Kate Moore, Head of Thematic Strategy for BlackRock’s [BLK] Global Allocation Team, tells OPTO Sessions what could lie ahead, including with regard to inflation. In short, things are looking up.

It’s been a rocky road of late for equities. However, Kate Moore, Head of Thematic Strategy for BlackRock’s [BLK] Global Allocation Team, is upbeat.

“I do believe, with high conviction, that we will end the year higher in equities,” she told OPTO Sessions, as she shared her outlook for the remainder of 2024.

She says the “sideways trend” in Q2 so far trails a strong Q1, but she’s giving her “highest conviction call”, despite a cloudy inflation picture. “They said, maybe it’s all over, maybe we have no more juice in the tank. I don’t think that’s going to be the case. I think it’s going to be a little bit of a bumpy ride as we digest some of the economic data, Fed policy moves and rhetoric, and the upcoming elections.

“I think, fundamentally, the corporate sector is in very good shape, and the economy is strong enough to justify a move higher in risk assets.”

Read our exclusive stories for FREE in the OPTO app

Changing Inflation Expectations

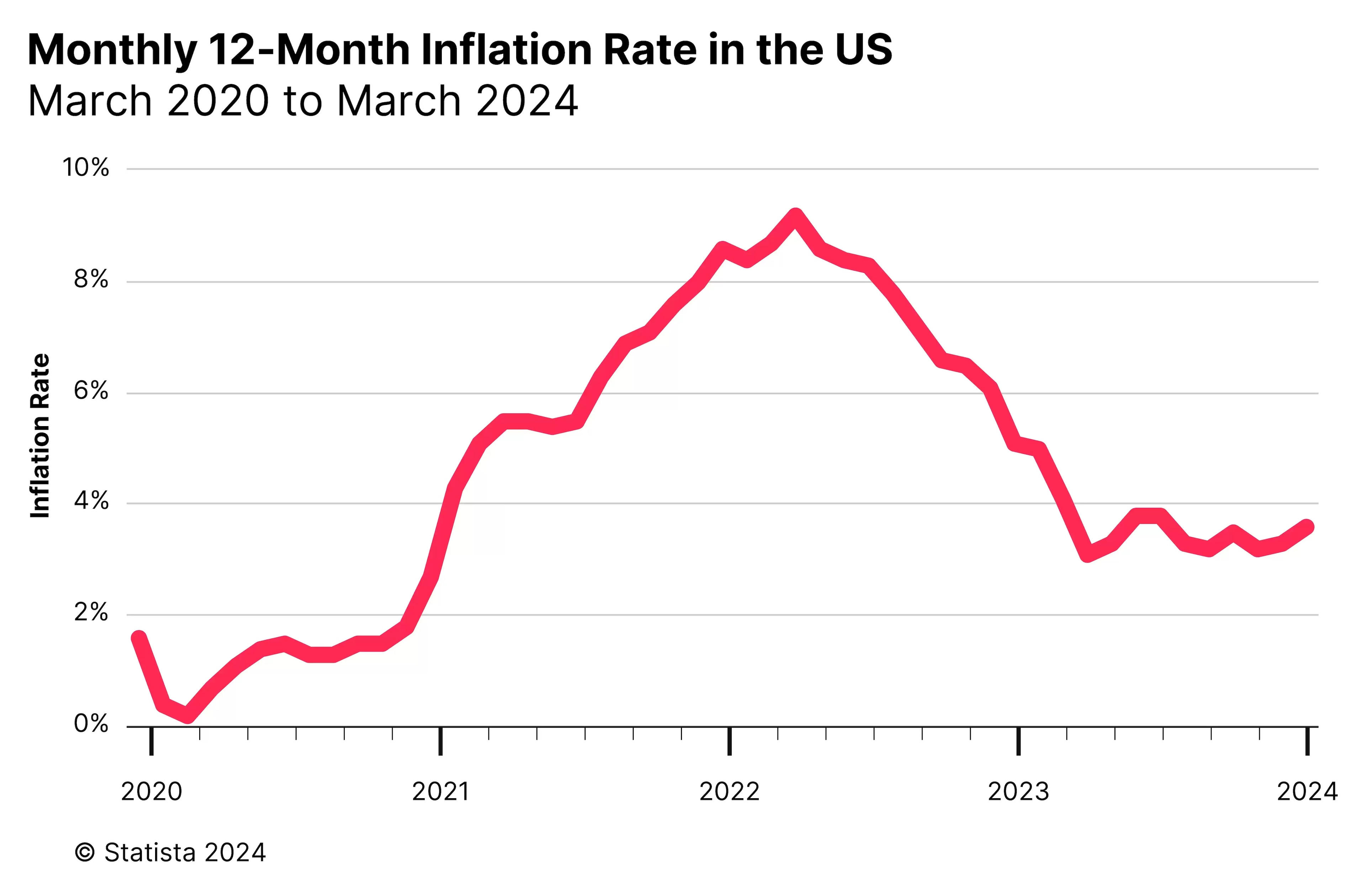

When it comes to predicting inflation, tracking the Consumer Price Index (CPI) and Producer Price Index (PPI) is critical, acknowledges Moore. While the latest figures may have driven new records among US stock indices this week, they also indicate we’re not yet out of the woods.

“On the inflation side, it’s been frustrating to a lot of us that parts of inflation have remained very sticky,” she says. “I think we have to expect a more moderate disinflationary trend than we expected at the beginning of the year.

“Internally, we’ve downgraded our own expectations for disinflation this year. But we still think we can get core inflation in December to 2.8%. Is that the 2% the Fed wants? Not really, but it’s a significant improvement, especially on a year-over-year basis.”

However, a key challenge for policymakers is managing public expectations. “As economists and market participants, we look at the inflation data and say, ‘Wow, it's improving, maybe not at the pace we expected six months ago, but certainly improving.’ And that’s great news.

“But most people don’t think about data on a year-over-year basis, they are going: ‘Inflation doesn't look good at all.’ In fact, they’re remembering, maybe pre-pandemic or even three years ago, what prices looked like, and it feels to them that inflation is really ugly.”

Positive Picture

When looking ahead and predicting sentiment, one useful data point to track, says Moore, is retail sales. These were flat in April, as the US Commerce Department's Census Bureau reported on 15 May.

“The low-end consumer seems to have traded down, or they’re visiting stores or outlets much less frequently. There’s definitely a tone of weakness there,” reiterated Moore. “So the Fed has to consider that, even as the aggregate data about consumers, in terms of overall debt burden and incomes, looks good.”

One other thing Moore likes to monitor is confidence among executives and its relation to sentiment. “What we’ve seen, as inflation spiked and a little bit of a disinflationary trend followed over the last few years, is that corporate confidence around the economy has picked up.”

There is also the question of debt. Here, Moore also has a positive take. “In aggregate, household debt service, as a percentage of disposable income, is less than 10%. And that is below pre-pandemic, and then certainly pre-global financial crisis levels. So you look at that data, and you say, that’s really manageable.”

In addition, “the vast majority of homeowners in the US have locked in fixed-rate mortgages; it’s 90% of mortgage holders. And the average effective mortgage rate is 3.8%. So it’s only the new buyers and people who are looking to trade houses that are really facing these much higher mortgage rates.”

While there’s been a marginal uptick in unemployment, Moore doesn’t believe jobs data will impact assets. “I think the labour market data, barring some huge shock where we have mass layoffs, is not that important for overall risk assets sentiment, how stock investors are thinking about the market, and probably less important for the Fed.”

The real story, she says, is still inflation. “If inflation were to surprise meaningfully over the course of the summer if we had six or seven months of warmer inflation prints, I do think that would be bad for sentiment,” says Moore.

Ultimately, she remains optimistic. “I think the economy is pretty resilient.”

“If inflation were to surprise meaningfully over the course of the summer, if we had six or seven months of warmer inflation prints, I do think that would be bad for sentiment.”

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy