Miriam McLemore, Enterprise Strategist at Amazon Web Services (AWS), is at the forefront of enterprise adoption of generative AI. In discussion with OPTO Sessions, she outlines four use cases for the suite of tools AWS offers to help its clients deploy the technology.

Amid the artificial intelligence (AI) boom that has followed the November 2022 launch of ChatGPT, it has become axiomatic that major cloud service providers — especially Amazon’s [AMZN] AWS — are among the major players in the broader space.

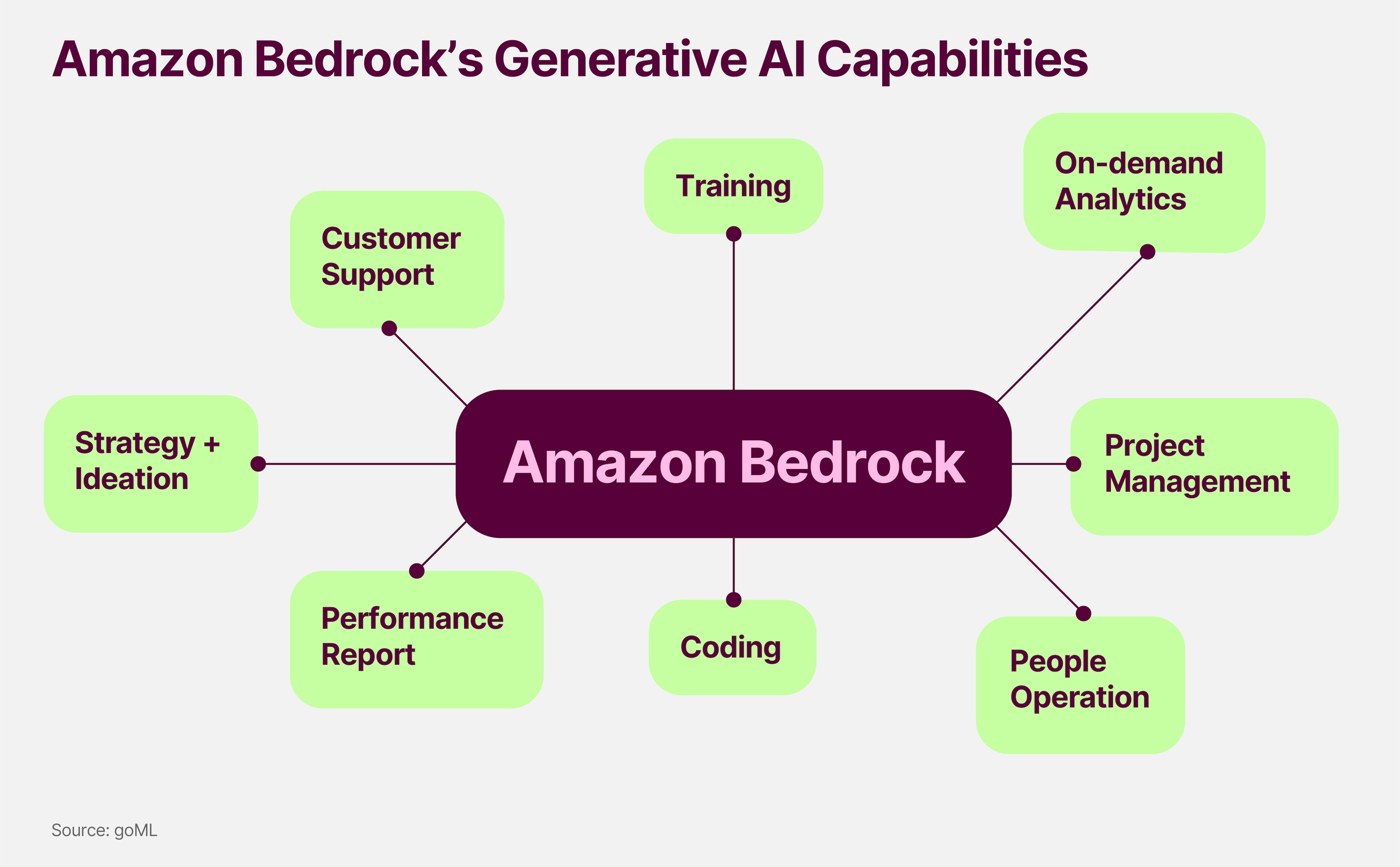

Miriam McLemore, Enterprise Strategist at AWS, spoke to OPTO Sessions to explain how its suite of tools and services — particularly Bedrock, which allows companies to build their own generative AI applications — is helping companies across a range of sectors achieve tangible results by deploying AI.

A Titan of Advertising

Dentsu [4324:T], one of the world’s largest marketing and advertising agencies, adopted Amazon’s Bedrock and SageMaker products in January as part of its broader AI strategy.

SageMaker is a service that facilitates the training and deployment of machine learning models.

The products give the agency access to platforms that help its client teams “to quickly innovate and prototype at scale”, according to a January press release announcing the partnership.

The press release also outlines how Dentsu is leveraging Titan, a suite of Amazon’s proprietary, pre-trained generative AI foundation models within the Bedrock service.

“Dentsu is using the Amazon Titan image generator to preview and generate realistic studio-quality images and large volumes using natural language prompts”, says McLemore. “It’s helped to generate compelling images from product placement and campaigns.”

Making its Merck

In the world of biopharma, Merck [MRK] is using Amazon Neptune, a graph database that stores information about its supply chain and regulatory operating environment, to underpin the Change Assessment Knowledge Engine (CAKE) it built with AWS.

CAKE has helped Merck streamline its operations by reducing the duration of change assessments by up to 90%, according to the AWS website.

“Merck is using Amazon Bedrock’s new customer model import capability to bring pre-trained models tuned especially for biomedical data and terminology to its scientific platform and documentation,” says McLemore.

In an online testimonial for Bedrock, Suman Giri, Executive Director of Data Science at Merck, said: “With Amazon Bedrock, we have quickly built generative AI capabilities to make things like knowledge mining and market research more efficient.”

Merck has also used SageMaker, along with other AWS tools, to reduce the occurrence of false rejects in its drug discovery pipelines, enabling it to speed up the production of new therapies.

An Intelligent Exchange

Finally, two of the world’s largest stock exchanges — the New York Stock Exchange (NYSE) and Nasdaq — also make use of AWS’ AI offerings.

“The NYSE, using Bedrock’s choice of foundation models and generative AI capabilities across multiple use cases, is building an intelligent document chatbot to analyse 20,000 pages of regulations,” says McLemore.

According to a testimonial video from Anand Pradhan, Senior Director of Technology at NYSE, this enables anyone to ask the chatbot questions about the trading rules. The responses to these questions can then be quickly presented in plain English.

Bedrock, he says, is also being used to create a news sentiment analysis tool for the exchange, which takes unstructured newsfeed data, summarises it using large language models, and then analyses investor sentiment based on subsequent stock price movements.

Nasdaq will also use the generative AI capabilities offered by Bedrock to more swiftly distill, analyse, and interpret relevant information, according to a May press release announcing the partnership.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy