Walk your talk. Invest your values.

We make it easy to build a portfolio aligned with your views on environmental, social and governance issues. Explore sustainable investing with your in-platform ESG Risk Rating feature.

We make it easy to build a portfolio aligned with your views on environmental, social and governance issues. Explore sustainable investing with your in-platform ESG Risk Rating feature.

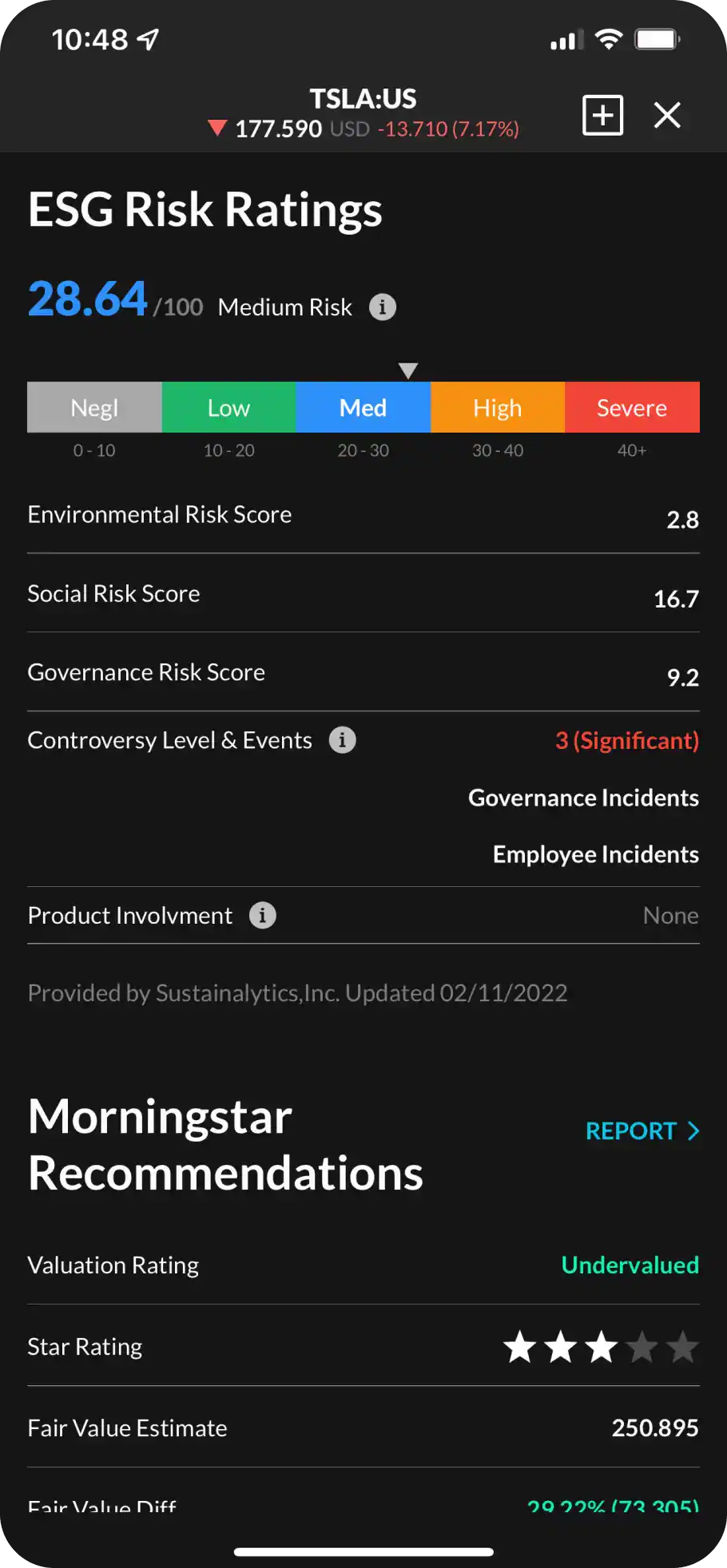

Know how exposed a company is to ESG risks that may impact its long-term performance and value.

ESG Risk Ratings can help you invest with a socially responsible strategy.

Independent corporate governance research and ratings are analysed across a large number of shares for a clear ESG risk score.

ESG investing involves selecting investments based not only on potential performance, but also on how a company is run, how it treats its employees and the environment. It's an ethical strategy that evaluates how exposed a company may be to Environmental, Social and Governance issues that may affect its long-term performance and value.

Knowing where a company stacks up when it comes to its impact on the world around it can help you make more informed investment decisions that align with your values.