The semiconductor industry is recovering from pandemic supply shortages and the effects of inflation. The First Trust Nasdaq Semiconductor ETF has soared in 2023, driven by gains from key holdings including Intel and Qualcomm.

- First Trust Nasdaq Semiconductor ETF rises 52.7% to date this year as semiconductor shares rally.

- Top holding Intel surges 78.7% so far in 2023.

- Global chip sector slated to grow 13.1% in 2024, outpacing 2023, but some analysts and investors say the sector is overheated.

Intel [INTC], the top holding in the First Trust Nasdaq Semiconductor ETF [FTXL], rallied 8.1% in the week to 15 December, contributing to the fund’s increase of 9.8% across the week.

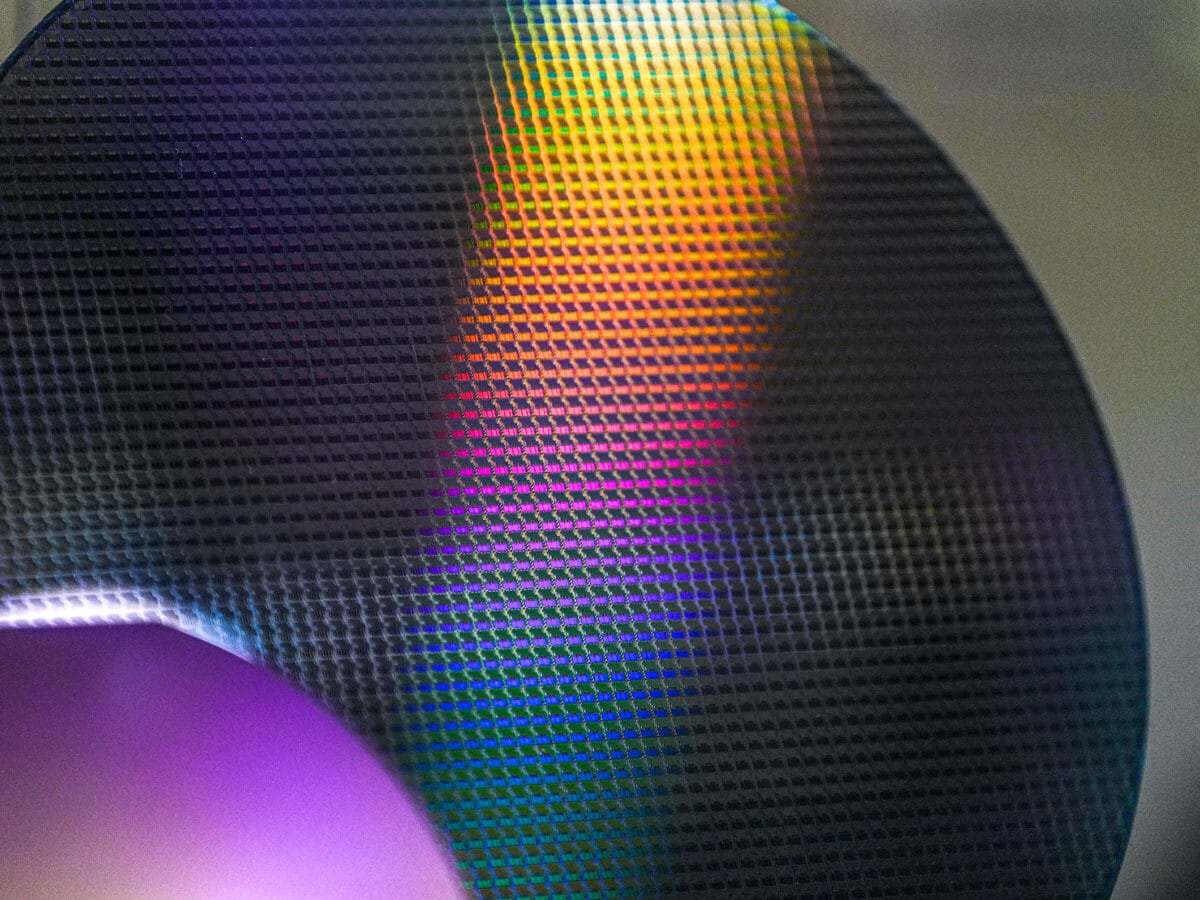

The California-based chipmaker revealed its Core Ultra processors at its AI Everywhere event on 14 December, which may have helped drive performance. Intel’s powerful new chips will be used in ultrathin laptops. The Core Ultra chips are divided into tiles — interchangeable components governing functions like computation or graphics, which can easily be swapped out in line with users’ needs. The firm is attempting to regain market share from rivals including Advanced Micro Devices [AMD].

Shares in Qualcomm [QCOM], the ETF’s second-biggest holding, also jumped last week, rising 7.6%. The chip designer is among seven companies, including Meta [META] and Alphabet [GOOGL], who called for open digital ecosystems, in a bid to spur growth in Europe.

The FTXL fund offers exposure to 32 companies in the semiconductor industry, and broadly tracks the Nasdaq US Smart Semiconductor Index. As of 15 December, 76.7% of the fund’s exposure was accounted for by semiconductor companies, while 23.3% was made up of production technology equipment.

The fund has surged 52.7% year-to-date.

Intel and Qualcomm Stocks Up In 2023

The biggest holding in the First Trust Nasdaq Semiconductor ETF as of 15 December is Intel, with a 9.4% weighting.

Intel posted earnings for the third quarter (Q3) of 2023 in late October, announcing revenue of $14.2bn, a decline of 8% year-over-year, with adjusted earnings per share (EPS) of $0.41. Despite the slump in revenue, the figures beat forecasts from analysts of $13.5bn revenue and EPS of $0.31, according to Yahoo! Finance.

Intel’s share price has soared 78.7% year-to-date.

The second-largest holding in the FTXL fund is Qualcomm, with an 8.9% weighting.

Qualcomm announced Q4 earnings on 1 November, posting revenues of $8.6bn for the period, up 24% year-over-year, and non-GAAP EPS of $2.02, up 35%. The latter comfortably beat the Zacks Equity Research estimate of $1.92 per share.

Qualcomm stock has jumped 33.7% year-to-date.

Chip Sector Set for Strong 2024?

The last couple of years have been difficult for chipmakers. A global semiconductor shortage during the Covid-19 pandemic, followed by inflationary pressures and interest rate rises, hit the market hard. Meanwhile, US chip production has reduced to 10% of global output, highlighting the necessity of investment in the space, as outlined by the White House CHIPS and Science Act.

According to MarketBeat, short bets on the FTXL fund increased by 508.5% in the last two weeks of November, suggesting that investors expect its value to decline.

However, chip stocks have soared this year and the semiconductor market is forecast to recover in 2024, according to World Semiconductor Trade Statistics. A 28 November report by the market research firm projected global market growth of 13.1% next year, following a decline of 9.4% in 2023.

Meanwhile, Intel is investing $33bn in R&D and manufacturing in Europe, and has already announced a €17bn mega-fab site in Germany this year.

FTXL is rated a ‘moderate buy’ by a consensus of 33 analysts at TipRanks.

Intel is rated a ‘hold’ by a consensus of 29 analysts at TipRanks.

Qualcomm is rated a ‘moderate buy’ at TipRanks by a consensus of 20 analysts.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy