Que Nguyen, Chief Investment Officer at Research Affiliates, discussed the potential winners and losers of the generative artificial intelligence (AI) rally on a recent episode of OPTO Sessions. She drew comparisons between companies like Cisco and the semiconductor firms that are dominating markets today and explained why these won’t necessarily be the long-term winners.

Que Nguyen, Chief Investment Officer, Equity Strategies at Research Affiliates, believes many lessons from the dot-com bubble of the 1990s can be applied to the AI boom.

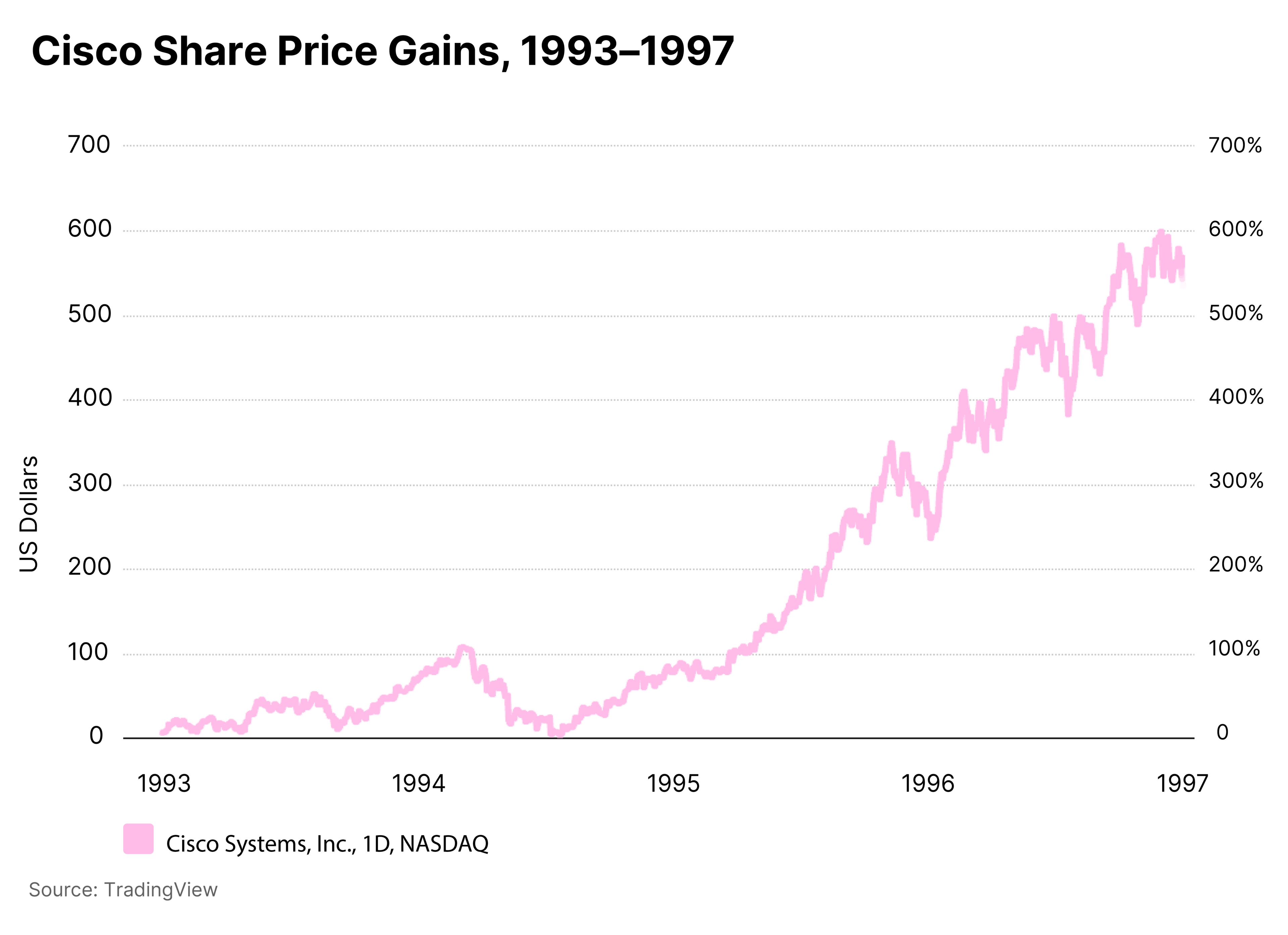

In a May report entitled ‘Learn from Last Tech Bubble to Embrace GenAI Mania’, Nguyen highlights the fact that some of the first businesses to see significant share price gains during the 1990s were the providers of the infrastructure that underpinned the internet.

“In the early internet days, people were very excited about telecommunications. In order to connect to the internet, you had to have a cable or a phone line,” Nguyen told OPTO Sessions.

Companies like Cisco [CSCO] provided the lines, switches, and routers that underpinned the internet. Their share prices surged during this period: Cisco’s gained almost 550% between the start of 1993 and the start of 1997.

Hard to Pick

As generative AI scales, Nguyen expects the investment landscape to change. Like the internet, it will improve productivity over time.

“We need to build out all this capacity, all this throughput, before people start to use it… Over time, I think the case for the picks and shovels will fade, and it will take a back seat to the useful applications — business, personal or consumer — of generative AI.”

This isn’t to say that there is no value in investing in today’s picks and shovel companies. Nguyen still expects growth in the space, as well as “shifting sands” in terms of the key players.

According to Nguyen, Nvidia [NVDA] and Micron Technology [MU] are leading the space at present, alongside suppliers to these companies, such as Lam Research [LRCX] and ASML [ASML].

“There are also other chip companies that are trying hard to catch up. This is going to be great for generative AI because it increases innovation and investment, and it brings down the cost of deployment.”

What Can We Tell from Wintel?

Nguyen compares the challenge of trying to pick future winners at this stage in the cycle to trying to predict the rise of Meta Platforms [META] during the mid-1990s. “I think there will be some new companies that come along that become very big winners in businesses that we don’t even conceive of yet. I don’t think anybody thought of social media as a business model in 1996.”

Furthermore, Nguyen doesn’t think it is possible to predict which of the companies in established industries will see the biggest long-term gains. “Players like Nvidia, and to some extent Microsoft [MSFT], are going to try to stay ahead of the pack. But that is very difficult in a technology environment because the technology always evolves more quickly than business models.”

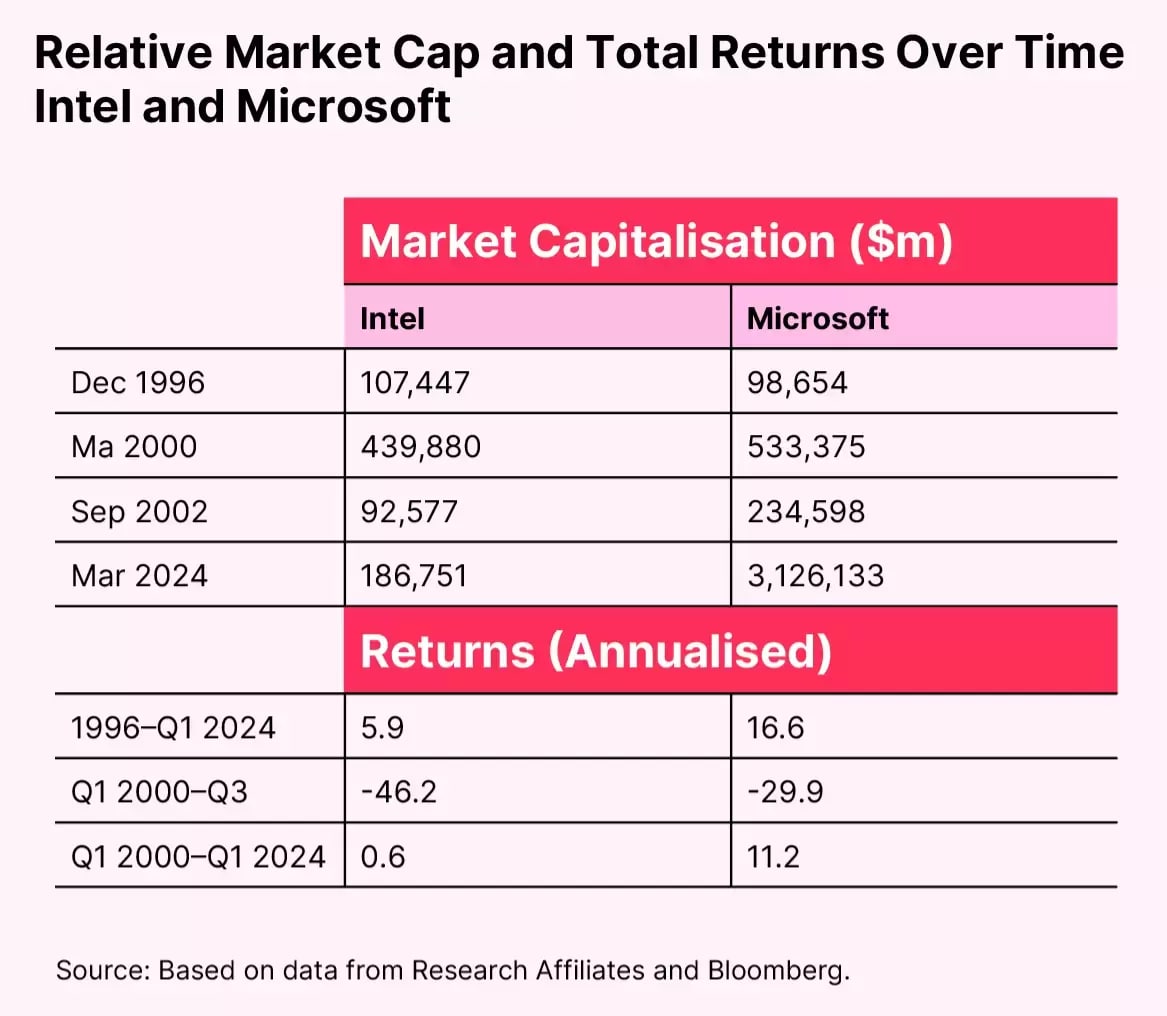

To maintain a long-term business edge, Nguyen identifies the need for a competitive moat. The ‘Wintel’ partnership that formed between Microsoft and Intel [INTC] during the 1980s is illustrative.

Microsoft has been the bigger winner from this partnership over the long term, despite Intel having the larger market cap at the end of 1996.

In Nguyen’s view, this is because Microsoft’s product was closer to the end user than Intel’s.

“Microsoft had the point and click graphical user interface (GUI) that made the internet much more usable, much more accessible to normal people.”

While Microsoft’s software was running on Intel’s chips, these were “hidden from the consumer”. As more chipmakers entered the market, Intel’s moat was eroded, whereas Microsoft’s endured because of the degree of familiarity users had with its GUI.

“If you are hidden away from the end user, the risks to your business moat are higher than if you are known to the end user and you bring them a certain amount of usability.”

Who Has a Generative AI Moat?

When it comes to generative AI, Nguyen feels that computing power is the single greatest source of moat. This means that, as the major cloud providers, Microsoft and Amazon [AMZN] have the largest moats.

Access to data is often touted as a key competitive advantage for AI companies, but Nguyen believes that it is still too early in the cycle for this to be a major factor.

“Once the technology becomes more efficient, having data will become more useful.”

This could prove a tailwind for data-heavy players such as Alphabet’s [GOOGL] Google or Meta over the long run.

Despite the difficulty of picking individual winners and losers, given the nascent status of the field, Nguyen is upbeat about the general prospects for generative AI.

“It’s really early right now to say who’s going to be a winner and who’s going to be a loser, except to say that I’m pretty sure that over time there will be many more winners than there are losers. And even the losers won’t really lose that much.”

Please see disclaimers from Research Affiliates at: http://bit.ly/3hT1PuD.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy