Every day, we handpick the 5 Top Stories stock market investors need to know. In 5 minutes, you’ll learn the stocks, CEOs, and money managers moving markets.

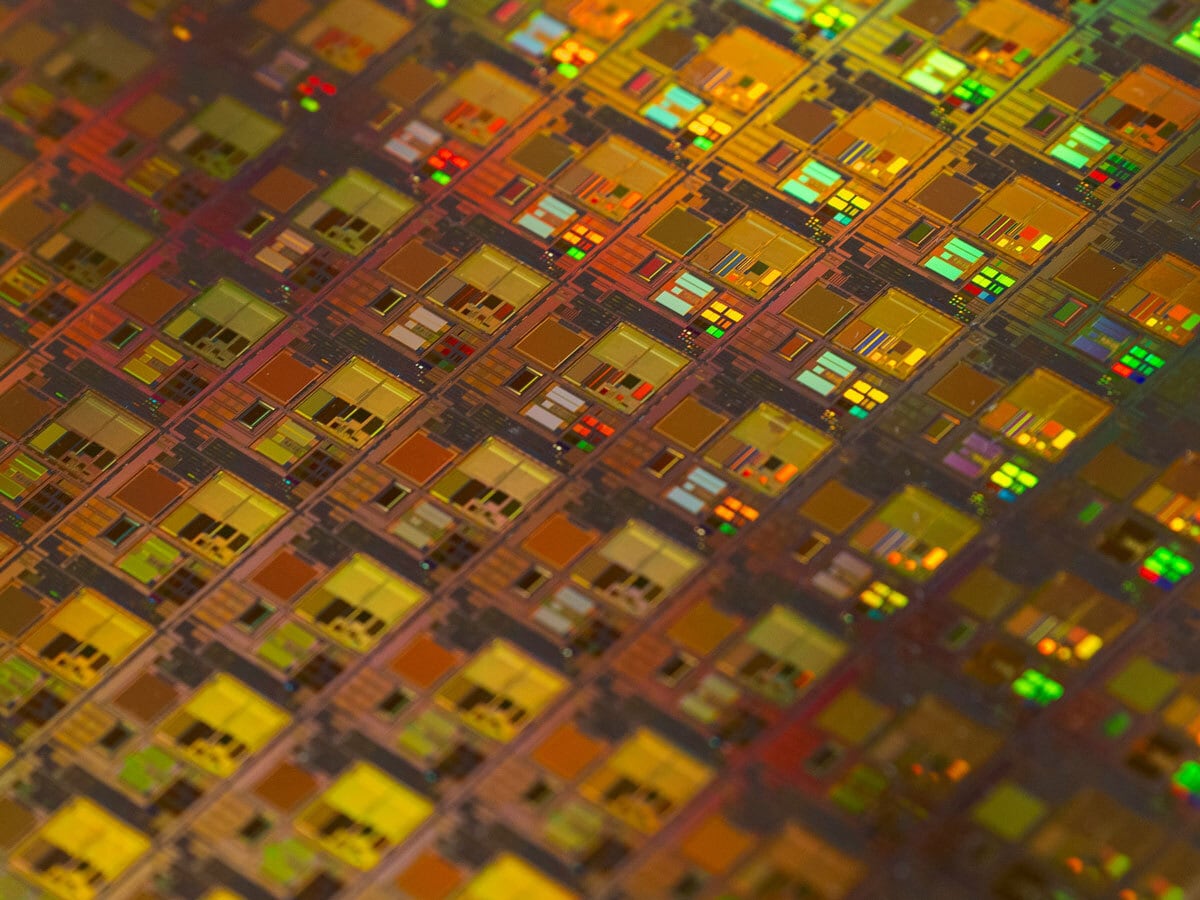

EU Chip Group Urges Action

ESIA, Europe’s top computer chip industry group, has called on the EU to provide more support for the sector, Reuters reported. The group represents chipmakers Infineon [IFNNY] and STMicroelectronics [STM], as well as equipment maker ASML [ASML]. In a statement, ESIA said that a “Chips Act 2.0” should be rolled out, and an envoy named to champion the sector. The bloc’s first Chips Act was launched in 2023 and constituted a €43bn subsidy plan.

Expecting More Tariffs, GlobalWafers Expands Overseas

The world’s third-largest silicon wafer provider [6488:T] is ramping up overseas manufacturing to counter anticipated tariffs on chip materials. The company is expanding factories in six of the nine countries in which it operates, including the US, Italy and Denmark. Chairwoman and CEO Doris Hsu told Bloomberg: “I believe that not only in the US but also some other countries, there will be some special tariff.”

Huawei: Not as Good as Nvidia

China’s push to rival US artificial intelligence (AI) computing power is faltering due to buggy software, with customers of Huawei’s AI chips voicing concerns about performance. Despite emerging as a key competitor to Nvidia [NVDA] after US export controls tightened, Huawei’s Ascend series faces criticism over issues including slower inter-chip connectivity and software issues, the Financial Times reported.

EV Slump Pushes VW towards Closures

Volkswagen [VWAGY] may shut factories in Germany for the first time in its 87-year history, with the European automotive industry facing a “very … serious situation”, CEO Oliver Blume warned, according to the Financial Times. Despite a cost-saving program launched last year, the company has struggled to meet its financial goals, hindered by lower-than-expected demand for electric vehicles (EVs), among other factors. Blume emphasized the need for decisive action as new competitors enter the European market.

Tesla China Sales Surge

Tesla [TSLA] recorded its best sales month of the year so far in China, selling over 63,000 cars in August — a 37% jump from July, though slightly below last August’s figures, Reutersreported. Despite this growth, Tesla still trails behind major Chinese competitors. Elsewhere, Tesla plans to launch a six-seat variant of its Model Y in China by late 2025, seeking to rejuvenate its best-selling EV and boost production at its Shanghai factory.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy