About CMC Markets

CMC Markets provides leading-edge technology and execution along with the support and expertise which will enable your business to expand into new markets, offer new products and increase revenue potential.

Established in 1989, headquartered in London and listed on the London Stock Exchange, we have accumulated over 20 years' institutional experience, with existing partnerships in more than 25 countries. Our well-capitalised position further highlights our stability and appeal as a financial counterparty.

We facilitate bespoke, top-tier liquidity solutions for banks, brokers, funds and trading desks. Our comprehensive institutional suite provides liquidity services across multiple assets and includes Prime Derivatives, Prime FX, API Direct, plus white label offerings. Our Prime Derivatives offering, a standalone GUI and API for professional institutional counterparties, provides access to trade over 9,000 single stock CFDs.

Our flexible approach means that clients can connect to our liquidity by using either proprietary trading platforms, or via third-party technology. We also provide comprehensive back-office reporting tools.

Contact us and find out how we can work with you to find a bespoke trading solution for your business.

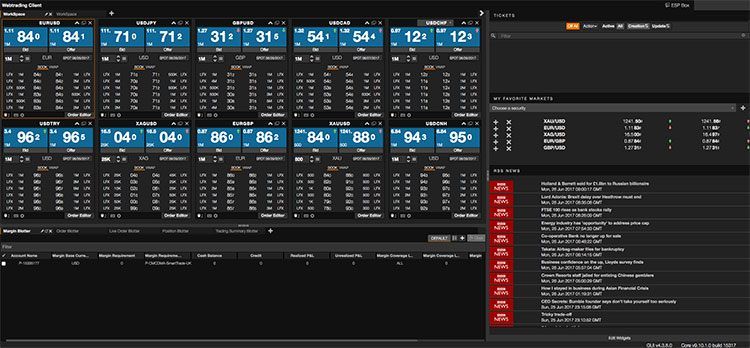

API Direct

Achieve comprehensive multi-asset coverage from a single source with CMC Markets’ API Direct feed. Access our market-leading CFD liquidity and FX product suite and enjoy consistent pricing and market depth across more than 400 instruments.

Liquidity, clarity & choice

- Huge range of ‘cash’ and forward contracts in global indices, commodities, treasuries, precious metals and over 300 major and exotic FX pairs

- Enhanced liquidity provision to API users facilitating execution of larger orders

- Compliant market data solutions

- Supported by our Next Generation trading platform technology

Total connectivity and support

- API channel supports market data and trade execution sessions through FIX protocol

- Robust trading infrastructure handles over 50,000 prices per second and over 6.5m trades a month**

- Strong failover capabilities provide availability and reliability worldwide, with uptime levels of 99.95%**

- Off-the-shelf integration with popular MT4/5 bridge technology and other fintech providers

- Connect through industry-recognised London data centres

Broker tools for total control

- Access real-time reporting with our partners portal, enabling fast identification of any opportunities or issues

- Monitor revenue levels, trade data and asset-class split with our award-winning GUI*

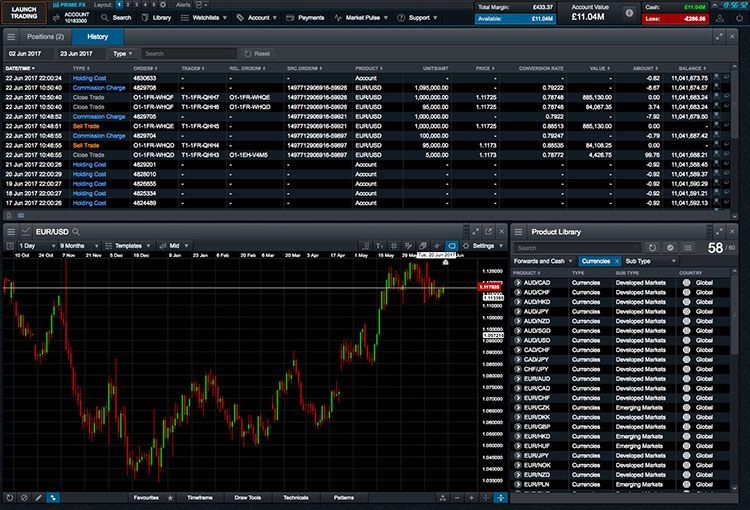

Prime FX

The prime brokerage market has changed significantly over the last few years, as some high profile institutions have retreated from the market. But as the big banks have moved away, demand has been created for a new generation of liquidity provider.

CMC Markets has built a single, flexible venue for all your institutional FX trading needs, while providing the most competitive prices to help improve your profitability – underwritten by decades of experience and one of the leading names in foreign exchange.

Tier one liquidity

- Direct access to both bank and non-bank liquidity

- More than 60 Spot FX pairs and bullion types available

- Benefit from competitive spreads and margin rates

Rapid integration allied to an intuitive interface

- FIX connection via industry-recognised London data centres and other popular fintech providers

- Access to an Institutional trading GUI with real-time position monitoring

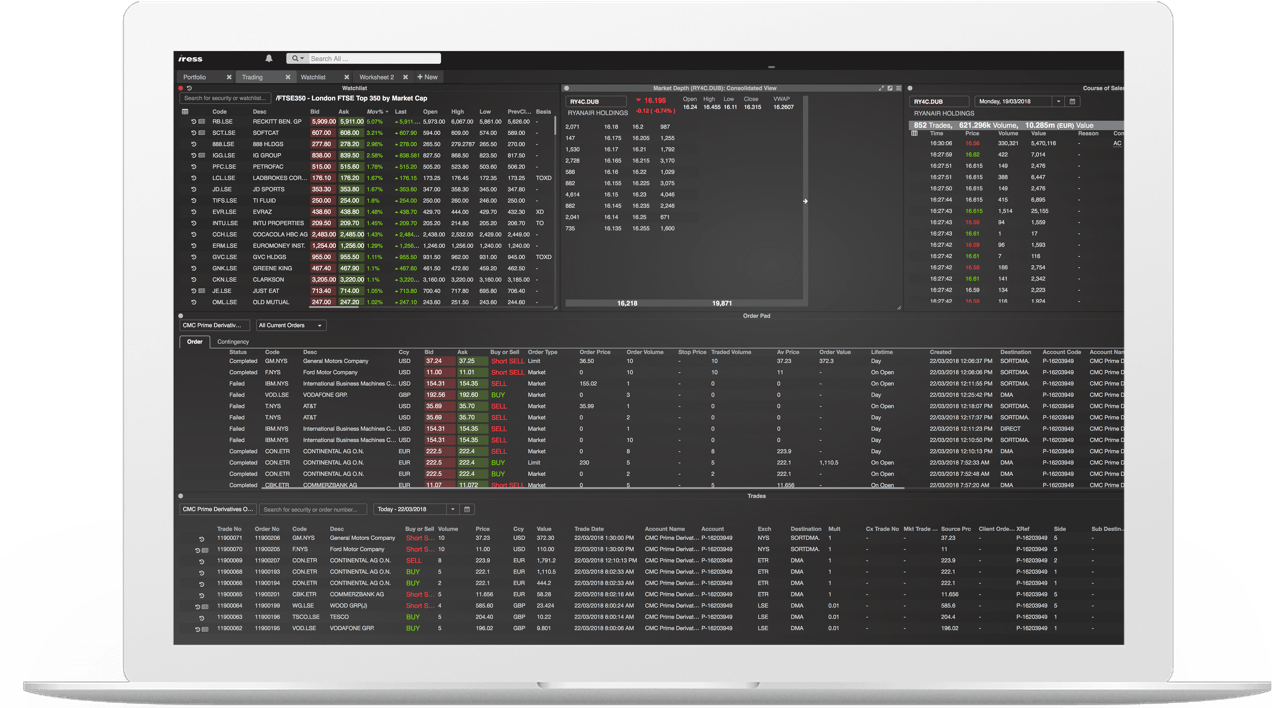

CMC Prime Derivatives

CMC Markets Prime Derivatives is an advanced trading system enabling institutional and professional clients to trade over 9,000 single stock CFDs across 20 countries, with trades smart-order-routed to a wide range of liquidity venues.

Trading features

Counterparties can trade CFDs via either FIX API connection, located in multiple data centres globally and connected directly to the order management system, or the prime derivatives trading platform. We additionally support connectivity of a number of platforms, including Fidessa, Reuters, Real-Tick and Bloomberg EMSX, as well other recognised industry services.

- Advanced order management with smart order routing

- Access primary exchanges and MTFs, plus other displayed (lit) and non-displayed (dark) liquidity venues

- Algorithmic trading capability including VWAP, TWAP and target percentage of volume

- Access to trade in opening and closing auctions

- Trade in the US pre- and post-market

Advanced solutions

Access thousands of single stock CFDs from Europe, the Americas and Asia.

- Subcribe to real-time level 1 and 2 market data

- Advanced charting capabilities with a wide range of indicators and drawing tools

- Live streaming newsfeeds

- Intuitive and easy-to-use Prime Derivatives platform, built on the latest HTML5 technology

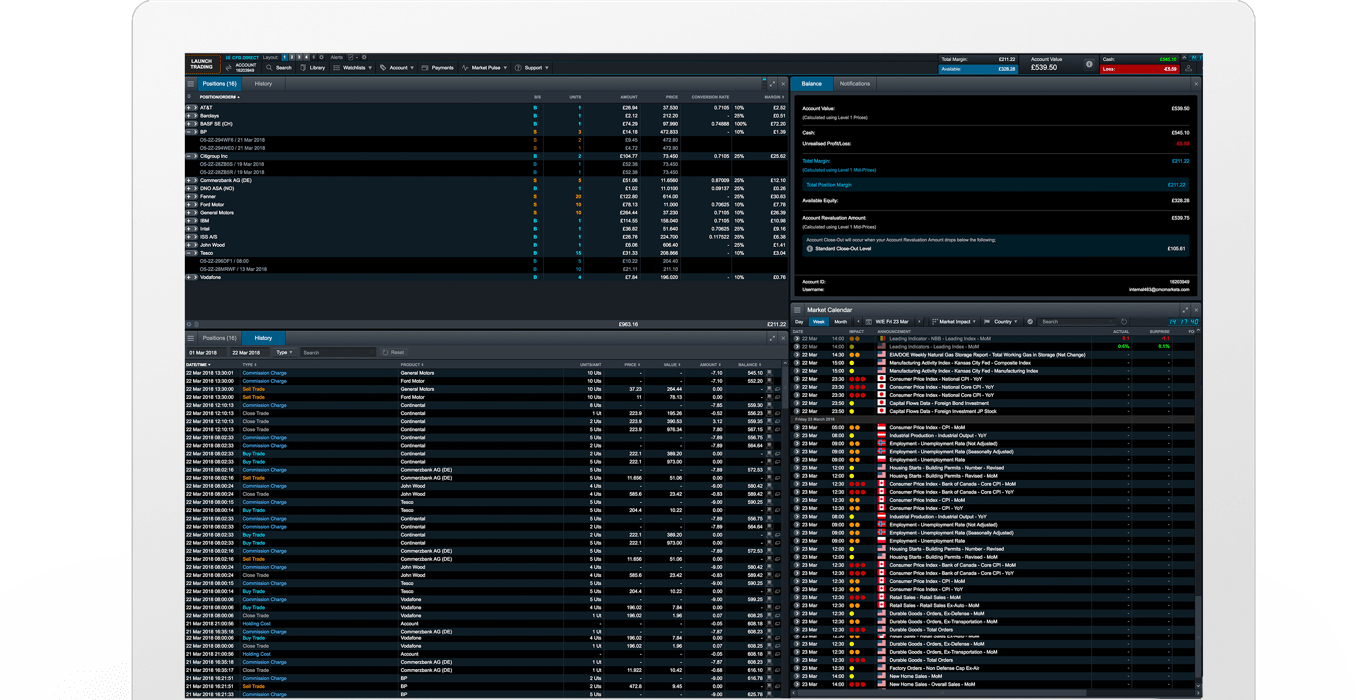

Back office

The Prime Derivatives, API Direct and Prime FX services are supported by our Next Generation platform back office alongside CMC Vision, our proprietary post-trade suite of tools, deliverable via GUI and API. Whether it’s for regulatory reporting, performance analysis or risk auditing, our service delivers your data when and how you require it.

- Monitor positions and margin utilisationDirect access to both bank and non-bank liquidity

- Automated delivery of end of day trading extracts

- View corporate action data

- Integrate real-time account data via API