In this article, Chris Brightman, the chief investment officer at Research Affiliates, and colleagues Vitali Kalesnik, a partner and head of research in Europe, and Ari Polychronopoulos, product manager and head of ESG at the firm, break down Europe’s sustainable finance regulations and how US investors can align their portfolios with the new structure.

Key points:

- Europe has led the way in regulation aimed at mitigating climate change. This regulation presumes climate change poses a material risk to investors and that trustees and managers have a fiduciary duty to incorporate this risk in their oversight policies and management of investment portfolios.

- The Biden administration’s position that climate change is an existential threat suggests that the United States may soon enact regulation similar to that adopted in Europe.

- This article summarises European regulation to help US investors now in planning how to align their investment policies, portfolio positions, and reporting practices with the new regulatory structure for sustainable finance emerging in Europe, likely soon to follow in the United States.

Climate research informs us that in 2017 anthropogenic global warming reached 1.0° C above pre-industrial levels. Most of us understand that this continued warming of our planet is causing severe adverse consequences for ecosystems, biodiversity, and human society. Today’s immigration crises and resultant political stress in Europe and the United States only hint at the scale of challenges to come.

Even climate change sceptics must accept the reality that the United States has re-joined the Paris Agreement, a legally binding international UN treaty under the United Nations Framework Convention on Climate Change. The Paris Agreement represents a worldwide commitment to limit global warming to significantly less than 2.0° C above pre-industrial levels in an effort to avoid the more extreme risks of global warming and thereby sustain a hospitable climate. Achieving this ambitious goal requires unpreceded cooperation — both among governments and between business and government.

To date, Europe has led this effort, particularly from the regulatory side. Now, President Biden is characterising climate change as an existential threat and his administration intends to join Europe’s regulatory effort. Accordingly, US investors may look to Europe’s regulatory approach as a guide to understanding this coming regulatory shift and its implications for climate transition investing.

European climate regulation coming to America

European regulation presumes that climate change poses a material risk to investors and that trustees and managers have a fiduciary duty to incorporate this risk in their oversight policies and management of investment portfolios.

In contrast, US regulation has taken nearly the opposite approach. In October 2020, the US Department of Labor (DOL) issued its final rule on ESG investing. The rule requires fiduciaries to base investment decisions on financial factors alone without promoting “nonpecuniary” objectives, which would include efforts to reduce global warming.

The ruling was the Trump administration’s exclamation point to its exit from the Paris Agreement and the rollback of numerous environmental regulations, emphasising the administration’s hostility to climate change regulation.

The Biden administration is now reversing course. President Biden re-joined the Paris Agreement, ordered a review of the Trump-era DOL guidelines, and announced a non-enforcement policy of the present rule while the review takes place.

In February, the US House of Representatives introduced the Climate Risk Disclosure Act of 2021, which requires companies to disclose physical and transition risks associated with climate change (although passage by the US Senate seems unlikely).

The Securities and Exchange Commission recently created the Climate and ESG Task Force and issued a statement requesting public comment on climate-related company disclosures to inform its policymaking.

The alphabet soup of climate finance regulation

European regulatory trends reveal the destination to which the United States is likely now setting its course. In Europe, the two principal bodies making recommendations for climate transition regulation are the Task Force on Climate-Related Financial Disclosures (TCFD) and the Technical Expert Group on Sustainable Finance (TEG).

For those new to the alphabet soup of European financial regulatory bureaucracy, the TCFD was established in 2015 by the Financial Stability Board (FSB), an international organisation funded by the Bank for International Settlements that recommends financial regulatory standards to G20 governments. The TEG was established by the European Commission in 2018 to develop and recommend sustainable finance legislation to the European Union (EU).

The FSB established the TCFD to “develop recommendations for more effective climate-related disclosures that could promote more informed investment, credit, and insurance underwriting decisions and, in turn, enable stakeholders to understand better the concentrations of carbon-related assets in the financial sector and the financial system’s exposures to climate-related risks.”

The TCFD framework requires companies to disclose risks related to the transition to a low carbon economy and risks related to the physical impact of climate change. Of companies with market capitalisations greater than $10bn, 42% currently disclose at least some information in line with TCFD recommendations.

In November 2020, the United Kingdom announced that reporting along TCFD guidelines will be mandatory by 2025 and will apply to almost all of the nation’s economy: public companies, large private companies, banks, insurance companies, asset managers, and pension schemes.

As outlined on the European Commission’s website, the purpose of the TEG is to provide “an EU classification system — the so-called EU taxonomy — to determine whether an economic activity is environmentally sustainable; an EU Green Bond Standard; methodologies for EU climate benchmarks and disclosures for benchmarks; and guidance to improve corporate disclosure of climate-related information”.

The EU taxonomy is a “tool to help investors, companies, and issuers and project promoters navigate the transition to a low-carbon, resilient, and resource-efficient economy”.

The taxonomy sets reporting standards and performance thresholds. Starting in January 2022, all fund providers, insurance product providers, and pension plans who market their strategies in the EU as being sustainable must report using the taxonomy framework.

Financial market participants will be required to disclose how the taxonomy was used “in determining the sustainability of underlying investments, to what environmental objective(s) the investments contribute, and the proportion of underlying investments that are taxonomy aligned, expressed as a percentage of the investment, fund, or portfolio”.

The EU Green Bond Standard (GBS) is intended to increase the “transparency and comparability of the green bond market, as well as to provide clarity to issuers on the steps to follow for an issuance, in order to scale up sustainable finance.” The purpose of the GBS framework and reporting requirements for proceeds of green bond issues is to increase the availability of financing, and to lower the cost of that financing, for projects aimed at reducing climate change.

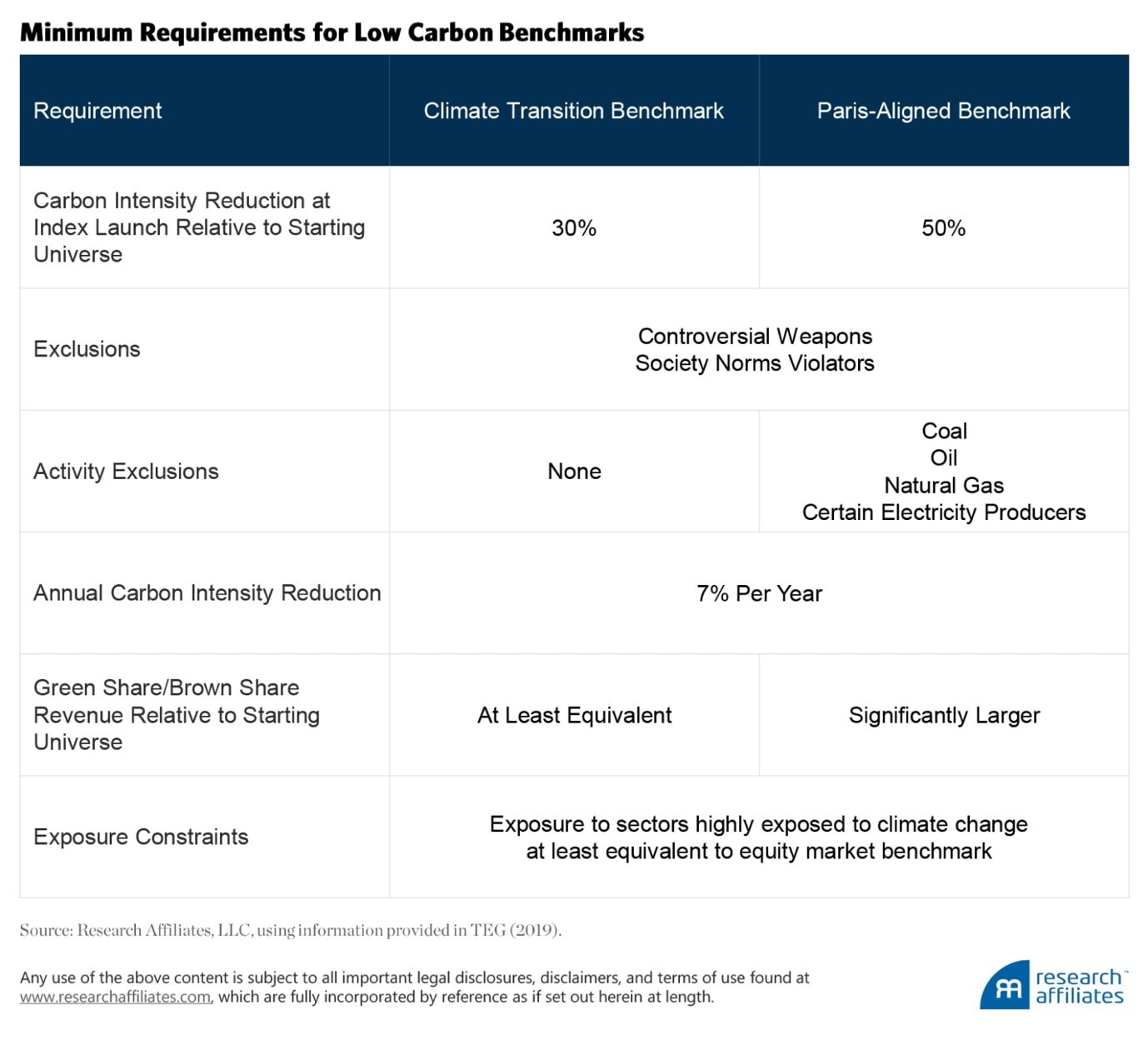

The EU Regulation for Low Carbon Benchmarks provides the “definition of minimum standards for the methodology of the ‘EU Climate Transition’ and ‘EU Paris-aligned’ benchmarks, that are aligned with the objectives of the Paris Agreement and addressing the risk of greenwashing.”

The TEG “has also worked on disclosure requirements in relation to Environmental, Social, and Governance (ESG) factors in the benchmark statement and the benchmark methodology for all types of benchmarks (except interest rate and foreign exchange benchmarks) including the standard format to be used to report such elements.”

A summary of the minimum standards of the EU benchmarks is provided in the following table:

Flows are accelerating in Europe and the United States

Morningstar data show that in 2020 $51bn flowed into sustainable mutual funds and ETFs in the United States, accounting for a quarter of all US fund flows. In Europe, where regulatory efforts have been stronger, flows into sustainable mutual funds and ETFs totalled $284bn, 45% of all European fund flows in 2020.

Fund flows result from a myriad of factors, but European regulatory efforts appear to have positively impacted awareness and driven demand for sustainable investing. “According to Morningstar, flows into sustainable mutual funds and ETFs in Europe totalled $284bn, 45% of all European fund flows in 2020.”

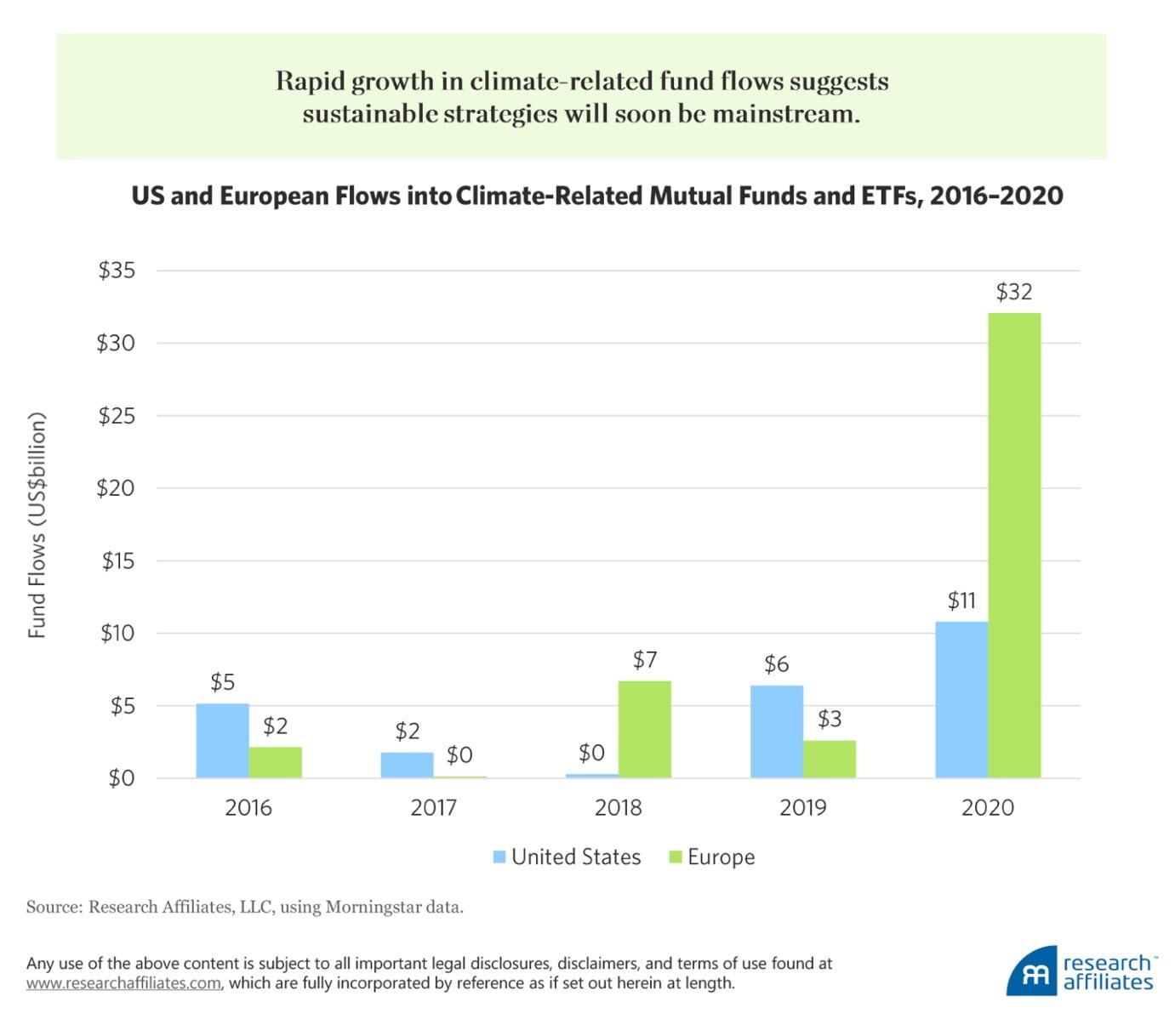

Of the flows into sustainable investing funds, a significant portion are going to investment strategies that focus on climate. In Europe, 2020 was a record year for low-carbon or climate-focused investment strategies, which attracted $32bn in mutual fund and ETF flows, nearly three times the combined amount of climate-related fund flows in the preceding four years.

Although the amount of climate-related fund flows represented only about 5% of all European fund flows in 2020, the rapid growth in this sector of the market suggests sustainable strategies will soon become mainstream.

Conclusion

Now is the time for US investors to plan how to align their investment policies, portfolio positions, and reporting practices with the new regulatory structure for sustainable finance emerging in Europe.

Our purpose in writing this article is not to assess whether, and how, such actions may measurably reduce greenhouse gas emissions and global warming nor to opine on whether ESG investment strategies will provide returns above or below market benchmarks. Such forecasts seem technically dubious.

Rather, we seek to raise awareness of the increasing regulatory pressure to measure and report on the sustainability activities of companies in which we invest and to take account of those metrics as we design and implement investment strategies.

This article was originally published in April 2021 and can be found on the Research Affiliates website.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy