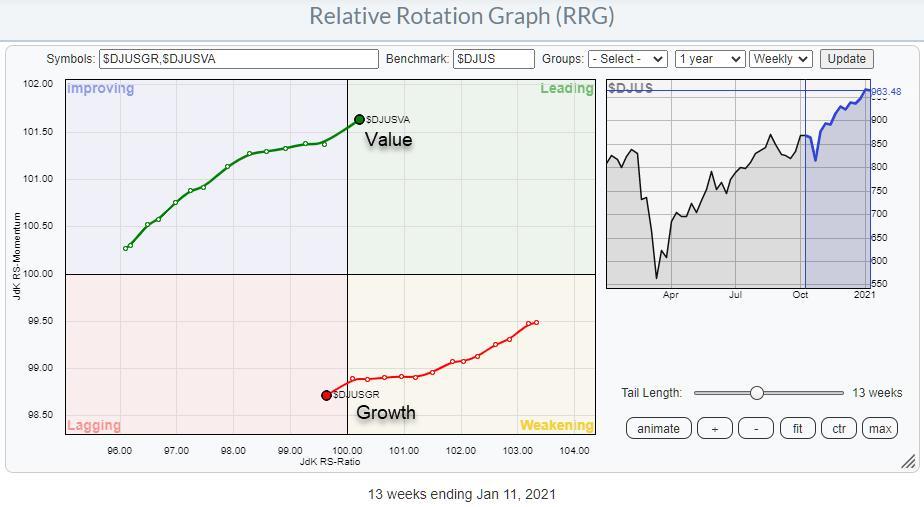

This week, the tails for growth and value are crossing over. Value is moving into the leading quadrant while growth crosses from weakening into lagging.

This rotation has been going on for quite some time already and was picked up by the RRG Lines and the rotation of the tails on the Relative Rotation Graph itself around the end of May/start of June. The tail for growth was inside the leading quadrant at that time, but started to roll over and move towards weakening while value, at the time, was inside lagging but started to curl upward and move towards the improving quadrant.

Over the last 13 weeks, this rotation continued and picked up steam, resulting in the crossing over to the other side of the RRG as mentioned above.

To read de Kempenaer’s complete insight, illustrated with further RRG graphs, you can find the full article here.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy