Our evolution

Increased our stake in StrikeX to 51%, securing a controlling interest and reinforcing CMC’s leadership in blockchain innovation and tokenised financial products. This supports the strategic development of our Web 3.0 vertical.

CMC Markets Connect signs major fintech partnership with Revolut

CMC Markets forms strategic partnership with ASB Bank

CMC Markets announces a strategic investment in blockchain solutions company, StrikeX.

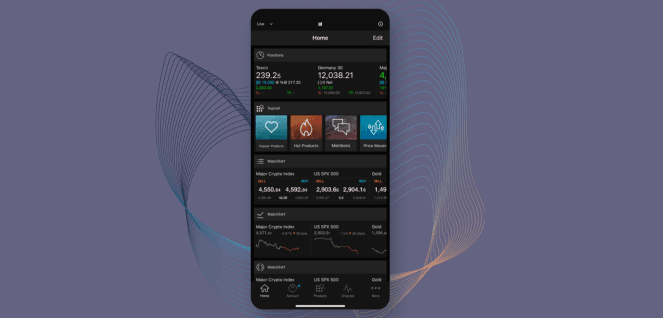

The Company launches CMC Invest, our UK share investing brand, while we also unveil a tiered-volume fee discount scheme, CMC Price+, and our bespoke premium membership, CMC Alpha, goes live in the UK.

The Group’s institutional business is rebranded as CMC Markets Connect, marking the B2B unit as a true multi-asset liquidity provider. We also release Spot FX as part of the Company’s multi-asset focus. In June, we announce a record annual performance, with net operating income up 63% year on year, and profit-before-tax increasing by 127%.

The Group unveils a 1,459% rise in profit before tax, with net operating income up 93%, as the Group reacts swiftly to the Covid-19 pandemic, with all employees successfully transitioning to remote working.

The Company’s white-label stockbroking partnership with Australia and New Zealand Banking Group (“ANZ”) is successfully implemented, with the migration of over 500,000 clients, and we add Equities DMA to our growing institutional product range.

Our dedicated professional trading offering, CMC Pro, is launched, as we also introduce cryptocurrency spread betting and CFD products. Our institutional business releases Prime FX functionality, and we launch Opto, an investing-focused magazine.

CMC Markets lists on the London Stock Exchange, trading as CMCX, with an initial market capitalisation of £693m.

We join Land Rover Ben Ainslie Racing as an official partner in Sir Ben Ainslie’s quest to win the 35th America’s Cup, and further expand the global brand with a new office in Warsaw, Poland.

The first iteration of our multi-award-winning web-based ‘Next Generation’ spread betting platform is unveiled in the UK, and we also release a spread betting app for the iPhone.

Global expansion continues with new offices in Oslo and Madrid, and CMC Markets Australia successfully acquires leading non-advisory Australian stockbroker Andrew West & Co, establishing CMC Markets Stockbroking.

Goldman Sachs purchases a 10% equity stake in CMC Markets, while the Company continues to expand, with new offices opened in Singapore and Stockholm.

As well as opening offices in Frankfurt and Toronto, the Company unveils its first mobile trading offering, and launches ‘one-click’ trading functionality.

CMC Markets becomes an online CFD and FX trading provider in the Australian market, with the opening of an office in Sydney.

Our online spread betting product is launched, and we become the first spread betting company to launch the daily rolling cash bet®, which becomes an industry benchmark.

CMC Markets expands to become a CFD broker, underlining a commitment to offering the most competitive and innovative trading products available to retail clients globally.

The Company launches the world’s first online retail FX trading platform, allowing clients to take advantage of markets previously only accessible to institutional traders.

Peter Cruddas starts CMC Markets in the UK as a forex broker.