Cathie Wood, CEO of ARK Invest, recently told OPTO Sessions that spot bitcoin ETFs would ultimately prove a tailwind for Coinbase stock — the largest holding in her portfolio. With the stock posting strong gains since mid-2024, Wood appears to be taking profits on what remains ARK’s largest holding.

Cathie Wood Sells Coinbase (Again)

Cathie Wood, Founder, CEO and Chief Investment Officer of ARK Invest, has been a long-term advocate of blockchain technology, particularly cryptocurrencies.

In January this year, she famously told CNBC she was convinced that the price of bitcoin could reach $600,000 — or, in a bull scenario, $1.5m — by the year 2030.

Unsurprisingly, ARK was an early mover after the SEC’s approval of spot bitcoin ETFs in January. The ARK 21Shares Bitcoin ETF [ARKB] launched on 10 January, and has gained 35.6% as of 5 March.

Prior to the launch of spot bitcoin ETFs, much of ARK’s bitcoin exposure came through Coinbase [COIN].

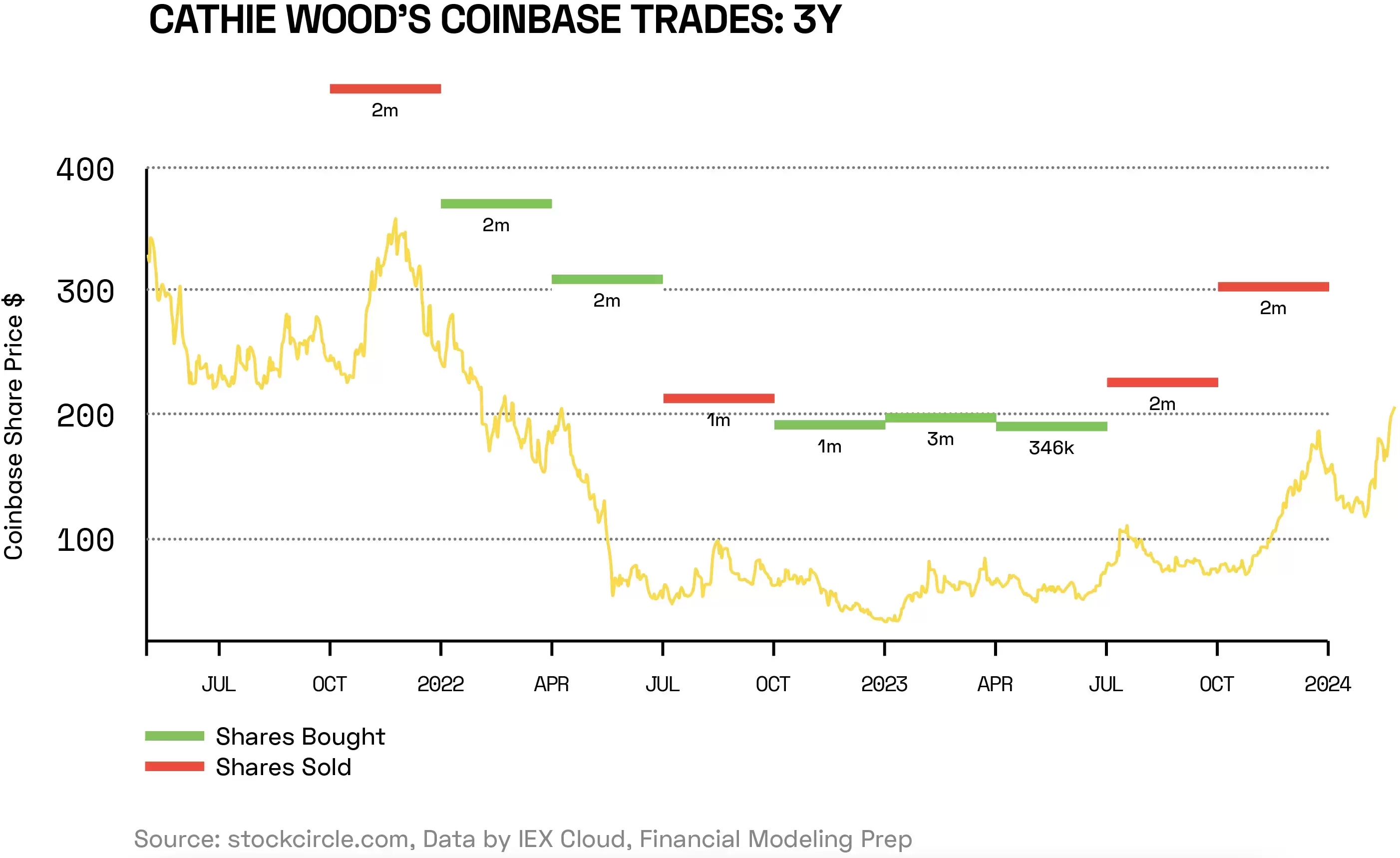

According to data from Stockcircle, Wood first bought the cryptocurrency exchange platform in Q2 of 2021. Since then, her position has grown to the point that it is now her largest holding, comprising 10.6% of ARK’s overall portfolio.

Wood has generated a positive return through her Coinbase plays. ARK has bought the stock at an average price of $170.27, 34.6% below its most recent close of $229.15.

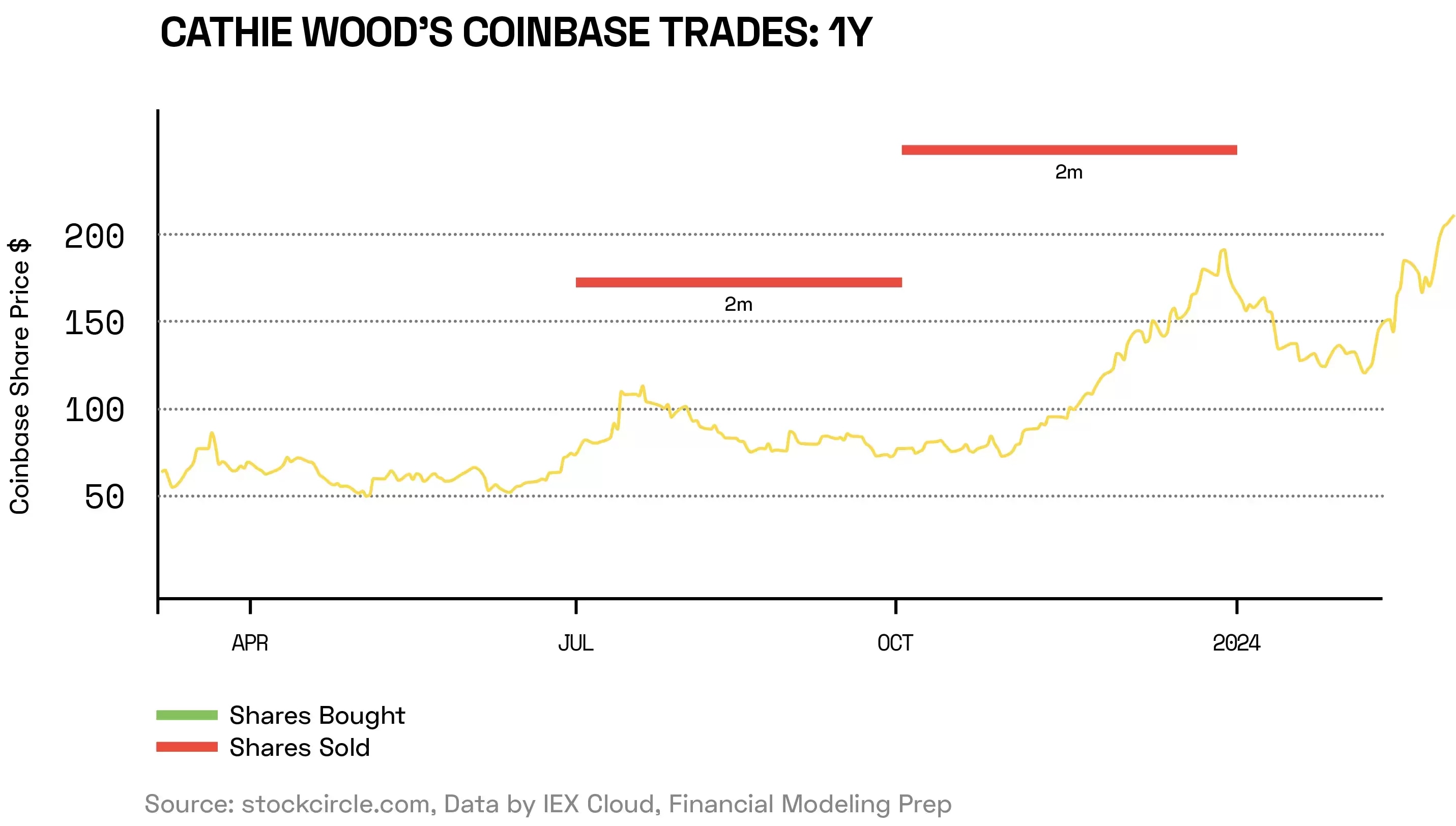

However, ARK sold over 2 million shares in Coinbase during Q4 2023 — the second consecutive quarter in which it sold the stock. Despite Wood maintaining a bullish stance, it appears that the selloff is continuing this year.

According to Crypto Daily, ARK sold 216,035 Coinbase shares worth approximately $43.4m in the last week of February. This followed sales of the stock earlier the same month, and during January.

Capitalising on Demand

Historically, Wood has tended to sell Coinbase shares during quarters when its price increases, and bought during quarters when it falls or bottoms. This reflects a pattern of taking profit when demand for the stock is high, and increasing her stake when many investors are looking elsewhere.

In the second half of 2023 (during which Wood sold approximately 4 million shares), Coinbase gained $143.1%. Despite this, Coinbase remains ARK’s largest holding, with 8.6 million shares left at the end of 2023.

Coinbase has gained a further 31.8% year-to-date, bolstered in part by a string of upgrades to analysts’ price targets for the stock. Following Coinbase’s earnings beat on 15 February, KBW raised its target to $160 from $93, while Wedbush raised its target to $200 from $180.

Spot Bitcoin ETFs: a Gateway to Crypto

Wood remains bullish on Coinbase over the long term. In January, she predicted the current spike in demand for Coinbase shares, telling OPTO Sessions that she believes the spot bitcoin ETFs launched that month will act as “a feeder for Coinbase”.

“Anything that gets more investors involved in the [cryptocurrency] ecosystem is important,” she said. “The ETFs are a stepping stone for people who want to just get a toehold. But as they learn more and more about bitcoin, many will use this as a bridge into establishing their own wallets, which would be very helpful to Coinbase.”

ARK’s Coinbase holdings are distributed among four funds.

The largest stake is held by ARK’s flagship fund, the ARK Innovation ETF [ARKK]. As of 5 March the fund holds $918.9m worth of Coinbase shares, which account for 11.4% of the fund’s exposure.

The ARK Next Generation Internet ETF [ARKW] and ARK Fintech Innovation ETF [ARKF] hold $207.3m and $163.8m worth of Coinbase shares, respectively. The stock is the top holding in both funds, with respective weightings of 11.9% and 14.2%.

Finally, 1,793 shares are held in the ARK 21Shares Blockchain and Digital Economy Innovation ETF [ARKD] as of 3 March. In terms of individual stocks, Coinbase is the fund’s largest holding with a weighting of 15.2% and a market value of $410,865.95.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy