Marathon Digital, the world’s largest bitcoin miner by market capitalisation, recently joined OPTO Sessions to discuss the company’s imperative to innovate. He explains its novel two-phase immersion cooling system and how the excess heat from bitcoin mining could be used to power entire towns.

The business model of a bitcoin miner such as Marathon Digital [MARA] is very varied.

Adam Swick, Chief Growth Officer at Marathon, explained to OPTO Sessions that, besides solving the complex cryptographic challenges that add new bitcoins to the blockchain, Marathon also engages in utility-scale mining (the synchronisation of its mining operations to balance power demand on the grid), energy harvesting (giving economic value to otherwise unviable energy sources by using them to power bitcoin mining), and its technology arm.

Marathon’s technology division develops software and hardware innovations to optimise its own mining operations and, where possible, to sell to third parties.

The company’s own Layer-2 Bitcoin blockchain, called Anduro, emerged from its technology division.

Anduro, says Swick, can do anything that any other blockchain can do, with the added advantage of Bitcoin’s security.

“A lot of the other chains talk about programmability or speed to transaction confirmation. All of that can be done by Anduro, but it’s on Bitcoin.”

Transaction Fees and the Efficiency Imperative

The incentive for Marathon to innovate is rooted in the economics of bitcoin mining. As well as block rewards — the bitcoins that miners harvest when adding new blocks to the blockchain — bitcoin miners can also earn money from transaction fees.

These, explains Swick, currently sit at approximately 4–6% of the block reward. However, because miners are naturally incentivised to keep their energy use low, this percentage will increase over time as competitors step out of the race.

“Someone will always be mining bitcoin, and it’ll be the most efficient person.”

Transaction fees ensure that the most efficient miners will always remain in business. “If the economics get bad, inefficient miners unplug, and while the per-bitcoin rewards that you’re getting in a dollar-denominated way might go down, you might be getting a higher percentage of them,” explains Swick.

“It’s this fun balancing act, and the thing we have incredible control over is how efficient we are.”

Efficiency takes various forms, including securing the cheapest energy sources and ensuring that mining machines are converting that energy into computing power as efficiently as possible. However, the most groundbreaking innovation occurs in the proprietary technology around the machines.

2PIC: Marathon’s Coolest Innovation

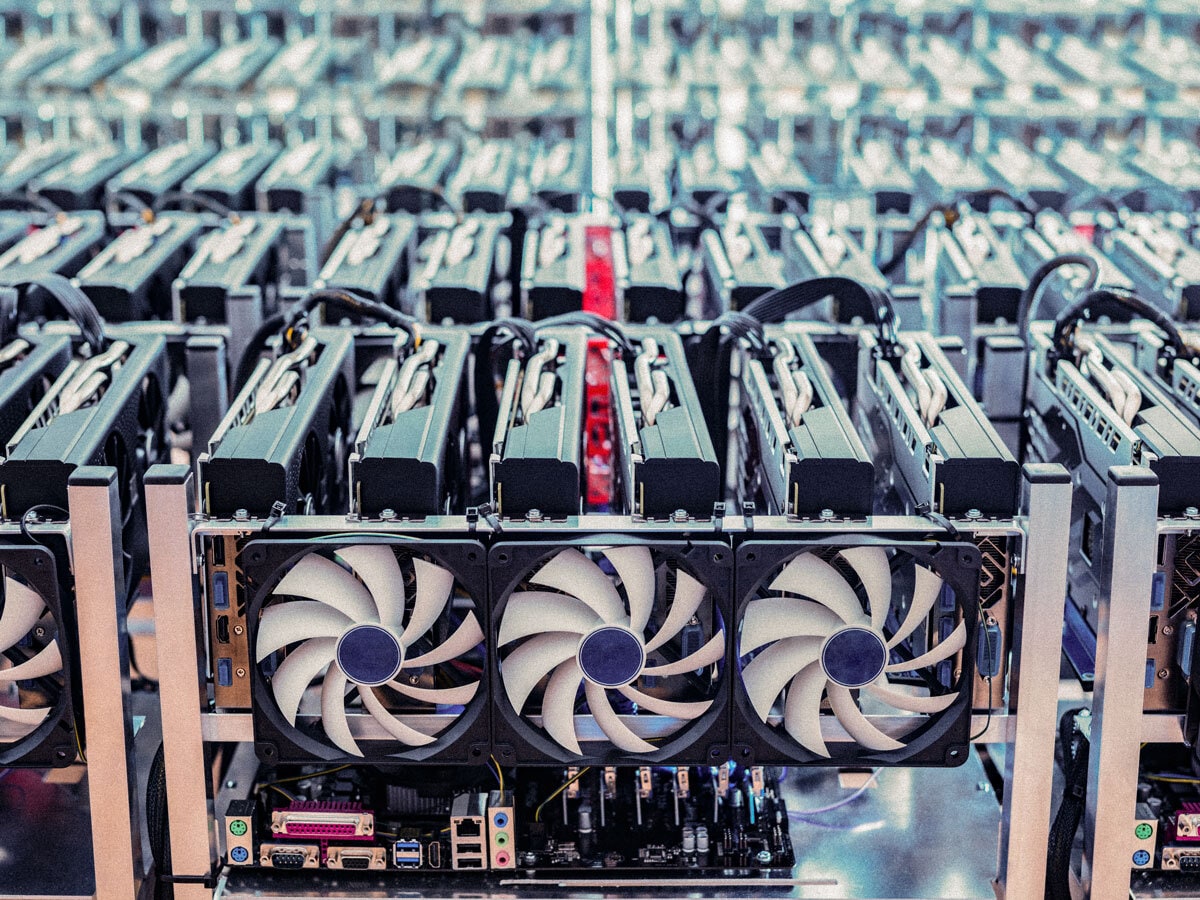

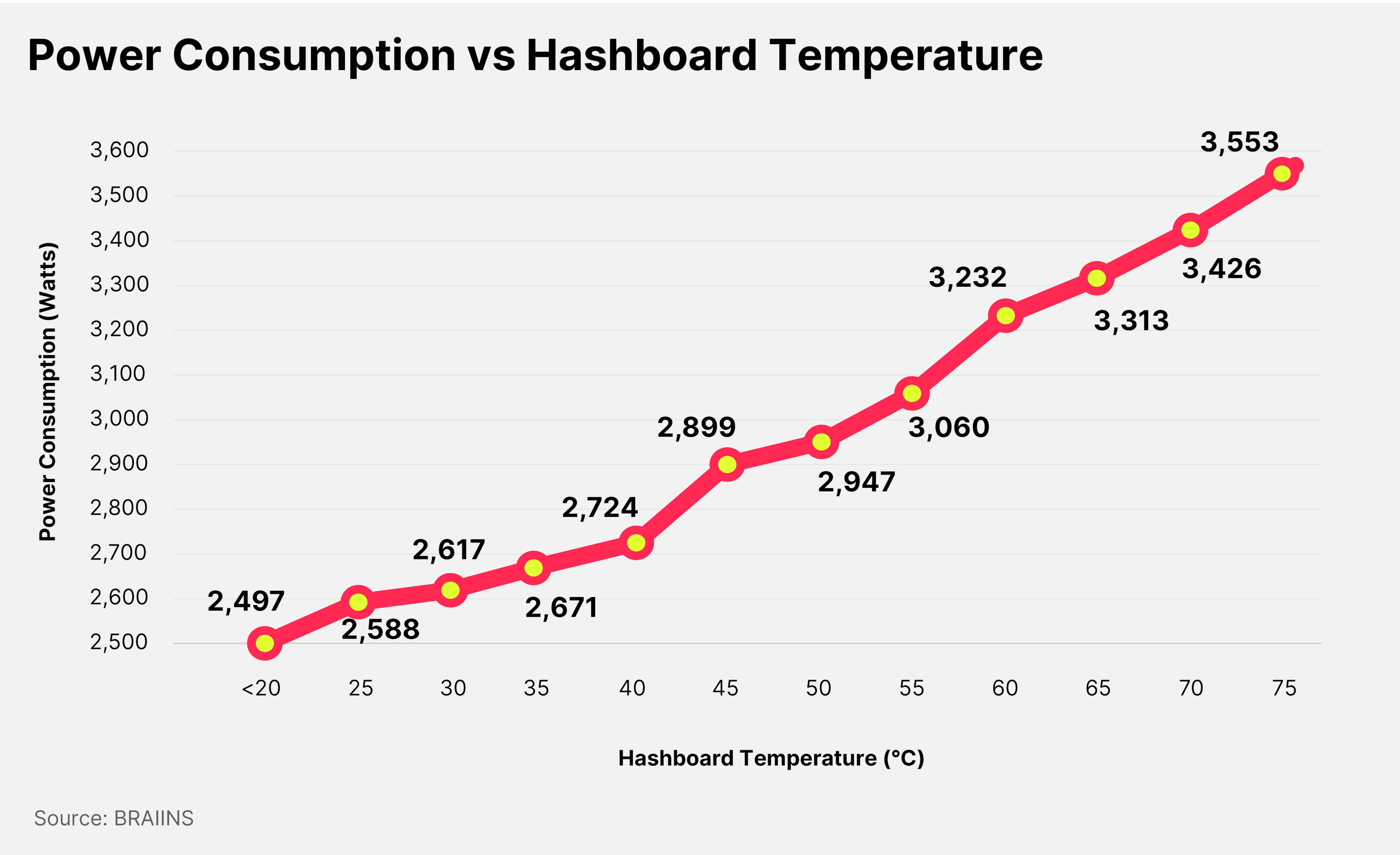

Bitcoin mining servers generate enormous amounts of heat. Preventing them from overheating is one of the major challenges faced by bitcoin miners. Higher running temperatures have a significant impact on the efficiency with which mining machines convert energy into computing power.

Marathon has developed novel solutions to this problem.

“Historically, bitcoin miners were air-cooled, meaning they’re just machines that have a fan blowing on them.” This was followed by hydro cooling, where cold water is run over a heat exchanger to cool the plates, and immersion cooling, which uses oil to absorb and redirect the heat.

However, Marathon’s in-house solution is two-phase immersion cooling (2PIC). “It’s a sealed tank, and it’s called two-phase because the oil is changing state from liquid to gas.

“This particular type of oil has a very low boiling point. As the compute gets hot, the liquid around it boils and rises up to the top of the sealed container, where it hits a condenser, like a coil that you’d see in your fridge that has cold water running through it. The gas then condenses back into liquid and drops back down.”

The Benefits of 2PIC

Swick claims that the cooling improvements that this brings allow Marathon to work its machines 60–100% harder than they could run in air while reducing the need for manual maintenance such as dusting.

“We’re seeing, compared to traditional data centres, up to 75% less space needed because this is so energy dense. You can get two to four times more power in the same space.”

Another benefit of the 2PIC system is that it enables Marathon to harness, rather than waste, the heat generated by its mining operations. Marathon is using this in a pilot project to heat a town of 11,000 residents in Finland.

The technology can also be sold to third parties, such as other cryptocurrency miners or businesses involved in artificial intelligence (AI) or high-performance computing (HPC).

Swick believes that the nature of the bitcoin mining business puts Marathon ahead of the competition in optimising its server technology. “I think we’re a step ahead of the AI-HPC world in solving problems that they’re about to start facing.”

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy