From the explosive debut of Chinese artificial intelligence (AI) model DeepSeek, to tariffs levied by the Trump administration, upheaval seems to be the name of the game for markets at the moment.

According to Pieter Slegers, Founder of investment newsletter Compounding Quality, this volatility should not worry investors too much — as long as they have a strong strategy.

“To put it bluntly: ‘don’t know, don’t care’. I have no clue what the market will do… I just try to find those great companies.”

Over the long term, he says, wise investments will pay off, no matter how the market fluctuates.

That said, what does Slegers think is the biggest danger for quality investors?

“Disruption.”

Even with a quality company, an unforeseen shift in the market can turn a winner into a loser overnight. “Just imagine that you bought Kodak, for example, or Nokia.”

It’s important to remember, however, that “every active investment strategy will underperform from time to time.”

He cites Walmart [WMT] as a good example of how a company’s intrinsic value may not be reflected in its stock price for many years, underscoring the importance of holding onto good investments.

Following a brief spike in price in December 1999, WMT stock traded more or less flat until December 2016 — when it began a climb it has yet to turn back from. As of February 11, 2025, WMT stock was up 338.28% from that December 1999 high.

Not every company is Walmart, but every portfolio should contain at least one Walmart, Slegers says.

“You only need one company like Starbucks [SBUX], Amazon [AZM] or Apple [AAPL] in your portfolio during a lifetime and you need to keep it, which is the hardest thing.”

AI: Worth the Hype?

Given the bull run big tech has been experiencing in recent years — further fueled by the election of Donald Trump — any discussion of investment invariably turns to AI. But, from a quality investing perspective, is AI worth the hype?

“I’m quite skeptical about the performance of big tech nowadays,” Slegers admits, citing ballooning valuations as “overperformance”.

For the average investor, picking the right company from a slew of exciting options can be a nearly impossible task. There’s just too much information, Slegers says.

“Everything is evolving so rapidly that it’s very hard to take an educated guess about who will be the winners in AI.”

That is not to say investors cannot get value from AI-driven stocks. However, he argues that the ultimate winners of the AI boom may be the companies applying the technology in less flashy ways.

“Take Domino’s Pizza [DPZ], for example. They are using AI in large cities like London and New York to predict how many margaritas will be ordered during peak hours.” This approach streamlines an already effective business model and underscores a company’s intrinsic value.

Finding Your Niche(s)

Slegers is a big supporter of what he calls “boring” stocks.

Companies that are doing cutting-edge work often present exciting investment cases — take the meteoric rise of Nvidia [NVDA], for example, which accounted for 20% of the S&P 500s total gains in 2024. But, in the long term, a quality investor is looking for predictable, if more modest, gains.

“I have no clue how the market for AI or for cybersecurity will look like in a decade from now, but I know that everyone will still be brushing their teeth and drinking coffee.”

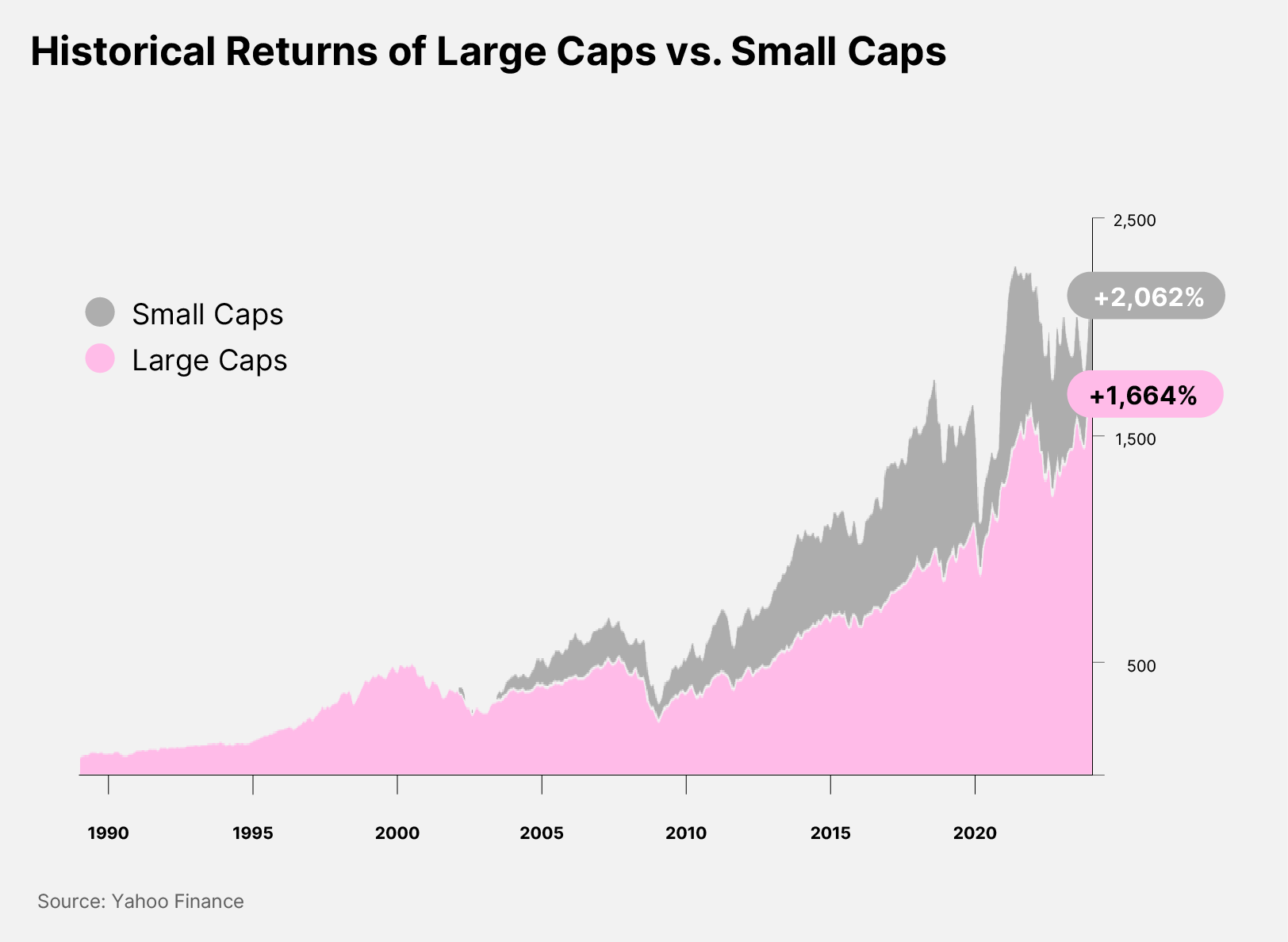

Slegers cites the advice of Charlie Munger, the former Vice Chairman of Berkshire Hathaway [BRK-B]. If you want to outperform the market, “go where the competition is weak”. With so many institutional investors focused on large-cap stocks, that means small-cap companies.

“There will come a day that all those big tech companies will underperform and some small-cap companies will outperform,” Slegers says. Indeed, that has historically been the case, with small-cap stocks providing returns 23% higher than large-cap stocks over the past 35 years.

No matter the stocks you choose, Slegers underlines that the challenge is knowing when to sell and when to hold.

“As long as your investment thesis is correct, you shouldn’t sell,” he explains. “The best time to sell a great business is almost never.”

In short, “winners tend to keep on winning, losers tend to keep on losing.”

Listen via Apple Podcast, Spotify, or watch on YouTube.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy