Every day, we handpick the 5 Top Stories stock market investors need to know. In 5 minutes, you’ll learn the stocks, CEOs, and money managers moving markets.

Apple Loses Ground in China, Gains Ground in India

Global smartphone shipments rose 6.5% in the June quarter, reported Bloomberg. Apple [AAPL] shipped 45.2 million handsets, up 1.5% on the year-ago quarter. In China, iPhone sales have been recovering, but Apple has lost market share to local brands, particularly Xiaomi [XIACF] and Huawei. However, Apple’s annual sales in India are at nearly $8bn, a record total, having climbed approximately 33% in the 12 months through March.

Alphabet Looks to Boost Cybersecurity Operation

In what would be the largest buyout in its history, Google parent Alphabet [GOOGL] is set to buy cybersecurity start-up Wiz for some $23bn, the Financial Times reported. The deal is still some weeks from completion, with a number of details yet to be addressed. Led by former Microsoft [MSFT] executive Assaf Rappaport, Wiz has raised some $2bn from investors since it was founded four years ago. Alphabet acquired cybersecurity firm Mandiant for $5.4bn two years ago.

Semiconductors: Not Everyone Can be a Winner

Taiwan Semiconductor Manufacturing Co [TSM], the world's largest contract chipmaker, reports this week; analyst consensus suggests it will log a 30% rise in profit in Q2. Earlier this month, Samsung Electronics [SSNLF] predicted Q2 operating profits would climb by nearly 1,500%; however, the South Korean giant has been enmired in a labour dispute, and is lagging rivals, among them domestic challenger SK Hynix [000660:KS]. Lastly, tech investor James Anderson told the Financial Times that Nvidia [NVDA] could be worth $50trn within a decade.

The Lure of an NY IPO for European Cannabis Companies

A report from the Financial Times shows that a number of European cannabis start-ups are planning an IPO in New York, as the US moves closer to reclassifying marijuana. Among them are Grow Group, a London-based medical cannabis distributor, and Lisbon-based Somai Pharmaceuticals, which is seeking a “reasonable” €250m valuation on the Nasdaq, CEO Michael Sassano told the Financial Times. Somai would also be aiming for a secondary listing on the Toronto Stock Exchange or LSE.

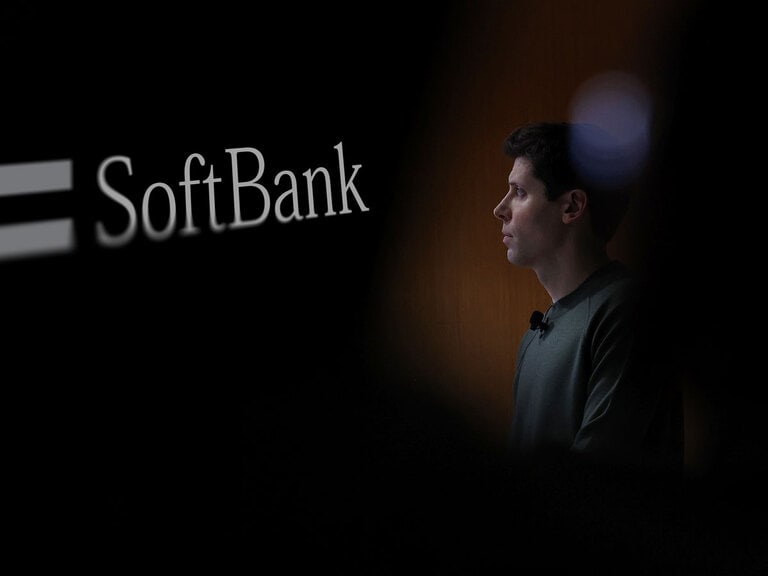

Should Tech Workers Fear AI?

The tech sector has seen 100,000 lay-offs so far this year, Seeking Alpha reported. Intuit [INTU] announced last week it is to shed 1,800 employees as it transitions workflows to artificial intelligence-native (AI) processes. However, the firm expects to hire approximately the same number of staff to run its AI. Also last week, UiPath [PATH] said it is to cut it global workforce by about 10%. Elsewhere, OpenAI whistleblowers have lodged a complaint with the US Securities and Exchange Commission over non-disclosure agreements, Reuters reported.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy