In last week’s Opto Sessions compilation podcast, experts from BlackRock, JPMorgan, and Pzena Investment Management shared their take on the most promising emerging market investment opportunities. From India’s projected rise as the world’s largest consumer market to the transformative power of digital payments across the region, here are the five key ideas gleaned from these conversations.

EM stocks are at their most attractive level ever, but their valuation discount relative to developed markets may decrease.

Digital payments and blockchain are revolutionising financial inclusion in EM.

Analysis of 3 undervalued EM stocks that are at least +30% year-to-date.

India and China to become the largest consumer markets in the world by 2030.

India is projected to house a staggering 357 million young consumers below the age of 30 by 2030, according to a 2023 Brookings report. Currently, more than half of the world's consumers reside in Asia, primarily driven by India and China, as shown in the below Statista infographic. In addition to its growing consumer base, India's population is expected to reach 1.429 billion people in 2023, surpassing China as the most populous country.

In a past Opto Sessions episode, Kevin T. Carter, Founder and Chief Investment Officer of EMQQ Global, described consumption in emerging markets as "the biggest growth opportunity in the history of Capitalism," citing a 2012 McKinsey & Co report that projected annual consumption in EM to reach $30 trillion by 2025.

The widespread adoption of smartphones among billions of people is set to catalyse a digital consumer revolution. This technological advancement, coupled with the rise of the middle class in Asian markets, including Southeast Asia, is a prominent secular theme, according to Gabriela Santos, Managing Director and Global Market Strategist at JPMorgan. "That's a theme that's not done in China. It's a big theme for India and for Southeast Asia as well,” said Santos.

India and China collectively constitute one-third of the global consumer class and account for approximately a quarter of global consumer spending. Experts predict that this trend will persist throughout the next decade and even several decades beyond. "We've had a huge increase in consumption there with hundreds of millions of people brought into the middle class in emerging markets just over the last decade. And that's expected to continue over the next several decades as well,” said Jay Jacobs, US Head of Thematics and Active Equity ETFs at BlackRock.

EM Digital payments to increase at a CAGR of 15% between 2021-26.

Digital payments in EM increased at a CAGR of 25% between 2018 and 2021. This upward trajectory is set to continue in the coming years, according to a 2022 McKinsey report, which estimates a CAGR of 15% between 2021 and 2026.

The growth of digital payments in emerging markets is propelled by the convergence of factors such as the pandemic-induced shift to contactless payments and the transformative capabilities of blockchain technology.

BlackRock’s Jay Jacobs emphasised the transformative power of blockchain in enabling financial inclusion. “Decentralised finance is bringing finance to hundreds of millions of people around the world,” said Jacobs, adding, “We think that the emerging market consumer is really uniquely excited about blockchain technologies going forward.”

Christian Magoon, founder and CEO of Amplify ETFs and Magoon Capital, highlighted the ability of blockchain to facilitate fast and cost-effective digital payments and transactions. "I think that is one of probably the biggest global use cases for blockchain, to be able to make payments really frictionless,” said Magoon, illustrating its potential impact on emerging markets.

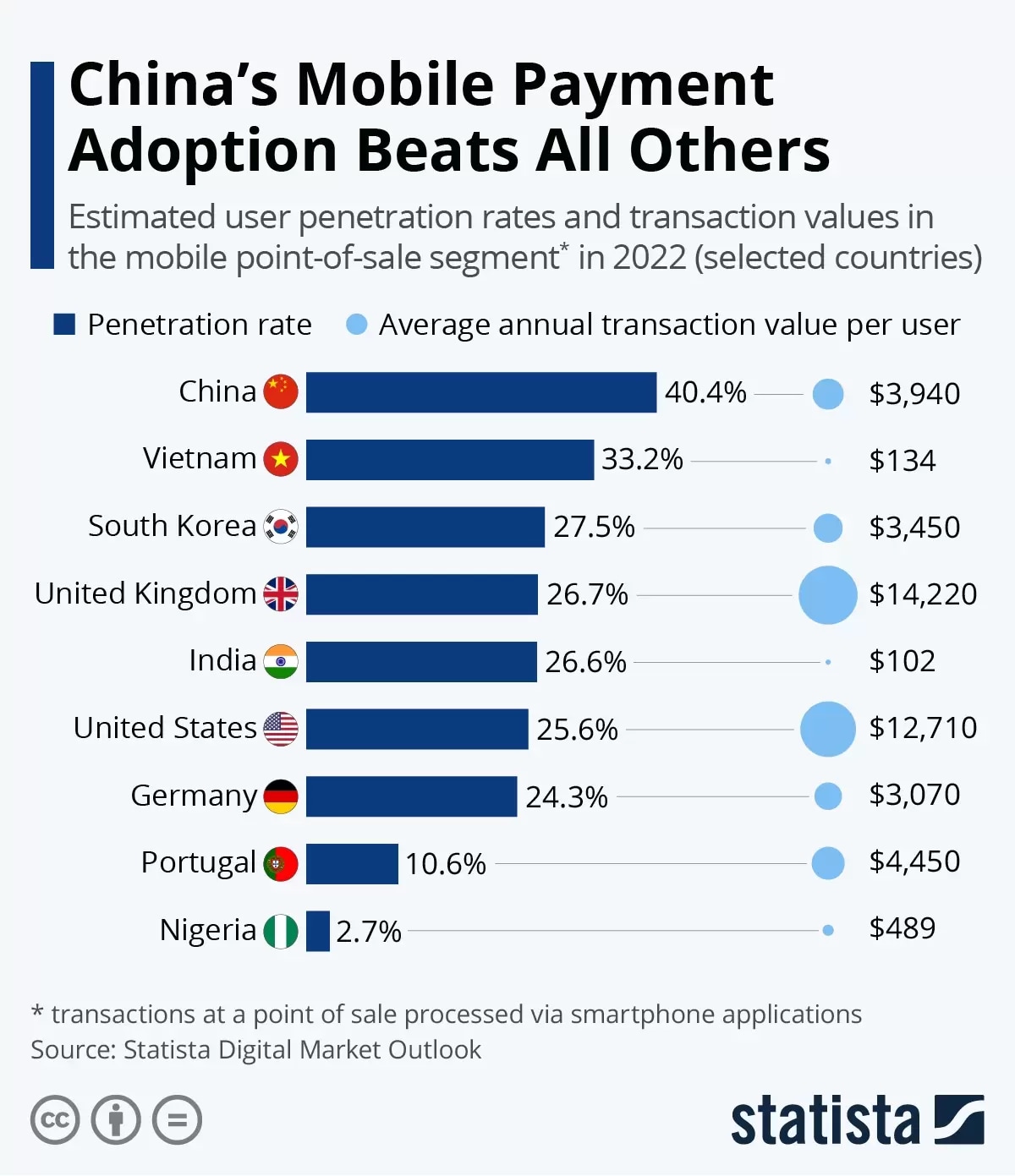

China leads the way in the adoption of payment apps, according to Statista. While payment app usage is high in India and Vietnam, the average spending per customer remains relatively low, however, suggesting casual usage by a majority of consumers.

Are you finding this content insightful? Leave us some feedback here.

Fintech funding in Southeast Asia hit a record $3.5bn in the first nine months of 2021.

Fintech funding in Southeast Asia soared to a record-breaking $3.5 billion in the first nine months of 2021, surpassing the total funding of $1.1 billion in 2020, according to a 2021 United Overseas Bankreport.

EMQQ Global’s Kevin T. Carter emphasised the emergence of unique entrepreneurial conditions in emerging markets, drawing a parallel with the birth of Silicon Valley. He highlighted India as an example of this thriving entrepreneurial ecosystem.

“You need experienced smart risk-taking entrepreneurs. You need a venture capital culture and a venture capital market. And India has that well developed. [...] India has a very well-educated population. Their technology colleges are world-class. [...] It's hard to see how this can be anything but a big growth story over the next 15 or 20 years even,” said Carter.

This growth is fueled by the billions of people who have never had traditional banking or retail access, which are propelling the e-commerce and internet sectors to become the fastest-growing sectors globally.

"The reason investors ought to be interested in emerging markets is because the thing that's emerging is the billions and billions of people,” said Carter, adding, “Because they've never had a bank account, they don't have a cable TV, and there's no Target store to go to, these billions of new consumers are leapfrogging to digital consumption and driving what I believe continues to be the fastest-growing sector in the world.”

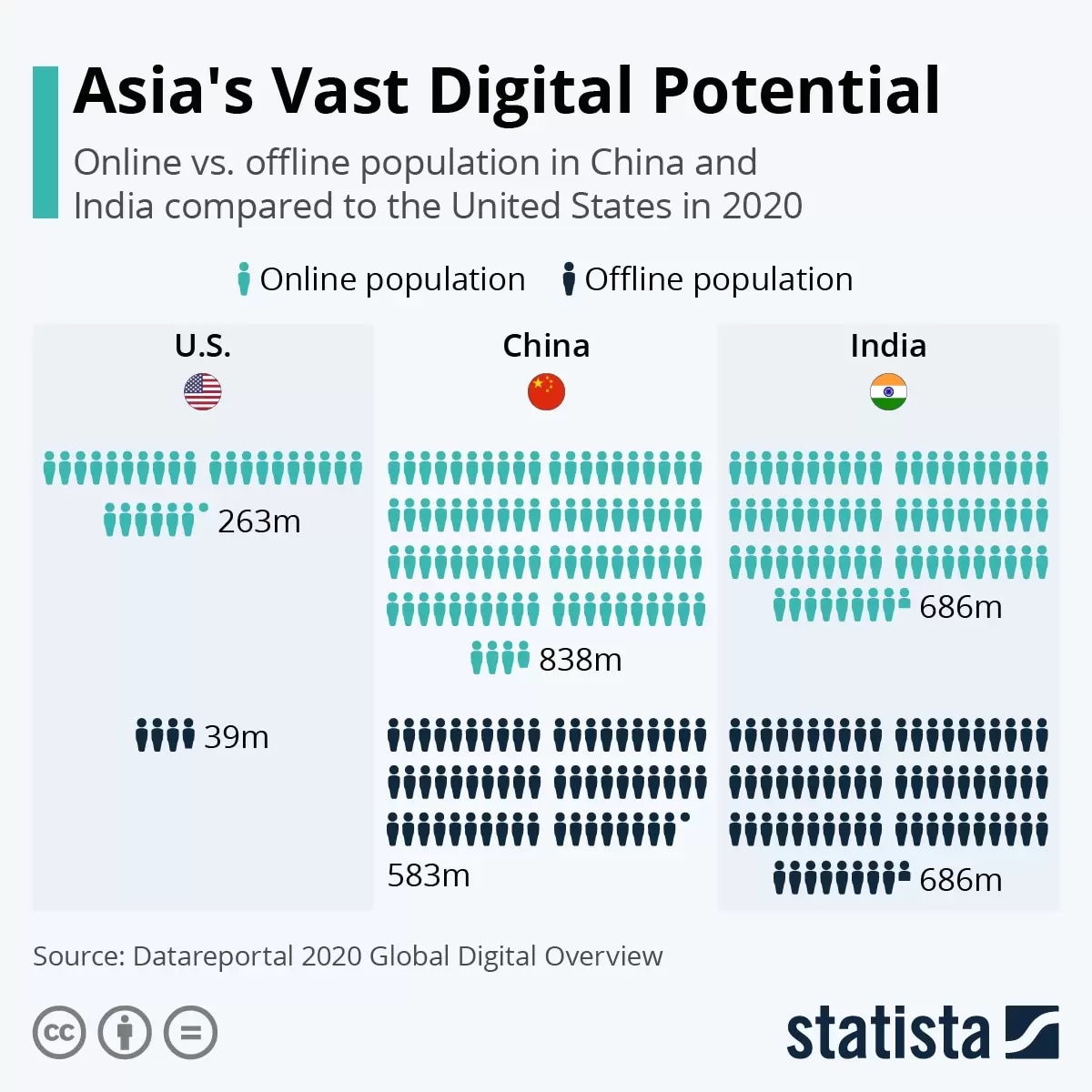

China, with its vast population, continues to exhibit significant untapped digital growth potential, even compared to the United States. Similarly, India's online population, although substantial, represents only approximately half of the country's total population, indicating considerable room for further expansion in the online space, as shown in the Statista infographic below.

Emerging markets at their most attractive levels ever in 2023.

Emerging markets may be one the most mispriced asset classes, with valuations reaching some of their most attractive levels ever in 2023, according to a Lazard Asset Management report.

Despite global economic growth forecasts declining in 2022 due to the pandemic, the war in Ukraine, and tighter financial conditions, emerging markets still offer significant growth potential compared to developed markets.

Lazard Asset Management forecasts emerging markets to enter a period of economic recovery in the second half of 2023, with many parts of the asset class currently being undervalued and under-owned.

Geopolitical uncertainty is one of the factors that contribute to market volatility and investor pessimism, leading to lower stock prices and potentially undervalued opportunities.

According to several industry experts we spoke to, when geopolitical uncertainty rises and valuations decrease, investors have the opportunity to capitalise on value dislocations.

"For us, when the geopolitical uncertainty is rising, or has risen, and the valuation has come down in response to it, it could be an interesting area of opportunity to look for good businesses," said Caroline Cai, Managing Principal and Portfolio Manager at Pzena Investment Management.

Similarly, Rakesh Bordia, Principal and Portfolio Manager at Pzena Investment Management, added that geopolitical fears and their impact on the market can create value investment opportunities.

"When there is uncertainty, there's fear in the market. Stock prices deviate from their long-term fundamentals because people don't want to own those stocks. And that is what creates opportunities for value investors like us to capitalise on those price dislocations,” said Bordia.

The table below provides a valuation analysis of prominent companies identified by Opto Sessions’ EM experts, emphasising their significance as key players in their respective sectors. The comparison is based on their stock performance.

| Stocks | YTD % | Price-To-Earnings (P/E) vs Peers |

|---|---|---|

Alibaba [BABA]

| -6.65% | Good value 21.7x (compared to the peer avg: 70.6x) |

| Samsung Electronics [KOSE: A005930] | +30.98% | Good value 10.9x (compared to the peer avg: 10.9x) |

| Tencent [0700.HK] | +5.47% | Good value 15.3x (compared to the peer avg: 42.1x) |

| TSMC [TWSEE: 2330] | +30.91% | Expensive 15.1x (compared to the peer avg: 10.9x) |

| MercadoLibre Inc [MELI] | +46.73% | Expensive 100.6x (compared to the peer avg: 55x) |

Data from SimplyWallSt. Figures are accurate as of Tuesday, June 13th.

“More diverse” EM quality stocks

Experts highlighted how the range of quality stocks present in emerging markets expanded significantly in recent years, offering a broader selection for investors.

"One of the things that I think are interesting about China, South Korea, and Taiwan is really just the very diverse set of businesses that you can potentially invest in,” said Caroline Cai.

However, quality stocks have always been present in emerging markets, according to Rakesh Bordia.

“Quality stocks were always available in emerging markets. It’s just that the range of quality stocks that are available today has become a lot more diverse than it has been in the prior decade or so,” emphasised Bordia.

Overall, experts seem to agree on the growth potential of emerging markets going forward. However, as their return on equity (ROE) improves, narrowing the gap with developed markets, many believe that the valuation discount that currently exists for EM compared to developed markets could decrease.

LISTEN TO THE EPISODE:

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy