US restrictions on exports to China are likely to hit European chipmakers and tool suppliers. While the financial impacts make be large, they are “not something that will kill us”, according to ASMI. While chip stocks have suffered this year, they have all gained significantly over the past month.

- China export restrictions from US to hit leading European chip suppliers

- Chip-tool giant ASML predicts a 15% to 25% loss in sales, but demand remains strong

- Global X Semiconductor ETF down 25% year-to-date, but up 13.5% in the past month

Share prices for European semiconductor companies like ASML Holding [ASML.AS], ASM International [ASM.AS], STMicroelectronics [STM] and Infineon Technologies [IFX.DE] have suffered this year on the back of tightening export controls from US to China.

In late November, Benjamin Loh, CEO of Dutch chipmaker ASM International (ASMI), said the US was “putting a lot of pressure” on the Dutch government to stop companies selling “high-end tools” to China.

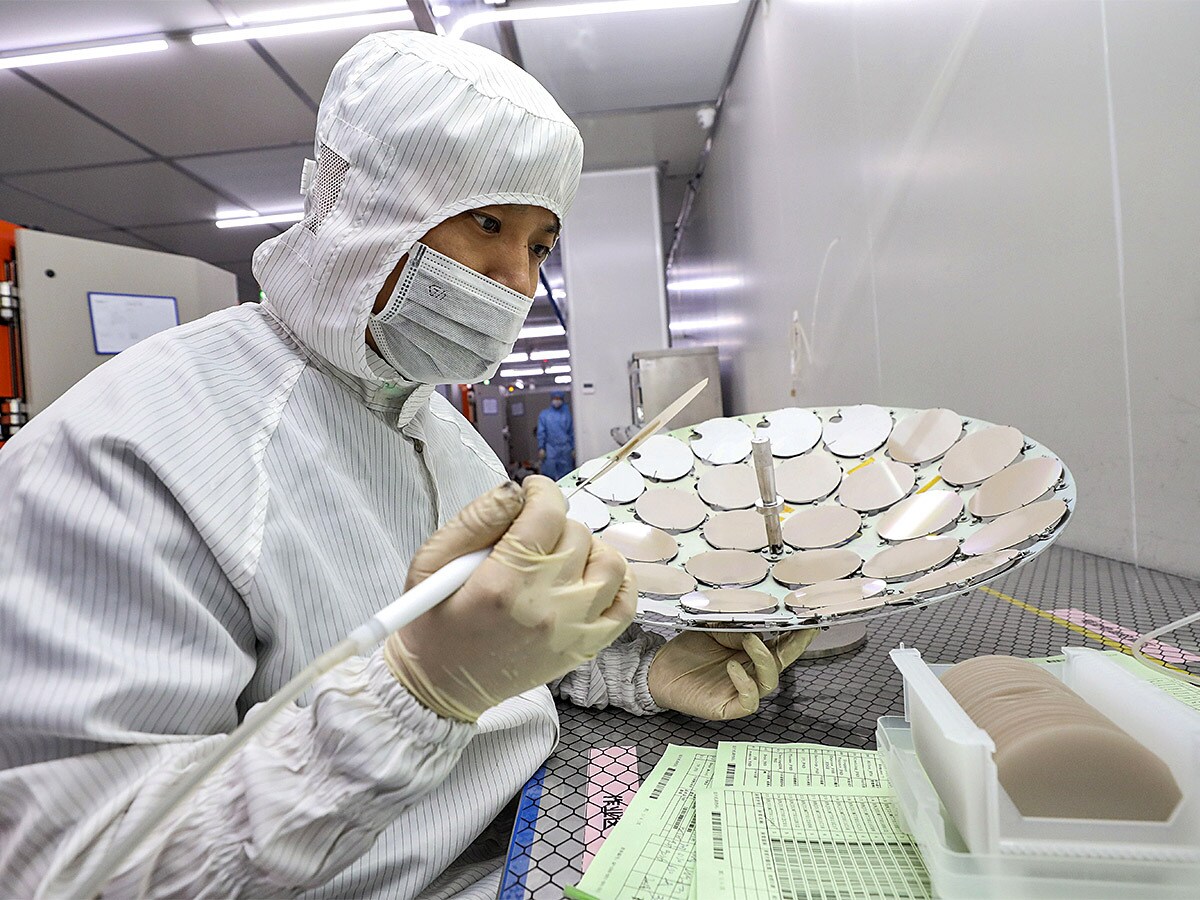

Along with Dutch group ASML, ASMI leads the European market in manufacturing chip tools.

On 30 November, the day after Loh’s statement and US-Netherlands talks on export controls, the ASMI share price remained immune, rising by a mere 1.1%. While the stock is down 29.1%, however, it has gained 22.6% in the past month.

ASML, meanwhile, has dropped 18% year-to-date, but gained 23.3% over the past month.

Other major chip companies in Europe include Dutch firm STMicroelectronics, which has seen its share price fall 20.9% this year, but rise 21.2% in the past month. German semiconductor manufacturer Infineon has continued the pattern, down 20.7% year-to-date and up 24.5% over the month.

Chinese sales large chunk of revenues

In October, ASMI predicted US government sanctions would slash 40% of its sales to China; these currently make up 16% of its revenue. However, Loh said the move was “not something that will kill us”, despite the fact that its Arizona facility is likely to be directly impacted by the US government’s trading decisions. The company adjusted its forecast to say the sanctions will dent only 15-25% of sales, down from what it had previously estimated could be 40% or more in lost sales.

Key semiconductor company ASML, meanwhile, is behind an ultraviolet lithography machine needed to produce the world’s most advanced chips, and which China is keen to access. In November, ASML released bullish forecasts, citing strong demand for its tools and announcing it intends to buy back €12bn of its stock; its share price jumped 10.6% in response.

STMicroelectronics CEO Jean-Marc Chery said in November that “this is the market we do not want to escape”, and indicated no plans to halt Chinese operations, which account for approximately 30% of its revenues.

Theme outlook reliant on politicians

In October, President Joe Biden increased sanctions against China: to sell semiconductor and manufacturing tools, firms must secure export licenses from the US Department of Commerce.

GlobalData research shows China uses 40% of globally manufactured semiconductors, but covers only 12% of its own needs.

The outlook for companies like ASML will depend on whether Dutch politicians agree to ongoing sanctions which restrict Chinese access. “We are weighing our own interests, our national security interest is of utmost importance, obviously we have economic interests… and the geopolitical factor always plays a role as well,” said Liesje Schreinemacher, the Netherlands’ minister for foreign trade and development cooperation.

After global chip shortages in 2021, demand has dwindled, and so have the stocks for the companies making them. Longer term, however, China is likely to make more of its own chips, reducing reliance on Europe and the US. According to Tech Insights, the Semiconductor Manufacturing International Corp. (SMIC) [0981.HK], China’s biggest semiconductor manufacturer, is rumoured to have begun shipping Bitcoin-mining semiconductors using 7-nanometer technology, despite being barred from access to state of the art technologies.

Funds in focus: Global X Semiconductor ETF

ASML is the second-largest holding in the VanEck Semiconductor UCITS ETF [SMH.L], at 11.28% of its portfolio as of 5 December. The fund also contains STMicroelectronic stock in its top 25 holdings at a weighting of 1.30%. Year-to-date, the fund has fallen by 29.4%, but gained 18.4% in the past month.

All four stocks are held in the Global X Semiconductor ETF [SEMI.AX]. As of 6 December, ASM was the second-largest holding with a weighting of 10.38% in the portfolio. Infineon had a weighting of 1.75%, STMicroelectronics 1.07% and ASM International 0.55%. The fund has slumped by 25.3% year-to-date, but risen 13.5% in the past month.

ASML is the ninth-largest holding in the iShares Semiconductor ETF [SOXX], with a weighting of 4.23% as of 5 December. STM Microelectronics has a weighting of 1.45%. The fund is down by 30% year-to- date, and up 14.3% over the past month.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy